The increased concern regarding the environmental impact of Bitcoin mining has birthed a new era of eco-friendly cryptocurrencies. Bitcoin’s environmental impact has left a general sentiment that blockchain technology and all digital currencies are unsustainable, however, this is not the case. Organisations are starting to focus on sustainability and new technologies are constantly being developed to improve efficiency and reduce energy consumption on cryptocurrencies.

This article will talk about the environmental impact of Proof of Work blockchains and explore some of the most eco-friendly cryptos. It will also discuss the sustainability of cryptocurrencies in the future.

What is the environmental impact of cryptocurrency?

Bitcoin and Ethereum are the biggest cryptocurrencies and make up a majority of energy use and carbon footprint in all cryptocurrencies. Bitcoin and Ethereum currently use a consensus mechanism known as Proof of Work (PoW), although Ethereum is planning a transition to Proof of Stake. Transactions on the Proof of Work blockchain are verified by miners who solve complex mathematical puzzles. Miners compete with each other simultaneously to be the first to solve the puzzle, and the winner receives rewards paid out in cryptocurrency, this is known as crypto mining. All the electricity consumed by the other miners essentially goes to waste, making this mechanism extremely energy inefficient.

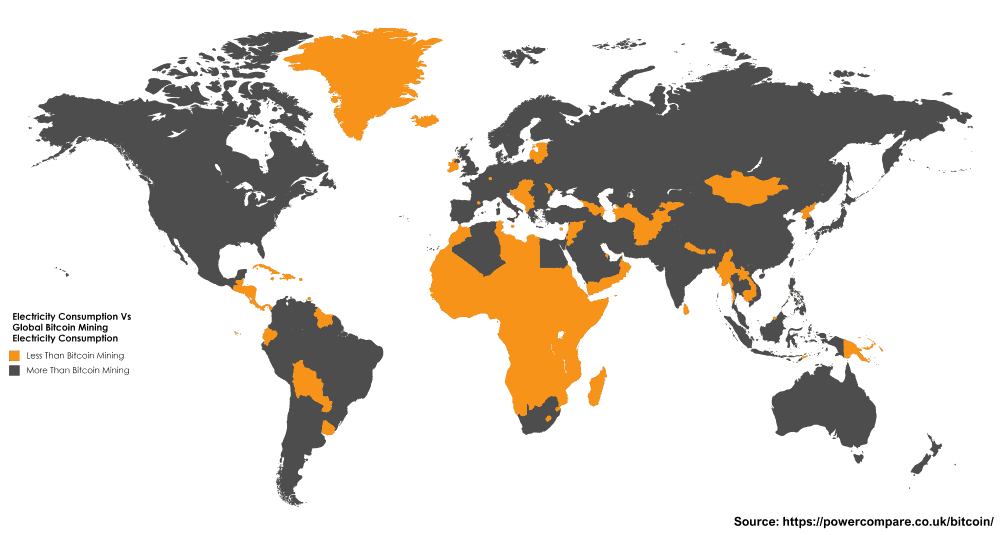

The Bitcoin blockchain is estimated to have a larger annual energy consumption than countries like Ukraine and Argentina. The rise in popularity of Bitcoin led to a surge in crypto mining equipment production, which created a lot of electronic waste. Keep in mind that the energy consumption of the Bitcoin blockchain does not take into account the energy required used to produce mining equipment.

What makes a cryptocurrency sustainable?

Emerging cryptocurrencies are starting to use an energy-efficient consensus mechanism known as Proof of Stake (PoS) which is roughly 99.95% less energy intensive than Proof of Work (PoW) mechanisms. Instead of having miners compete simultaneously, participants on the network are selected to create new blocks, based on the amount of cryptocurrency staked. What makes a cryptocurrency sustainable?

Over time, blockchains have been competing against each other on who can be the most energy efficient and generate the lowest carbon footprint. This led to the development of new consensus mechanisms, new technologies, and sustainable cryptocurrencies.

Did You Know

Tesla halted the use of Bitcoin as a mode of payment with the primary reason being Bitcoin’s environmental impact and energy-intensive nature.

