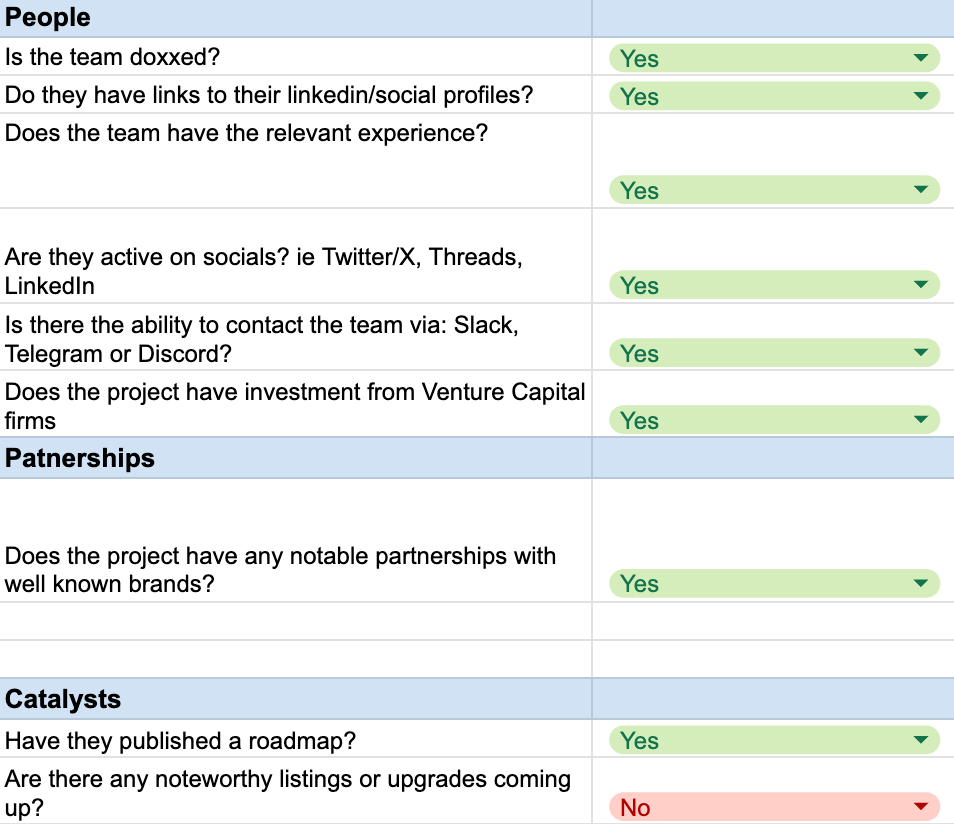

The fundamental analysis checklist can help you answer questions related to the project’s people, catalysts and weaknesses. Please note that this does not cover all aspects to be considered when performing a fundamental analysis.

People

Teams experience

It is essential to recognise that cryptocurrencies are backed by a team of individuals with certain expertise and experience comparable to those who have successfully managed traditional companies over the years.

Understanding the project leadership’s skills and history is vital to gauge their capacity to execute the project’s objectives. Examples could include:

- Founders experienced in blockchain/crypto for 5+ years.

- Founders from giants like Apple, Microsoft, Facebook, Amazon etc.

- Founders with success in tech/finance companies, having over 100 employees or significant company exits.

Background information on the team can be sourced through LinkedIn, by viewing their social media profiles or through a simple Google search to find any coverage on them. However, this should be taken with a grain of salt like anything online.

If the team is strong, they will typically have a higher chance of success.

For instance, Polkadot and Cardano were founded by former founders of Ethereum, indicating strength and experience within their stables.

If the team members are anonymous, it could signal that they are protecting their identity because of their history or financial crimes they are preparing to commit with the project.

- Do they have relevant experience in the field they are working in?

- What is their track record with other projects?

- Is the team publicly known (and are they real people) or are they anonymous?

Investors

Looking at the involvement of investors is a crucial element in evaluating a project, specifically the backing from venture capital firms as opposed to retail investors. Many emerging projects actively seek financial support from these firms before opening up to the public. If the project has several well-recognised, reputable investors, this often indicates these firms have strong confidence in the project to do well in the long term.

