A bear market – an extended period of market decline – can be a scary time for new cryptocurrency investors. This is especially true in a market as volatile as cryptocurrency, where fear and emotion can quickly take over and impact investing decisions. When beginners are met with a sea of red candles and falling prices, their first instinct may be to panic and sell.

However, it is always important to remember that a bear market is a natural part of any market cycle. By staying calm and making informed decisions, traders can avoid common mistakes that can compound a market downturn. This article will explore some of the potential mistakes people can make when navigating a turbulent bear market.

6 common bear market mistakes

1. Panic selling

Panic selling occurs when traders sell off an asset en masse, often as an immediate reaction to bad news or a sudden price drop. Panicking is an evolutionary response to danger and can result in decisions not based on sound logic or strategy. This is one of the easiest mistakes inexperienced investors can make when the market is trending down.

The biggest issue with panic selling is that it involves a hair-trigger decision based on emotion when most crypto trades should take place after hours of meticulous research. Deviating from a well-thought-out plan due to a momentary rush of fear can lead to poor decision making that can adversely affect a portfolio. Remember –investments are rarely linear. There will likely be peaks and troughs, bad news and days of immense volatility, particularly in cryptocurrency.

Investors that ride the bumps and stick to their strategy are better equipped to navigate a bear market than those who make decisions without reflecting. Of course, this does not mean that selling is not the right choice, as this may protect investors from further losses, only that it is important to make your decision with a clear head.

