This section of the course introduces the practical world of Decentralised Finance (DeFi) and Non-Fungible Tokens (NFTs), focusing on real use cases, user behaviours, and the tax implications of various events. We’ll cover how the Australian Taxation Office (ATO) classifies these activities and how to approach common scenarios involving lending, staking, farming and NFT trading.

What is DeFi?

DeFi refers to blockchain-based financial applications that operate without third-party intermediaries, such as a bank. Though it represents innovation, it also introduces intricate tax considerations that are challenging for taxpayers. Navigating these complexities can be daunting, so we’ve dedicated an entire section to exploring the many layers of DeFi and tax.

DeFi examples include:

- Lending platforms (e.g. Aave, Compound)

- Decentralised exchanges (DEXs) like Uniswap or Hyperliquid

- Yield farming and liquidity provision

- Staking pools

- Governance tokens & more

How does the ATO view DeFi?

The ATO treats DeFi differently depending on the transaction type. Generally, lending and borrowing that results in a beneficial ownership change may trigger in a Capital Gains Tax (CGT) event. The ATO guidance suggests a CGT event occurs when you transfer a fungible crypto asset (e.g. ETH) to an address that you don’t control or that already has a balance of the same fungible asset.

For more information on the ATO’s stance on DeFi, visit the ATO website.

Tax implications of yield farming

Yield farming, a DeFi strategy where people can earn token incentives by providing assets to a protocol, also has tax implications. Like staking, earning new coins or tokens may generally be considered income, attracting income tax based on their fair market value at the time of receipt.

However, an increase in the value of tokens through yield farming is typically subject to CGT upon disposal. The ATO’s latest web guidance covers the tax treatment of DeFi, including situations where providing assets to a protocol results in token rewards, so it is important to be aware of the ATO’s focus on this area.

Tax implications of liquidity pools (LPs)

As a liquidity provider in DeFi, people add tokens to a pool and receive liquidity tokens in return. If they earn new coins or tokens, they may qualify as income depending on how they are distributed and therefore be subject to income tax. If these liquidity tokens appreciate, this increase may fall under the CGT regime upon disposal.

In the most recent web guidance release, the ATO explicitly states that ‘ CGT event happens when you deposit your crypto assets into a liquidity pool.’ In this case, the market value of the capital proceeds of the deposit, which is usually an LP token, are considered for CGT purposes. When you withdraw assets from the pool, the LP token typically has to be returned, once again triggering a CGT event and resetting the holding period of your assets.

While the web guidance is non-binding, liquidity pools are particularly tricky to track for tax purposes, so it is highly recommended to use a reputable crypto tax software provider and, if necessary, speak to a crypto-savvy tax professional.

Tax implications of borrowing and lending

The ATO has provided guidance on the tax implications of lending and borrowing in DeFI in their most recent web guidance release. It’s important to note that despite the use of terms like ‘lending’ and ‘borrowing’ in DeFi, these arrangements often have different tax implications than their traditional finance counterparts.

The ATO states that most DeFi lending and borrowing activities may trigger a CGT event This is because these transactions usually involve either exchanging one crypto asset for another, or trading a crypto asset for a future right to an equivalent amount of the same asset. The key factor is whether beneficial ownership of the crypto asset changes hands.

For example, if you ‘lend’ your cryptocurrency to a DeFi platform, and the terms of the contract are unclear about whether you retain beneficial ownership, or if your assets are pooled with those of other lenders, a CGT event is likely to occur.

The capital proceeds for this CGT event are equal to the market value of what you receive in return for transferring the crypto asset – whether it’s another crypto asset or a future right. It’s crucial to keep track of the value of your crypto assets at the time of these transactions to accurately calculate any capital gains or losses.

Example:

- Alex purchased 1,000 YCoin for $5,000 six months ago. He decides to ‘lend’ 500 YCoin (now worth $3,000) through a DeFi platform offering a 5% annual return.

- The terms of the smart contract indicate that Alex doesn’t retain beneficial ownership of the YCoin he has ‘lent’.

