It wasn’t that long ago when Satoshi Nakamoto’s vision – a ‘peer-to-peer electronic cash system’ – gave birth to the first and only cryptocurrency, Bitcoin.

Fast forward to today and there are over 20,000 digital currencies on the market.

In the beginning, most cryptocurrencies were created as a secure payment method free from the meddling hands of intermediaries.

But now, digital asset projects span a wide spectrum, from solving supply chain issues to rethinking artist compensation and simplifying real estate contracts.

And as the industry continues to evolve, new and meaningful use cases for cryptocurrency are emerging.

Payment coins

Payment coins are a digitised form of money to pay for goods and services, or to transfer value from one party to another. These cryptocurrencies can act as an entirely digital alternative to fiat currency, like as the Australian dollar. You can use payment coins to buy food, cars, massages, and plane tickets – just like you would with regular cash.

Payment coins still see lower adoption than established networks like Visa, but their speed and reliability is constantly improving.

Did You Know?

Bitcoin can only natively process up to seven transactions per second, which pales in comparison to the Visa network’s 1,700. The Lightning Network aims to solve this by performing certain transactions outside of the main Bitcoin blockchain and broadcasting only key information. This vastly increases the speed of transactions while significantly lowering transaction costs.

Examples of payment coins

Bitcoin started its life as a payment coin, however, due to its slow transaction times, low supply and high value, it has morphed into more of a store of value akin to digital gold.

In contrast, projects like Nano, Dash, XRP, and Toncoin have been designed specifically to facilitate payments. These cryptocurrencies support near-instant transactions with minimal fees.

Stablecoins

Stablecoins are digital currencies designed to match the value of another asset — usually a traditional currency like the US dollar, Euro, or Japanese Yen. They maintain their price through different methods, most commonly by holding real-world reserves such as cash or government bonds in a 1:1 ratio. Other stablecoins use different strategies like algorithms or crypto-backed reserves.

Because traditional currencies don’t usually swing wildly in value, stablecoins offer a way to hold money on the blockchain without the price ups and downs seen in other cryptocurrencies. This can be especially helpful during market downturns, when investors want to avoid big losses but keep their funds in crypto.

Stablecoins are also popular in illiquid DeFi activities such as lending, borrowing and earning yield, since their stable value makes them less risky to lock up than other cryptocurrencies.

Outside of DeFi, stablecoins can have several advantages over government-issued money like the Australian Dollar. For example, sending them overseas is often faster and cheaper than using a bank or an international payment gateway like PayPal.

Examples of stablecoins

Tether (USDT) and USD Coin (USDC) are two of the most well-known stablecoins and account for a large portion of the trading volume in crypto markets worldwide. Several major institutions use or facilitate these stablecoins, such as PayPal and Visa.

Not all stablecoins are tied to fiat currencies, though. For example, wrapped Bitcoin (wBTC) is an Ethereum-based token that follows the price of BTC. This lets investors engage with Ethereum’s DeFi network while keeping Bitcoin’s value as an investment.

Layer 1 and DeFi coins

Decentralised finance (DeFi) is a fast-growing ecosystem that provides a range of financial services leveraging blockchain technology.

In traditional finance, there are all sorts of ways you can use your money – you can lock it up in a savings account to earn interest, buy stocks and bonds or use it to take out a loan.

Decentralised finance lets you do all of this without the need for banks or brokers, all thanks to a blockchain network. That means DeFi can provide faster access, lower fees, potentially higher returns and more control over your own money.

Most modern DeFi ecosystems manage to execute transactions without a third-party thanks to innovative technology known as ‘smart contracts’.

The networks that power these smart contracts are often referred to as Layer 1 blockchains.

Examples of DeFi coins

DeFi has become key to the crypto industry’s future, and since its introduction in the 2010s, has expanded rapidly. There are two main cryptocurrency categories associated with DeFi – those that power the underlying blockchain (Layer 1s), and those used to participate in specific financial services (DeFi coins).

Layer 1 blockchains

Ethereum (ETH) and Solana (SOL) are two of the largest DeFi ecosystems, hosting thousands of decentralised applications that provide a range of financial services. Ethereum is known for its strong security and long-standing reputation, while Solana is praised for its high-speed performance and ability to support large-scale activity.

