As the popularity of cryptocurrencies continues to grow, so does the need for individuals and businesses in Australia to understand and fulfil their crypto tax obligations. In the earlier chapters of this course, we outlined the guidelines and regulations provided by the Australian Taxation Office (ATO) regarding the taxation of cryptocurrencies. Building upon this, it’s crucial for crypto users to not only follow these rules but also to be familiar with the process of filing their crypto taxes. In this chapter, we’ll cover the key tax dates which you need to be aware of in Australia and show you 3 different ways you can go about filing your crypto taxes.

This course is for educational purposes only and should not be considered tax or financial advice. You should seek out the help of an accountant to obtain advice.

Key Crypto Tax Dates

To ensure compliance with tax regulations, it is important to know key tax dates in Australia. The following dates are relevant for crypto tax filing for individuals:

- 1st July 2023: Start of the financial year period. You can file your tax returns any time from this date onwards.

- 31st October 2023: Tax deadline for individuals filing without an accountant.

- 31st March 2024: Tax deadline for individuals filing through an accountant.

- 30th June 2024: End of the financial year period.

To see the key dates for businesses involved in crypto, please check out our bonus guide here.

3 Different Options

Before we dive into the 3 different methods for preparing your crypto taxes, it’s important to note that the method you go with may depend on the complexity and volume of your transactions, as well as your budget for tax-related expenses.

If you’ve invested in crypto and are thinking about potentially not reporting your crypto taxes, you will want to think again. Tax authorities worldwide are dedicating more resources to identify individuals who evade taxes on crypto gains, and the ATO is no exception. With the advent of mass audit tools and the traceability of blockchain transactions back to your KYC-verified exchange or otherwise through your bank account activity, evading crypto taxes has become increasingly challenging.

Option 1: Do-It-Yourself Manually

One option for filing your crypto taxes is to do it yourself manually. This approach gives you complete control over the process. However, it can be time-consuming and prone to human error, especially if you have many transactions or complex crypto holdings. If you only have a handful of transactions, this option may be best for you.

Here is a 4-step process you can follow for filing your crypto taxes manually:

1. Compile your transaction history

To begin, you’ll need to collect all transaction data related to your cryptocurrency holdings from various sources, including exchanges, wallets, and protocols you’ve used. You’ll need to gather the following relevant information for each transaction:

- Date and time of the transaction

- Amount of cryptocurrency involved

- Type of transaction (e.g., buy, sell, transfer)

- Price at the time of the transaction

- Any associated fees or commissions incurred

2. Categorise your transactions

After gathering your complete transaction history, the next step is to review and categorise each transaction accordingly. Based on what we’ve learnt in earlier chapters, we know that different types of transactions have different tax implications. Therefore, we can now determine whether a transaction falls under capital gains, income or if it’s a non-taxable event.

3. Calculate your tax obligations

Calculating your tax liabilities involves determining your capital gains or losses. For each transaction, you’ll need to calculate the cost basis (including any fees) and subtract it from the proceeds (i.e., the sale price). If the sale price exceeds the cost basis, you have a capital gain; if it is lower, you incur a capital loss. Sum up the overall gains and losses to determine your total net capital gain/loss.

Once you have categorised your transactions, you’ll need to compute your capital gains and income. Your capital gains and losses will be determined based on the inventory method you have chosen to employ (i.e., FIFO, LIFO or HIFO). To calculate your capital gains or losses, simply find the cost basis for each transaction (including any fees) and subtract this value from the proceeds received from the transaction (i.e., the sale price). If the proceeds exceed your cost basis, you have a gain, while if the proceeds are lower, you incur a loss.

Conversely, your total income can be calculated by just summing up the total proceeds received from income-generating crypto activities (e.g., staking rewards, airdrops, etc.).

4. Generate and file your tax reports

Once you have computed your capital gains, losses, and income in step 3, you must create tax reports that accurately reflect these values. Your tax reports should comply with ATO standards and should include the following:

- Total gains and losses

- Split into short-term and long-term

- Net capital gain or loss

- Income from crypto-related activities

- Deductions, fees, or tax credits

After creating and finalising your tax reports, you can file your tax returns with the ATO and settle any taxes owed. In Australia, your capital gains get added to your total income (i.e., it’s not a separate tax rate); therefore, how much you owe will depend on your total income throughout the year (including salary and capital gains from other activities).

If you don’t want to file the tax reports yourself, you can entrust your tax reports to an accountant who can handle the filing process on your behalf.

NOTE: Remember to maintain accurate records of your cryptocurrency transactions for future reference to avoid complications in subsequent years!