Most eco-friendly cryptocurrencies

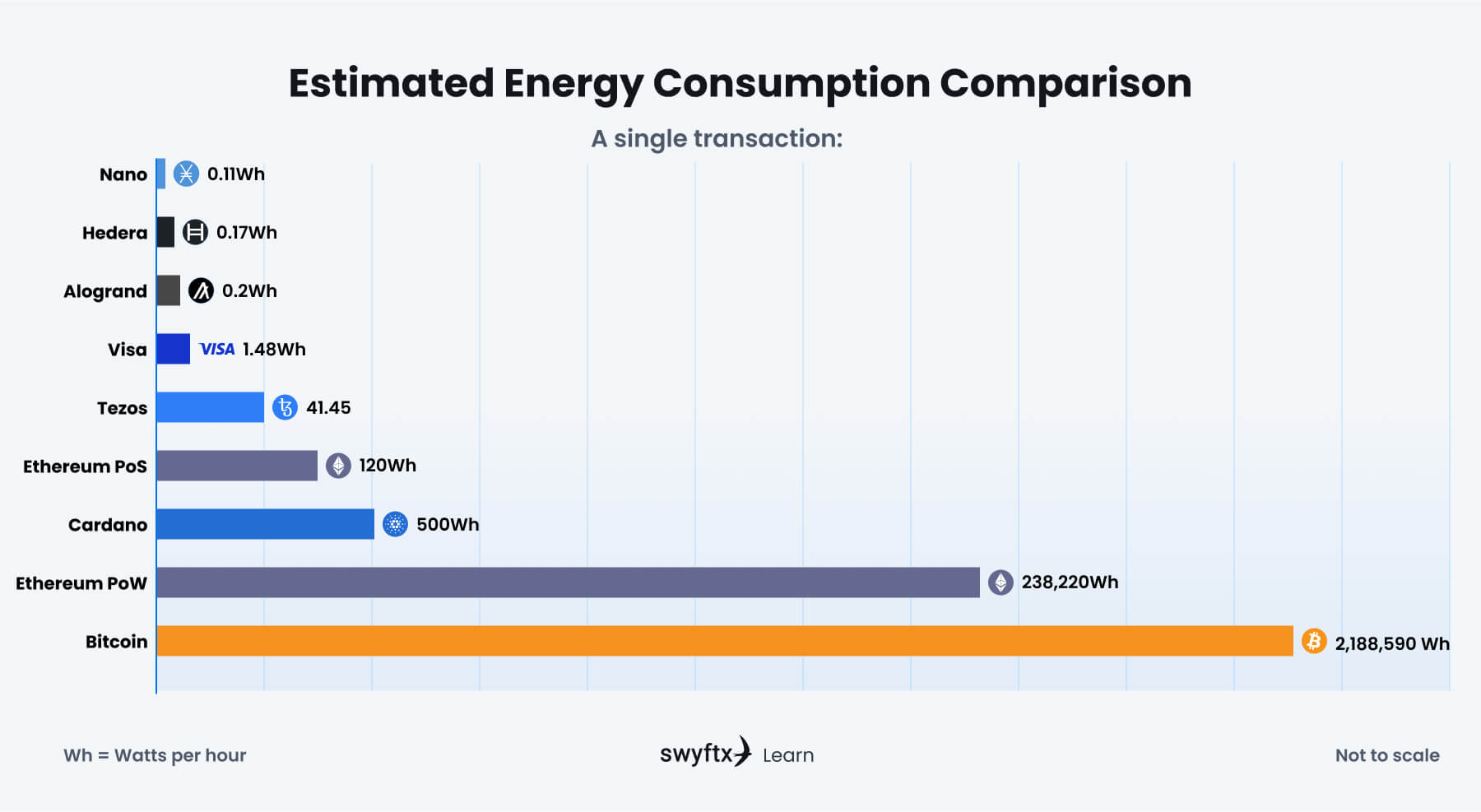

It is hard to justify which crypto holds the title of the most eco-friendly cryptocurrency, as determining the energy consumption per transaction of a cryptocurrency is a very complex task. The comparisons aren’t 100% accurate as they have been derived from various studies.

A single Bitcoin transaction uses 199,716,000 Watts per hour (Wh) of energy. This is roughly equivalent to the electricity consumption an average family in the US uses for 68 days. This is the measurement we will use to compare the energy efficiency of the following cryptocurrencies.

Hedera Hashgraph (HBAR)

Hedera Hashgraph is an open-source decentralized blockchain that uses a Proof of Stake consensus mechanism. The environmentally friendly network has an extremely low energy consumption per transaction at 0.17Wh, with an incredibly large transaction throughput at 10,000 transactions per second (TPS). Transaction throughput is the number of transactions that can be processed, usually measured in seconds.

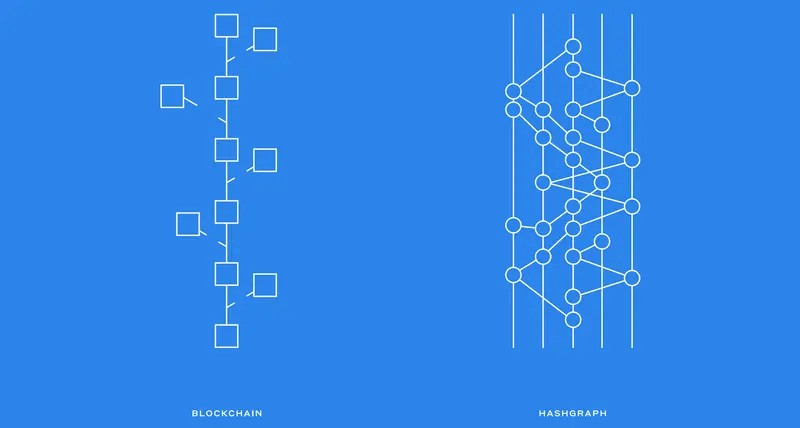

Hedera uses the Hashgraph consensus, which is an alternative to traditional blockchain consensus mechanisms that rely on the communication of nodes instead of computing power. In blockchain, blocks are linked in a single chain, discarding additional blocks that were created simultaneously. Hedera doesn’t discard blocks but instead incorporates them into the network – making it more efficient than blockchains. This mechanism gives Hedera a directed acyclic graph structure.

