What is dollar-cost averaging?

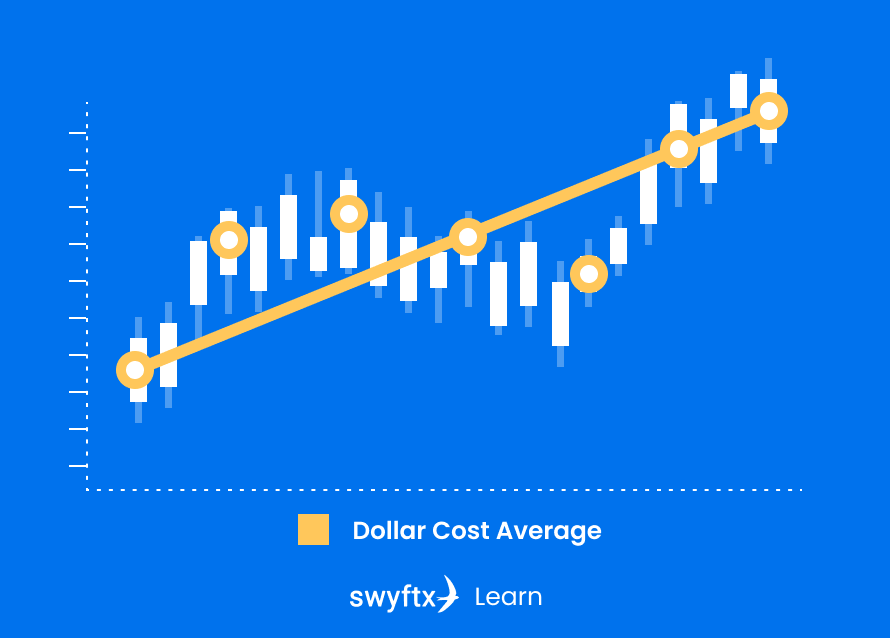

Dollar-cost averaging (DCA) is an investment strategy that is designed to remove the “emotional” factor in investing and help mitigate the risk of badly timed trades. It is used by both amateur and professional investors, and works on a simple principle: invest a fixed amount of money on a regular basis over set intervals (i.e. every week) regardless of market conditions and then take advantage of long-term price.

While this investment strategy has often been applied to the stock market, it is now being adopted by crypto investors to build wealth over time. This guide explains what dollar-cost averaging is and how it works. It will also look at the pros and cons of this investment strategy.

How does dollar-cost averaging work?

Generally speaking, there are two main options when choosing to invest. Investing all your money at once as a lump sum investment, or contributing smaller amounts of money over regular intervals. Dollar-cost averaging (DCA) is a strategy that helps minimise the risk of investment losses by breaking down the total amount to be invested across periodic purchases over time (Figure 1). The DCA Strategy means that the investor will be buying at a variety of prices, which should average out to the price at which the target asset is purchased, or better.

Say Lucy wants to invest $12,000 in Ethereum. She could do a lump sum investment, which means buying $12,000 worth of Ethereum at a certain price. Alternatively, she could do a dollar-cost average investment, which would mean she buys $1000 worth of Ethereum at a pre-determined interval i.e. every month. She’s still invested the same sum of money after 12 months, but the outcome of each method is potentially very different.

Key Takeaway

Dollar-cost averaging (DCA) involves investing pre-determined smaller amounts at regular intervals over a set period of time as opposed to a larger lump-sum investment

Does dollar-cost averaging work for cryptocurrencies?

The dollar-cost averaging strategy can be applied to most sectors and markets with varying degrees of success. The strategy is especially useful in the crypto market, where timing the market can be difficult and the market can be highly volatile.

With DCA you can minimise the risk of poor timing and maximise exposure to the market. By balancing volatile price movements with averaging costs across a larger period of time, risks become more manageable. Your portfolio is increasing in value when the market is going up, but it can also decrease in value during down markets. When this happens, as long as you keep investing, you’re gaining more crypto assets at a discount.

