So, you’ve purchased your first cryptocurrency – what now?

Just like if you have a hundred-dollar note, you need somewhere safe to store your digital assets.

Cryptocurrencies are stored in wallets, similar to cash. But unlike the wallet you keep in your pocket, crypto wallets are entirely digital and are essential for sending, receiving and securely holding digital assets.

There are several types of crypto wallets for investors to choose from, and understanding how they work can help keep your hard-earned assets as secure as possible.

What is a crypto wallet?

A crypto wallet is a mechanism that lets you interact with digital assets on a blockchain network.

Despite what the name suggests, a crypto wallet itself doesn’t actually store your cryptocurrencies. Instead, the wallet acts as a private key that unlocks access to your funds on a blockchain.

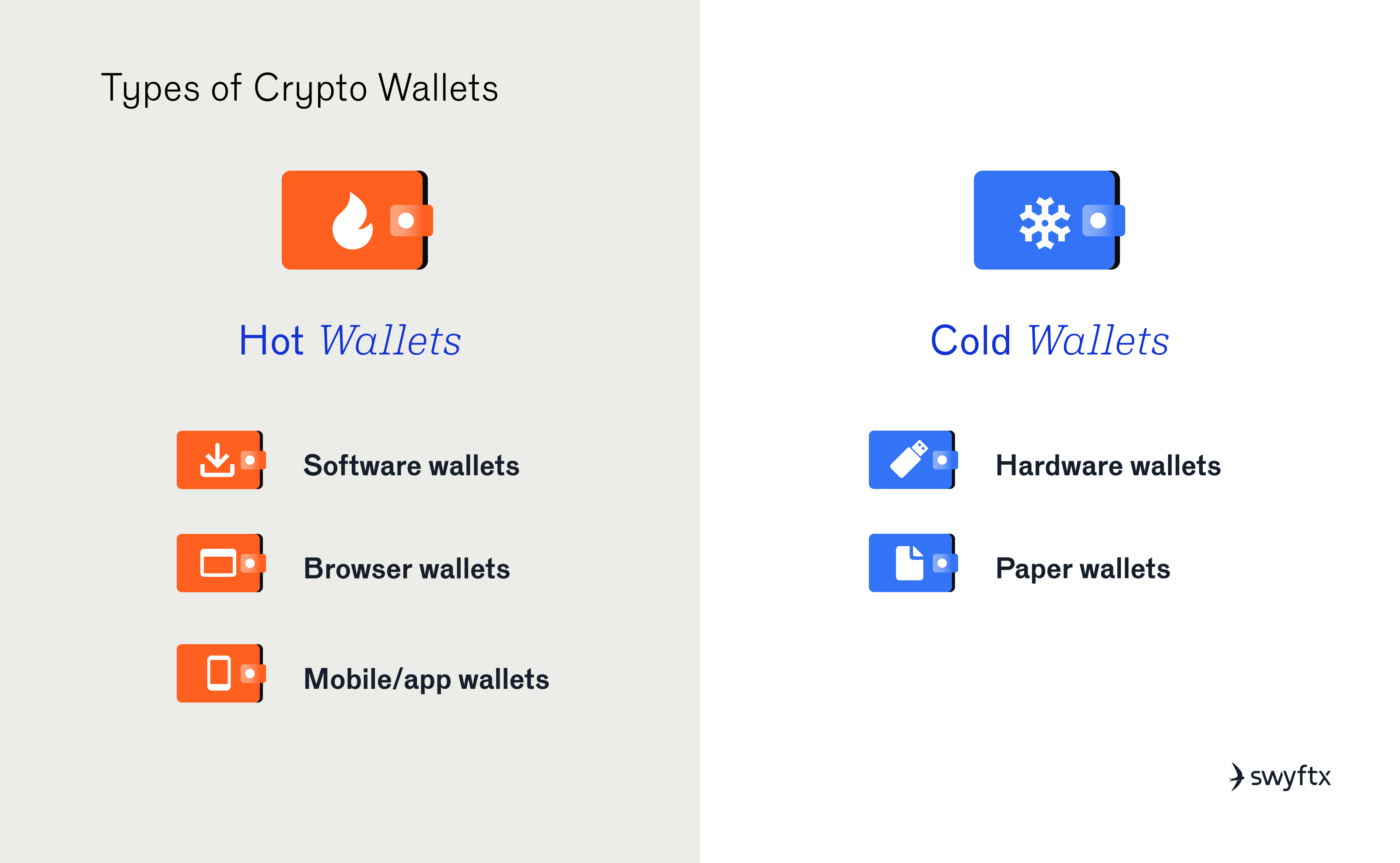

There are two major types of crypto wallets: hot and cold.

