Most people have heard a story about that lucky person that bought Bitcoin back when it was worth a dollar. It might seem like everyone that invested in Bitcoin early made out with huge gains, but the reality wasn’t quite so clear cut. Over its twelve years of existence, Bitcoin has experienced massive peaks, as well as giant troughs.

Understanding Bitcoin’s price history is a great way to learn more about the cryptocurrency market and blockchain technology, it can also help investors make informed decisions about Bitcoin’s future. So, let’s explore the tumultuous history of Bitcoin and the most important factors that have impacted its price.

2009: The birth of Bitcoin

Bitcoin came into play as a virtual currency in the early stages of 2009. Its price was glued to zero for months when it first started trading. Slowly, the coin started to rise in value as it was distributed to Bitcoin miners.

Impact factor 1: Supply and demand

In 2009, the Bitcoin creators coded in an element of the cryptocurrency still influencing its price today – the total supply. For Bitcoin to be circulated, a block must be “mined” with a computer that solves a complex mathematical algorithm. To avoid the possibility of inflation, the Bitcoin developers implemented a system that only 21 million BTC could be mined.

Over 19 million BTC have been mined as of 2022, representing over 90% of the supply that will ever exist. It is expected that the last Bitcoin will be mined in 2140.

Supply and demand have been one of the biggest drivers of Bitcoin growth. There is only a limited number of BTC that can ever exist in the market. So, when more people want to own BTC than is circulating, they are more inclined to pay a premium to get their hands on it. The result is a substantial spike in price. The opposite is true – in periods of slow crypto growth, there are more Bitcoins than buyers, which can quickly lead to a drop in value.

Did You Know?

The very first block ever mined on the Bitcoin network– the genesis block – was mined by Satoshi Nakamoto. Mining this block came with a reward of 50 BTC, a far cry from the fractions of Bitcoins rewarded to miners today.