- As there has been a change in beneficial ownership of the crypto assets, a CGT event occurs when Alex ‘lends’ the YCoin to the platform. Alex would calculate a capital gain of $500 at the time of ‘lending’ the YCoin (assuming a cost base of $2,500 for the 500 YCoin).

- In return for his ‘loan’, Alex receives a token representing his right to reclaim 500 YCoin plus yield in the future. This right is valued at $3,000 at the time of the transaction, forming the cost base for any future CGT event when Alex exercises this right.

- The ATO has also noted that the income tax rules that apply to traditional securities lending do not apply to crypto asset ‘lending’ in DeFi. Therefore, any returns from these arrangements are likely to be considered in the context of CGT rather than income tax.

Tax implications of airdrops

Airdrops involve the distribution of free tokens to cryptocurrency holders as a promotional or reward mechanism. For example, some early adopters of protocols like zkSync and Blast were rewarded with generous airdrops in the past few months.

In most cases, airdrops are treated as ordinary income based on the tokens’ fair market value at the time of receipt and are therefore included in assessable income for income tax purposes. And just like staking rewards, if you dispose of your airdropped tokens at a later date, you may also be subject to capital gains tax with the market value of the airdrop at the time it was received, forming the cost basis for the capital gains or loss.

However, if the airdrop is an initial allocation of tokens and the tokens were never previously traded, and thus, do not have a fair market value, they may not be treated as income. Instead, they may be assigned a cost basis of $0, meaning that if a recipient ever disposes of them, the full proceeds will be subject to CGT.

Tax implications of forks

Forks occur when a blockchain network undergoes a significant change, sometimes resulting in the creation of a new cryptocurrency. There are two types of forks: soft and hard forks.

Hard forks

In the case of a hard fork where a new cryptocurrency is created, the individual receives an allocation of the new cryptocurrency based on their holdings of the original cryptocurrency.

The new cryptocurrency received is often considered ordinary income and subject to income tax at its fair market value at the time of receipt. And similar to staking rewards and airdrops, the cost base of the new cryptocurrency is also set at the fair market value at the time of receipt for future CGT calculations.

Soft forks

There are generally no immediate tax consequences for soft forks where no new cryptocurrency is created. The individual’s original cryptocurrency holdings remain unchanged, and no income or CGT event is triggered.

How are NFTs taxed?

You may or may not be familiar with NFTs (feel free to check the Swyftx course on NFTs here). Still, as a refresher, NFTs are unique digital assets that represent ownership or proof of authenticity of a particular item, such as digital artwork, collectibles or in-game items. Regarding taxation, the ATO treats NFTs similarly to other forms of cryptocurrencies.

