Generating profit, over either the short term or long term, is the primary goal of any cryptocurrency investment. When creating a crypto portfolio, it’s impossible to avoid risk entirely because the crypto market is inherently volatile. Creating a well-balanced crypto portfolio by diversifying the assets you invest in can significantly reduce your exposure to risk while increasing exposure to a broader range of digital assets. This guide will look at why it is important to diversify your portfolio and will explore the best practices for doing so within the crypto market.

Diversification is key

Building a balanced crypto portfolio means diversifying your investment portfolio. Diversification provides investors and traders with a powerful way to hedge against the volatile nature of the cryptocurrency market and assists with risk mitigation.

Many new cryptocurrency investors and traders choose to invest only in major cryptocurrencies with high market capitalization such as Bitcoin or Ethereum. The crypto market does follow the price action of Bitcoin to a certain extent — bullish Bitcoin price movements, for example, are typically reflected across most other crypto assets and altcoins. However, this doesn’t mean that it’s best to only invest in Bitcoin.

Spreading your crypto portfolio across multiple assets is an effective strategy that can assist traders in managing potential gains and losses, distributing potential risks. A portfolio consisting only of Bitcoin may be adversely affected by bearish Bitcoin news, while a well-balanced portfolio may balance Bitcoin losses with other assets.

Portfolio balancing basics

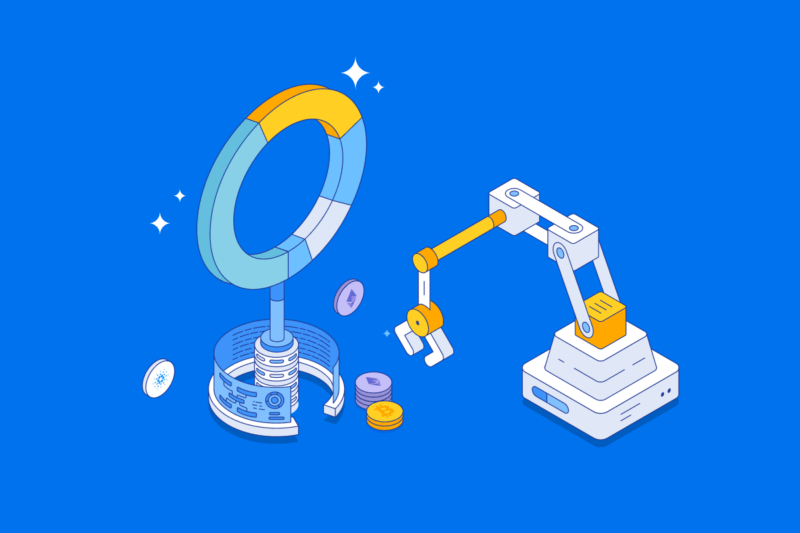

The primary goal of building a balanced and well-diversified portfolio is to minimize the impact of the volatile market by managing risk and adopting a variety of different investment approaches or strategies. Investing in a group of assets that provide exposure to a broad spectrum of uncorrelated areas or markets provides traders with reduced risk and a significantly more robust portfolio.