2011: Bitcoin breaches $1

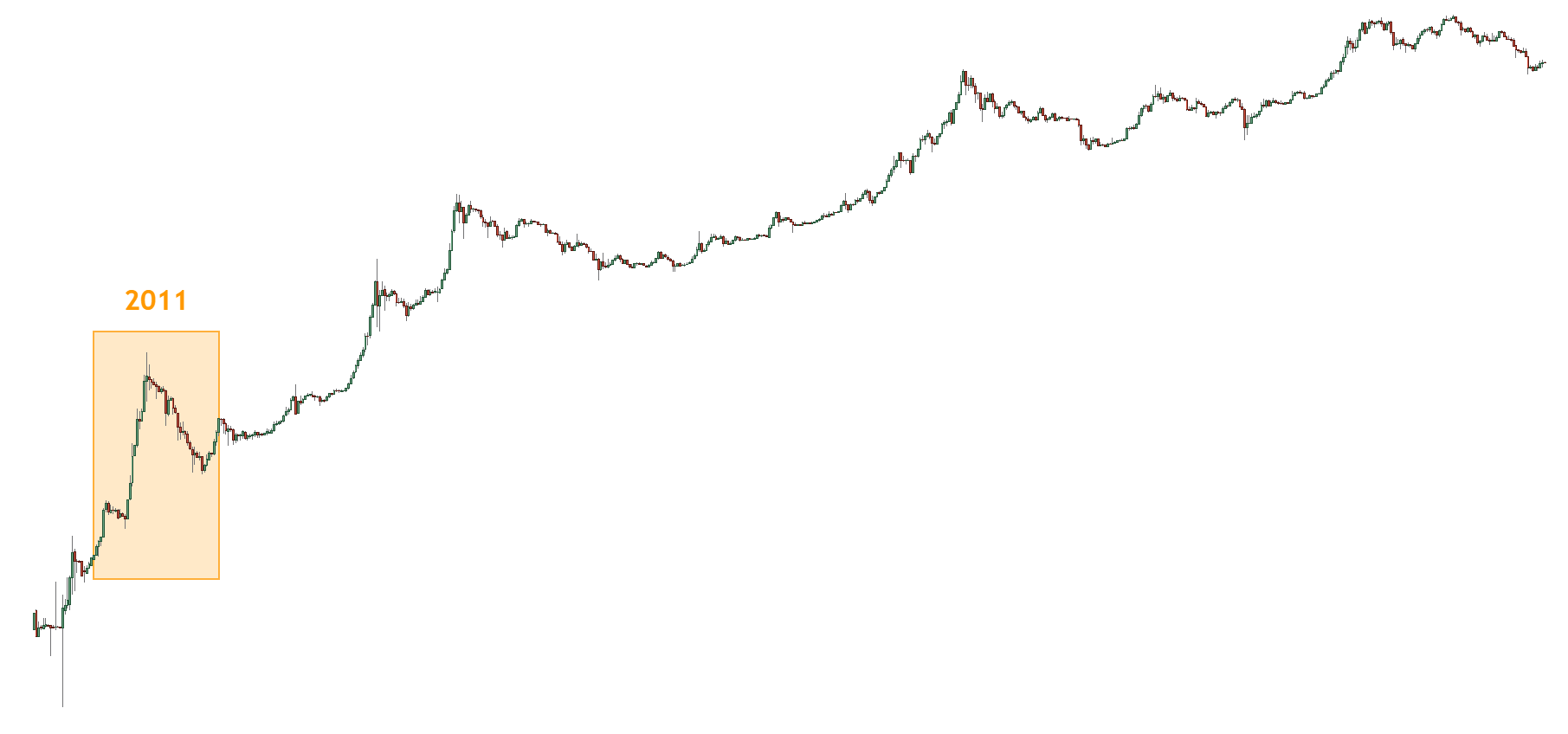

Figure 1 – Bitcoin price action in 2011

Between 2009 and 2011, Bitcoin had experienced slow but steady growth. By 2010 the digital currency had broken the 50-cent barrier, and on February 9, 2011, BTC reached parity with the US dollar.

The landmark milestone for Bitcoin was soured just a few months later when the blockchain network underwent its first ever theft. Approximately 25,000 BTC was stolen, which in June 2011, was equivalent to about $375,000 USD.

