Disclaimer

This is an article about the general features of staking, as well as certain benefits and risks associated with staking. It is not intended to describe all of the ways staking occurs or is offered by any particular provider, including Swyftx, nor does it specify all of the risks associated with staking. This article has been prepared for educational purposes only and does not constitute personal advice of any kind. As with all cryptocurrency investing, you should conduct your own research to decide if staking is right for you.

Staking has become a huge part of the cryptocurrency industry and in particular decentralized finance (DeFi), as it allows cryptocurrency holders to earn passive income in the form of rewards from their holdings. This piece will take you through what staking is, how it works, and the benefits and risks of staking crypto so that you can make an informed decision about whether or not staking suits your investment strategy.

What is crypto staking?

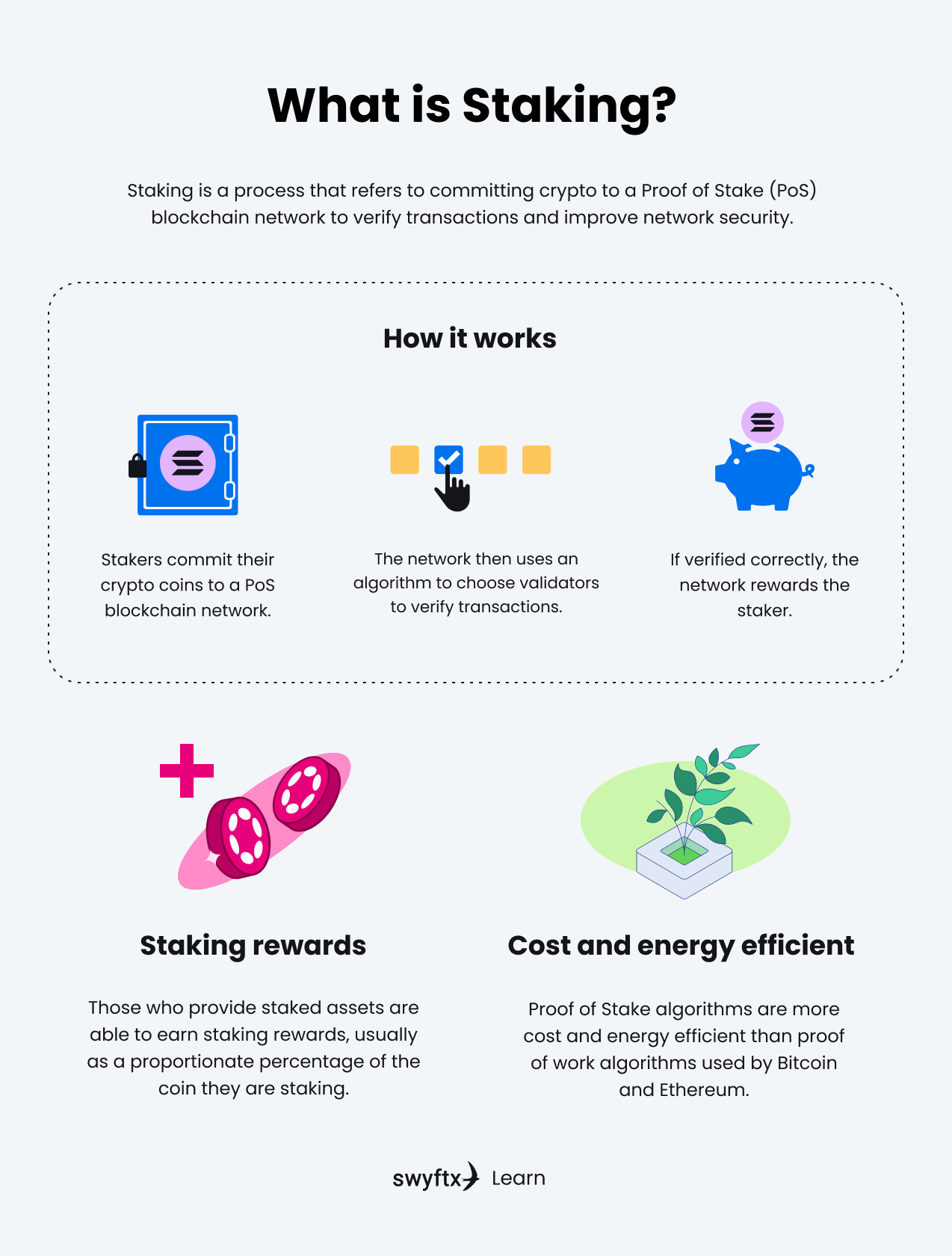

Staking may seem like a complicated concept, but when it’s broken down, it’s quite straightforward. Put simply, staking crypto is a way of earning rewards for holding specific cryptocurrencies.

Think of a staking cryptocurrency (i.e. Cardano) as a company, which pays out dividends (staking rewards) to its shareholders (those holding the staking coins). The main difference is that the coins that you stake work to secure the network.

How does crypto staking work?

Certain cryptocurrencies use staking as a mechanism for improving the security of the network, and in return, those who provide staked assets are able to earn staking rewards, usually a proportionate percentage of the coin they are staking.

When you “stake” a coin it means that you are temporarily lending a certain amount of your coins to the network to help verify and secure transactions without the need for a trusted third party like a bank.

Figure 1 – Staking explained

Proof of Stake vs Proof of Work

Proof of Stake (PoS) and Proof of Work (PoW) are the two main consensus mechanisms used to confirm all blockchain transactions.

With a PoW blockchain, miners use a combination of computational power and cryptography to solve complex mathematical problems to verify transactions and create new blocks. The miner that successfully solves the problem is given the block reward. PoW is very secure because of its decentralized structure and the immense amount of computational power required to run the network, but the downside is that it requires a lot of energy, and therefore a lot of money, to operate.