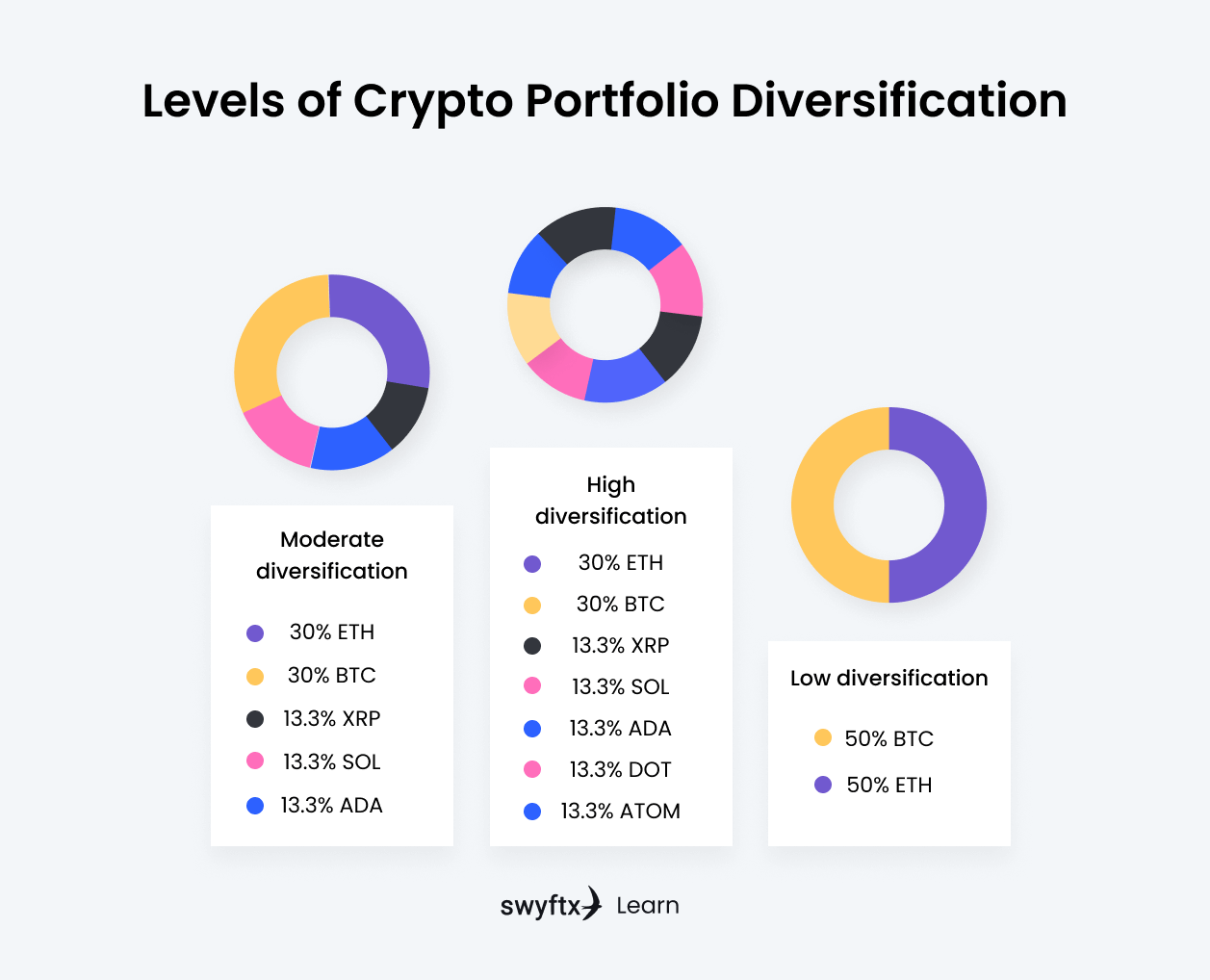

A poorly diversified crypto portfolio may consist of just two assets — Bitcoin and Ethereum — at a 50/50 distribution. While this portfolio spreads an investment across multiple cryptocurrencies, both assets within this portfolio are highly correlated. A major price drop in the value of Bitcoin is likely to be reflected in Ethereum markets.

Creating a suitable portfolio means spreading an investment across multiple uncorrelated assets and balancing your asset allocation regularly. This allows traders and investors to manage losses during bearish market movements.

Figure 1 – Levels of crypto portfolio diversification

What to consider when building a portfolio

When building a balanced crypto portfolio, it’s important to perform both fundamental and technical analysis on the assets you’re considering investing in. Technical analysis can provide insight into potential future price movements of an asset, based on previous price movements. Fundamental analysis, however, can assist with identifying strong, uncorrelated assets to include in your portfolio.

When performing fundamental analysis on an asset, it’s important to identify the category, purpose, or use case of the crypto asset you’re investing in. The crypto ecosystem, while founded on blockchain technology, consists of thousands of different projects that all provide different use cases or target different markets.

Key Takeaway

Diversifying your crypto portfolio means investing in multiple crypto assets. This can provide a hedge against the volatility of the crypto market. Thus, instead of riding the highs and lows of Bitcoin, your gains in some areas might offset losses in other areas. It is all about creating balance and stability within your investments.