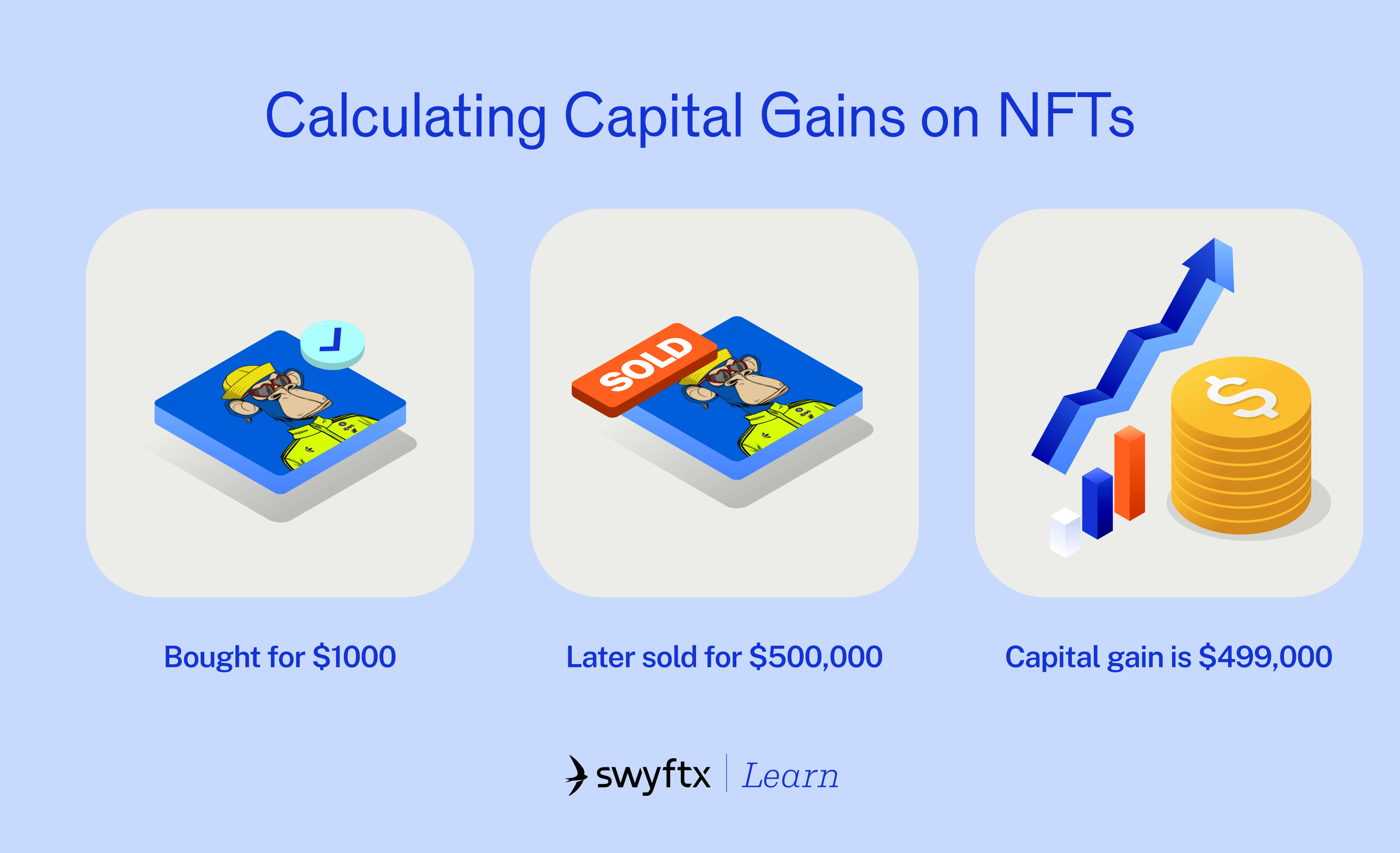

For individuals who acquire and hold NFTs as an investment (as opposed to personal use), any capital gains made upon selling or disposing of an NFT may be subject to CGT. The CGT event occurs when the NFT is sold or exchanged for another cryptocurrency or fiat currency. Capital gain is calculated by subtracting the cost base (purchase price) from the selling price (proceeds).

Additionally, if you use another cryptocurrency to purchase the NFT, the transaction is taxed the same as a crypto-to-crypto swap. Therefore, you will trigger a CGT event on the disposal of the asset used to purchase the NFT.

Example:

- You purchase 10 ETH for $1,000

- Suppose you purchased a Bored Ape NFT for 10 ETH when the price of 1 ETH = $1,000

- You must recognise a CGT event on the sale of ETH to purchase the NFT

- Gain = Proceeds – Cost base

- Proceeds = $10,000

- Cost base = $1,000

- Gain = 10,000 – 1,000 = $9,000 on the sale of 10 ETH

- You then later sold the NFT for $500,000.

- The capital gain is calculated by subtracting the cost base from the selling price.

- In this fictitious example, the capital gain on the NFT would be $500,000 – $10,000 = $490,000.

What if you’re selling NFTs for a living?

For those who create and sell NFTs as part of their business (e.g. artists who sell their own digital artwork as NFTs), the income generated is generally treated as business income and therefore, would be taxed as part of business earnings.

In the next course, we will explore how to file your crypto taxes, and any key factors to consider.

Get 30% off all Crypto Tax Calculator plans* using code SWXAU30

Crypto Tax Calculator is the official tax partner of Swyftx and is an Australian-made crypto tax solution built to handle everything from exchange trading to complex on-chain activity.

Claim offer now

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Course rewarded

Course rewarded

Article read

Article read