As we approach the height of the digital age, internet users are more prone to cyber-attacks and malicious activity than ever before. Having reliable security is essential to all computer and network systems.

Blockchain is the backbone of cryptocurrency, and this technology is being adopted in a wide range of industries such as finance, healthcare, supply chains, and more. A major factor behind the popularity of blockchain is its inherent data security mechanisms including cryptography, decentralization, and consensus. This article will explain the mechanisms behind blockchain security, and the risks associated when incorrectly implemented.

What is a blockchain?

A blockchain is a digital ledger of transactions that uses a distributed network of peer-to-peer computer systems. Each block contains transaction data, a timestamp, and the cryptographic hash of the previous block. This infrastructure allows blocks to be linked together in a chain, which makes altering data extremely difficult as the data in all subsequent blocks will also need to be altered.

Decentralization

Decentralization plays an important role in blockchain technology. Having a decentralized system means that there is no central entity in control, making hacking or corruption difficult. Traditionally, data is stored in a centralized database. In this system, anyone who gains access to that database will have complete control over the data. In a decentralized system, all participants have a copy of the ledger. If one ledger is corrupted, it can be identified by comparing it with other copies and the corrupted ledger will be rejected. However, prioritising decentralization can sometimes come at the cost of security or scalability, which is known as the blockchain trilemma.

