The blockchain trilemma is a widely accepted theory that blockchains can only provide two out of three benefits at any one time in relation to decentralization, scalability, and security. This article will explain what the blockchain trilemma is and explore the current attempts to address it within the blockchain industry.

What is a trilemma?

Before we dive into what the blockchain trilemma is, it’s important to first understand what a “trilemma” is. In this context, a trilemma is having three elements that are highly desirable, but only being able to prioritise two out of the three.

A great example is the project management triangle (time, quality, and cost), which is widely used, even outside of project management. For instance, if you were to hire a graphic designer to create a logo for your company, you could have a high-quality logo done quickly, but it would cost a lot. Or you could have a logo created quickly and cheaply, but it wouldn’t be high-quality.

What is the blockchain trilemma?

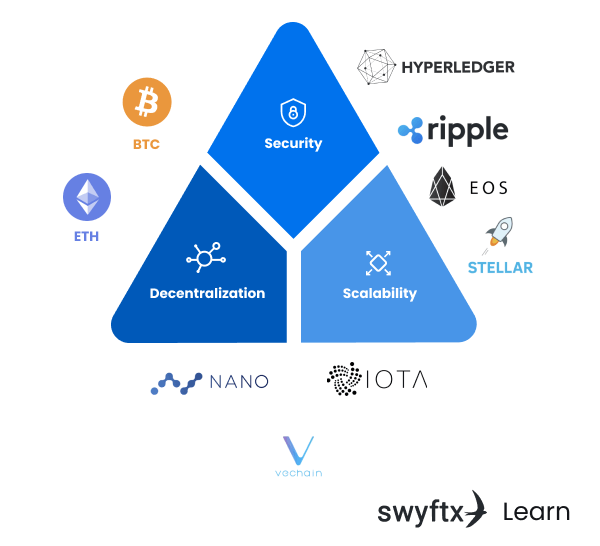

The term “blockchain trilemma” was coined by Ethereum co-founder, Vitalik Buterin, to describe three core issues that developers face when creating blockchains. The three elements of the blockchain trilemma are decentralization, security, and scalability (Figure 1). As with the previous example, only two can be prioritised. To use Bitcoin as an example, decentralization and security were prioritised in its development, which means that scalability was sacrificed.

There are a number of very technical reasons as to why it’s difficult to achieve balance between security, decentralization, and scalability. For the purpose of this piece, let’s just say that the three elements are intrinsically linked, and therefore if you alter one element you alter the others.

Key Takeaway

The “blockchain trilemma” is a widely accepted theory that developers can only effectively prioritise two of the following three components in the development of blockchains: security, decentralization, and scalability. And by prioritising any two, you sacrifice the third element.

The three elements of the blockchain trilemma

Decentralization

Decentralization is one of the foundations of cryptocurrency and blockchain technology. A decentralized blockchain is one that operates across a wide network of computers or nodes. This system means that there is no central entity, such as a bank, that can control the decentralized network. In essence, blockchains distribute control equally between participants.

There is generally a positive relationship between decentralization and network security because there is no longer one point of failure, rather the security of the network is distributed amongst many powerful computers. Unfortunately, achieving a high level of decentralization usually has a negative impact on the speed of a network and the number of transactions it can process.

Cryptocurrencies like XRP and EOS prioritise speed and security, however this comes at the cost of decentralization. Both of these networks have been criticised for their lack of decentralization.

Security

Security is essential to the effective operation of cryptocurrencies and blockchain networks. It ensures that every piece of information on the network is accurate and incorruptible.

Without a high level of security, a blockchain would be a bit like Wikipedia. It would provide access to information around the world in a quick and easy to use format, but with content that anyone can alter or delete. For this reason, people don’t keep valuable or sensitive information on Wikipedia, and by the same token, users are unlikely to use a blockchain that has poor security.

In order to improve the speed and throughput of a blockchain network, it can be effective to reduce the number of nodes on the network, either geographically or in number. However, a more centralized network has far less security because there are fewer computers working to secure the network. This makes centralized blockchains more susceptible to attack.

Blockchains like Nano (XNO) and IOTA are quick and have decentralized networks, but this comes at the cost of less security. That’s not to say that these networks are easy to crack by any means, but that they are a lot less secure than a network like Bitcoin or Ethereum.

