The world of cryptocurrency is vast and exciting, but it can be a bit confusing or overwhelming when you are first getting started. This piece will explain what cryptocurrency is, how it works, why it’s so popular, and whether it is a good investment.

What is cryptocurrency?

A cryptocurrency is a digital asset or currency that is secured by cryptography, which makes it very difficult to counterfeit or double-spend. Bitcoin is the most well-known cryptocurrency, but there are over 20,000 on the market!

Many cryptocurrency assets are built on decentralized networks based on blockchain technology, which is a distributed ledger that is maintained by a network of computers around the world. A defining characteristic of a decentralized cryptocurrency is that it is usually not issued by a central authority, such as banks or governments, meaning that they are resistant, but not immune, to government manipulation and interference.

How did cryptocurrency start?

In 2009, during the aftermath of the global financial crisis, an anonymous developer, or group of developers, known as Satoshi Nakamoto, created the first cryptocurrency, Bitcoin. Nakamoto’s intention was to create a global, decentralized digital currency that was separate from the traditional banking system, which was largely responsible for the worldwide economic recession in 2008.

In the following years, people took notice of the blockchain technology that Bitcoin was built on and could see the exciting potential in the technology in a range of different areas. A sea of cryptocurrencies was soon introduced, with different attributes and use cases. Smart contracts enabled the development of decentralized applications (Dapps). Along with NFTs and metaverse gaming, which paved a fun and interactive way to engage with crypto.

Key Takeaway

Bitcoin was the first cryptocurrency. Along with the innovative blockchain technology, Bitcoin paved the way for other cryptocurrencies, which aimed to provide services or solve specific problems.