By contrast, the PoS system selects a user to create the block instead. In order to be selected, users must stake a certain amount of their cryptocurrency in a smart contract. The more coins a user has staked, the more chance there is that they will be selected to solve the block. Sort of like a lottery: the more tickets you have in the lottery, the more chance you have of winning the prize. Except the lottery keeps running and those with tickets will always have a chance to win. PoS is far more energy-efficient than PoW, but there are concerns about bias towards validators with more coins getting more rewards.

Key Takeaway

PoW uses computational power to solve problems and verify transactions. PoS randomly selects users who have contributed coins to the network to generate new blocks.

How are staking rewards calculated?

As mentioned previously, staking rewards are generally calculated based on the coin you are staking, the amount staked, and the staking period. Each coin has a different base Annual Percentage Yield (APY) or Annual Percentage Rate (APR). These are the bases for how rewards are calculated. This is then multiplied by the number of coins staked.

For example, Lily decides to stake her 10 ETH at an APY rate of 5%, compounded annually.

At this rate, Lily will receive 0.5 Ether if she keeps her 10 Ether locked in staking for a whole year. Most staking platforms have different options for staking duration, for instance, one week, 30 days, 90 days etc. It is possible to re-stake your coins after the initial staking period including your earned rewards, thus creating a compound effect, and a higher APY.

Did You Know?

There is a sub-system of staking called delegation, which allows users to send their stake to a “validator” in order to increase that validator’s total staked amount. This means the delegator will receive rewards more frequently (proportionate to their contribution). Some wallets, such as Keplr and Cosmostation, allow the user to claim their rewards whenever they like and re-invest if they choose, which results in a compounding rewards system.

What is a staking pool?

Certain providers facilitate staking through what is commonly referred to as a ‘staking pool’. A staking pool allows multiple people to pool together their staked assets and computational power in the process of verifying and validating blocks in order to increase their chances of being rewarded.

For instance, Kevin is staking 20 ATOM and on average is waiting four days between block rewards, which are 0.1 ATOM. Kevin then joins a staking pool where the total ATOM is 100. He now only has to wait 12 hours between block rewards. He doesn’t receive the whole amount, but a proportion of the reward relative to his contribution, in this case 0.02 ATOM, but because his pool receives the staking rewards much more frequently, Kevin is now making 0.16 ATOM every four days.

