All markets go through an extended period of turmoil from time to time, but in crypto markets, it’s exacerbated by even wilder price swings. These sustained declines in value are called bear markets. Navigating a bear market in crypto can be extremely challenging for investors, especially if it’s their first time. Luckily, there are strategies that you can use to mitigate damage. For the savvy trader, a long run of price drops can even present an opportunity to turn a profit.

This guide will explain what a bear market is and give some context to why they usually occur, before exploring some of the popular strategies traders can use during bear markets.

What is a crypto bear market?

The simplest way to define a crypto bear market is a long-term downward trend in the price of cryptocurrencies across the board. Typically, a market is considered bearish when it experiences a market decline of 20% from its previous high. During bear markets, crypto investors are often scrambling to sell off their portfolios to accumulate cash or “defensive assets”.

Cryptocurrency bear markets can be particularly harsh. Looking back to 2018, the price of Bitcoin plummeted by over 80% within 12 months. The crypto market suffered massive losses during this prolonged bear market, with $700 billion in market capitalization being wiped out.

Interesting Fact

The term “bear” in finance has been around long before stock markets or cryptocurrency. It was a popular phrase in the 18th century and referred to bearskin traders that would finalise sales before they actually had any assets in stock. This was a strategy to lock value in case the demand for bearskin was to drop in the near future.

Why do bear markets occur?

A bear market occurs for a number of reasons, the simplest being investors have lost confidence in cryptocurrency’s short-term future and begin selling off their assets. There are a number of possible catalysts for this negative market sentiment, which are outlined below.

Regulatory issues

Cryptocurrency frequently encounters issues with government regulations, which can ward off some investors. Over 10 different countries have completely banned the use of cryptocurrency, the most notable being China in 2021.

Societal instability

Major societal events, such as the Covid-19 pandemic or the Russia–Ukraine conflict, often lead to investors pulling their money out of the financial market.

Excess leverage

Using leverage to invest is essentially taking on debt to buy cryptocurrency futures. Over-leveraged assets can experience extreme market volatility as their price may be driven by debt.

Illiquidity

When investors take on exorbitant amounts of leverage, the market can quickly become unstable if they sell their assets. Similarly, high-capital investors that sell off their crypto can cause a rippling effect of price drops.

Global economy

Cryptocurrency is often thought of as a hedge against inflation and uncorrelated to traditional markets as a whole. This is not really the case and the two are intrinsically linked. Massive selloffs in the stock market will often result in a similar bearish outcome for crypto.

Security breaches

Large-scale security breaches – like a major exchange losing billions of assets – often send investors into a frenzy. They may quickly react by selling or moving their coins, which can cause sustained price drops.

Bear market trading strategies

A bear market in crypto can be overwhelming, as red charts and negative percentages are everywhere. In situations like this, the most important thing to do is not panic. By assessing the situation strategically and rationally, one can avoid making bad decisions that may result in heavy portfolio losses.

It’s vital to remember that bear markets are a natural part of the market cycle. Every financial sector in human history has experienced prolonged periods of success, just as they have experienced lengthy hardships. It is part of an endless push and pull – and every time crypto has encountered a bear market, it has eventually rebounded to enter another bull market once investor confidence has been restored.

Below are some popular strategies traders can use during a bear market.

