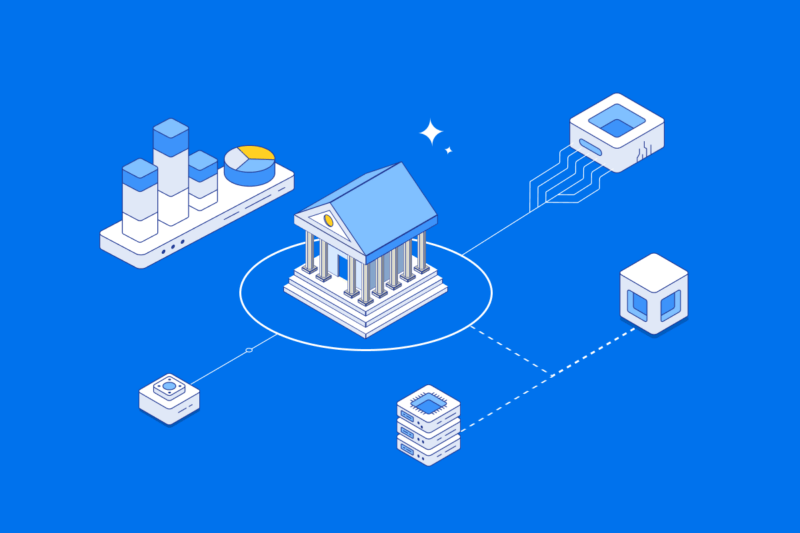

Decentralized finance (DeFi) is a framework for financial products that can be accessed on a decentralized, public blockchain network. DeFi makes it possible for buyers, sellers, borrowers, and lenders to interact directly with other with each other or a strictly software-based intermediary, which removes the need for a company or institution, such as a bank, to facilitate transactions. This piece will explore what decentralized finance is, how it works, and why it is such a significant innovation in the crypto world.

What is decentralized finance?

When something is decentralized, it means that it is not controlled by one central authority, but rather a collection of people or computers. Finance is a broad term that includes any activity regarding money, whether it be transferring, lending, or investing. Therefore, decentralized finance is any activity that involves money operating on a platform that is backed by multiple servers rather than just one.

DeFi protocols are becoming more popular because they help eliminate flaws and corruption that have been found over the years using CeFi (centralized finance). There are a number of different types of finance that are currently centralized, however, there are opportunities for these systems to make the transition to being decentralized.

What are some current types of DeFi projects?

DeFi is trying to recreate a whole new financial ecosystem in a permissionless and open way. Here are the main parts of the ecosystem DeFi is trying to recreate:

- Transferring Money

- Lending and borrowing

- Stablecoins

- Exchanges

- Margin trading

- Derivatives

- Insurance

How can money be decentralized?

One of the best examples of a decentralized system that is used today is Bitcoin. Bitcoin is a decentralized currency. It was created in 2009 by an individual, or group of people, using the pseudonym Satoshi Nakamoto. In creating Bitcoin, Nakamoto also created blockchain technology. A blockchain is a digital ledger that records transactions and distributes them across multiple connected computers (or nodes) for validation.

Any Bitcoin transactions, big or small, are on this ledger and will be there forever. This makes the system nearly impossible to change or hack because there are so many different computers running it.

Did You Know?

Bitcoin, released in 2009, was the first blockchain. Since then, there have been hundreds of other public and private blockchains created for different purposes. Most of these blockchains are represented by unique cryptocurrencies as well!

How does one build a DeFi system?

The Bitcoin blockchain is only one example of decentralized infrastructure, however, it is very difficult and uncommon to build other applications on it. The Ethereum blockchain, however, is an open DIY platform that any developer can build decentralized applications (dApps) on.

Almost all of the DeFi projects out there are built on the Ethereum blockchain. Programmers use the Ethereum blockchain to create automated code or smart contracts on this platform to set up decentralized financial systems.

What are smart contracts?

Smart contracts are a set of instructions that are built on a blockchain like Ethereum and executed by code when certain conditions have been met. These DeFi protocols and autonomous programs are constant and consistent leaving very little room for error.

For example, if the smart contract says, “only pay out a dividend once a profit of $1000 USD is reached” that will happen every time. Once this code is written, it will then run by itself and is impossible to change, unless the smart contract specifies that it can be changed. If it does get changed it will be shown on the Ethereum blockchain on multiple servers, meaning it is impossible to hide a change if one does occur.

Some examples of DeFi platforms

One of the first DeFi projects that was created and is still running today is called Maker DAO. It essentially started the DeFi lending and borrowing movement, a huge part of the financial ecosystem. Another DeFi lending and borrowing project is Compound, which is “an algorithmic, autonomous interest rates protocol built for developers to unlock a universe of open financial applications”. There is also Aave which is “an open-source and non-custodial liquidity protocol for earning interest on deposits and borrowing assets.”

What is DeFi crypto?

Some examples of DeFi crypto are Uniswap, ChainLink, and Terra. DeFi crypto or DeFi tokens are intended to recreate traditional financial services such as earning interest or taking out a loan. The only difference is that instead of using a bank or institution, DeFi crypto allows these actions to happen on their computer through code or a smart contract. Another form of earning interest on crypto-assets is called staking, which allows users to lend their crypto to a Proof of Stake network to assist with validating transactions, and in exchange for their contribution, users are paid staking rewards.

What are DeFi exchanges and their benefits?

Uniswap, Kyber, and 0x are currently the most popular DeFi exchanges (also known as DEXs). The more recognisable exchanges such as Binance, Coinbase, and Swyftx are centralized. Centralized exchanges are very popular as they are easy to use and users can buy crypto with fiat currency. Below we’ve listed the pros and cons of decentralized exchanges (DEXs):

Pros

- Users own private keys

- Greater privacy and anonymity

- Large range of low cap altcoins

Cons

- Low liquidity

- Order speed can be affected by network congestion

- Exposure to risky investments

Is DeFi safe?

DeFi relies on smart contracts to function, which offers a high level of security. However, there are still risks associated with DeFi. The biggest risk is around the DeFi projects themselves. While many are legitimate and properly decentralized, some are fraudulent. Over $10 billion USD has been lost to DeFi scams in 2021 alone. This is why it is very important to do research about whether projects are reputable before using them.

Additionally, on the smart contract side, many users do not take the time to read the contracts as they are often very long and technical. The result of this is that there could be some bugs and protocol changes that affect the existing contracts.

New technology always has flaws and room for improvement. This is no different for DeFi, which is still in its infancy. But as time goes on, DeFi projects and smart contracts will only improve, leaving less room for error.

Key Takeaway

Ethereum and smart contracts are very secure, however, DeFi platforms can be a cause for concern. It is important to always do your research on whether a project is reputable and legitimately decentralized before using it.

The future of DeFi

It is likely that the popularity and uses of DeFi will continue to grow. It’s probable that more and more businesses and individuals will adopt DeFi technology in the years to come as it has shown that it can be faster, safer, and smarter than traditional financial instruments and infrastructure.

Summary

Decentralized finance (DeFi) is a system of financial products that are accessible on a decentralized network. DeFi makes it possible for people to buy, sell, borrow, and lend directly from other users through the use of quick and secure smart contracts, which removes the need for a third-party intermediary, such as a bank. This piece explained explore what decentralized finance is, how it works, and why it is so innovative. To learn more about smart contracts, decentralized exchanges, or anything else to do with cryptocurrency or blockchain, check out the other great content on Swyftx Learn!

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read