Consensus

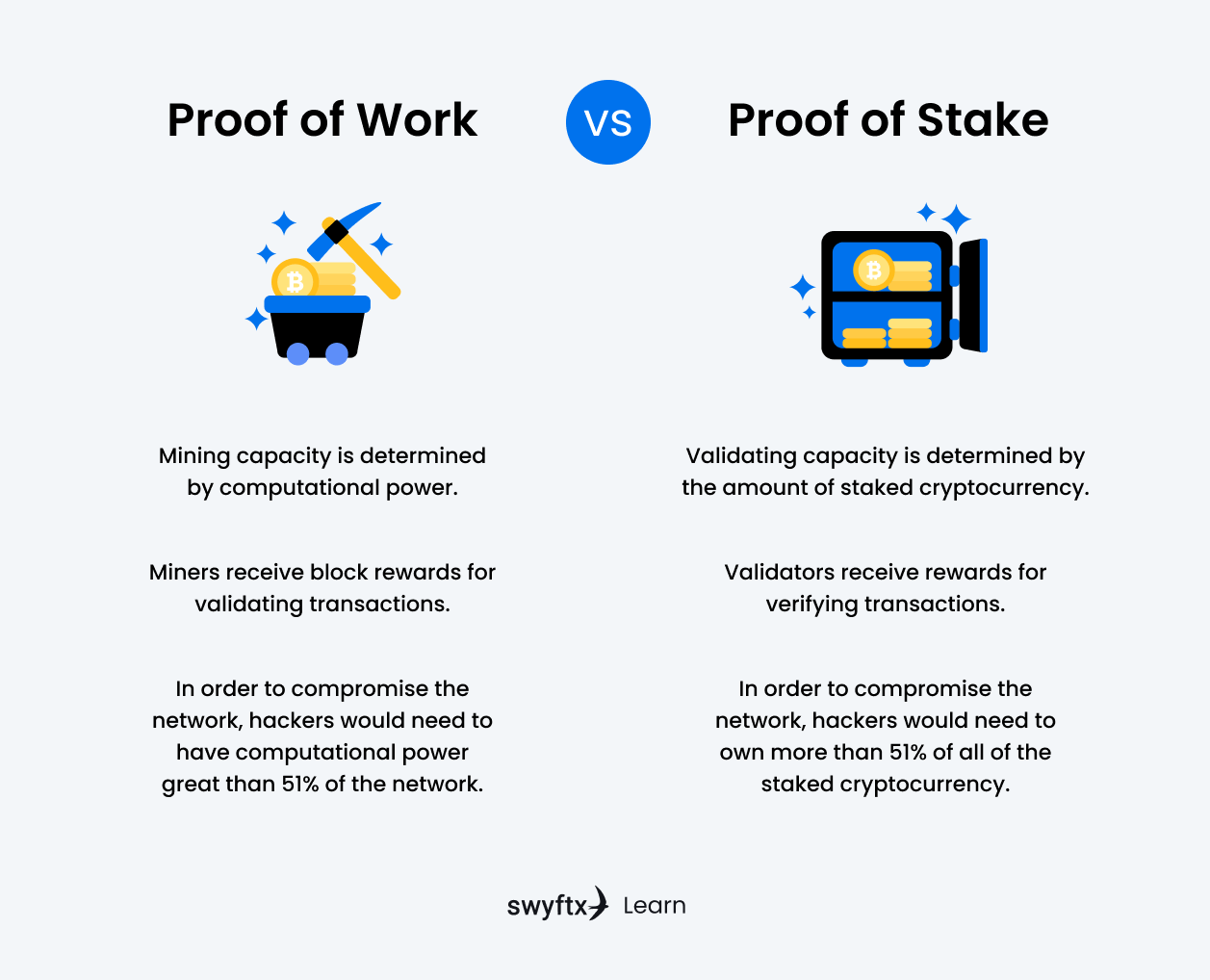

In a centralized system, only one entity is responsible for updating the database. Decentralized systems like blockchain use consensus mechanisms to determine how the next block of transactions are verified and added. Consensus mechanisms are a set of rules for network participants to follow to ensure authentic transactions. There are many different types of consensus mechanisms around, each influencing the amount of energy used, transaction speed and cost, and how to participate on the network.

Interesting Fact

If an attacker controls 51% of the network, they can undermine the network. This is also known as a 51% attack. Consensus mechanisms are in place to make this attack less feasible and often less rewarding.

Proof of Work (PoW)

Proof of Work is a common consensus mechanism used by the most popular cryptocurrency, Bitcoin. Miners are participants in the network that are verifying transactions and solving computational puzzles, who compete against each other. The first miner to solve the puzzle will add a block of transactions onto the Bitcoin blockchain and will receive a predetermined amount of digital currency native to the blockchain protocol they’re mining on.

In addition to block rewards, miners are also rewarded in transaction fees by verifying transactions in the block, which network users will pay.

A huge benefit of the PoW mechanism is that an attacker on the network would need to acquire 51% of the total mining power, making it nearly impossible to achieve. The more miners competing on the network, the greater the overall mining power, resulting in a more secure blockchain.

Since only one miner can solve the puzzle, all the computing power and energy consumed from other miners will be wasted. This is one of the reasons why PoW blockchains like the Bitcoin network (BTC) are extremely energy-intensive, leaving a large environmental footprint.

Proof of Stake (PoS)

Popular cryptocurrencies such as Solana and Cardano use a different consensus mechanism called Proof of Stake. Instead of having every miner use energy to solve block problems, validators are selected by algorithms to validate transactions and mint/forge the next block to receive staking rewards. To be selected, a validator must stake a certain amount of cryptocurrency for a period – the more cryptocurrency you stake, the more likely you will be selected to validate the next block.

Proof of Stake also aims to solve the 51% problem. An attacker would need to acquire 51% of the total staked cryptocurrency and the blockchain network’s mining power, however, anyone attempting malicious activity would lose all their staked cryptocurrency.

A downside to PoS is that the model benefits whoever stakes the most cryptocurrency, leaning more towards centralization and favouring those with larger volumes of cryptocurrency.

Figure 1 – Proof of Work vs Proof of Stake

Immutability

Blockchain technology is well known for its immutability. Once a transaction has been verified, it is near impossible for an entity to manipulate the data on the network. This enables a high degree of data integrity, which leads to increased trust and reliability.

A downside to immutability is that it does not account for human error. If a transaction was made to the incorrect address, there is no way to reverse that transaction. Making a transaction on the blockchain can be intimidating, especially when you’re new to the space. Our article on withdrawing and depositing cryptocurrencies has all the information you need to help you choose the right network and begin making transactions.

Cryptography

Cryptography is a key element to blockchain technology and is utilised in securing transactions, ledgers, smart contracts and wallets on the blockchain. Blockchain makes use of two types of cryptographic algorithms: hash functions and asymmetric cryptography.

Hash functions

Hash functions are algorithms that receive input data of any length and output a unique value at a fixed length. If the input data was changed, the resulting output will be drastically different. The length of the output is dependent on the algorithm used. SHA-256 (Secure Hashing Algorithm) is a hash function used by Bitcoin that consistently has an output length of 256 bits.

Scrypt is another hashing algorithm used by Litecoin and is proven to use less resources and generate blocks quicker. Some have argued that Scrypt’s simpler algorithm makes it more susceptible to security issues, however, there has yet to be a security breach or instance of reverse engineering.

