The fundamental analysis checklist can help you answer questions related to the project’s people, catalysts and weaknesses. Please note that this does not cover all aspects to be considered when performing a fundamental analysis.

Screenshot taken from checklist

What are tokenomics?

Tokenomics delves into the fundamental economic principles applied to crypto assets. It’s pivotal in finding the potential success of a crypto asset, as it evaluates the dynamics between the asset’s price, its quantity, and the market’s buying and selling pressures.

Interesting Fact

At the core level, Cryptocurrency prices ultimately appreciate when the demand rises higher than supply for the coin.

Additionally, tokenomics addresses reward structures prompting certain behaviours within a network. Consider the vote escrow model, where users are incentivised to temporarily lock up their coins, thereby potentially increasing the asset’s price due to decreased availability.

Supply Side

Token distribution and ownership

Launching a crypto project involves intricate decisions regarding initial token distribution. Often showcased in whitepapers with visual aids like pie charts, this distribution demarcates allocations for investors, team members, miners, and rewards, among others.

However, a skewed distribution, where a select few hold a majority, is problematic. It introduces potential volatility and manipulation risks. Investors must scrutinise distribution methods, ownership concentrations, caps on token holdings, reserved token allotments, and the potential market impact of large-scale sales.

Emission rate

Understanding how crypto tokens are created is similar to understanding how new money is made. There are different ways tokens can be created:

- Fixed Supply: A set number of tokens are made initially, with no more added later.

- Inflationary: More tokens are continuously made, increasing the total number over time.

- Deflationary: The number of tokens decreases, often through processes like “burning”.

- Halving: At certain times, the rate of new token creation is cut in half.

- Proof of Stake (POS) Rewards: People hold onto tokens and help validate transactions to earn rewards.

- Proof of Work (POW) Mining: Miners earn new tokens by using computer power to add to the blockchain.

For instance, the following graphic shows the supply of ETH decreasing following the Merge, where Ethereum moved from PoW to PoS. The white line represents the supply of ETH had it continued using PoW.

This means that Ethereum is now currently a deflationary asset.

ETH Suppy pre and post-Merge. Source Ultra Sound Money.

It’s important to know how these methods can affect a cryptocurrency’s value and how it works.

Token unlocks

Tokens, initially inaccessible, may be periodically released into the market. This is generally the case for tokens reserved for founding teams and/or early investors. This phased approach aims to prevent abrupt market shocks due to substantial changes in the supply of tokens in the market.

For example, if a group of investors in coin ‘XYZ’ were to unlock access to all their allocations on a fixed date, that would impact the supply and demand and likely impact price as a result. However, if coin ‘XYZ’ were to gradually release tokens monthly or annually, it would greatly reduce this risk to investors.

Example token distribution – optimism (OP). Source TokenUnlocks

Circulating, max and total supply

Cryptocurrencies have three supply types:

- Circulating Supply: This is the number of coins that are out there in the world and owned by people. When there are fewer coins around, the coin tends to be worth more.

- Maximum Supply: This is the most coins that can ever exist for a cryptocurrency.

- Total Supply: This is the total number of coins made until now, including ones that might not be used right now.

Interesting Fact

Let’s look at Bitcoin and Dogecoin. Bitcoin will only ever have 21 million coins, and they will all be mined by around 2140. But not all 21 million will always be around because some get lost or are saved for a long time. This makes each Bitcoin more valuable. On the other hand, Dogecoin currently has over 140 billion coins and it doesn’t have a fixed supply limit.

Demand side

Utility

An asset may boast optimal Tokenomics, but without utility, its long-term value is questionable.

Token utility varies. For instance, a blockchain might make its native token the network’s currency. To transact, users pay fees (like gas) in this token. Ethereum exemplifies this; users pay gas fees in ETH for network interactions, driving ETH demand.

Token utilities can encompass:

- Fees for executing transactions

- Data storage

- Staking and participating in network security

- Governance participation

Investors should pay attention to how useful a token is. Some tokens don’t have much use, so they will have low market demand, given that it doesn’t provide a practical purpose. If few people want the token, its price is unlikely to go up.

Community

A crypto project’s community is crucial for its success. A robust, dedicated community promotes growth and value, helping the project gain a market foothold.