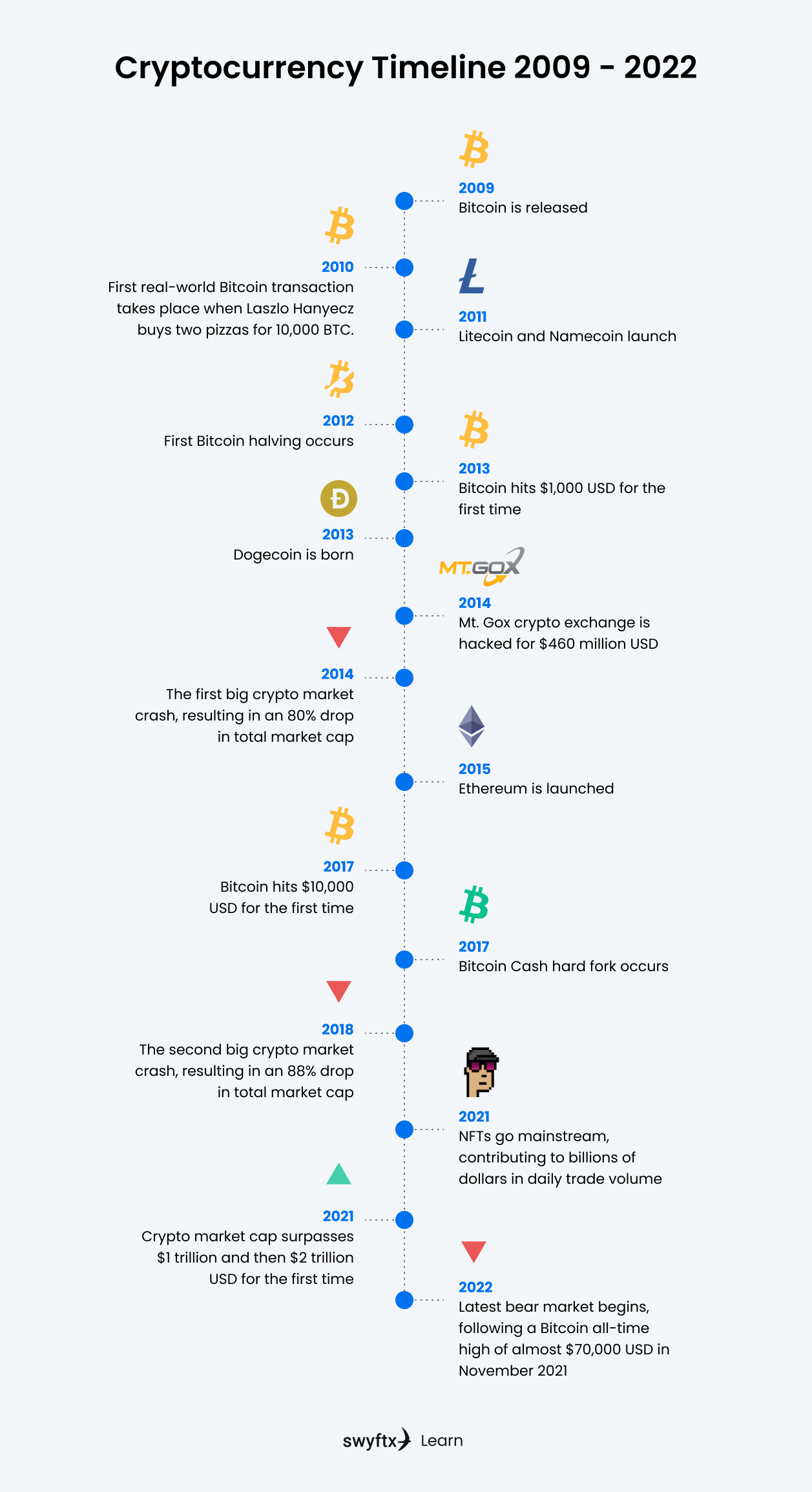

A brief history of cryptocurrency

Figure 1 – Cryptocurrency timeline from 2009 to 2022

How does crypto work?

Cryptocurrency transactions are generally sent between peers using cryptocurrency wallets. In a peer-to-peer network like Bitcoin, computers (or peers) can share information without the need for a third computer to act as a server. The user initiating the transaction uses the digital wallet software to transfer crypto to another wallet ( a public cryptocurrency address). The cryptocurrency transaction is then encrypted and broadcast to the network to be recorded on the blockchain through a process called “mining”.

