Do your own research (DYOR) — it’s such a common refrain in crypto circles it’s become a cliche. Like many cliches though, its prevalence reflects a fundamental truth: in the crypto space investors really do need to know what they’re investing in, or there’s a good chance they’ll get burned. This guide reveals how to spot hidden crypto gems and avoid overhyped land mines. It describes what research areas to focus on, how to evaluate a good crypto project, provides useful free resources, and explains portfolio diversification.

Why is it important to do your own research?

The crypto market is notoriously volatile. It’s also not as well-regulated as other financial markets, which can increase the risk, particularly for poorly informed crypto investors.

While nothing can entirely guarantee protection from crypto’s volatility, often the worst projects can be avoided if an investor has done thorough research. Similarly, legitimate projects with the potential for growth and widespread adoption are more easily identified if investors take the time to learn what to look for.

Tip

Hype on social media platforms isn’t a good indicator of project quality. Crypto influencers are sometimes paid to promote assets they don’t believe in. Worse still, some unscrupulous projects create multiple fake accounts to promote their crypto and trick investors into thinking there is support where there is none.

How to do your own research?

This guide covers two types of investment analysis: fundamental analysis and technical analysis. Both types of analysis can provide useful information. Investors should prioritise different aspects of each type of research process depending on the nature and timeframe of their particular investments.

Fundamental analysis

The purpose of fundamental analysis (FA) in crypto investing is to establish the ‘real’ value of a digital asset. This allows investors to decide if a particular digital asset is undervalued and potentially worth investing in, or is overvalued and best avoided.

FA is particularly important for longer-term investments — knowing a particular crypto project has strong fundamentals can help an investor more confidently weather the inevitable storms in the crypto industry. Similar to how an academic researcher might compile scientific evidence, undertaking FA involves examining all the available information about an asset, including qualitative factors.

Project website and white papers

An excellent place to begin FA is by scrutinising the project’s website. Initially, this involves looking for any red flags such as excessive use of empty buzzwords, irrelevant jargon, and celebrity endorsements. If there aren’t any red flags, the next step is to look for information on the website that can be used to judge the future potential of the project, such as:

- A project roadmap that demonstrates transparency and accountability

- A roadmap with milestones that are based on achievable targets and deadlines

- Use cases and meaningful partnerships

- Team member profiles and track record

- The project’s white paper

- Crypto news stories.

Most projects have a white paper. It should offer a clear understanding of how the project works, what problem it solves, and how it creates value.

