Modern finance is evolving fast, and crypto is helping write the next chapter.

Technologies like the blockchain have unlocked a new path for how society can think about money – and investors have a unique opportunity to get on the ground floor of this potential game changer.

But crypto investing for beginners can also be a daunting prospect. There’s so much to learn, from how the technology works, how to diversify your portfolio, to how to safely store your digital assets.

This article will guide you through the early stages of crypto investing and help you build the confidence to begin your journey.

Picking a reputable exchange

Arguably the most important decision – after choosing to invest in crypto – is picking the right exchange.

Exchanges or brokerages are necessary for buying, selling and swapping digital assets. They are essentially trading platforms that let you deposit money (such as Australian Dollars) and use it to purchase cryptocurrencies like Bitcoin and Ethereum.

There are hundreds of exchanges on the market, ranging from feature-rich, advanced platforms with thousands of cryptocurrencies, to brokers that exclusively deal in BTC.

When deciding on your first crypto exchange, it’s worth evaluating if the platform:

- Has a user-friendly, intuitive interface and user experience

- Provides excellent security options to secure your crypto assets

- Supports the cryptocurrencies you wish to buy

- Offers excellent, preferably local, customer support

- Offers low trading fees

- Offers different options for withdrawals (to an external cryptocurrency wallet) and online transactions

There are a few exchanges that meet all these criteria. For example, Swyftx is a popular trading platform for Australian and New Zealand customers. Different users will prioritise different factors. For some, ease of use will be a dealbreaker, while others may need advanced trading features to meet their needs.

Comparing key services, fees, and security records is essential to choosing the right crypto exchange.

What are the best cryptocurrencies to invest in?

As with any investment, there is no such thing as the ‘best’ asset. Rather, different digital currencies will offer different advantages and disadvantages.

Usually, it is recommended for crypto investors to build a diversified portfolio of cryptocurrencies. This approach can help reduce the impact of any single project underperforming.

Bitcoin is the oldest, most popular and most valuable digital asset in the world. It has become, by far, the most culturally significant cryptocurrency available. This, paired with its increasing use as a long-term investment from financial institutions, makes it an appealing option for beginners to begin a solid foundation for their portfolios.

In general, higher market cap assets like Bitcoin tend to be less volatile, and are often considered lower risk, than smaller, lesser-known cryptocurrencies. It may be advisable for those just starting out to stick to reputable, entrenched projects as they ease into their investment journey.

From there, as investors gain experience, they may wish to diversify their portfolio further. A common strategy is to weight exposure 10% to lower-cap, higher-risk altcoins. Low-value crypto projects end up being busts more often than not. However, with a sensible allocation to entrenched cryptocurrencies, investors may consider higher-growth products to round out their portfolios.

The phrase ‘with great risk comes great reward’ springs to mind.

Important to Remember

Above all else, it is important to do your own research before you start investing in cryptocurrencies. There are plenty of scams in the crypto market and influencers who are paid to shill (shamelessly advertise) coins to newbies.

How to identify good cryptocurrencies

There are over 20,000 cryptocurrencies on the market. Many are excellent projects with a lot of potential for massive growth and real-world adoption. But sadly, not every cryptocurrency will be successful.

Just like starting your own business, in such a saturated market even great, innovative crypto projects can fall by the wayside.

To make matters more complex, the crypto industry was a bit of a ‘wild, wild west’ for the first decade of its existence. Without much regulation and oversight, scammers freely operated rug pulls, while billion-dollar projects have collapsed due primarily to poor management and design.

Though the market has matured, it is still of utmost importance to identify quality projects with a clear direction and value. Performing high-quality and thorough research is vital, and while this is easier said than done, looking at use cases, adoption, market cap, and road maps can help get you started.

Use cases

Most cryptocurrencies are built to solve a specific problem, from creating fast, high-supply coins for online tipping, to tackling philanthropic goals like reducing financial inequality.

That’s why analysing the purpose and utility of a cryptocurrency can help investors sort through their options. Common use cases include:

- An international payment method (XRP, stablecoins, XLM)

- Providing infrastructure for decentralised finance (Ethereum, Solana, Avalanche)

- Improving the scalability of existing blockchains (Arbitrum, Celestia, Optimism)

- Specific DeFi services (Uniswap, Curve Finance)

- Gaming, metaverse and NFTs (Axie Infinity, Decentraland)

- Supply chain transparency (VeChain, Chainlink)

- Decentralised digital identity (Worldcoin, Polygon)

Adoption

As we’ve touched on, adoption plays a huge role in a cryptocurrency’s value and its long-term viability. Simply put, the more people that use it, the greater the demand for the project. So, a digital currency might have the grandest, most innovative use case in the world…but if nobody uses it, then its value will suffer.