Is dollar-cost averaging an effective investing strategy?

While all investment strategies have their pros and cons, there are certainly times that DCA is more effective than other strategies. Markets that are more volatile typically benefit from this strategy. Dollar-cost averaging helps investors get in at a good price and limit their losses if they invest on a “bad” day.

For both new and experienced investors alike, it can be difficult to time the market right. Hindsight is sometimes the only way to know whether or not it is a “good time to buy”. DCA mitigates the risk of an extreme outcome, be it negative or positive. Although the concept is easy to understand, it takes discipline and self-control. You’re less likely to make emotional decisions if you are forced to invest over a period of time.

Tip

DCA can help investors avoid making “emotional” decisions in response to market swings. DCA may be especially useful in markets that have high volatility, hence why it can appeal to many crypto investors.

Using a dollar-cost averaging calculator

To get a better understanding of dollar-cost averaging in action, you may want to try a DCA calculator. Although a DCA calculator cannot predict the future price of an asset, it can show you the benefits of utilising this investment strategy over time. Cryptohead has a useful Bitcoin DCA calculator, which has been used for the example below.

Say you had invested in BTC from January 1st, 2014 through to January 1st, 2022. If you had invested $10 AUD per week over that period of time you would have invested a total of $4,080 dollars, and accumulated $185,000 worth of Bitcoin (or 3.36 BTC).

Pros and cons of DCA

Investing your money all at once, or setting up an investment plan over time both carry risks. There are pros and cons to each, and dollar-cost averaging is no exception. In this section, we’ll have a look at the main benefits and risks of DCA.

Benefits of dollar cost averaging

By dividing your investments into equal intervals and also being aware of potential market shifts that could rapidly affect the value of large investments, you can reduce the risks associated with investing.

By having a dollar-cost averaging strategy in place, you can invest at regular intervals, typically monthly, regardless of market conditions. This means that even if prices are rising or falling you can invest as normal without worrying about making big investment decisions based on emotions like fear and greed.

This also ensures that your average cost price, the final price you pay per unit of an asset purchased over time, is more likely to be at your desired purchase price even if prices are rising or falling. This hedges against sharp market fluctuations, and can also help build good investment habits.

Risks of using dollar-cost averaging

A key risk of DCA is that often the value of cryptocurrencies rise over the long term. While DCA hedges against risks, the returns on a “good investment” in crypto with dollar-cost averaging would likely be less than if you had invested a lump sum at the start.

Dollar-cost averaging also cannot replace being able to identify genuinely good investments. Yes, seeing market dips and spikes can lead to rash decisions, but there’s also a time and place for well-informed estimates when it comes to buying crypto assets.

For instance, if a certain cryptocurrency is about to make a development that will likely result in a large increase in value in the short term, you may then want to invest more into that particular digital asset, which is not an approach that DCA allows for.

Important To Remember

In markets that are less volatile or have a history of increasing over time, DCA may not deliver the returns an initial lump-sum investment would have.

Is DCA right for you?

If you’re considering buying cryptocurrency, one of the most important things to keep in mind is that crypto-assets are often volatile and unpredictable. This makes it all the more difficult for investors who want to avoid risk at any cost.

However, dollar-cost averaging can help mitigate some of those risks while still allowing you to invest – even if only a little bit each month or week. This can be especially useful for beginners still familiarising themselves with the crypto market, as it requires much less of an initial investment.

Summary

The core premise of dollar-cost averaging (DCA) is investing a fixed amount of money at regular intervals over a longer timeframe, as opposed to lump-sum investments. This can help reduce risk in volatile markets, such as the crypto market. This guide has explained what dollar-cost averaging is and how it works. It has also covered the pros and cons of this investment strategy.

To learn more about investing strategies, how to build a balanced portfolio, or anything else crypto-related, keep exploring Swyftx Learn.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.