It’s no secret that cryptocurrencies are a particularly volatile asset class. Huge ups and downs that would be considered major upheavals in traditional financial markets are regular occurrences in crypto. While most investors know that cryptocurrency prices fluctuate, the reasons for this extreme volatility are often less well understood. This guide examines crypto’s variability and the factors that create price volatility, to help investors better judge the risks and opportunities crypto presents.

What is market volatility?

Market volatility refers to the size and frequency of price movements for an asset or market, either up or down. High volatility is indicated by larger and more frequent price movements. In traditional financial markets, turbulence tends to occur in response to significant events with the potential to disrupt the economy, such as the outbreak of COVID-19 or a military conflict. Increased volatility brings more unpredictability and risk, but it can also mean greater opportunities for investors.

Did You Know?

Volatility is usually measured by either using historical data or by analysing market behaviour to project future volatility. The Cboe Volatility Index (VIX) is perhaps the most popular measure of future market volatility: it’s a real-time index that forecasts the market’s expected or implied volatility over the next 30 days by analysing S&P 500 index option prices.

Crypto market volatility

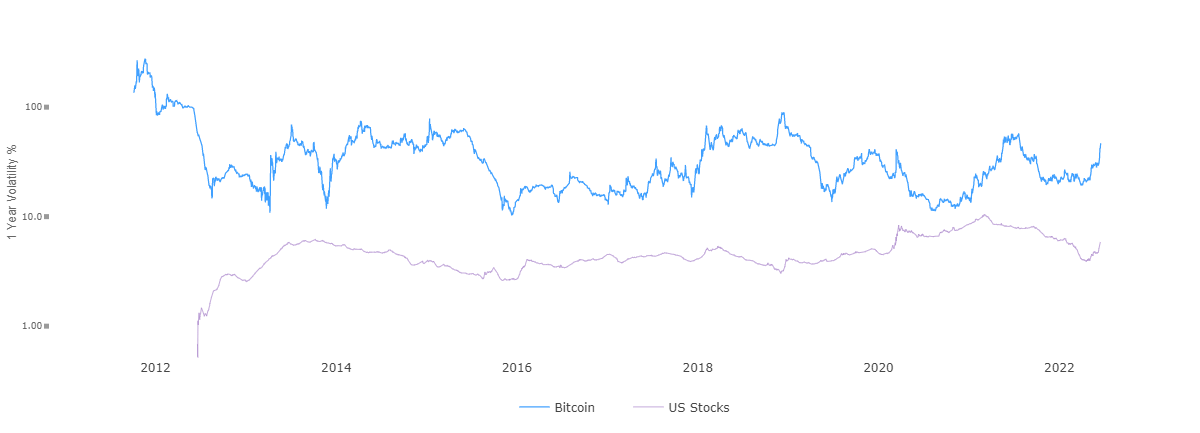

Compared to traditional markets, crypto markets are significantly more volatile. For example, in the first six months of 2022, when interest rates were increasing globally and war broke out in Ukraine, the S&P 500 index fell about 18%. During the same period, the total crypto market capitalisation fell close to 60%, and many coins declined over 90% from their recent highs.

Figure 1 – A comparison between Bitcoin and the US stock market from 2012 to 2022

Major events affect both crypto and traditional financial markets, but crypto markets are also uniquely susceptible to a range of other factors that create price volatility such as social media sentiment, mainstream media hype or fear, changes in perceived utility, the behaviour of large holders, and lack of government regulation. This reflects the relative immaturity of crypto markets and the fact that its underlying technology is at an early stage of development.

Factors that contribute to crypto volatility

Price discovery

Unlike established assets like gold or fiat currency, it’s still unclear how important crypto will become in the future. Crypto assets are still in the price discovery phase: in which market participants try to come to an agreement on the true value of an asset.

Assets in the price discovery phase often experience volatility because investors are unsure of the value and are strongly influenced by new information. Until investors gain more certainty about crypto’s long-term utility and level of adoption, price discovery will continue to be a major driver of crypto volatility.

Utility

Large-scale use cases, in which cryptocurrency plays a central role, are often powerful drivers of volatility in crypto markets. For instance, when video game retailer GameStop announced that it had chosen to use Loopring (LRC) to power its NFT marketplace, the value of Loopring’s native token LRC jumped 57% in just two days.

Naturally, failed use cases can also increase volatility such as when the stablecoin UST lost its peg to the US dollar in May 2022 and could no longer be used as intended — resulting in the value of its sister currency, LUNA, collapsing by over 99% in a matter of weeks.

Media hype

A quirk of cryptocurrency markets is the degree to which price volatility is driven by media hype, partly because it’s seen by many as a novelty and a quick way to make money, but also because many investors are poorly informed about crypto and are therefore more impressionable. A great example of this is the enormous growth in the popularity and value of Dogecoin (DOGE) in the early part of 2021, largely due to a series of supportive tweets from Tesla CEO, Elon Musk.

Another example of hype contributing to crypto’s volatility is the ill-fated EthereumMax, which used endorsements from the likes of Kim Kardashian and Floyd Mayweather to create build excitement and artificially inflate prices. However, once the bubble burst, the price of EthereumMax rapidly plummeted 97%.

Tip

Volatility and risk, while related, are not the same thing. Volatility refers to rapid price movements, both up and down. Risk refers to the possibility of losing some or all of an investment. Although volatile markets can present great investment opportunities, they can also contain a lot of risk for beginner investors.