These two cryptocurrency projects provide the blockchain infrastructure for applications – like those we’ll cover below – to thrive.

DeFi coins and decentralised applications (dApps)

There are tens of thousands of decentralised applications powered by distributed ledger (blockchain) technology.

Some of the most used dApps are decentralised exchanges (DEX). These platforms let you swap digital assets without needing a middleperson to facilitate the trade. This can be significantly more cost-effective than using centralised alternatives.

Uniswap may be the highest-volume DEX on the market, processing millions in crypto transactions every day. The application, initially built on Ethereum, has its own native cryptocurrency – UNI.

UNI, and other dApp coins, typically provide holders with benefits such as reduced platform fees and yield generation.

Important to Remember

It’s generally a good idea to diversify the crypto assets in your portfolio – not only in terms of what you buy, but also where you store them. This can help protect your investments in case of fraud or hacks.

Memecoins

Memecoins are one of the more polarising, yet most popular categories of cryptocurrencies. These projects are characterised by having little real-world utility. Instead, memecoins typically derive their value from social media hype, cultural impact and community engagement.

Given the ease of minting your own cryptocurrency, thousands upon thousands of memecoins are created every day on platforms like Pump.fun. Most of these will never attract more than a cent from investors, but every now and then a new cultural phenomenon emerges and captures the market’s attention.

Though the speculative, hype-driven, volatile nature of meme coins make them an easy target for crypto detractors, these projects hold a special place in the digital currency tapestry. They are a reflection of modern-day internet culture and society – so while they may lack utility, they can make up for it in heart.

Examples of meme coins

Dogecoin was the first memecoin ever created, launched in 2013 at the hands of programmers Billy Markus and Jackson Palmer. Originally created as a joke, DOGE paid homage to the popular Shiba Inu meme ‘Kabosu’, whose image circulated across prominent online message boards.

Despite its satirical origins, Dogecoin has evolved into a cultural icon, helping spawn one of the most influential subcategories within the cryptocurrency world.

Since then, countless new meme coins have emerged, each typically inspired by an internet meme in some form. Projects like Pepe, Shiba Inu, Popcat and even Fartcoin are just a few examples among the plenty that have gained traction in this space.

Pop Quiz

A blockchain is a national bank database.