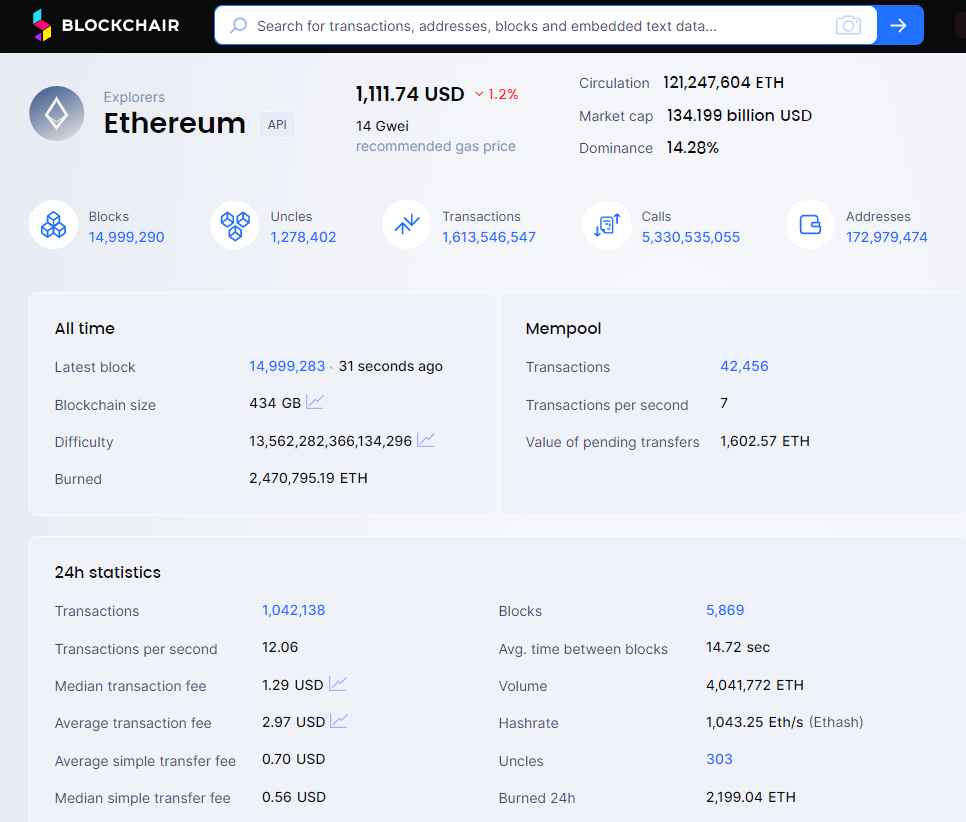

Data aggregators and blockchain explorers

Another good source of information is data aggregator websites that provide information about most cryptocurrencies, including current market capitalization, exchange listings, price history data, and much more. This information can help round out an investor’s knowledge of a project. These sites also provide useful links, including blockchain explorers and project accounts on various social media platforms.

Using block explorers enables the examination of on-chain network data including transaction volume and current active addresses. Blockchain explorers can also help investors determine how decentralized token ownership is and whether large holders have been selling, holding, or accumulating tokens.

Figure 1 – An Ethereum blockchain explorer

Social media and GitHub

Another avenue of research is the project’s accounts on social media platforms and its GitHub repositories. Reviewing GitHub reveals how active development is, and if the project has momentum. On social media, sceptical views by reputable bloggers and respected community members can be useful. Although it’s unwise to base digital currency investments on social media chatter or crypto groups alone, critically evaluating social media content can allow investors to gain a broader perspective on an asset.

Key Takeaway

The aim of fundamental analysis in crypto is to get a sense of a digital asset’s real value. By understanding the real value of an asset, investors can better judge if there’s potential for its market value to increase.

Technical analysis

Technical analysis (TA) is a form of research used to reveal market trends, identify patterns and anticipate price movements by examining quantitative data. TA can be thought of like climate modelling: hard data is collected and analysed to generate statistical frameworks which predict what might happen in the future.

While TA trends may emerge over months and years, the patterns it identifies tend to play out over days and weeks — making it particularly useful for short to mid-term trading, and less useful for long-term holders. Most exchanges provide basic TA tools, making it easy for investors to use the approach to analyse investments. For example, Swyftx offers TradingView charts for every asset.

Important TA skills include reading market indicators like candlestick charts and trading volume columns — these basic metrics can indicate if an asset has buy or sell pressure and the current level of market interest in the asset. Understanding these basics helps investors progress to using statistical indicators such as a simple moving average (SMA) and an exponential moving average (EMA) to identify market trends.

Once an investor can read price charts and understand volume data they can start to look for patterns which can help them anticipate future price movements. For example, a bullish pennant pattern, where an initial upward move is followed by a period of consolidation with lower highs and higher lows, can indicate another upward move is coming.

