There has been an explosion of interest in cryptocurrency over the last few years. This has attracted the interest of tons of new investors, but it has also attracted the attention of a lot of scammers as well. This guide will outline several common cryptocurrency scams and explain how you can avoid them.

What is a cryptocurrency scam?

A cryptocurrency scam is a type of scheme that is designed to steal your crypto. Financial scams have existed since the inception of money, but the number of scams has increased exponentially since the beginning of the internet age. Furthermore, financial scams have become a lot more advanced. Cryptocurrency scams are some of the worst. With crypto transactions, once they are sent and secured on the blockchain, they are irreversible. That is why you must secure your cryptocurrency and learn how to avoid scams.

Types of crypto scams

There are lots of different scams out there. This list is by no means exhaustive, but it does contain the most common financial scams that can be found in the crypto space. In general, the best way to protect yourself against these scams is to use our security best practices, but the sections below will also outline great ways to avoid each specific scam.

Phishing

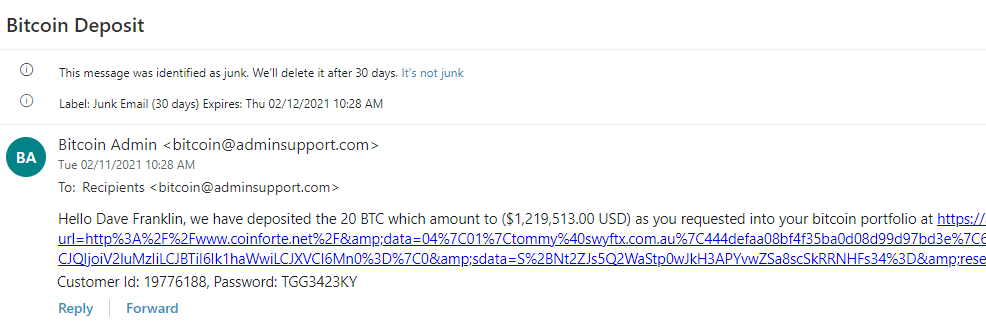

Phishing is when an attacker tries to gain access to your sensitive personal information, such as account details or crypto wallet passwords, via emails or private messages on social media. Scammers who use this method will often impersonate a well-known cryptocurrency exchange company or a trusted individual within the crypto community.

Figure 1 – Example of a phishing email

How to protect yourself from phishing scams

The most important thing is to never click on links in emails or private messages from people you don’t completely trust. A simple but effective technique to verify the sender’s authenticity is to check their email address or handle (for websites like Instagram or Twitter). This is because scammers can easily replicate a profile picture or display name, such as Elon Musk, but it is difficult for a scammer to replicate (or hack) an exact company email or social media handle.

Tip

When checking an individual’s email address or social media handle, pay special attention to the spelling. Scammers often use extra characters that make the handle or email look similar at first glance, but upon closer inspection, they are a forgery. For instance, the real Elon Musk’s Twitter handle is @elonmusk, but fake accounts might use handles like @elonmuskk or @elonnmusk.