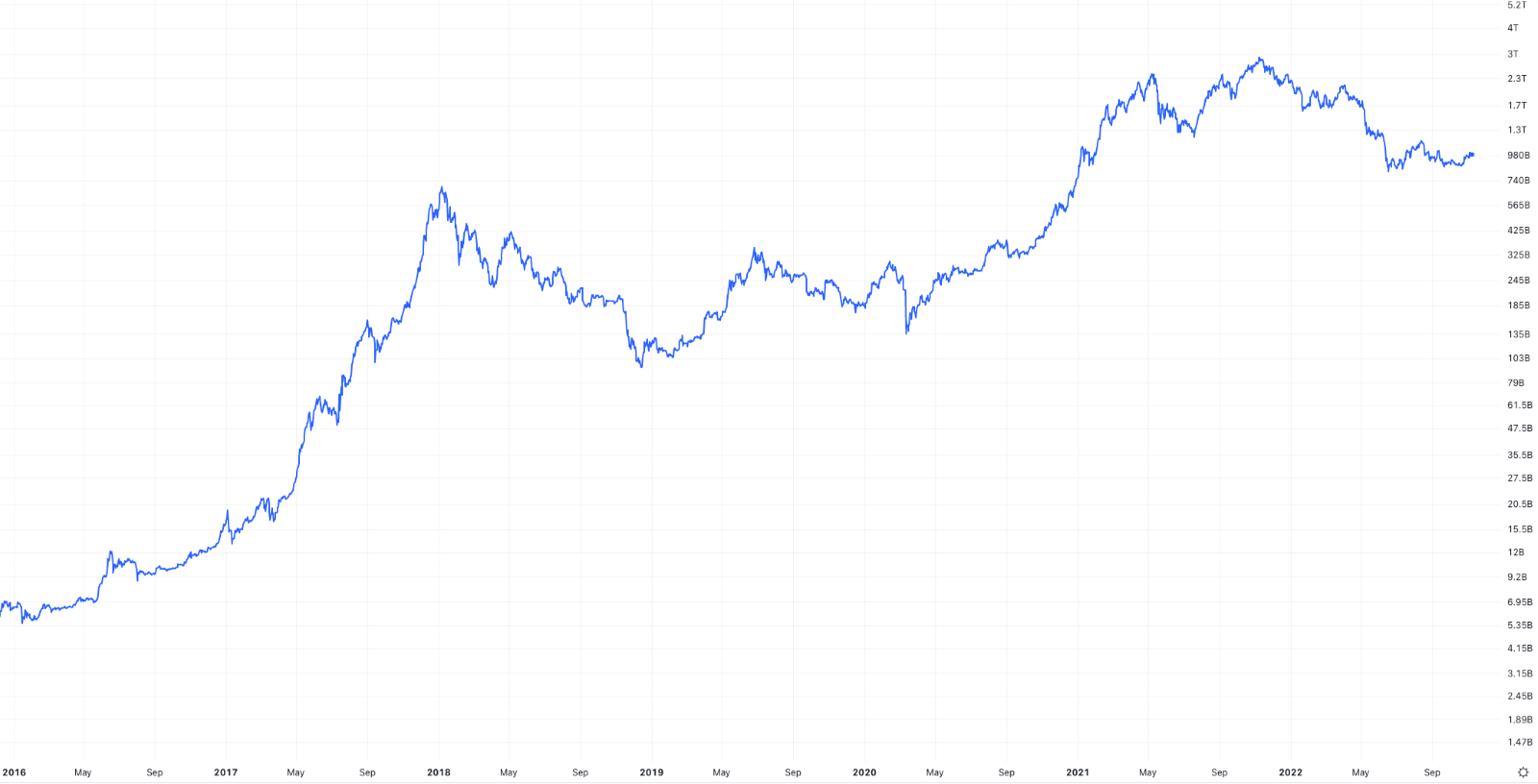

Historically, the crypto market has undergone periods of immense growth and rapid contraction. For example, after the major bull run in 2017 the crypto market experienced a major crash, dropping from 800 billion USD to 100 billion USD in market capitalization. In 2021, the market rebounded to a high of 2.5 trillion USD which was followed by another contraction to around 900 billion USD at the time of publishing.

Crypto market cap. Source: TradingView

2. HODL pressure

“Hold on for Dear Life” is the battle cry of some crypto traders who believe that the market will continue to grow in value. However, the pressure to HODL a coin in unfavourable market conditions can be just as emotion fuelled as panic selling. If adequate due diligence is performed and all signs point to selling, it would be equally irrational to continue holding.

It is a common mistake for traders to become overly attached to their holdings and ignore the market’s reality. If catastrophic news hits a particular coin and its price begins to tumble, mindlessly holding in the hope of a grand recovery can end up crippling a portfolio. Everyone, even professionals, makes bad trades from time to time. Investors need to be humble and accept when they have made a mistake. Selling at a loss during a crypto bear market can be a viable strategy, to reduce your exposure or invest elsewhere.

Did You Know?

HODL pressure can resemble a classic psychological trap – the ‘sunk cost fallacy’. This fallacy refers to the theory that humans have a predisposition to continue working toward something because of a prior investment (be it money, time, or effort), even when an objective assessment would indicate that it is better to cut one’s losses.

A real-world example might be buying an album from an unfamiliar band. Even after not liking it the first ten times, the buyer continues playing it repeatedly to “make the most of your investment” when they would be better off simply listening to a different artist.

3. Attempting to pick the bottom

Trying to time the market is another potential mistake beginners can make when embarking on their investment journey. Selling when a cryptocurrency is at its peak price, and buying when it is at its bottom, is almost impossible. If it were easy, everybody would be rich. While research and experience can help traders pick smart entry and exit points, waiting for the “perfect time” to buy during a bear market can result in opportunity costs.

Conversely, holding an asset for too long with the expectation that it will rebound can exacerbate the damage. Timing the bottom can be more challenging in cryptocurrency markets, which are traditionally subject to significant fluctuation.

