What is the project’s purpose?

Understanding a project’s goals and relevance is key to evaluating investment opportunities. If the project seems unclear, irrelevant, or offers a subpar solution to a problem.

You’re on the right track if you can explain your investment rationale to a 12-year-old.

The fundamental analysis checklist can help you answer questions related to the project’s people, catalysts and weaknesses. Please note that this does not cover all aspects to be considered when performing a fundamental analysis.

- Can you explain what the cryptocurrency aims to achieve in one or two sentences?

- Is it disruptive or innovative?

- Does it solve an existing problem?

General resources

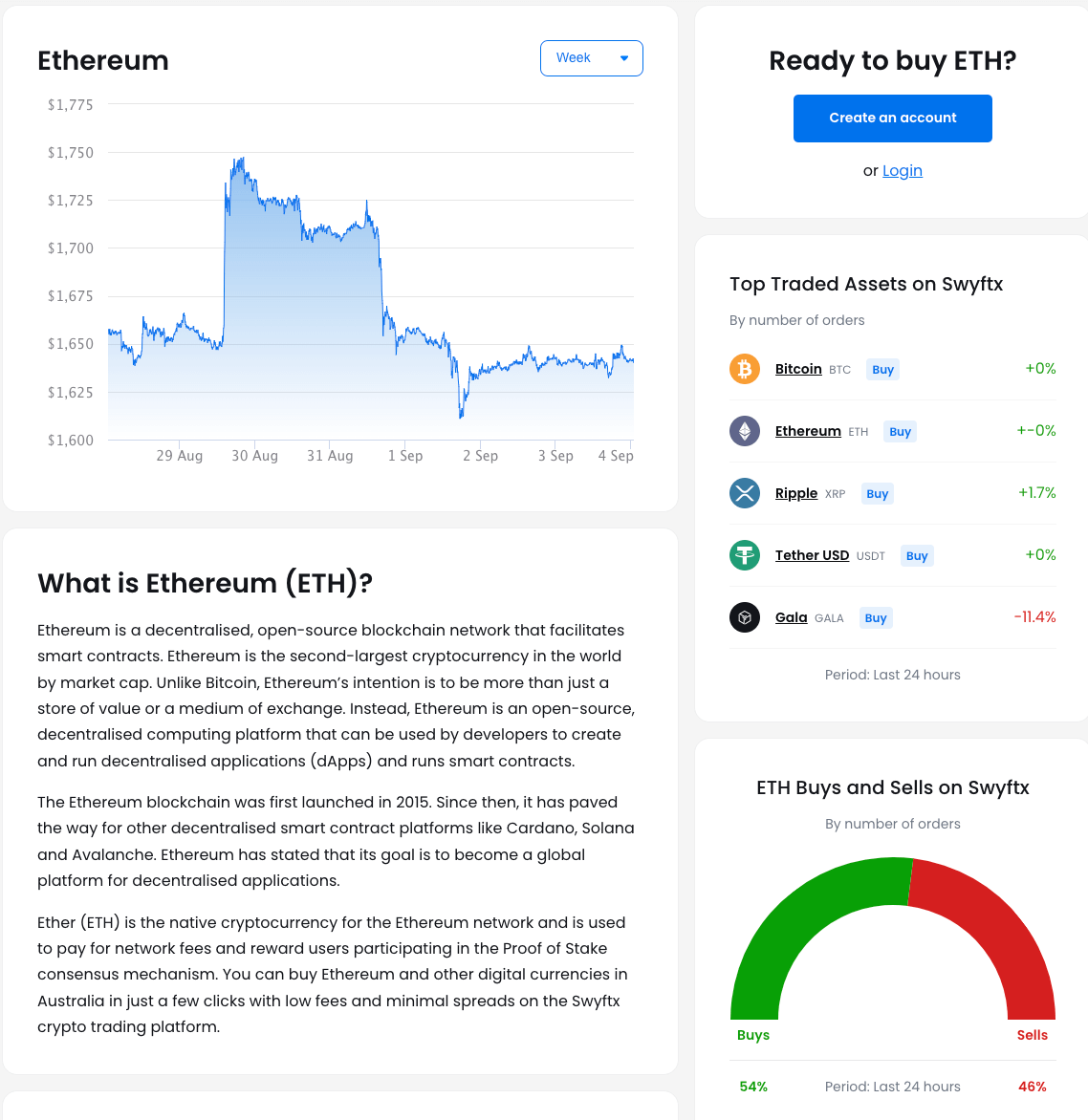

Swyftx’s asset pages (Ethereum)

Is the project an idea or a working product?

It’s crucial to recognise a concept from a functional product. Assess the development stage of the protocol and whether there is an established network, a functional prototype, a minimum viable product (MVP) or just an idea on a napkin (or whitepaper).

A viable product should be public-ready, with its mainnet operational for a significant period. Consistent updates and frequent user engagement, using dApps, smart contracts, etc., are indicators of product maturity.

Examples of projects to be cautious of:

- A gaming project that has a trailer or graphics but is yet to have a playable game.

- A new blockchain claims to revolutionise transactions but is yet to arrive at the testing stage.

A working product highlights a team’s capability to execute its vision. While many projects in crypto are built on speculation, this shouldn’t be the sole driver of value.

- What is its development stage?

Is there market demand?

Existing or rising demand for a cryptocurrency often indicates a greater chance of investment inflow. Naturally, more demand means more buyers and more potential for price growth.

Competitor comparison

Recognising the competitors of a project within its industry is crucial for assessing the project’s possibilities. While a project might appear attractive at first glance, its true standing comes to light when stacked against rival projects that potentially boast a stronger team, distinctive product attributes, influential partnerships or a more robust community involvement.

For instance, in Solana’s case, its biggest competitor is Ethereum, a more widely used layer 1 network with a greater security and infrastructure. Solana, however, offers a faster, more scalable solution.

- Who are the competitors?

- What is the market cap of the top-performing competitors?

Evaluating user feedback

A glitchy platform or a lackluster interface is a red flag. Seeking user feedback from others can uncover potential weaknesses or flaws in the cryptocurrency’s design, functionality, or implementation.

Positive user experiences can drive adoption and value growth. If a project actively seeks feedback, it indicates transparency and a willingness to listen to the community.

Weighing strengths and weaknesses

You want to adopt a non-bias opinion throughout the research phase to provide a balanced viewpoint. Researching with rose-coloured glasses will mean you could oversee key information that could be detrimental to your process and the longevity of the investment.

It is recommended that while you are conducting research, notes are taken of any possible red flags as well as their strengths. Weak points might include:

- Team members with dubious histories.

- A token that has an abnormally high inflation rate which could dilute the price.

- Token unlocks from early backers.

- Poor response from the team around any issues in the community.

- An unclear vision or irrelevant solution.

Test the product

Trialling the protocol’s/project’s user experience is akin to taking it for a test drive. Test a transaction, navigate their platform, or explore their app. This evaluation gives insights into its usability and functionality.

Factor in design, transaction speed, fees, security, and overall feedback.

A satisfactory user experience boosts the likelihood of market success, adoption and potential investment confidence.

- Are there any concerns when using the product?

Enhance your Investing Journey with Australia’s Premier Crypto Education and Research Company

Test drive the Investified platform with a free trial and 50% off Crypto Pro memberships. Swyftx will receive a commission for Crypto Pro purchases.

Start 14-day free trial

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read