Dollar-cost averaging

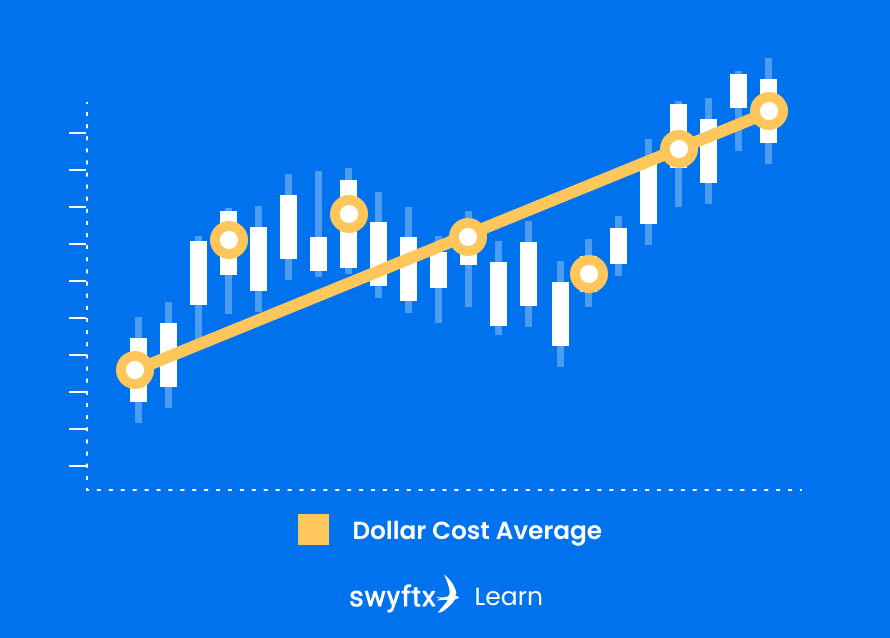

Timing a volatile market is incredibly difficult and can be a trap for beginners. Instead, some traders opt to use a trading strategy like dollar-cost averaging.

Dollar-cost averaging (DCA) is a powerful tool for those with a long-term outlook on their crypto investments. It is the process of buying a set amount of cryptocurrency at set intervals over a period of time, regardless of market prices. This essentially allows you to ignore price fluctuations and simply accumulate more assets. It also takes the emotion out of investing and ensures that you’re making level-headed decisions.

Figure 1 – Dollar-cost averaging in practice

Let’s say Esther had $10,000 that she wanted to invest in Ethereum. Say she purchased $10,000 of ETH while it was worth $1,000, but over 10 months it dropped to $500, and her portfolio’s value would be halved. Alternatively, she could use DCA and buy $1,000 worth of Ethereum over 10 months. In this case, her average buying price of ETH would be closer to $750, a much more palatable loss.

Important To Remember

Dollar-cost averaging (DCA) is a great strategy for beginners, especially if it’s their first time experiencing a bear market. However, DCA will not deliver the same returns as a well-timed lump sum, especially in bull markets.

Diversify your investments

Having a diverse portfolio of assets is generally a good strategy, regardless of market sentiment. By owning a wide variety of cryptocurrencies, you prevent exposure to the risk of a single coin’s value rising and falling. For example, some weeks Bitcoin and Ethereum may drop in price, but Solana and Dogecoin might rise in price. A well-diversified portfolio can mitigate the damage caused by Bitcoin and Ethereum’s losses.

Part of diversifying your portfolio involves more than just accumulating different cryptocurrencies. Owning assets across various markets can be another good way to negotiate a bear market. For example, traditional financial markets, precious metals (gold and silver) and defensive stocks (healthcare, military, and food) will often perform well when entering bear market territory.