Types of cryptocurrencies

A portfolio consisting of only payment-oriented coins, such as Litecoin, Dash, and Ripple, is highly correlated with Bitcoin. A portfolio that consists of a combination of different coins including payment coins, stablecoins, privacy coins, security tokens, utility tokens, and DeFi tokens, however, is highly uncorrelated. Below are some examples of different types of the main crypto categories.

Payment coins

Payment coins are considered to be the purest form of cryptocurrency. They are typically used as an alternative to fiat currencies to pay for goods and services. Popular payment coins include Bitcoin, Litecoin, Digibyte, Bitcoin Cash, and XRP.

Smart contract platforms

Smart contract platforms provide infrastructure and a framework for executing smart contracts. Large smart contract platforms include Ethereum (ETH), Cardano (ADA), and Solana (SOL).

Stablecoins

Stablecoins are blockchain-based currencies that are pegged to real-world assets like fiat currencies (e.g. the U.S. dollar) and commodities (e.g. gold). Examples include USD Tether (USDT), USDC, and PAX Gold.

DeFi tokens

DeFi tokens are used within applications that provide decentralized finance services like crypto loans, staking, and liquidity pools. Examples include Uniswap and Aave.

Privacy coins

Privacy coins are crypto coins and tokens designed to offer privacy and anonymity to their users. Examples include Monero (XMR) and Zcash (ZEC).

NFT coins

NFT coins refer to blockchain-based protocols and applications that support NFTs and have their own native tokens. Popular examples include Axie Infinity (AXS), Decentraland (MANA), Enjin (ENJ), and Theta.

It’s extremely important to do your own research when investing in cryptocurrencies. You can read our guide on different cryptocurrency categories to learn more about the different crypto-assets and their use cases.

Tip

When diversifying your portfolio, it can be a good idea to invest in cryptocurrencies across the spectrum of use cases, such as payment coins, DeFi coins, stablecoins, and privacy coins.

Fundamental analysis factors to consider

In addition to measuring the correlation between assets in a diversified portfolio, it’s essential to perform due diligence. Effective due diligence assesses a variety of factors, which can include:

- Use cases, or the purpose of a coin. Consider the utility of a coin, what kind of problems it solves, and how likely it is to be adopted in favour of legacy solutions

- Technical advantages or obstacles can play an important role in the success of an asset. Crypto projects that provide a compelling solution to the scalability problem with high transaction speeds, for example, may present a compelling investment opportunity

- Market capitalization can impact the volatility of an asset — “small-cap” cryptocurrencies are typically more volatile than cryptocurrencies with higher market cap.

Keep up with industry news

The crypto market is a fast-moving ecosystem that is significantly affected by major news announcements, project updates, and new information. It’s important to note that the top 50 cryptocurrencies by market cap were all, in their earlier stages, new projects with little to no media or community interest.

Keeping up to date on the latest news within the cryptocurrency sector can provide investors and traders with insights into potential investment opportunities or upcoming roadmap milestones for major projects that can have an impact on price trends.

Charting tools such as TradingView provide traders and investors with customisable updates and news feeds on tracked assets, allowing users to capture up-to-date information on promising projects.

Also, Coindesk is a reliable resource for crypto news and updates.

Track your portfolio

Tracking your portfolio is critical when maintaining a balanced and diversified cryptocurrency investment portfolio. There are numerous reputable crypto portfolio trackers available. Swyftx provides users with a real-time profit/loss status across all holdings through a robust portfolio tracker that can be accessed via the navigation panel on your Swyftx account.

Learning how to track and, if necessary, rebalance your crypto portfolio is a highly effective investment strategy. The information provided via Swyftx’s portfolio tracking features allows users to stay updated on price movements, performance, and cap.

Wrap up

Setting up a well-balanced crypto portfolio can vastly reduce your exposure to risk and help you invest in a range of strong projects. This guide has explored why it is important to diversify your portfolio and has looked at a number of techniques for determining assets to invest in. If you would like to learn more about cryptocurrency use cases, technical analysis, or fundamental analysis, there is heaps of great content on those topics, and more, on Swyftx Learn!

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read