You can gain insight into a project’s insight by looking at its use in the real world, scope out existing or upcoming partnerships, or look at engagement on social media communities such as Reddit and Discord.

Market capitalization

Market cap is the total market value of a cryptocurrency, determined by multiplying the price of the coin by the number of coins in circulation.

This metric can help you determine whether a project is undervalued or overvalued. For example, an exciting new project has been launched with a market cap of fifty million USD. It offers an excellent service that has good adoption, on par with a more established project, which has a market cap of ten billion USD. This suggests that the project may have a lot of room to grow. Coinmarketcap, Coingecko, and The Top Coins are great resources for checking market cap figures and coin prices.

In general, coins with a higher market cap aren’t as volatile as their less valuable counterparts.

Road map

Most cryptocurrencies will have a road map on their official website that outlines their current development objectives and goals for the next year (or more). Analysing this can provide valuable insights into a project’s future direction.

To get a better understanding of a cryptocurrency’s vision, you can ask yourself:

- Does the road map seem to hit important milestones?

- Are the goals achievable?

- Is there anything in the roadmap that may entice investors or increase adoption?

Important to Remember

Although websites like Twitter and Reddit are great resources for information and learning, not everything you find on there will be true or verified. Make sure to use a variety of sources to fuel your investment research.

Cryptocurrency investing and trading strategies

So, you’ve done your research and you have found a couple of crypto assets that you’d like to invest in. What now?

Well, it’s important to find a crypto trading strategy and stick to it. Most successful beginners tend to use simple, hands-off trading strategies such as dollar-cost averaging and long-term holding.

