Tezos is an open-source platform for developing smart contracts and decentralized applications. The Tezos network is renowned for its ability to self-upgrade enabled by its unique governance process and consensus mechanism. It also implements formal verification; one of the highest system integrity standards, to secure its smart contracts. This article explores what Tezos is, how it functions and what makes it unique.

What is Tezos?

Tezos is an open-source blockchain that enables smart contracts and supports decentralized applications (dApps). Tezos is well known for its ability for self-amendment, on-chain governance, and use of formal verification in smart contracts. Tezos has a native cryptocurrency called Tez (XTZ), sometimes called Tezzies.

The Tezos blockchain was founded by Dynamic Ledger Solutions, led by husband-and-wife duo Arthur and Kathleen Breitman. Tezos is also backed by the Tezos Foundation, a non-profit Swiss foundation. The Tezos Foundation facilitates the promotion and development of modern technologies and applications related to the Tezos blockchain.

Did You Know?

Tezos held an initial coin offering (ICO) in 2017 to raise funds for the project. The Tezos ICO was extremely successful, raising $232 million USD, making it the largest blockchain fundraiser at the time.

How does Tezos work?

Tezos Consensus Algorithm

The Tezos platform uses a consensus mechanism called Liquid Proof of Stake (LPoS) to validate transactions. LPoS is a variation of the existing Proof of Stake (PoS) consensus algorithm and features delegation. Because of the ability to delegate, Tezos’ consensus mechanism often gets confused with Delegated Proof of Stake (DPoS). LPoS is like DPoS, but there are a few distinct differences.

In a DPoS system, a fixed number of validators are voted in through delegation. However, in LPoS, the number of validators is dynamic, and any user can become a validator if they have enough coins. Tezos’ implementation of LPoS can support up to 80,000 validators. Tezos validators are called “bakers”, and the amount of XTZ required to become a Baker is currently 8,000 XTZ.

Tezos users who are unable to acquire 8,000 XTZ have the option to delegate their coins to a baker to earn staking rewards. Unlike DPoS, delegated coins in an LPoS system remain in the user’s ownership and are not subject to a lockup period, this allows them the flexibility to switch bakers at any time, hence the term liquid.

Key Takeaway

Delegation is optional for LPoS systems and can function without it, whilst DPoS systems centres around the delegation process.

If a user violates the integrity of the blockchain, they will incur penalties. Malicious bakers will have their rewards slashed, which means either burned or distributed among other network participants. Double-baking (trying to add the same block twice) is an act that is penalised on the Tezos blockchain.

Smart contract and formal verification

Smart contracts are lines of code embedded in a blockchain, usually in the form of instructions. These lines of code automatically execute when certain conditions are met. A popular application of smart contracts is non-fungible tokens (NFTs).

Most smart contracts undergo extensive tests and audits to check for bugs. Tezos’ smart contract platform goes the extra step and uses formal verification to prove that the smart contract will operate as intended mathematically.

Formal verification verifies that a given state is true based on rules and mathematical proofs. Formal verification theory is complex, but when implemented correctly, it ensures that Tezos’ smart contracts are reliable, efficient, secure, and bug-free. The extra security provided by formal verification is a major attraction for industries such as finance and aerospace that have very low fault tolerance and a high cost of failure.

Tez (XTZ)

Tez (XTZ) is the native cryptocurrency for the Tezos blockchain. It is used to pay for transaction fees and partake in Tezos governance. Bakers act as voters, and the value of their vote is proportional to their stake (including delegations).

Tezos currently has a circulating supply of over 900 million. Tezos adopts a unique inflation-based funding model where XTZ is minted to reward block producers and developers. Users who stake their tokens on the network will be awarded with newly minted XTZ proportional to the amount staked at the end of upgrade cycles.

This model means that inflation is non-dilutive for stakers. Imagine if every time the Reserve Bank printed money, a portion of newly printed money was transferred into your savings account!

What makes Tezos unique?

Energy efficiency

Tezos prides itself on being a green blockchain and is one of the most sustainable cryptocurrencies. A Proof of Stake blockchain does not rely on computing power to secure the network, unlike Proof of Work blockchains like Bitcoin and Ethereum. The energy consumption of a single transaction on the Bitcoin blockchain is 830kWh. Ethereum has an energy consumption per transaction of 50kWh. Tezos has an energy consumption per transaction of 30mWh. To put things in perspective, the conversion from mWh to kWh is 1 million. This means the difference in energy consumption between Bitcoin and Tezos is a factor of 25 million, and the difference between Ethereum and Tezos is a factor of 1.5 million.

Tezos’ flexible design allows seamless integration of new features and improvements. The energy efficiency per transaction has increased by at least 70% since the initial release of the Tezos protocol. The energy cost per transaction has decreased by 30% from 2020 to 2021.

Did You Know?

Tezos’ annual carbon footprint is equivalent to 17 global citizens. Bitcoin is notorious for its incredibly high energy consumption. By comparison, Bitcoins’ carbon footprint is equivalent to small countries like Jordan and Sri Lanka.