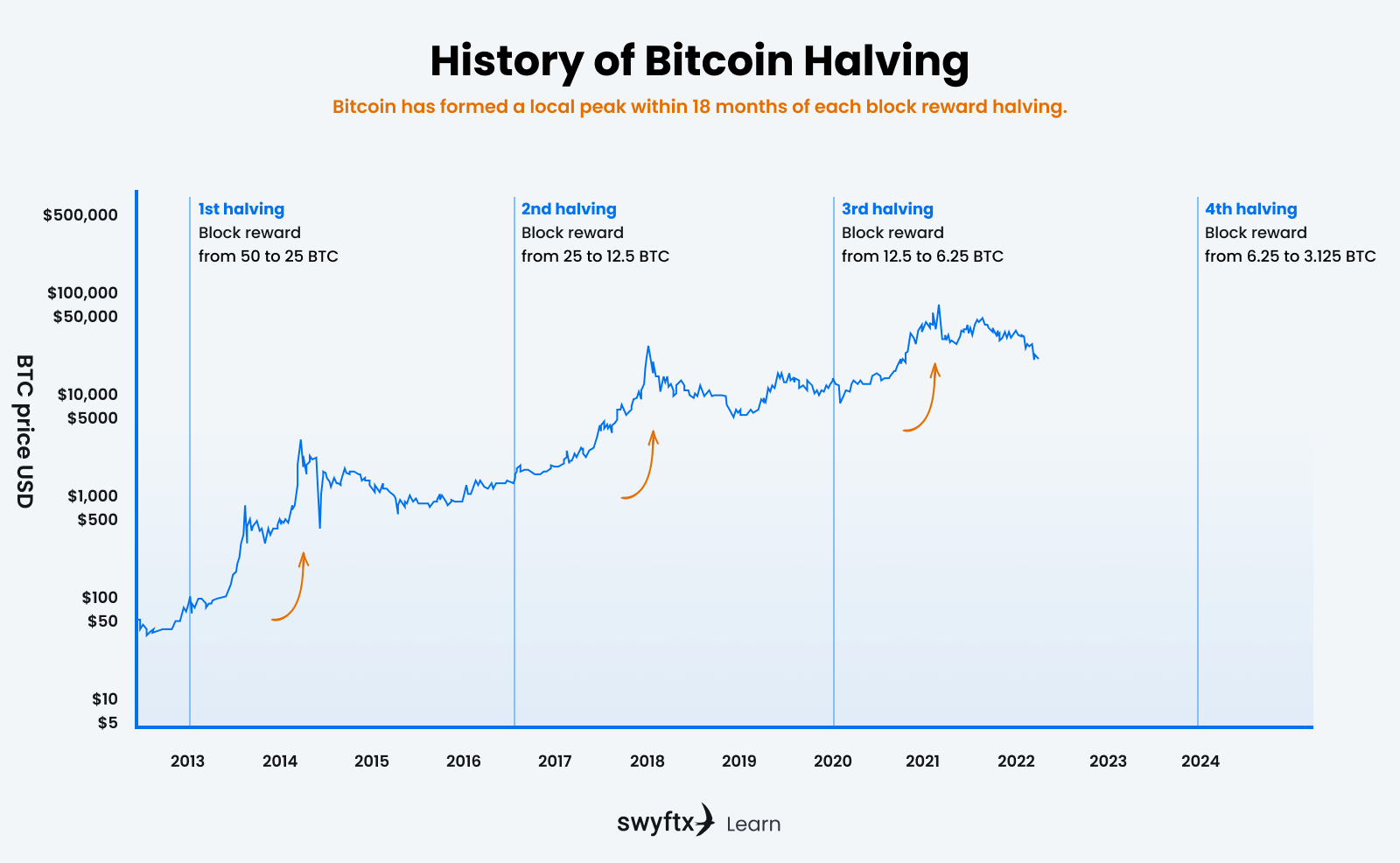

Impact factor 2: Bitcoin halving

Although 2012 was a quiet year for Bitcoin, one event had a lasting impact on the currency’s value – the first ever Bitcoin halving.

Between 2009-2011, whenever a Bitcoin miner validated a new block on the Bitcoin blockchain, they were rewarded with 50 BTC. After every 210,000 blocks mined, this block reward was set to halve. On November 28 this milestone was reached, and miners were now only earning 25 BTC per block.

The purpose of halving the rewards is to prevent exponential growth and oversupply. By promoting scarcity, Bitcoin can maintain its deflationary nature and avoid drops in value due to inflation.

The impact this event had on BTC’s value was not immediately apparent – but by 2013, its effect was starting to take shape.

Figure 2 – Bitcoin Price history following Bitcoin halvings

2013: Bitcoin worth more than a gram of gold (over $1,000)