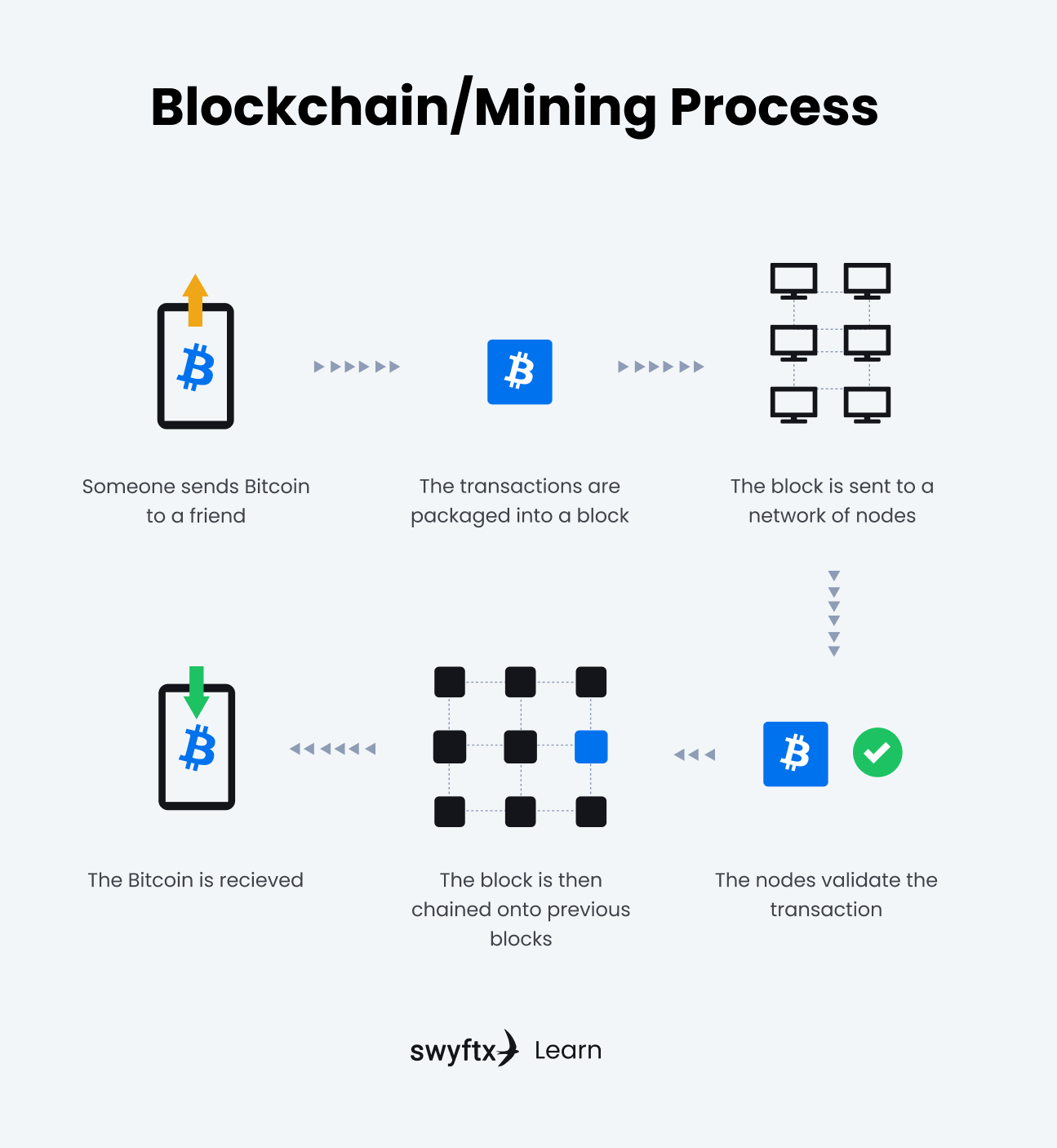

What is mining?

Cryptocurrency mining is a process that uses computers from around the world to solve complex mathematical problems in order to verify transactions. The miner who solves the problem is compensated with a certain amount of the coin they are mining.

Crypto transactions are stored in blocks, which are linked together to form a chain. The blocks are linked with a hash, which is a long string of integers and numbers. Each block has its own hash and contains the hash of the previous block. Simply, miners are trying to find the value of the next hash, and the first one to do so gets rewarded in cryptocurrency.

What is blockchain technology?

A block is a collection of transactions that is recorded in a distributed ledger. After the successful miner solves the problem, a new block is added to the ledger. When the next problem is solved, another block will be chained to the end of the previous one. And thus a “chain of blocks” or a “blockchain” is born.

Figure 2 – The blockchain/mining process

Blockchain is a powerful technology because each block is duplicated and distributed to every node on the decentralized network for verification, which removes the need for a trusted third party, such as a central bank. It also makes it virtually impossible to create false or counterfeit transactions.

Important to Remember

This is a description of how Bitcoin and many other popular cryptocurrencies work, however, this does not apply to every crypto. Some coins use Proof of Stake (PoS) rather than Proof of Work (PoW); several privacy coins don’t use a public ledger; and a few cryptocurrencies, such as IOTA, do not even use a blockchain, although this is rare.

Why are cryptocurrencies so popular?

Crypto is popular for a number of reasons, including the potential for huge returns on investment, low transaction fees, and being part of the future of technology.

Crypto is seen as the future

A lot of people are excited about crypto because they see it as the future of finance and technology. Cryptocurrency and blockchain have made a huge impact and continue to innovate in areas such as finance, cloud storage, gaming, trading, art collecting, contracts, documentation, and even voting. Many people in the crypto market want to be early investors in innovative and revolutionary technology and reap the rewards from this as time goes on.

Potential for huge returns on investment

Another reason that crypto is so popular is the potential for huge profits. It is also far more accessible than the stock market, which many believe is elitist in nature and geared towards those with large initial investments. Crypto has opened the door for millions of everyday people to trade and invest whatever they can afford.