Baking

Transactions are validated on the Tezos blockchain via a process called “baking,” also referred to as staking. A decent computer, stable internet connection, and one roll of Tez is required to become a baker. Currently, one roll requires 8,000 XTZ. The more rolls, the higher chance of being selected to validate the next block. Users who do not want to run a node and acquire the necessary XTZ can opt to delegate XTZ to earn rewards proportionate to the amount delegated.

Self-amendment

Tezos is the first self-amending blockchain. This enables the network to upgrade itself without creating hard forks. Hard forks can occur when participants do not agree with decisions, this splits up the blockchain into two different versions that co-exist with each other. Bitcoin Cash and Ethereum Classic are two well-known hard forks.

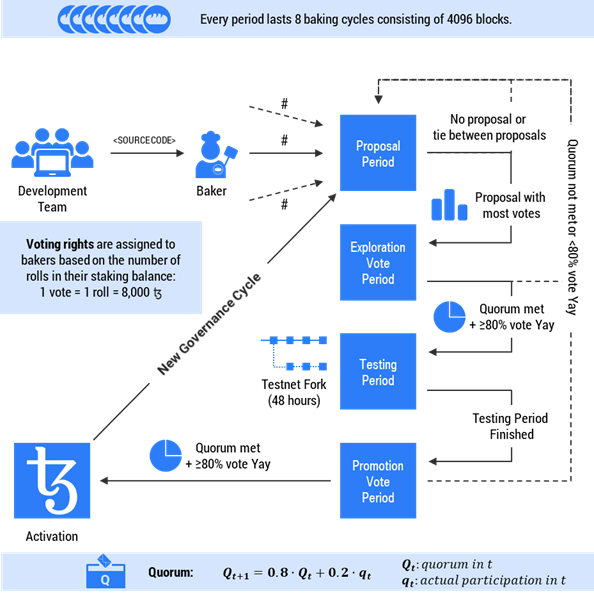

Self-amendment is made possible with on-chain governance. On-chain governance means that the governance process takes place on the platform and the proposed changes are implemented automatically. Tezos’ self-amendment process (Fig 1) is composed of five periods each lasting roughly fourteen days.

Figure 1 – Tezos’ self-amendment process

- Proposal period. The proposal period is the first step in the Tezos amendment process. During this period, bakers can submit proposals to upgrade or amend the Tezos blockchain, whilst other bakers can vote on their favourite proposal(s). All XTZ holders can delegate their coins to a baker that aligns with their votes whilst maintaining full ownership of their coins. The proposal with the most votes will proceed to the exploration vote period.

- Exploration vote period. During this period, bakers can vote to approve, disapprove, or pass on the top-ranked proposal. Passing implies that the baker chose not to vote but will accept the decision. If the voting participation passes the quorum – a dynamic threshold that updates throughout the process and reaches an 80% approval rate – it will advance towards the next stage. If the voting process fails either of the requirements, the process will revert to the proposal period.

- Cooldown period. This period is to let time elapse before the next step. Off-chain discussions and tests are held during this period.

- Promotion vote period. During this period, the network will vote once more on whether to adopt the amendment after the cooldown period. The voting process adheres to the same requirements as the exploration vote period.

- Adoption period. The final stage in the amendment process is the adoption period. This period allows time for the ecosystem to update. After the adoption period, the upgraded mainnet will be live.

Did You Know?

Developing proposals can be quite a lot of work. As an incentive, Tezos developers are allowed to attach invoices to proposals. If the proposal is approved, the amount of XTZ stated in the invoice is automatically minted and paid to the developer.

Tezos use cases

Corporate Baking

Enterprises that are baking on the Tezos blockchain are known as corporate bakers. Notable companies include Ubisoft, McLaren, and Redbull Racing.

dApps and smart contracts

Tezos provides a platform to develop decentralized applications (dApps) and smart contracts. Tezos is inherently secure with its implementation of formal verification. This incentivises industries that require a high degree of confidence in accuracy to develop using the Tezos blockchain. Example applications that align with these requirements include freight tracking and pharmaceutical supply chain management.

NFTs

Tezos also has a large non-fungible token (NFT) ecosystem, supporting many popular NFT marketplaces including Objkt and Rarible. Tezos is also partnered with major brands to provide a platform to host NFTs. Famous brands include Manchester United, Ubisoft, Redbull Racing and McLaren.

How to buy Tezos

You can buy XTZ from most large crypto exchanges. Swyftx is a reliable crypto exchange in Australia and New Zealand where users can buy XTZ with low fees and store it in their Tezos wallet.

Summary

Tezos takes a unique approach to blockchain design. It uses on-chain governance and Liquid Proof of Stake to perform self-amendments and upgrades. Implementing formal verification to secure their smart contracts adds a high standard of security and functionality to their applications. Like most blockchains, Tezos’ ecosystem is still in its early stages. But even still, there is plenty of exciting potential.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.