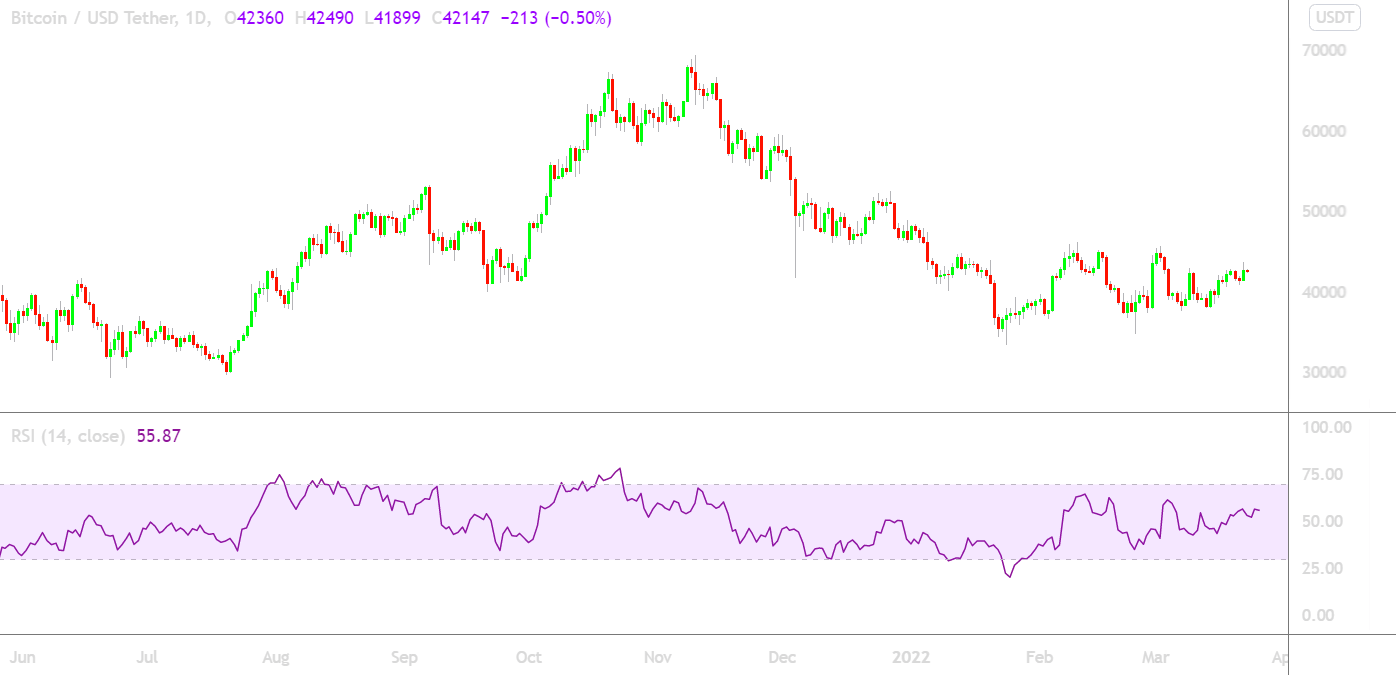

Use indicators to identify a good entry position

Technical analysis is a great way for more experienced investors to analyse market conditions. Technical indicators can be used to assess trends in cryptocurrency and determine how this may impact the price of certain assets going forward. By predicting fluctuations in value, investors can try and figure out the bottom (or top) of a trend and accumulate crypto accordingly.

There are a few technical indicators that are often implemented to great effect. For example, a relative strength index (RSI) is a mathematical formula that attempts to portray if an asset is oversold, or overbought. Generally, an RSI of over 70 indicates overbuying and an impending dip and an RSI of under 30 is the opposite.

Figure 2 – The relative strength index (RSI) on a price chart

Set targets and take profits regularly

The saying goes that “everyone in a bull market is a genius”. This can lead to investors feeling invincible, becoming greedy and ignoring sensible exit points. As the bull market recedes and the bear market kicks in, they can end up losing all the paper profits they once had.

A great way to avoid this is by setting and sticking to price targets. Even in a bear market, cryptocurrencies can still experience shorter-term gains. You can set up trade triggers on crypto to automatically sell when the asset hits a specific price. These are known as stop-losses or take-profits. By implementing this strategy, you can minimise losses on the way down and not worry as much about timing the market.

Summary

Bear and bull markets are an integral part of crypto. But bear markets don’t have to be a time of despair. The first rule is to never let emotion dictate your investment moves, as this will nearly always end up in a loss. Long-term investors may want to just sit tight through market instability and simply HODL.

However, there are a range of strategies you can use to help trade your way through a prolonged market downturn, no matter your investment outlook. By keeping calm and critically evaluating your crypto portfolio, you can make smart decisions that will benefit you in the long run.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.