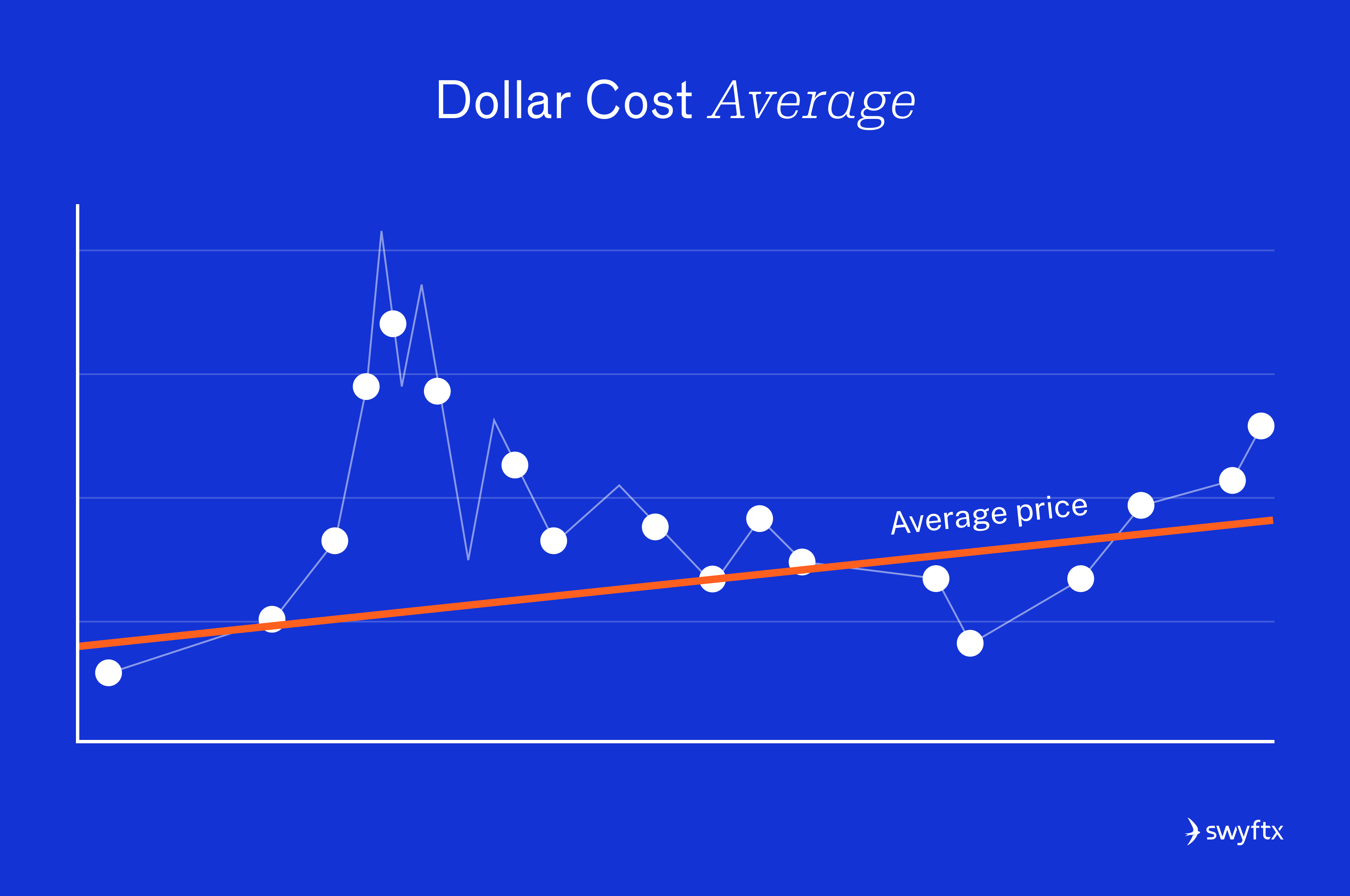

Dollar-cost averaging

Dollar-cost averaging (DCA) is a straightforward strategy that involves investing smaller amounts of money on a regular basis, regardless of market conditions (Figure 1). It has been used in the stock market for decades.

DCAing helps new investors avoid classic pitfalls like trading emotionally and attempting to time the market, while sticking to a long-term strategy.

Most popular exchanges offer DCAing in some form. For example, Swyftx allows customers to set up an ‘Auto Invest’ order.

The downside of DCA is that often your return on investment would be much higher if you had bought early with a lump sum. However, this is quite hard to predict, particularly for beginners.

Holding

If you’ve been on crypto social media before, you’ve probably come across the acronym HODL – Hold on for Dear Life.

Hodling can be a very effective strategy for investors that believe in the long-term vision of a crypto project. The strategy’s execution is exactly what it sounds like: buying and holding a cryptocurrency regardless of market movements.

The idea is that although the market can fluctuate wildly, good projects will generally follow an uptrend over higher time frames. Of course, this technique comes with downsides, such as becoming too attached to a failing project or forgetting to secure profits.

Tip

If the coin you want to hold also offers staking, that is an excellent way to increase the size of your position through staking rewards while holding and waiting for a potential increase in the asset price.

Buying the dip

Buying the dip is a strategy that should only be used on crypto assets with very solid fundamentals. The concept is simple – investors purchase more of a cryptocurrency after a market downturn, believing it to be a short-term correction rather than a lasting trend.

As buying the dip is a form of timing the market, it can be a little more complex than other strategies. While the strategy can be extremely effective, it can also lead to losses faster than other beginner-friendly alternatives.

Key Takeaway

It can be easy to find or develop a trading strategy that works for you – the hard part is sticking to it through thick and thin. Once you’ve found your strategy you should stand by it, no matter how much fear, uncertainty, and doubt (FUD) or fear of missing out (FOMO) is present in the market.

Using demo mode to practice trading

Even with ample research, using your hard-earned money to buy cryptocurrency can be a little bit daunting for beginners.

That’s why exchanges like Swyftx offer a ‘demo trading’ feature, which lets customers ‘invest’ in digital currencies without giving up any real-world money.

Using a demo mode can be a great way to build confidence in the market and your investment strategy of choice, without the risk of losing money.

Where to store your cryptocurrency

After you have made your cryptocurrency investment, it will need to be held in a cryptocurrency wallet. A crypto wallet is a digital tool that stores your private keys and allows you to interact with the blockchain.

There are two types of digital wallets – cold wallets and hot wallets. Hardware wallets, which are a type of cold storage wallet, store your crypto assets offline with a USB-like device. This helps reduce the risk of online hackers and scammers and is considered a more secure method for long-term storage.

If you’re looking to trade cryptocurrency more regularly, then a mobile, exchange or desktop wallet may be more suitable for you. We will touch more on crypto storage in the next lesson.

Summary

The crypto market provides many exciting opportunities for new investors. Whether you’re a veteran of the stock market or crypto will be your first investment, navigating the industry can be both exhilarating and confronting.

However, by educating yourself, developing and sticking to a trading strategy that suits your financial needs, you will be well-equipped to begin building a successful crypto portfolio.

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read