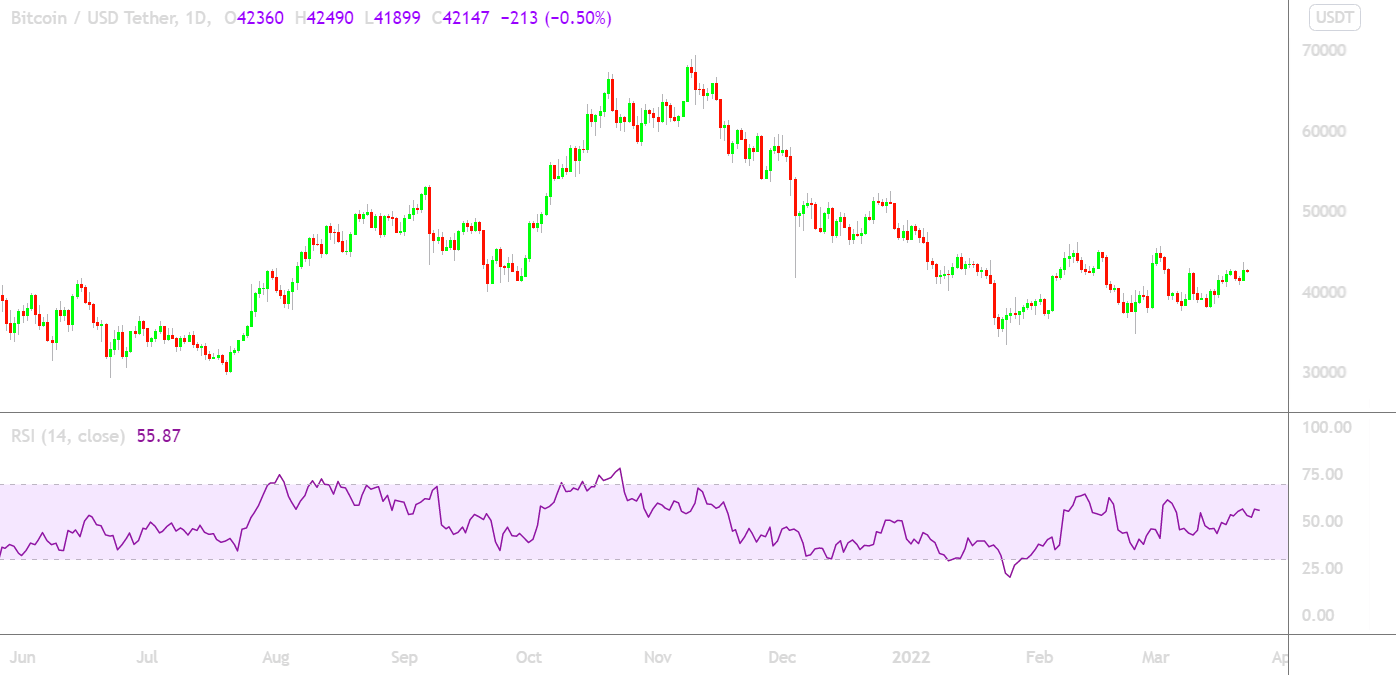

More advanced statistical tools, such as a relative strength index (RSI), are often used in conjunction with chart patterns. For example, a price chart showing a bull pennant combined with an RSI of under 30, indicating the asset is oversold, makes an upward move even more likely.

Figure 3 – The relative strength index (RSI) at the bottom of a price chart

Combining these indicators in this way builds a clearer picture of the market forces acting on an asset, making it more likely the predicted price movement is accurate.

Did You Know?

Technical analysis was first used in the late 1800s by Charles Dow, developer of the Dow Jones Industrial Average. Dow’s ideas and methods were later expanded by others into Dow Theory, an early theory of how markets function.

Complete an investment checklist

Fully benefiting from research requires a system for evaluating the relative strengths and weaknesses of potential crypto investments. A great way to do this is by completing an investment checklist. The exact makeup of an investor’s checklist will vary depending on what they decide is important, but might include items such as:

- What is the problem the project is trying to address?

- Are there many competitors and what makes this coin unique?

- How does the project work on a technical level?

- How does the cryptocurrency fit in with the goals of the project?

- Are the team members identified and are they competent and trustworthy?

- Does the project have a public roadmap?

- If it does have a roadmap, does it strike a balance between ambitious and achievable?

- Is there active development and growth in transactions and active addresses?

- What is the price history, and at what stage is the asset in its market cycle?

- What are the weaknesses of the asset?

Best free cryptocurrency resources for DYOR

Coin Market Cap

Coin Market Cap is a crypto market data aggregator website that provides information on over 20,000 cryptocurrencies. It can be used to research digital assets or to discover new assets, providing access to a wealth of information and relevant links for most assets.

Blockdata

Blockdata provides high-quality research on specific crypto projects, crypto market conditions and emerging crypto trends. It can be used as a resource to deepen investors’ knowledge about specific assets and also equips crypto traders to identify which crypto sectors may be primed for growth.

Swyftx Learn

Swyftx Learn is an educational platform that caters to the needs of all crypto users, from beginners to seasoned crypto veterans with one or two gaps in their knowledge. It provides foundational knowledge of the crypto space that helps users to understand technical content found on project websites and in white papers.

In addition to a wide range of in-depth guides and courses, Swyftx Learn also provides detailed profiles of many of the larger cryptocurrencies, such as Ethereum, Ripple, and Cardano.