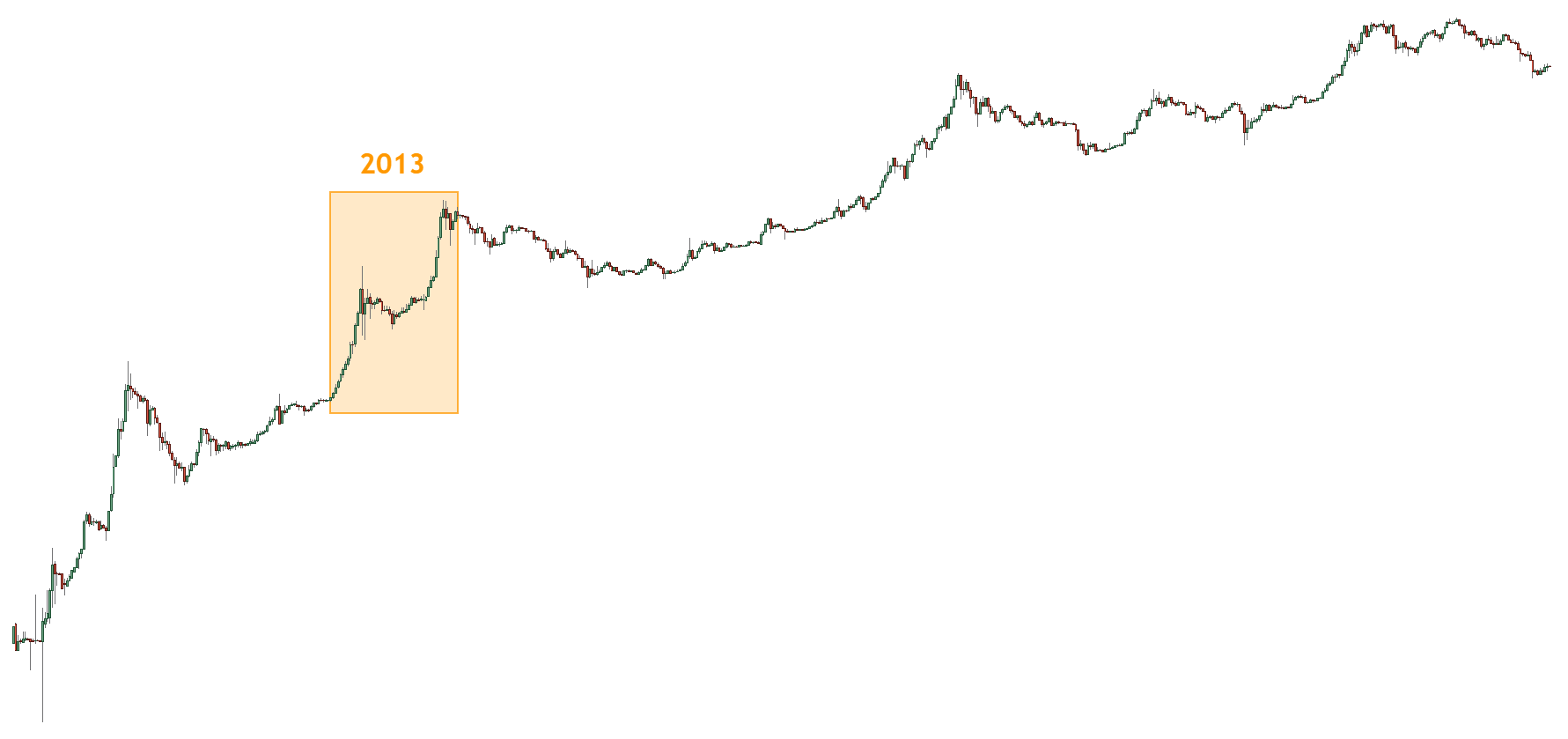

Figure 3 – Bitcoin price action in 2013

2013 was a very big year for Bitcoin. When the first-ever Bitcoin halving occurred, the digital coin’s price was around $12 USD. By April 2013, the Bitcoin prices rocketed to $100, only to propel even further upwards to be valued at over $1,000 by November. Along the way, the total market cap for the cryptocurrency broke the $1 billion barrier.

Impact factor 3: Psychological barriers

Although the cryptocurrency market can seem a little mysterious at times it is still humans that ultimately control price movements. These psychological barriers can have an impact on Bitcoin’s price.

For example, whole numbers tend to act as an area of resistance. In 2013, Bitcoin breached the $1,000 USD mark but was quick to sink back under as investors grew wary of the currency being valued at four figures. It took another three-and-a-half years for BTC to breach $1,000 again.