Scalability

Scalability is the capacity a blockchain has to support high transactional throughput and sustain future growth of the network. This means that as more people start using the network the performance of the network won’t suffer. For example, the Visa payment network can operate efficiently whether 100 people are using the network or 100,000. A scalable blockchain would be able to do the same.

Many blockchains are founded on decentralization and security. Achieving scalability without sacrificing security or decentralization is one of the major challenges for established and emerging blockchain platforms.

Bitcoin and Ethereum both prioritise decentralization and security, however this comes at the cost of scalability. Currently the Bitcoin blockchain network is able to process around seven transactions per second (TPS) and Ethereum can process a maximum of 15 TPS. Compared to Visa, which processes roughly 1,700 TPS, this is clearly an area for concern, especially if mass blockchain adoption is to be achieved.

Solving the blockchain Trilemma

The issue of the blockchain trilemma has existed for a long time, ever since blockchain technology in fact. Therefore, solving this problem is unlikely to happen overnight. At present, there are a number of different solutions that have been developed or are in development. These are a combination of Layer 1 and Layer 2 solutions.

Tip

Layer 1 solutions make improvements to networks like Bitcoin and Ethereum directly. Layer 2 solutions add an extra layer on top of the original network that adds functionality, such as efficient transaction processing, without affecting the underlying blockchain.

Ethereum 2.0 (aka Consensus Layer)

The Ethereum 2.0 upgrade (also known as Consensus Layer) is a huge overhaul of the Ethereum platform. This upgrade is a Layer 1 solution to Ethereum’s scalability issues, which will increase Ethereum’s throughput from 15 TPS to a theoretical maximum of 100,000 TPS.

There are two key elements to how the upgrade will achieve this massive increase. First, the Ethereum network will move away from Proof of Work (PoW) and towards Proof of Stake (PoS). PoS is much faster, and it uses drastically less energy as well, which means it costs less for each node to maintain the network.

Second, Ethereum will use a concept known as sharding, which will split the Ethereum blockchain into 64 parallel chains that will work together to process transactions. The result of these two factors will be a faster, cheaper, and infinitely more scalable Ethereum network. The downside is that the whole upgrade is not due to be finished until 2023.

The Bitcoin lightning network

The Bitcoin lightning network is a Layer 2 solution for the Bitcoin network to improve scalability. It is designed to allow users to send near-instant transactions between one another. It does this by taking certain high-frequency transactions off the main blockchain and broadcasting them in chunks at a later point back to the main chain, thus easing network congestion. The lightning network went live in 2018, and has since had a decent impact on the Bitcoin scalability.

The lightning network, however, can only accept certain high-frequency transactions, which means that the bulk of transactions still remain on the congested Bitcoin network. Additionally, some experts criticise the lightning network for being less decentralized and much less secure. The lightning network is a good start to solving Bitcoin’s scalability issues, but it is not enough to solve the problem entirely.

Did You Know?

There are currently over 35,000 nodes operating on the Bitcoin lightning network and there has been almost 3,500 BTC sent through these nodes.

Polygon PoS

Polygon (MATIC) is a “decentralized Ethereum scaling platform” that offers a number of different scaling solutions for the Ethereum network. The most impressive is Polygon PoS, which is a Layer 2 solution aimed to address Ethereum’s scalability issue by implementing side-chains for processing transactions more efficiently.

Polygon PoS claims to be able to process up to 65,000 TPS, which is a considerable step up from Ethereum’s 15 TPS. Furthermore, transaction fees on Polygon PoS are reportedly around 10,000 times lower than through the Ethereum network.

Did You Know?

So far, Polygon PoS has recorded over 1.3 billion transactions between 130 million unique wallets and 2.7 million monthly active users. These figures suggest that this scaling solution is an effective one and that it is being adopted widely.

There are a few downsides to this solution though. First, people need to learn and use another platform that is not Ethereum. Second, the security of side-chains such as Polygon are far less that of Layer 1 networks such as Ethereum or Bitcoin. Third, it is seen by many as a temporary solution until Ethereum 2.0 (Consensus Layer) is completed.

Summary

The blockchain trilemma is a major issue for blockchain developers all over the world. It outlines three key blockchain elements – decentralization, security, and scalability – and states that one of these must be sacrificed in order to successfully implement the other two. There have currently been a number of attempts to solve the blockchain trilemma, but no universal solution has been found yet.

Quiz

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read