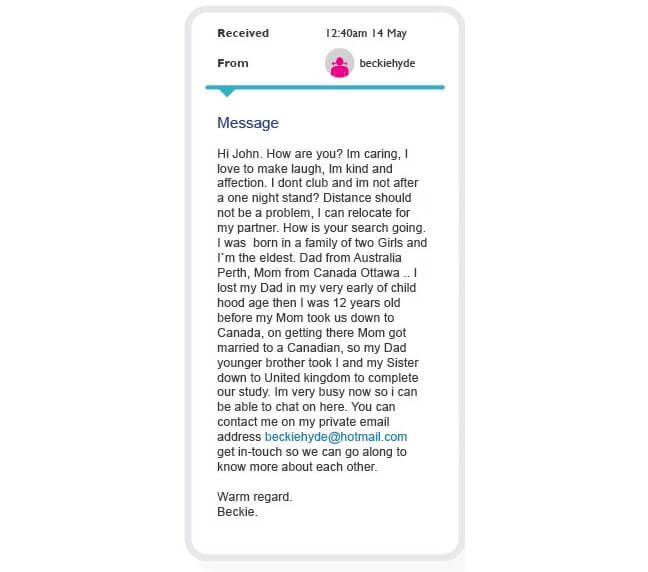

Romance scams

Scammers will often use dating websites or apps, such as Tinder, to establish a seemingly real relationship with someone. But once they have earned the trust of their partner, conversations will then usually turn to lucrative cryptocurrency opportunities. Often this leads to the transfer of either account details or crypto assets. Once the scammer has received these details or funds, they generally disappear without a trace.

How to protect yourself from romance scams

There are many red flags you can look out for in relation to romance scams. The person you are talking to might ask you a lot of personal questions but avoid answering similar questions about themselves. They might ask for financial help. They might try to form a bond with you very quickly, using pet names or telling you things like “I have never felt this way before”. Their profile picture might look fake, low-resolution, or seem to belong to someone else (after performing a reverse image search). They might mention on their profile that they are interested in cryptocurrency, which could be an attempt to attract people with crypto investments.

There are several things you can do to protect yourself from romance scams. First of all, if you see any of the red flags above, consider avoiding the person altogether or breaking communication with them. Otherwise, try to avoid sharing personal details such as your full name, date of birth, or home address. Do not send money or digital currency to someone you’ve met online, regardless of how convincing their story might be. Only use trusted dating apps or websites. Scammers will often try to move communications off the platform as soon as possible so that the dating website or app has no proof of them asking you for money.

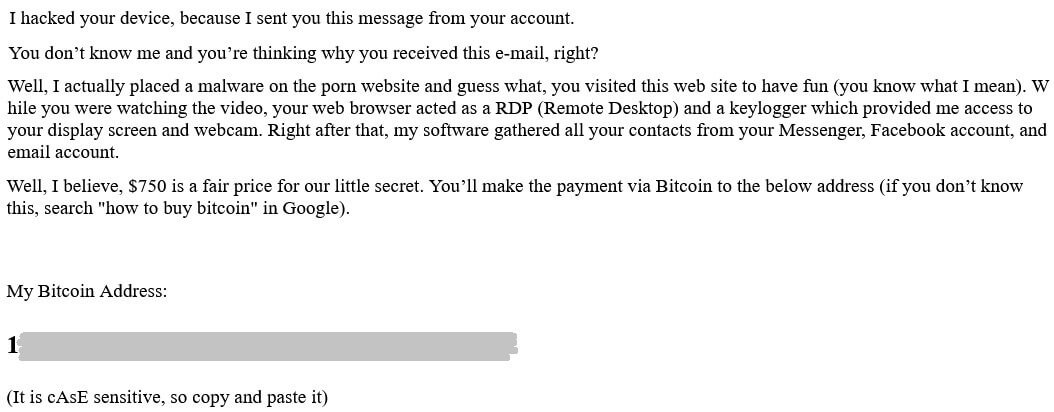

Blackmail

Blackmail is when a scammer threatens to release sensitive information unless they are paid a sum of money. The sensitive information might be something like a record of adult websites visited by the user. In very bad cases the scammer might claim to have access to personal photographs, videos, or documents that the victim wants to keep private. The scammer will then threaten to release this information unless the victim transfers a certain amount of crypto or reveal their private keys to the scammer.

How to protect yourself from blackmail scams

The best way to avoid blackmail scams is to be very careful about selecting your login details, which websites you visit, and who you give your information to. Always use two-factor authentication (2FA) if possible. It is a good idea to make sure that any sensitive information you have is either offline, or if it is accessible online that it is secure or encrypted.

If someone tries to blackmail you, this is classified as a criminal extortion attempt and you should consider reporting it to a relevant authority.