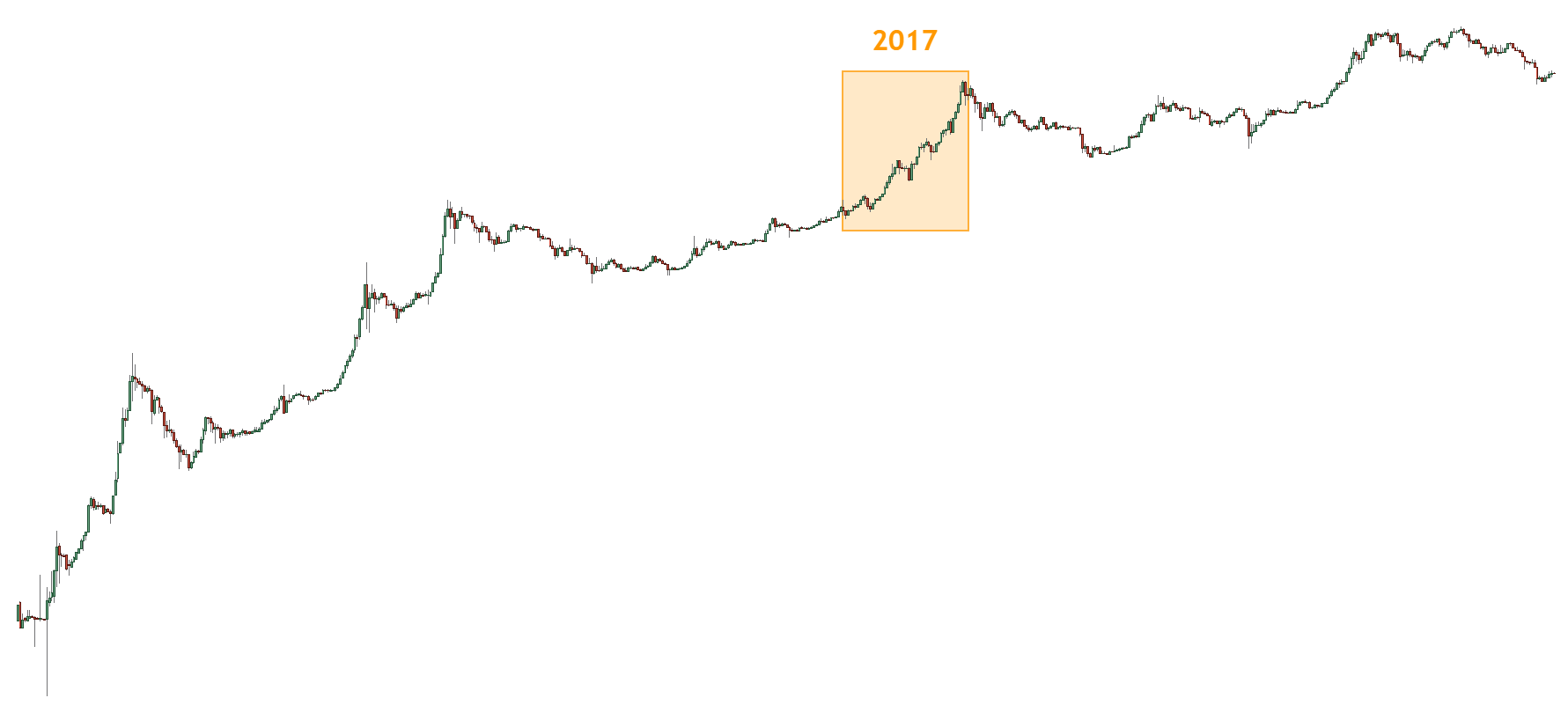

The same was true after Bitcoin’s bull rush in 2017 when the price spiked to $13,000 in December. Investors quickly flooded the market looking to sell Bitcoin, and the asset’s price fell under five figures within a month. It took until July 2020 for Bitcoin’s price to rise above $10,000 again.