NFT and GameFi

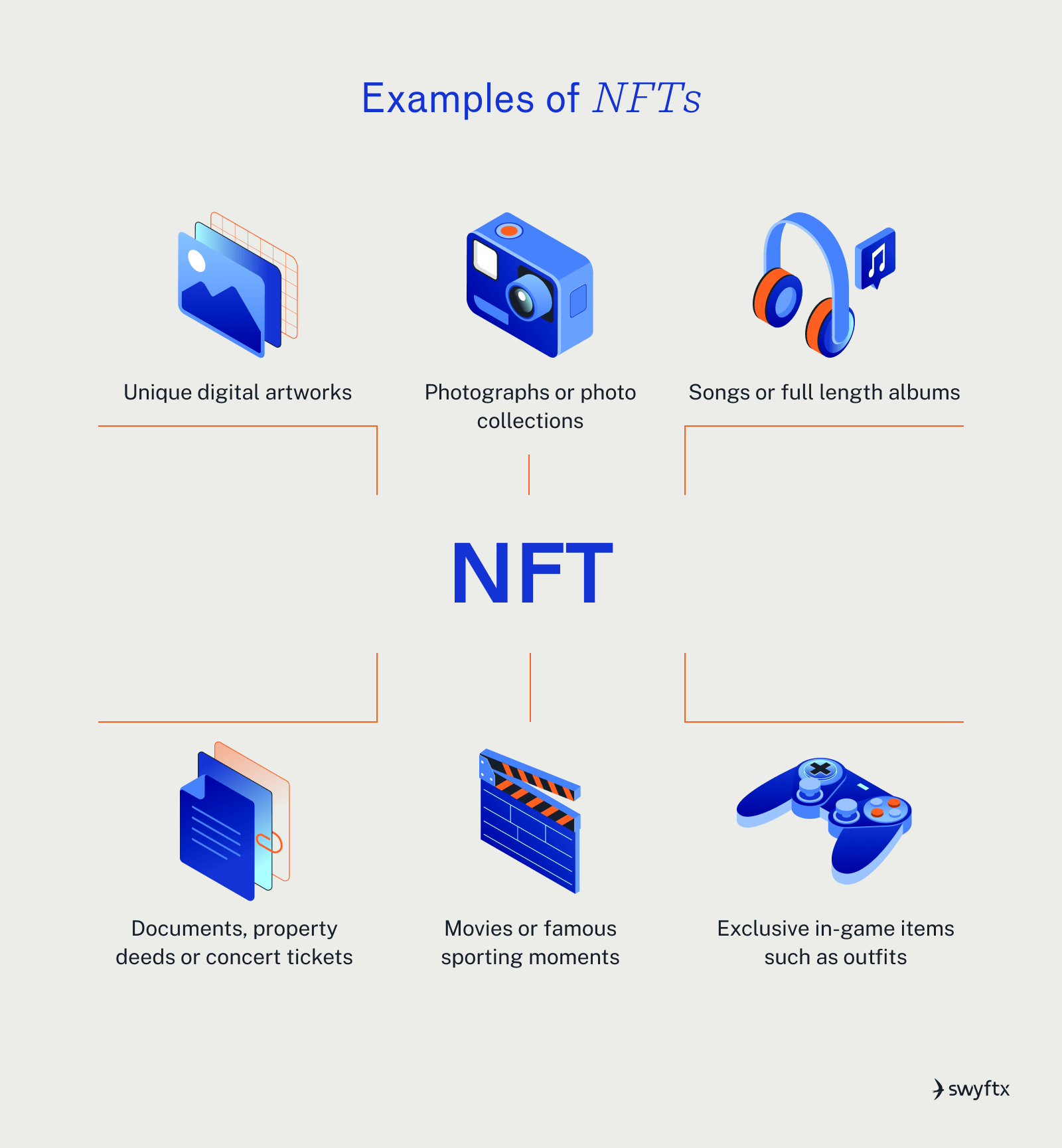

Non-fungible tokens (NFTs) are unique digital collectibles, such as original pieces of art, books, and games. Unlike cryptocurrencies, no two NFTs can be the same – which is where the phrase ‘non-fungible’ comes from.

NFTs are typically used to represent ownership of something valuable – whether virtual or physical. Although most tend to associate these tokens with digital artwork, NFTs are also used to represent in-game items, fractional ownership of real-world assets or as entry tickets for an event.

NFT platforms such as OpenSea and the Enjin Marketplace allow users to mint (create), buy, and sell the tokens, which can be stored on digital or hardware wallets, just like other cryptocurrencies.

NFTs are closely linked to GameFi, a sector of cryptocurrency that combines decentralised finance with gaming. Typically, GameFi titles allow players to participate in a realistic economy that leverages elements of the blockchain.

Did you know?

American digital artist, Beeple, sold his NFT artwork ‘The First 5,000 Days’ for $69 million USD in March 2021. It sold through Christie’s auction house, which marked the first time a major auction house had ever sold an NFT.

Examples of NFT projects

There are many different types of NFTs – with some of the most popular and valuable being collections of digital artwork like Bored Ape Yacht Club or CryptoPunks.

Non-fungible tokens have also found a home within the GameFi and Metaverse ecosystems, where they can be used to represent items, avatars or even land. For example, Decentraland, a popular sandbox VR world, lets players buy NFTs called ‘Parcels’ which represent in-game real estate and can be used to build virtual experiences.

Summary

Cryptocurrency has blossomed from a simple means of exchange to a thriving ecosystem with thousands of uses – both widely applicable and incredibly niche.

This course has explored some of crypto’s key categories, but it’s only scratched the surface of what this technology could mean for society.

From revolutionising supply chains, to improving access to stocks and bonds, to protecting the privacy of medical records – digital assets have the potential to reshape the world.

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read