Lack of controlling agency

Cryptocurrencies are not currently regulated by government agencies, which can increase volatility. Unscrupulous pump and dump schemes and other cryptocurrency scams are much more common in the unregulated crypto space than in regulated financial markets.

Lack of regulation also increases the scope for founders, promoters, and large crypto holders to make exaggerated claims about the potential of projects that can temporarily boost crypto prices, which often fall again in the longer term.

Scarcity

Many cryptocurrencies have a finite supply, creating a dynamic where demand increases but supply is fixed, putting upward pressure on prices and increasing volatility. Bitcoin, for example, is limited to a maximum of 21 million coins. Another mechanism that contributes to scarcity is token burning: the destruction of a percentage of the token supply over time, which creates a deflationary cryptocurrency and increases upward price pressure and volatility.

Sentiment

Crypto markets can swing wildly in line with the general sentiment towards cryptocurrencies. The immaturity of the overall crypto market means that positive or negative views can spread like a contagion. This is evidenced by the collapse of the Terra blockchain in May 2022, which triggered cascading volatility — at first hitting projects closely linked to Terra, then spreading across Decentralized finance (DeFi), before contributing to huge declines across the entire market.

On the upside, good news tends to create optimism and excitement about the potential for crypto to revolutionise all kinds of industries, which can lead to huge price increases.

Limited supply and major holdings

The limited supply of many cryptocurrencies can contribute to their increased volatility, especially when large holders — often called whales — hold a large percentage of the circulating supply. When whales buy or sell significant quantities of a particular asset it can send its price soaring or tumbling.

A report from the National Bureau of Economic Research published in October 2021 found that the top 1% of Bitcoin holders control over 27% of circulating Bitcoin. Considering that as Bitcoin’s price fluctuates the entire market tends to follow, it’s clear that the behaviour of large holders contributes significantly to Bitcoin volatility in the cryptocurrency market.

The pros and cons of crypto volatility

The most obvious benefit of crypto volatility is the potential for crypto investors to make huge profits relatively quickly. Large, regular price swings provide many opportunities for investors to buy assets at a low price and sell them at a higher price for profit. This is true for both long-term holders — who hold their assets over multiple bull and bear market cycles — and for day traders looking to swing trade on the day-to-day market fluctuations.

Of course, volatile assets are unpredictable and in crypto markets, there’s the potential to lose money just as quickly as you can make it due to extreme price volatility. Random events such as exchange hacks, whales selling, or even negative tweets can, and do, lead to huge waves of panic selling that result in sizeable losses. One of the most important steps that investors can take to increase the odds that crypto’s volatility works in their favour is learning how to do thorough research before investing in any digital asset.

Did You Know?

Extreme crypto market volatility can be a very good thing for investors. $1000 invested in Bitcoin on January 1, 2017 would have made a return of over $49,000 on January 1, 2022. For Ethereum, the returns are even better — an investment of $1000 over the same period would have returned a whopping $457,370!

Crypto volatility vs other markets

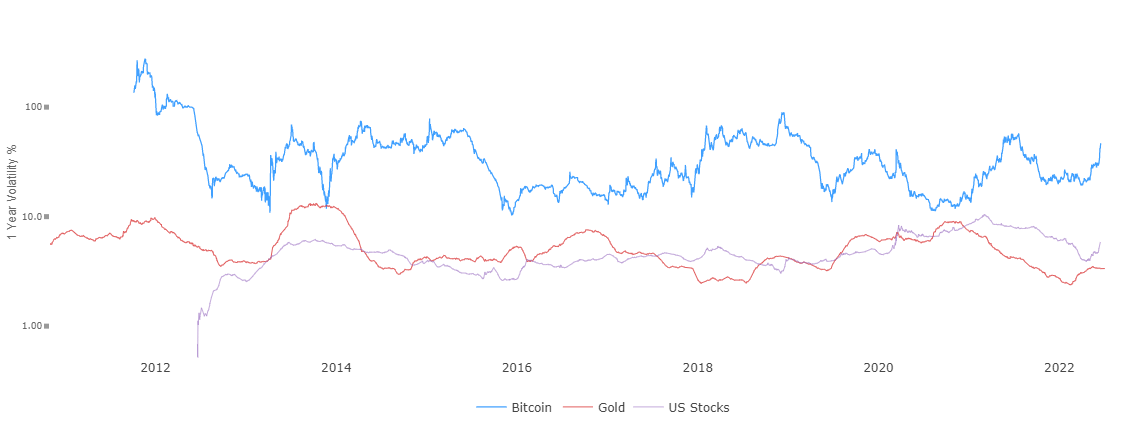

For perspective, it’s helpful to compare the volatility of cryptocurrencies with the volatility of other asset classes that are more established. Compared to the S&P 500 Index between 2013 to 2021, the crypto market’s volatility over the same period was four times higher, and compared to the bond market or stock market, it was a whopping 26 times higher. Contrasting gold with Bitcoin— often referred to as ‘digital gold’ — reveals that Bitcoin volatility is six times higher.

Figure 2 – A comparison of Bitcoin, gold, and S&P 500 volatility between 2012 and 2022

Summary

Cryptocurrencies are an entirely new asset class and are currently much less understood than established investments such as equities and commodities. This novelty and uncertainty, combined with a lack of regulatory clarity and other unique characteristics such as enforced scarcity, mean that crypto has an extremely volatile nature. Yet, knowledgeable investors can benefit from this volatility by making well-informed investment decisions based on research and an appreciation of the risks that volatility presents.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.