As the world of cryptocurrencies continues to expand, there has been an increasing number of different decentralised applications offering a range of various activities such as staking, borrowing, lending and NFT trading. Mining as a hobby or as a business has also become increasingly popular due to the potential for passive income.

However, these activities can come with tax implications that individuals and businesses need to be aware of. In this chapter, we’ll dive into the tax consequences of engaging in these activities in Australia to provide a general overview of the potential tax liabilities.

How is mining crypto taxed in Australia?

Mining crypto involves validating transactions and securing networks like Bitcoin in exchange for rewards or tokens. It is important to note that depending on your classification – either a Hobby miner or a Business miner – you will have different taxable implications on your activity.

- Hobby miner. A hobby miner mines crypto occasionally, with a non-commercial intent.

- Business miner. A business miner mines crypto regularly and at scale, with intent to profit, and involves specialised mining equipment

For individuals considered to be hobby miners, the rewards are generally not taxed upon receipt. Instead, a Capital Gains Tax (CGT) event may occur when the mined coins are later disposed of (e.g., sold).Since the coins were obtained through mining, the cost basis is considered $0 – therefore, the entire amount received when selling mined coins represents the capital gain.

A business miner’s mining rewards are typically treated as ordinary income at the time of receipt, and may also trigger CGT at the time of disposal.

It is important to note the difference between a hobby miner and a business miner, as the taxable implications are vastly different. A hobby miner may have a small setup in their home where they passively mine crypto, whereas a business may have a large setup with professional equipment, a building specifically for mining crypto or other scaled activities. The determination depends on specific ATO criteria. If you are unsure which category you fall into, it’s best to seek professional advice from a registered tax agent, as the determination depends on your specific facts and circumstances.

Business expenses and deductions

One of the benefits of being classified as a business miner is the ability to claim various expenses and deductions on your tax return. You must be registered as a business for tax purposes to claim any deduction. As a mining business, you may be able to claim:

- Electricity

- Hardware depreciation

- Internet fees

- Hosting fees

How is staking taxed in Australia?

Staking refers to the process of holding and validating cryptocurrencies in a wallet to support the operations of a blockchain network. It is somewhat similar to having savings in the bank and earning interest, and stakers are typically rewarded with additional tokens for their participation

For individuals staking cryptocurrencies as part of their personal investment strategy, the rewards received from staking are typically considered ordinary income subject to income tax. The fair market value of the tokens received at the time of receipt is usually required to be included in the individual’s assessable income.

Keep in mind, if the individual disposes of their staking rewards in the future (either in exchange for another cryptocurrency or for fiat currency), they will also be subject to capital gains tax with the market value of the rewards at the time they were received, forming the cost basis for the capital gain or loss.