Structure representation of blockchain and Hedera Hashgraph

Cardano (ADA)

Cardano is one of the biggest eco-friendly cryptocurrencies by market capitalization and is seen as a green alternative to Ethereum. The energy-efficient network uses a Proof of Stake consensus mechanism that consumes roughly 500Wh per transaction. Cardano holds the title of the first peer-reviewed blockchain and was founded by Charles Hoskinson, who was a co-founder of Ethereum.

Did You Know

Based on total energy consumption, Cardano is more energy efficient than Youtube, Netflix and PayPal.

Tezos (XTZ)

Tezos is an open-source platform for developing smart contracts and decentralized applications, with a primary focus on self-amendment and sustainability. The energy-efficient Tezos network is estimated to consume 41.45Wh per transaction.

Liquid Proof of Stake (LPoS) is the consensus mechanism used on the Tezos network, which is a variation of the energy-efficient Proof of Stake mechanism. LPoS features delegation which often gets confused with Delegated Proof of Stake, however, LPoS can function without delegations. Tezos is also highly secure as it utilises formal verification; a method of code checking which relies on mathematical proofs, to secure their smart contracts.

Did you know: Chia is labelled as an eco-friendly crypto but is also seen to produce considerable amounts of electronic waste. Chia uses a Proof of Space mechanism, which uses a lot less power as the Chia network relies on storage capacity instead of processing power. However, this prompted an increased production of hard disks, which requires energy and resources.

Nano Token (XNO)

Nano is one of the most environmentally friendly cryptocurrencies and is estimated to use 0.11Wh of energy per transaction. Nano was previously known as RaiBlocks, a platform where users can earn cryptocurrency by solving CAPTCHA puzzles (“Select images of a boat”).

The Nano network uses a variation of Delegated Proof of Stake (DPoS) called Open Representative Voting. This consensus mechanism was designed to support the design of Nano’s blockchain. On the Nano network, a block is a single transaction instead of a group of transactions, and each account has its own blockchain.

Algorand (ALGO)

The Algorand blockchain is a smart transaction platform for deploying decentralized applications. Algorand was founded in 2017 by Turing award winner Silvio Micali and aimed to solve the blockchain trilemma. The environmentally friendly network is estimated to consume 0.2Wh of energy per transaction.

Algorand uses a customised version of the Proof of Stake consensus mechanism known as Pure Proof of Stake (PPoS). The mechanism allows any node to validate transactions, increasing decentralization and transaction speed.

Do cryptocurrencies have a sustainable future?

The intense energy consumption in cryptocurrency mining has arisen concerns regarding environmental sustainability. Numerous upcoming and existing cryptocurrencies are focused on sustainability. New technology and methodology are constantly emerging, attempting to improve energy efficiency and reduce carbon footprint, and the results have been impressive. Sustainable cryptocurrencies are starting to rival major payment processors like Visa, which uses 1.48Wh of energy per transaction.

The second biggest cryptocurrency Ethereum has set their eyes on a sustainable future and announced that it will transition from Proof of Work to a Proof of Stake blockchain to reduce their environmental impact and improve scalability. The transition is set to take place in Q4 2022 and is estimated to reduce the networks energy usage by 99.95%.

The global shift towards renewable energy sources directly affects the carbon footprint of cryptocurrencies, especially Proof of Work blockchains like Bitcoin. According to a report by the Bitcoin Mining Council early this year, all Bitcoin mining ran on 58.8% renewable energy by Q4 2021. Keep in mind, mining Bitcoin on renewable energy sources does not grant carbon neutrality but has a much lower carbon footprint.

Did You Know

More than 250 companies and individuals have joined the Crypto Climate Accord, which is an initiative inspired by the Paris Climate Agreement, focusing on reducing the carbon footprint of the cryptocurrency industry.

How to buy eco-friendly cryptocurrencies

All the eco-friendly cryptocurrencies mentioned above can be purchased from major exchanges. Swyftx is a popular crypto exchange in Australia and New Zealand with low fees and spreads. To make things easy, Swyftx has an eco-friendly bundle, which is a collection of environmentally friendly cryptos that can be purchased at the click of a button.

Summary

Organisations and individuals are starting to focus on reducing environmental impact. Cryptocurrencies are being optimised with new technologies to improve efficiency and lower energy usage. Ethereum’s transition from a Proof of Work network to a Proof of Stake is one of the biggest eco-initiatives in the digital currency space.

It’s no debate that Bitcoin’s mining process has a big environmental impact. The process is extremely inefficient, using a tremendous amount of energy to compute a single transaction. The slow pull away from non-renewable energy sources does help lower the carbon footprint of Bitcoin mining, but the large amounts of electronic waste from mining equipment still need to be addressed.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.