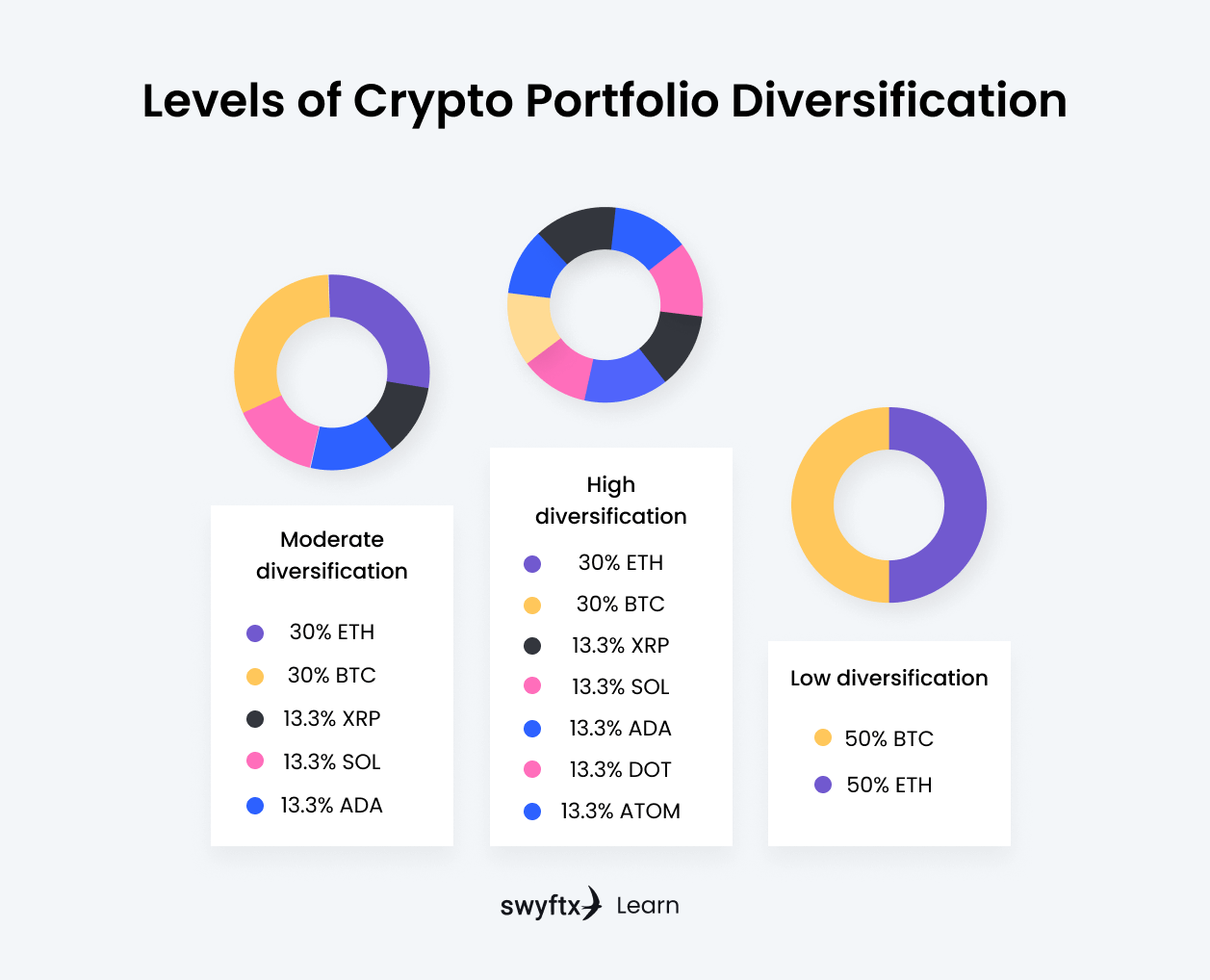

Analyse your portfolio allocation

Creating a diverse crypto portfolio can help minimise risk and hedge the volatility of the crypto market, supporting a balance between safe and speculative investments.

Increasing the diversity of a crypto portfolio can be achieved by buying assets across a range of sectors. Like traditional financial markets, the crypto market contains numerous distinct sectors. Some of the major sectors include:

- Payment coins e.g. Bitcoin (BTC), Ripple (XRP)

- Smart contract platforms e.g. Ethereum (ETH), Solana (SOL)

- DeFi tokens e.g. UniSwap (UNI), Aave (AAVE)

- Privacy coins e.g. Monero (XMR), Zcash (ZEC)

- NFT coins e.g. ApeCoin (APE), Enjin (ENJ)

- Metaverse coins e.g. Sandbox (SAND), Decentraland (MANA)

- GameFi assets e.g. Illuvium (ILV), Axie Infinity (AXS).

Investors must decide which sectors they want to invest in and how heavily to invest, based on their research and where they see the most potential for growth.

Figure 4 – Levels of crypto portfolio diversification

Summary

Crypto as an asset class presents incredible investment opportunities but also presents significant risk. Doing high-quality, independent research is one of the best ways for investors to improve their chances of making gains. This article has highlighted the most effective techniques and tools for making informed, evidence-based crypto investment decisions.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.