Venture Capital Investment Resource

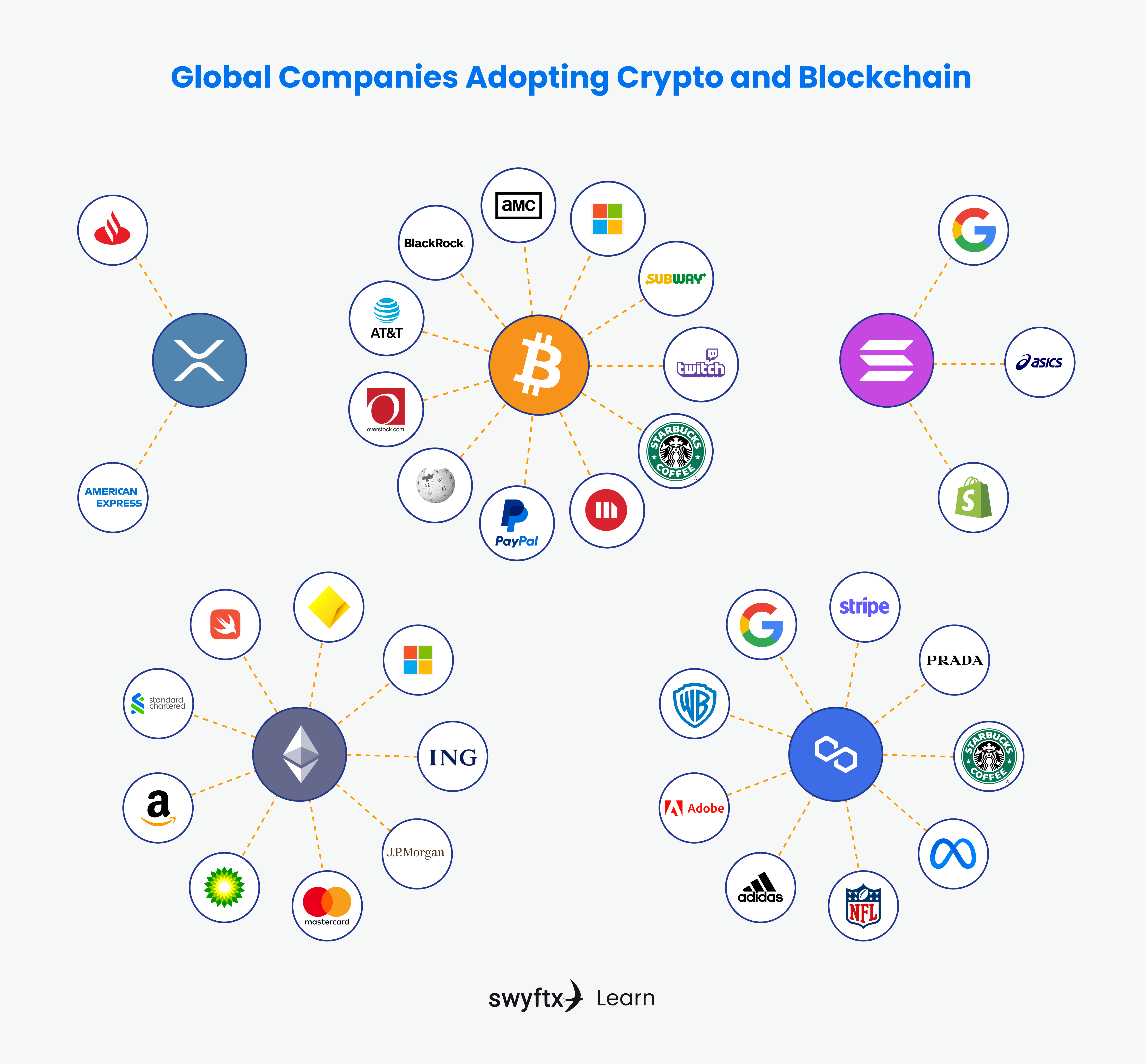

Partnerships

Partnerships hold significant importance within the realm of cryptocurrencies for several reasons:

Credibility: Ties with well-known companies boost a project’s credibility. Endorsements from respected partners foster trust among users and investors.

Adoption: Collaborations can drive the cryptocurrency’s adoption and real-world use. Partnerships with payment processors, or e-commerce platforms for example, enhance its practical value.

Market Access: Partnerships expand access to new markets and audiences, boosting the potential for broad adoption.

Tech Advancements: Collaborating with tech companies can refine the cryptocurrency’s technology, enhancing its competitive edge.

Marketing: Joint marketing endeavours increase the cryptocurrency’s visibility, drawing more users.

Investor Confidence: Meaningful partnerships can enhance investor confidence by signalling that the project has concrete plans and support from reputable players, reducing perceived risks.

Long-Term Viability: Partnerships demonstrate that a cryptocurrency project is thinking beyond its immediate development phase and is focused on building a sustainable future.

However, it’s important to note that not all partnerships hold equal value. The quality and relevance of partners matter. A strategic partnership should align with the cryptocurrency’s goals and vision to have a meaningful impact on its growth and success.

Crypto partnerships with Mainstream brands

Catalysts

Tokens or coins only rise in value if others are willing to buy. Therefore, the success of a project is often driven by interesting catalysts or stories that will attract new investors. Sometimes great projects remain stagnant in price because they don’t know how to get attention.

Catalysts that can drive attention:

- Listing the token onto a new exchange

- Hiring new talent to the team

- Launching a new product

- Upgrading the current product

- New tokenomic structures

- Regulation clarity

- Ecosystem growth

- Partnerships announcements

- Web 2 integration (E.g. Amazon, Apple)

Interesting Fact

A report found that coins would on average, increase by 41% on the day after listing on Binance and 24% after listing on Coinbase.

Where can catalysts be found?

Catalysts can be pinpointed by examining different sources, including the project’s official website, whitepaper, and roadmap. However, to access some of the most valuable insights, a thorough exploration of the project’s social platforms like Telegram, Twitter, and Discord is often necessary. Additionally, engaging with interviews that feature the project team can provide valuable information. It’s crucial to conduct a comprehensive investigation across these channels to uncover concealed hints and develop a more profound comprehension of the potential catalysts for the given project.

Staying informed about upcoming events, regulatory changes, technological advancements, and market trends allows market participants to make informed decisions and manage their risk effectively.

Important to Note

Not all catalysts are created equal. For example, a website upgrade will provide different attention to a new partnership formed with Disney.

Product roadmap

The majority of cryptocurrency projects lay out a roadmap for their future, outlining when they’ll test things, make releases, and add new features. This roadmap should give a clear picture of what’s coming next. Investors can use it to track milestones and see if the team is delivering so far on their plans.

Enhance your Investing Journey with Australia’s Premier Crypto Education and Research Company

Test drive the Investified platform with a free trial and 50% off Crypto Pro memberships. Swyftx will receive a commission for Crypto Pro purchases.

Start 14-day free trial

Quiz

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read