Cryptocurrency transactions can be cheap

Crypto is gaining popularity all around the world because it is often cheap to use. Other forms of online payments, particularly sending money internationally, can be expensive as there are often large fees attached to these transactions. But with cryptocurrency, you can make everyday transactions or send large sums of money worldwide on the cheap, regardless of the total value.

Pop Quiz

Cryptocurrencies are built on decentralized networks and based on blockchain technology.

Some examples of popular digital currencies

The cryptocurrency market is full of exciting projects! There are a lot of different cryptocurrency use cases. Many of them have a specific utility and others aim to solve a particular problem.

Bitcoin is a popular payment coin that can be used to pay for goods and services, as well as to transfer value from one party to another. There are several other payment coins (or digital currencies), such as Litecoin and Bitcoin Cash, that have quicker transactions and smaller fees, but Bitcoin remains the most well-known.

Coins like USDT, known as stablecoins, are frequently used because they are pegged to real-world assets and traditional currencies, such as the U.S. dollar, which doesn’t change much in value, and as such can provide a safe place to keep money without being subjected to Bitcoin volatility. Ethereum is a hugely popular smart contract platform that is used for building decentralized apps (dApps) and also executing smart contracts.

Decentralized finance (DeFi) projects, like Uniswap, are popular with users who want access to financial services without having to trust a third party. People who are primarily concerned with privacy and anonymity flock towards privacy coins, such as Monero. Recently there has been a huge surge in the interest and adoption of Non-Fungible Tokens (NFT), which are unique digital collectibles. This is partly because people see huge potential profits from trading NFTs, but also because it provides a way to prove ownership of unique digital assets, such as original pieces of art, books, and games.

Is cryptocurrency a good investment?

Since its inception, cryptocurrency has been steadily increasing in adoption worldwide. This generally translates to increased value in the market. That said, there have been several large crashes as well, most notably in 2014/15 and 2018. Historically, the markets have bounced back stronger, but it’s important to remember that no matter how promising the projects you are investing in are, there are no guarantees in crypto. Be careful who you take investment advice from and always do your own research.

Did You Know?

In 2014/15, the entire cryptocurrency market cap plummeted by 80%. It then entered the stratosphere with a 27,000% recovery by the start of 2018. At the end of 2018, the market crashed back down 88%. But it recovered again in 2021, surging upwards by over 2,500%. This is why crypto is seen as an exciting, but volatile market as cryptocurrency prices can fluctuate wildly.

How can cryptocurrency make you money?

The crypto market has a lot of inherent value, but it is also largely based on speculation, similar in some ways to the stock market and real estate.

Real estate speculation involves buying a property with the hopes of reselling it at a higher price in the future. This is based on a number of factors, such as the quality and location of the house and property, access to parks, schools, and shopping centres, crime rates, etc. In the stock market, investors and traders speculate on the future valuation of publicly listed companies, such as Apple and Tesla. This is based on an extensive range of factors, such as the revenue and profit the company generates, competitors, quarterly reports, government regulations, etc.

Crypto is quite similar. Traders and investors use a variety of different information and tools in order to speculate on the future valuation of crypto assets. There can be a high level of risk involved, which is why it is very important to be educated before diving into the deep end. But on the flip side, it can be very exciting, and there is potential for huge profits as well!

How do I buy cryptocurrency?

The easiest way to buy and sell crypto is to use a cryptocurrency exchange, such as Swyftx. There you will be able to deposit your fiat currency and buy the cryptocurrencies of your choice, quickly and affordably. You can then store your cryptocurrency on the exchange to sell at a later point, or you can transfer it to a software or hardware wallet if you plan to hold it long-term.

Summary

This article was written to give you a brief introduction to cryptocurrency. It has highlighted what crypto is and how it works. It has also discussed why crypto is popular and whether it is a good investment. If you would like to learn more about any of the terms or concepts mentioned in this article, there are plenty of resources on each topic located on the Swyftx Learn platform.

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read