Community sentiment, can be assessed via social channels like Telegram, Discord, and Twitter discussions about crypto.

Negative vibes in community forums may hint at project issues, suggesting a potential sell-off. Whether transient or grave, it’s key to observe the core team’s response to these concerns.

What do a project’s financials refer to?

Market cap

Market capitalisation or market cap is the total value of a cryptocurrency.

You can find it with simple math: The number of coins being used right now (that people have) multiplied by the price of each coin.

Market Cap = Number of Coins in Circulation x Price of Each Coin

Why does this matter? It helps you understand the potential risk, stability and growth potential. A low market cap, generally speaking, only takes a small amount of capital to move it up or down significantly. Exposing you to a higher risk, higher potential return investment.

If it’s higher in market cap, it is typically associated as being a lower risk, and lower potential reward investment comparably. However, this is not always the case.

Knowing the market cap helps you make smarter choices about what to expect from certain crypto investments.

Marketcap resource

TVL

Total value locked (TVL) is a key metric in decentralised finance (DeFi) reflecting the value of assets in DeFi protocols or individual projects. Investors use it to find the health and value of the DeFi space or a particular protocol.

TVL showcases the influence of capital on DeFi apps’ profitability and utility. Higher TVL suggests increased liquidity and benefits for users. Researching the TVL of a project can provide insights into the sum value of assets committed to that project. A growing TVL may suggest that investors are seeing value in that project, and is a sign of trust, growing confidence or positive sentiment.

TVL resources

Ecosystem growth

Ecosystem growth is of paramount importance in the realm of cryptocurrencies due to its indication of the development, adoption, and sustainability of a cryptocurrency project.

It can often lead to increased cryptocurrency adoption, value, and utility. As a result, cryptocurrency projects with a strong and expanding ecosystem are better positioned for success in the competitive and dynamic cryptocurrency landscape.

Ecosystem growth will depend on what the project is. I.e. if you’re looking at a crypto gaming project, a metric to measure ecosystem growth would be number of active users. Alternatively, if you’re looking at a layer 2 network, you could measure growth by the number of daily transactions.

Ecosystem system resources

Fees

As part of your research, there are two possible assessments of fees:

- Network fees growth rate – Monitoring a blockchain’s network fees can help you measure its traffic. Rising or falling fees can hint at the ecosystem’s current appeal.

- Personal transaction fees – Each blockchain has unique transaction fees affected by network activity. Chains like Solana, Binance Smart Chain, and Tron offer low fees, while Ethereum and Bitcoin are higher. The chain and token you choose impacts your transaction costs.

Activity and adoption

Transactions and active wallet addresses

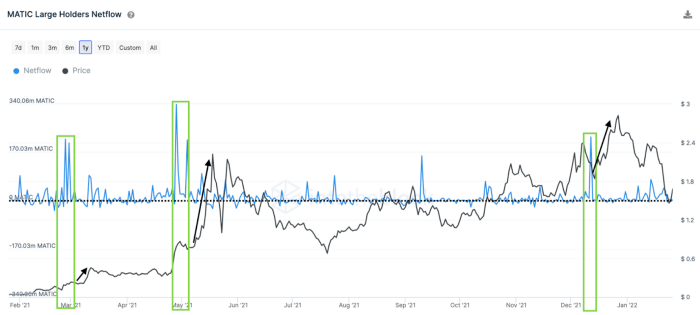

Tallying active wallet addresses offers insights into a coin’s consistent demand and the community’s engagement level. Moreover, Large Holders Netflow provides a vantage point into substantial investors’ behaviours, influencing market dynamics.

Activity and wallet address resource

MATIC Large holders netflow. Source Swyftx Analytics

The above illustration is taken from the MATIC large holders netflow metric on Swyftx. As can be seen, the large spikes in transaction volume (in green boxes) have, in this instance, historically been correlated with large upswings in price.

Enhance your Investing Journey with Australia’s Premier Crypto Education and Research Company

Test drive the Investified platform with a free trial and 50% off Crypto Pro memberships. Swyftx will receive a commission for Crypto Pro purchases.

Start 14-day free trial

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read