2. Hiring a Tax Professional

Hiring a tax professional such as an accountant specialising in crypto taxes can be a wise choice for individuals who don’t mind the increased expense and prefer a hands-off approach. Some advantages of working with a professional include:

- Expertise and Guidance: A crypto tax accountant generally has in-depth knowledge of tax regulations and can provide personalised guidance based on your specific circumstances. They can help navigate complex tax laws and ensure compliance.

- Comprehensive Tax Planning: An accountant can help you strategise and optimise your crypto tax liabilities, potentially identifying deductions, credits, or tax-loss harvesting opportunities.

- Accurate Tax Reporting: By entrusting your tax filing to a professional, you can have peace of mind knowing that your tax reports will be prepared accurately and in compliance with tax regulations.

- Audit Support: In case of an audit or tax-related inquiry, having an accountant on your side can provide valuable support and representation.

While a tax professional’s expertise and guidance is often highly valuable, it tends to be costly, and may sit outside your budget. In this case, doing it yourself manually (option 1) or using a reputable tax software (which we’ll explore next) may be more suitable for you.

3. Using Crypto Tax Software like CryptoTaxCalculator

The last option we’ll explore to file your crypto taxes is to use a specialised crypto tax software like CryptoTaxCalculator. Using crypto tax software is a popular choice as it tends to be more efficient than manually calculating your taxes and it’s generally cheaper than hiring a tax professional.

CryptoTaxCalculator is an Australian-made crypto tax software all-in-one solution designed for crypto investors and traders. CryptoTaxCalculator was built from the ground up to handle all types of crypto trading, from exchange trading to complex on-chain activity (including NFTs and DeFi) and supports over 800 exchanges and wallets, including Swyftx!

The software seamlessly deciphers complex data from various exchanges and wallets, automatically categorising transactions for tax purposes. Once all of your transaction data is imported, you can access tax reports that can be passed to your accountant or used to file directly via myTax.

The platform goes beyond simple calculations, offering many product features, including smart reconciliation that learns as you go, direct smart contract integrations, tax-loss harvesting tool, customisable reports and many more.

How to import your Swyftx transactions into CryptoTaxCalculator?

To import your Swyftx transactions into the CryptoTaxCalculator platform, simply start by visiting their website here, then create a free account by clicking ‘Start for free’ in the top right corner. Once you’ve created your free account, you can navigate to the ‘Integrations’ page and search for ‘Swyftx’. Click on the Swyftx logo that appears.