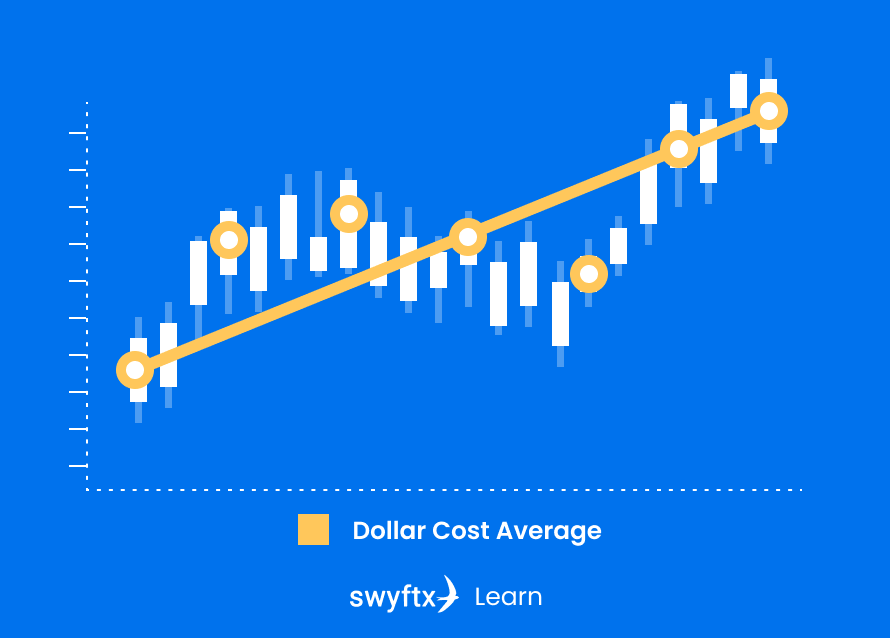

One way to avoid the guesswork altogether is to employ a dollar-cost average (DCA) strategy. DCA involves repeatedly investing a set amount of money into an asset, regardless of its price. This strategy gives traders broad exposure to the price of an asset over time and means they do not have to worry about attempting to pick a coin’s bottom.

For beginners wanting to invest but not wanting to sweat on every fluctuation a “time in the market, not timing the market” approach may be desirable. However, there are pros and cons to any strategy, and a DCA strategy may not perform better than a lump sum investment.

4. Resource management

A bear market can present crypto traders with opportunities to lower the average entry price of their investments (if previous investments were made at a higher price) or add cryptocurrencies to their portfolios at lower prices than when in a bull market. However, it is often a mistake to go “all in” during such timeframes. For starters, large-scale bear markets can result in investors’ net worth shrinking, so it is important to ensure sufficient funds are kept aside in case of a financial emergency.

5. Investing in projects before researching them

The term “due diligence” gets thrown around in investment circles. In trading, the term means to perform adequate research and planning before making a trade. Cryptocurrencies – and their underlying or alleged use cases – can be confusing for most people, even the most tech-savvy traders.

There are tonnes of helpful information available for traders to browse through, like YouTube videos, learn hubs and various online communities. However, solely relying on one resource for research is not recommended, as there is potential for bias and undisclosed interests on a publication-to-publication basis.

An excellent way to work around this is by getting involved in the project before putting any money toward it. That way, investors can form their own unbiased opinion on how the application runs, its value to consumers and its future potential. If an investor is interested in a new payment cryptocurrency, they can experience the process by making a transaction with that coin.

Blockchain has started expanding to new domains such as DeFi and metaverse, allowing for new ways to get involved.

Tip

Sandbox, Axie Infinity and Decentraland are three well-known crypto metaverse projects. A great way to help determine which project has the best potential is to try all three games while asking questions like how fun the game was and how easy it was to start playing.

And remember to avoid the hype. Large valuations do not always mean a project is poised for success and vice versa. A recent survey of prominent metaverse projects showed that despite enormous valuations, some platforms had surprisingly few active users.

6. Emotional trading

Investing in anything naturally contains an element of emotion. When money is at stake, people tend to ride the highs and hurt with the lows. Due to its volatile nature, the crypto market can evoke strong emotions – like panic or ecstasy. Many that got into crypto early will have experienced massive rushes and fond memories as Bitcoin, Ethereum, and other coins hit massive all-time highs. However, as bear markets come into the fray and downturns ensue, these emotions can quickly turn around.

Trading with emotion is a common mistake made by crypto traders, especially in a bear market. As initial gains slip away, it can be easy to adopt a mindset of “revenge trading” by finding the next big gainer. However, such an attitude may result in ill-advised investments in obscure, risky coins without sound fundamentals.

By taking emotion out of the equation, investors are less likely to fall into the trap of “chasing the dragon” and instead adopt a risk-adverse approach and invest in coins with more substantial long-term potential.

Summary

A crypto bear market can be one of the most challenging times for a new crypto investor. Sustained price declines can wreak havoc on their mental health, portfolios, and financial well-being. This stress, combined with inexperience, can lead to several avoidable mistakes. By navigating crypto bear markets with a clear mind and making decisions based on risk, logic and research, investors can find themselves in a better position.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.