Tip

A lot of blackmail scams take a scattergun approach. The scammer might claim they have sensitive information about someone, which they send to a range of people in the hope that some will believe them. The wording is usually generic because this appeals to more people. If you know that the information that the scammer is trying to blackmail you with is false, you are probably in the clear. But it is strongly recommended that you do not engage in any further conversations with them.

Fake exchange apps or exchanges

Fake exchanges are illegitimate copies of genuine cryptocurrency exchanges. Typically, this type of scam is presented as a mobile app, but they can appear as fake websites or desktop applications as well. You have to be cautious because some fake exchanges look very similar to legitimate ones, but their goal is to steal your cryptocurrency. Often, fraudulent exchanges will attract investors and traders by offering things like free crypto, low exchange fees, competitive prices, or even gifts.

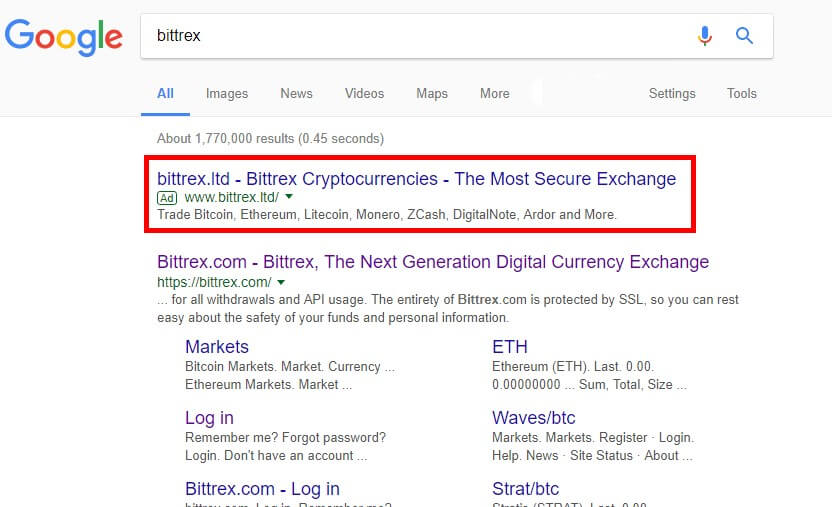

Some advanced scammers have even purchased targeted ads that copy a reputable exchange’s Google search title, metadata, and use a URL with very similar spelling. This result will sometimes appear first or high up on the page Google results page. If an unsuspecting person clicks on this link, it will take them to a fraudulent version of the exchange. If the victim then signs into the website, it will steal their private keys or passwords to access their crypto funds.

How to protect yourself from fake exchange scams

The best way to protect yourself from being scammed by a fake exchange is to bookmark the real URL and always double-check it before you log in. You can also use websites like Trend Micro Website Safety Centre to verify the authenticity of URLs.

Many victims of this type of scam have downloaded fake cryptocurrency apps. So be sure to verify the developer information, the reviews, comments, and the number of downloads. Most likely, fake exchanges will have fewer downloads and predominantly negative reviews and comments.

Rug pulls or ICO scams

As the crypto ecosystem continues to grow, new avenues for crypto-based investments have been introduced, such as decentralized finance (DeFi) an initial coin offerings (ICOs). While many of the projects in these areas are legitimate, there are now even more ways for scammers to steal your money.