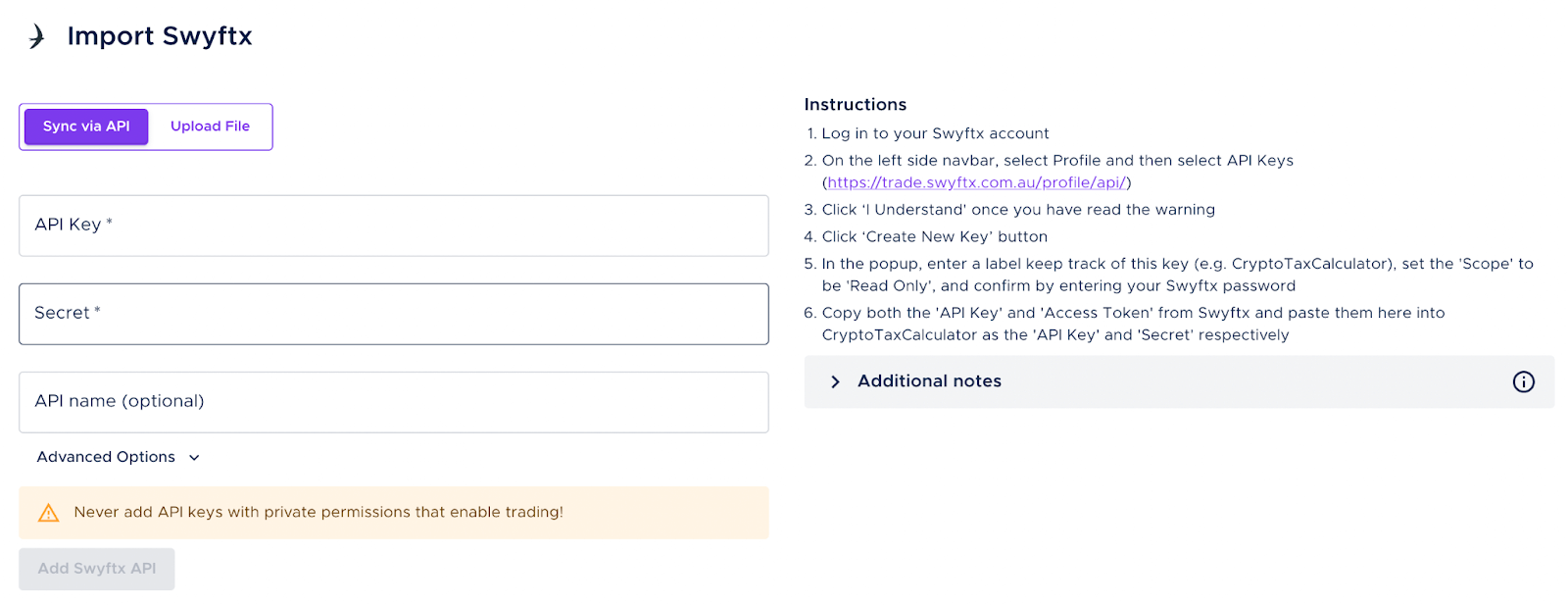

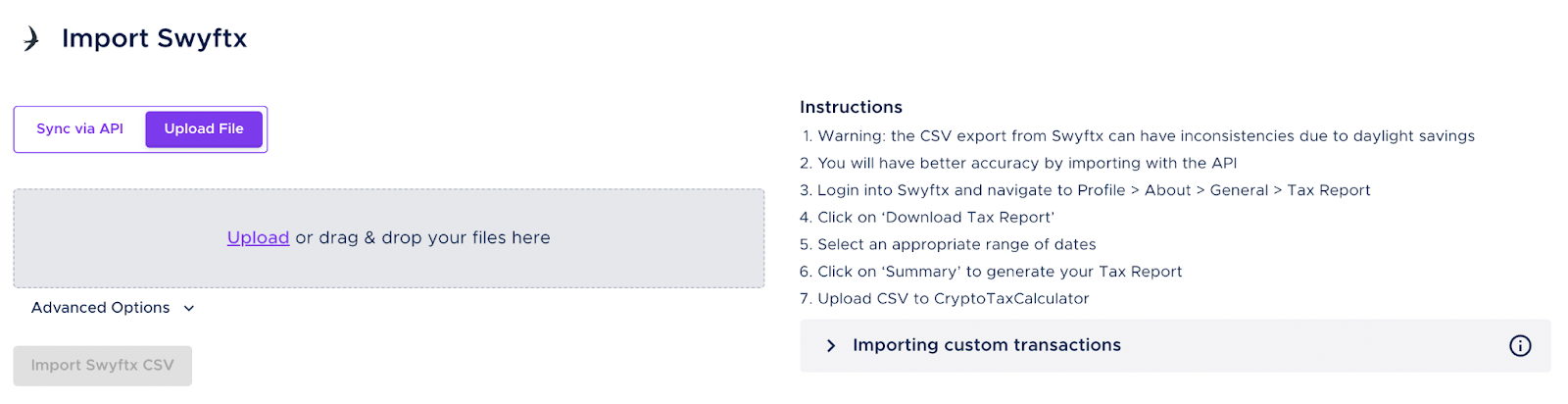

You’ll find two options for importing your Swyftx data. You can choose either option and simply follow the instructions which appear on the right-hand side.

Option 1: Import your data via API keys

Option 2: Import your data via CSV files

Remember to import data from any other wallets or exchanges you utilise. Once all your data is imported, head to the ‘Transactions’ page, where you’ll find a comprehensive overview of your crypto activity. The ‘Tips’ page will highlight any necessary actions you need to take to reconcile your transactions.

After reviewing your transactions, you can generate a range of tax reports on the ‘Reports’ page. These reports can be shared with your accountant or directly filed via myTax.

As part of Swyftx’s partnership with CryptoTaxCalculator, the team at CryptoTaxCalculator is generously offering a 30% discount off the first year of your subscription.

You can start by visiting their website here and using the promo code SWYFTX23 at checkout to claim your discounted subscription.

Summary

When it comes to filing your crypto taxes, being aware of critical dates and choosing the right filing method is crucial for compliance and accurate reporting. Whether you decide to file manually, hire a professional accountant or use crypto tax software like CryptoTaxCalculator, each approach has its upsides and downsides.

Consider your transaction complexity, volume, and budget to determine the most suitable method for your crypto tax filing needs. Remember, proper tax compliance is essential in the evolving landscape of crypto taxation, as tax authorities are increasingly focusing on enforcing tax regulations in this space.

We hope you’ve enjoyed this course as much as we have and that you are now equipped with the required knowledge to help manage and file your crypto taxes. To test what you’ve learnt, check out our quiz below!

Authored by Crypto Tax Calculator

Australian-made to ATO standards, CryptoTaxCalculator (CTC) simplifies crypto taxes for Aussie investors. Whether you’re simply buying and holding, staking or diving into DeFi and NFTs, CTC has you covered.

Simply connect your accounts, follow the automated tax-saving suggestions and generate your ATO-ready report. Claim 20% off new CTC plans using code SWYFTXTAX. See you soon!

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read