In a blockchain network, each block that’s added to the blockchain stores the hash value of the previous block. If data were to be manipulated, the hash values on subsequent blocks would change as well, creating a domino effect. Other users on the network would easily be able to identify the blockchain that has been tampered with and reject it.

Interesting Fact

Cryptocurrency DigiByte (DGB) uses five different hashing algorithms, this helps prevent miners from grouping together and becoming centralized.

Asymmetric cryptography

Asymmetric cryptography makes use of a public key and a private key. A public key can be a wallet address and is available to everyone, whereas a private key is kept secure and never lost. Information sent to an address will be encrypted with its public key, and only the private key can decrypt the information. However, you won’t be able to derive the private key from the public key.

In a secure blockchain network, public keys are wallet addresses that any user can send cryptocurrencies to, but only the user with the private key is able to withdraw and transfer money from it.

Digital signatures are built on asymmetric cryptography and are essential in blockchain. Digital signatures are impossible to forge, as they are encrypted using a user’s private key. When a transaction is requested, it is hashed using a hash function and encrypted with the sender’s private key, creating a digital signature.

The signature is attached to the transaction and sent off to a miner for verification. The miner verifies that the signature is authentic by passing the transaction through the same hash function and decrypting the signature with the sender’s public key. If the hash values of both the transaction and the signature are the same, the transaction is authentic.

The Repercussions of Poor Blockchain Security

Blockchain’s infrastructure is seen as secure, but poor implementation of this technology can cause major security vulnerabilities. Most of these vulnerabilities are caused by human error in the underlying code of the blockchain and if left unchecked could lead to double spending, private key leakage, frozen assets and more. Below are two real world examples of blockchain security issues and breaches.

A decentralized autonomous organization (DAO) is a decentralized governance system that runs on the blockchain network, and the code is publicly available. In 2016, the Ethereum DAO was attacked, resulting in 3.6 million ETH being stolen. The attacker found a loophole in the DAO’s code, which allowed them to reuse the same DAO tokens repeatedly.

Proof of Work consensus mechanisms have their vulnerabilities too. If more than 50% of the mining power is controlled by a single entity, they have the power to manipulate transactions and double spend coins. In 2019, Ethereum Classic (ETC); a hard fork of Ethereum (ETH), suffered from a 51% attack with an estimated loss of US$1.1M after the attacker carried out double-spending transactions on several exchanges. A major cryptocurrency like Bitcoin has extremely high mining power, making it less susceptible to 51% attacks.

Blockchain security in other industries

Blockchain technologies are proven to be very secure and difficult to manipulate, and is now being applied to various industries other than cryptocurrency.

Current Applications

Enormous amounts of cash flow through centralized banks, which makes them attractive targets to cybercriminals. JP Morgan is considered the largest financial institution in the U.S. and currently uses a blockchain-based platform called Quorum to process private transactions.

In the healthcare industry, patients are trusting companies with private and sensitive information. Having a weak cybersecurity system will expose this data to cybercriminals, which can be used to extort hospitals and patients for money. Hospitals are now starting to partner with tech companies to secure their data using blockchain technology. Hashed Health is a healthcare innovation firm, working to build secure digital blockchain networks for healthcare companies and hospitals.

Did You Know?

The Australian government recently partnered with tech giant IBM to assist in developing AI and blockchain solutions for cybersecurity and data management over the next five years.

Future Possibilities

Blockchain is making a large impact. Various industries are already implementing its technology to secure their data. In a world driven by big data, having a secure network is more important than ever.

Blockchain systems will continually evolve and expand to more industries to provide data integrity and security. Blockchain could very well be the new form of data storage. As this technology grows, we could see every small business operating on their own private blockchain network.

Summary

Blockchain has come a long way since its conceptualisation as Bitcoin in 2008. Because of its inherently secure framework, various industries are adopting this technology. Being decentralized gives control to the users and removes a central point of attack. Cryptography and digital signatures keep transactions on the network authentic and secure, and the use of hash functions makes blockchain technology immutable, providing high data integrity and increased trust in the network.

Repercussions of poorly implemented blockchain can be detrimental. Attackers can expose loopholes and exploit bugs in the code, resulting in data manipulation, double spending and private key theft. As long the underlying code of a blockchain undergoes thorough tests and audits, it will be safe to use in any industry.

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read