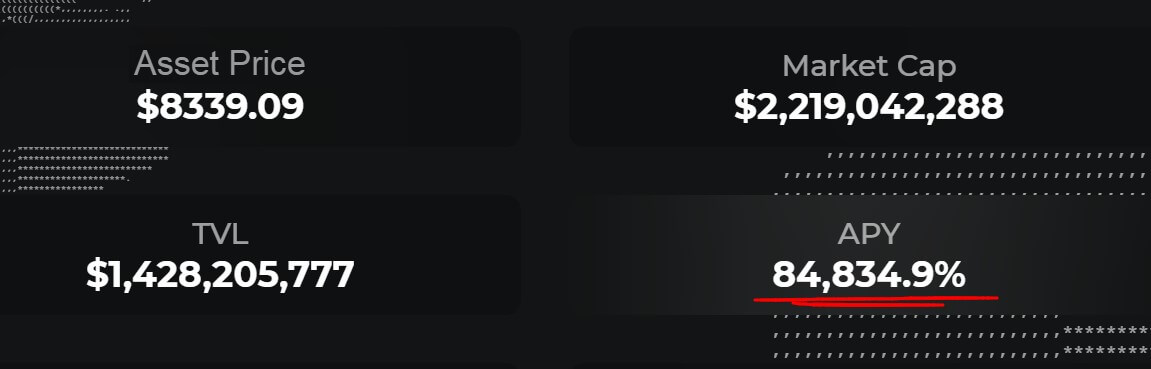

Over the last few years, DeFi has been an incredible space of innovation within crypto, but it has also seen some of the biggest cryptocurrency investment scams in recent times as well. Absurdly high returns on investment are often a key indicator of a potential rug pull. Likewise, while there are plenty of genuine ICO projects, some fraudulent ICOs spend a lot of money on marketing, attempting to draw investors to a product that barely resembles what was promised or is entirely non-existent. When investors finally realize this, the scammers have already taken their money and disappeared.

How to protect yourself from rug pulls or ICO scams

As mentioned above, if the annual percentage rate (APR) or annual percentage yield (APY) of an investment opportunity far exceeds the market average, do not invest in it. It is most likely a rug pull waiting to happen. For example, some of the DeFi rug pull scams have advertised an APY of 50,000% or more. To put this into perspective, they are saying you can make $500,000 a year from a $1,000 investment. Remember the adage, if something sounds too good to be true, it probably is.

In terms of initial coin offerings (ICOs), you should always perform thorough research on the project before investing. Make sure the project has a solid product, a transparent and achievable road map, and a team with the expertise and experience to deliver what they are promising.

Key Takeaway

Always do thorough research on projects you plan to invest in and stay away from investment opportunities that offer a return on investment that far exceeds anything else on offer in the market, as they are most likely scams. You can also use websites like Is This Coin A Scam?, to help verify the legitimacy of a coin or project before investing in it.

Fake giveaways

Fake giveaways try to steal your cryptocurrency by offering you something for free in exchange for a small deposit. Generally, scammers will promise that after you make a deposit they will send you free Bitcoin in return. Scams might contain text such as: “Send 0.1 BTC to the following address to receive 0.5 BTC!”. But if you transfer Bitcoin to the address, you will not receive anything, and you’ll never get your money back. There are many versions of this scam that ask you to transfer other digital currencies or ask for your private keys.

Fake giveaways are often found on Twitter and other social media websites. Scammers will often comment on popular tweets, news, or announcements.

How to avoid fake giveaways

The easiest way to avoid this type of scam is to never take part in any giveaways where you are required to make cryptocurrency payments or transfer something of value first. Genuine giveaways will not ask for funds.

Ponzi schemes

A Ponzi scheme is a business model that pays returns to older investors using the money of new investors. When the community is no longer able to attract new investors, the money stops flowing, and the scheme ends. If the community has managed to attract a lot of new investors during this time, the original scammer will have made a lot of money by the time the scheme is exposed.

Did You Know?

The most notorious crypto Ponzi schemes were OneCoin and Bitconnect. OneCoin defrauded cryptocurrency investors of a whopping $5.8 billion USD between 2014 and 2019. Bitconnect, operating between 2016 and 2018, fleeced crypto investors of $3.5 billion USD.

How to avoid Ponzi schemes

The most effective way to avoid these kinds of schemes is to do your own research on the cryptocurrencies you buy or the communities you join. If the investment strategy is totally dependent on new members or investors joining, there’s a good chance it’s a Ponzi scheme.

Summary

Although there are lots of amazing opportunities within the crypto market, there are also many scams that are designed to steal your hard-earned money. This guide has explored the most common crypto scams and described how you can best avoid them. If you want to learn more about how to secure or safely store your crypto, there are lots of excellent resources on Swyftx Learn.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read