By default, most beginners who buy crypto on an exchange will automatically have their assets stored in a ‘hot’ wallet managed by the platform. From there, it’s up to the individual to either leave their assets in the exchange’s custody or move them to a private wallet they control.

What happens when you buy cryptocurrency?

Most beginners who buy crypto on an exchange will automatically have their assets stored in a wallet managed by the platform. For example, if you purchase Bitcoin on Swyftx, it will be stored in the wallets tab of your account. This is the most common example of a hot wallet – a type of cryptocurrency wallet that is nearly always connected to the internet.

From there, it’s up to the individual to either leave their assets in the exchange’s custody or move them to a private wallet they control.

Leaving your crypto on an exchange isn’t considered the most secure storage method, but it is quite convenient and avoids the potential complexities of non-custodial wallets (such as MetaMask or Trust Wallet).

Let’s say you buy $100 AUD worth of XRP on Swyftx, and, after three months, you want to sell it.

If you leave the XRP in your Swyftx-linked wallet, all you need to do is sign in, put in a sell order and wait for the transaction to finalise.

Alternatively, if you use a non-custodial wallet and want to trade via Swyftx, you will need to send the digital assets back and forth between your personal wallet and the exchange’s wallet. This is not necessarily any more difficult or time-consuming than sending an email, but it can be a little intimidating for first-time users.

Despite the beginner-friendly nature of storing crypto in an exchange-linked wallet, it is often recommended for investors to utilise several different storage methods – which we will touch on later.

Pop Quiz

Bitcoin is the fastest cryptocurrency.

How does a crypto wallet work?

All cryptocurrency exists on a blockchain and can only be accessed using a crypto wallet.

A wallet uses two types of keys: a public key and a private key. No matter what type of wallet you decide to use, this pair of keys is how you access your crypto assets.

Your public key is a cryptographic code that anyone can send transactions to, sort of like a bank account number or, as mentioned earlier, email address. Your private key, on the other hand, works like a bank PIN or email password. It’s what your wallet uses to access and manage your crypto on the blockchain.

When you create a new wallet, you will receive what’s called a seed phrase (also known as a recovery phrase). A seed phrase is a sentence comprising a random combination of words.

Because a crypto wallet doesn’t actually store your digital assets, you could theoretically lose access to thousands of wallets but still recover your crypto using your seed phrase.

This is why it’s vital to record your seed phrase and store it somewhere secure. Saving it on a computer or smartphone can be risky, as it could be accessed by hackers or malware.

Important to Remember

If you choose to keep your crypto on the exchange where you bought it, you won’t need to manage a seed phrase. Instead, the exchange holds the private keys and seed phrase on your behalf.

What type of crypto wallet is right for you?

Each type of crypto wallet comes with a set of advantages and disadvantages. The right wallet for you will almost always depend on your personal goals.

Most beginners will buy Bitcoin, or another digital asset, and simply leave it on an exchange wallet. While this means entrusting your crypto to a third party, most modern exchanges have strong security measures in place to protect customer funds.

However, this is still the riskiest method of storing your cryptocurrency – and it’s recommended that, as you progress along your crypto journey, you also explore non-custodial options.

Software wallets, like MetaMask, provide a middle-ground of financial control and accessibility. They often directly integrate with decentralised finance (DeFi) apps, allowing more experienced investors to earn passive income through staking or yield farming. That said, they can be slightly less convenient than exchange wallets and are not as secure as cold storage solutions.

Cold wallets, such as hardware devices, are ideal for long-term investors HODLing larger amounts of crypto. While they’re more expensive and slower to access, they provide top-shelf security over your hard-earned investments.

As you progressively build a digital asset portfolio, it’s possible you will end up using all three types of crypto wallets. For example, you might keep a small amount of stablecoins on an exchange wallet for quick trades and use a software wallet to participate in DeFi opportunities. Meanwhile, you could use a cold wallet for a long-term storage strategy, like housing a Self-Managed Super Fund.

Key Takeaway

Hot wallets are connected to the internet. The most common types of hot wallets are exchange wallets and software wallets. They are very convenient but can be less secure. Cold wallets are isolated from the internet. The most common type is a hardware wallet, which often resembles a USB stick. While cold wallets are extremely secure, they can be less convenient for frequent trading.

Summary

Storing your crypto in a safe and secure place might be the most important step along your investment journey.

Just like you wouldn’t leave thousands of dollars lying around your house, you should ensure your portfolio is as secure as possible.

From simple apps to high-security hardware, every crypto storage method uses a wallet.

And if you’ve ever read one of those horror stories about someone tossing a hard drive with millions in Bitcoin, just remember – it all could’ve been avoided by writing down a seed phrase.

Quiz

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Course rewarded

Course rewarded

Article read

Article read