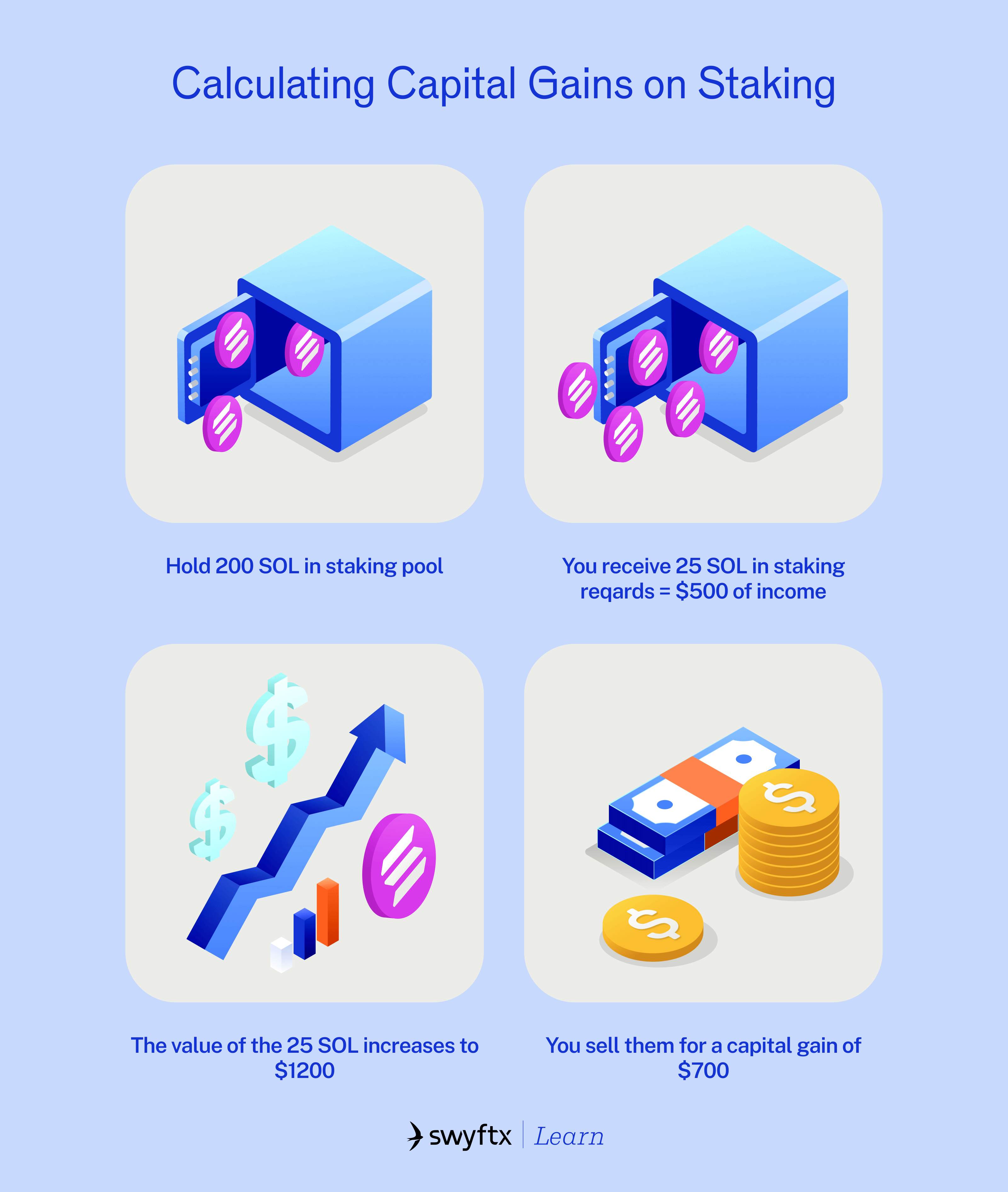

Let’s explore some fictitious, simplified scenarios involving staking cryptocurrency and later selling the crypto for cash:

Income Tax

- Let’s say someone holds 200 SOL in a Solana staking pool.

- After a given period, they receive 25 SOL in staking rewards with a market value of $500.

- This $500 worth of SOL is likely to be considered income and will be added to their total assessable income.

Capital Gains Tax

- Continuing, say they then decide to sell their SOL at a future date

- They may be subject to Capital Gains Tax (in addition to the income tax they’ve already incurred), with the cost base now being $500 (the market value of the staking rewards when they received them).

- For example, say they held onto that 25 SOL, and it increased to a value of $1200, at which time they decided to sell.

- Cost base: $500

- Capital proceeds: $1200

- Capital Gains = Proceeds – Cost Base = $1200 – $500 = $700

As seen in this scenario, this fictitious person has incurred BOTH income and capital gains taxes.

In the next section, we will explore the tax implications of DeFi and NFTs.

Get 30% off all Crypto Tax Calculator plans* using code SWXAU30

Crypto Tax Calculator is the official tax partner of Swyftx and is an Australian-made crypto tax solution built to handle everything from exchange trading to complex on-chain activity.

Claim offer now

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Course rewarded

Course rewarded

Article read

Article read