Did You Know?

Staking rewards are usually paid out as a portion of the coin a user is staking. However, there are some instances where rewards may be paid out in multiple currencies. For instance, Cosmos is working on a service called Interchain Staking, which will allow users staking ATOM to receive rewards from multiple blockchains in the Cosmos ecosystem.

Benefits of staking

There are many benefits to staking your coins, including helping to secure the network, generating rewards, value increase from holding, potential tax discounts, and participation in governance or voting on the future direction of the project.

Secure network

When you stake your coins, you are directly contributing to the security and efficiency of the network. Staking helps make the blockchain more resistant to attacks and increases its ability to process transactions.

Rewards

Staking crypto can generate rewards in the form of more coins, in addition to investing or trading. Of course, the rewards are proportionate to the number of coins you choose to stake. For instance, Bec decides to stake $1,000 in a coin with an advertised 50% APY on staking. If the price of that coin stays roughly the same throughout the year, Bec will receive the value of approximately $10 per week in staking rewards. If Bec chose to stake $10,000, her rewards would be to the value of $100 per week.

Important To Remember

Although a higher amount of rewards received per week is appealing, it is important not to stake beyond your means or actual risk appetite.

Value increase from holding long term

If you invest in a solid project and buy early, there is a good chance that the value of your coin will increase while your crypto assets are locked in staking. Therefore, if you decide to cash out later, you have a higher chance that your holdings will be worth significantly more than when you started. When you factor in the staking rewards as well, your overall returns will be even higher.

Potential capital gains tax discount

Most countries tax crypto traders and investors on their cryptocurrency gains. However, some countries, such as Australia, have a discount for investors who hold a cryptocurrency long-term (for example, more than a year). So you might be able to receive a capital gains discount while earning staking rewards at the same time!

Participate in governance

Some coins allow those with staked assets to participate in the governance of the network. In these circumstances, if you are staking a coin, you can vote on proposals that are presented to the community. Proposals might be about network upgrades, adding features, or increasing the number of validators for instance.

Risks of staking

As with most opportunities in crypto, staking does not come without its risks. The biggest risks in staking crypto are market fluctuations, liquidity, locked periods, and validator risks.

Market fluctuations

The biggest risk of crypto staking is the potential negative price movements in the asset you are staking. For example, if you are earning 25% APY staking rewards, but the value of the coin drops 40% during the year, you will still have made a loss. This is why it is very important to do your own research about a coin before investing. It’s best not to make your decision based on the staking APY alone.

Liquidity

Depending on the asset you are staking, the liquidity on exchanges might be low, meaning that you could find it difficult to convert your stake back to Bitcoin or fiat. Therefore, it’s important to always check the liquidity of an asset on popular exchanges before beginning the staking process.

Locked periods

Some staking programs have a locked period in which you can’t access your staked coins (I.e., 90 days). If the price of your staked assets drops within that period, you will not be able to sell or mitigate your losses. Depending on your trading strategy, it might be beneficial to only invest in assets without a locked period. Cardano (ADA) is a good example of a coin that does not require you to lock up your tokens for a set term.

Validator risks

Running a validator node is a complex process that requires reliable hardware and technical knowledge in order to ensure that the node has 100% uptime. In the unlikely event that the validator you have trusted with your coins does not fulfill this network requirement, they may be penalised, and in turn, it is possible for you to lose some of your stake. It is a good idea to do research on the reputation and track record of the validators you use before entrusting them with your coins.

Summary

Staking crypto can be a fantastic way to earn rewards while helping to strengthen and secure your favourite blockchain network. It is important to be aware of the potential risks and to research a project before staking an asset, however, the upside of staking assets for a good project are numerous and could form an integral part of your investing strategy. To learn more about Proof of Stake or anything else crypto-related check out the other great content on Swyftx Learn.

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read