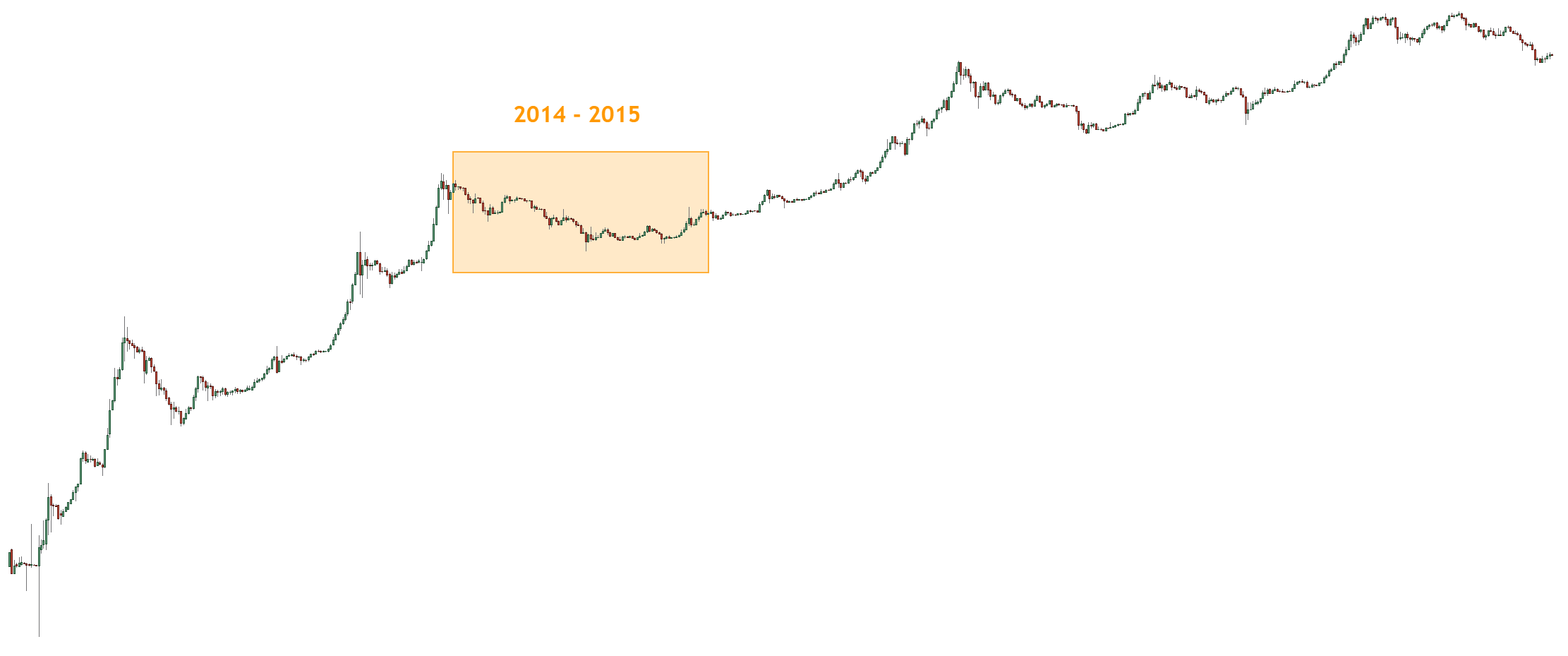

2014–15: Bitcoin experiences major bear market

Figure 4 – Bitcoin experiences a major bear market from 2014-2015

Bitcoin had constantly fluctuated in price throughout its first five years of existence. Still, pre-2013 data for Bitcoin is often sketchy and trading volume was mostly very low. The coin went through a minor bear market in 2011, but it recovered quickly and only affected a smaller number of investors and Bitcoin users.

However, Bitcoin’s 2014 bear market was much more impactful. It lasted for nearly three years, Bitcoin dropped from over $1,100 USD in November 2013 to $172 in January 2015.

One of the biggest factors for Bitcoin’s rapid decline in value was the hack of Mt. Gox – the world’s largest Bitcoin exchange at the time. The company filed for bankruptcy in early 2014 after hackers made off with approximately $460 million worth of Bitcoin from their reserves.

Impact factor 4: Economic climate

The broader economic climate plays a major role in the value of Bitcoin and other cryptocurrencies. The 2008 Global Financial Crisis, the biggest recession since the Great Depression, ushered in the concept of Bitcoin in the first place.

2014 wasn’t an economic disaster by any means, but much of the emerging world experienced setbacks. Japan, China, Germany and Russia’s economies all slowed down, and discretionary spending was falling worldwide.

During these periods of economic uncertainty, institutional investors tend to consolidate their portfolios and cut off volatile assets like Bitcoin in favour of “recession-proof” assets like defensive stocks or precious metals that can be bought on the stock market. This can lead to a quick drop in Bitcoin’s value.

Key Takeaway

Economic factors like rising interest rates or a recession can hurt Bitcoin’s value, as society is seeing in 2022. As interest rates go up, institutional investors become less likely to leverage their positions (borrow money) to acquire assets like BTC. Therefore, when Bitcoin trading activity drops, its price often follows suit.

2017: Bitcoin approaches $20,000 and altcoins soar

Bitcoin experienced its craziest year to date. The cryptocurrency slowly recovered from the previous crash, breaking the $2,000 USD mark by May. This was only the beginning, as by December 2017 its price had catapulted to $19,345 USD.

2017 was a big year for Bitcoin and was the first time the coin truly entered the public eye. Despite this, the year will mostly be remembered for its lasting influence on altcoins.

Impact factor 5: Competition

The rise of Ethereum’s popularity made it easy for programmers to start releasing their own cryptocurrencies. By the end of 2017, developers had released over 1,000 new currencies (known as altcoins) into circulation. These assets posed a threat to Bitcoin’s reign – some new cryptocurrencies were built on improving the weaknesses of the Bitcoin protocol and usurping it as a decentralized global currency.

The competition Bitcoin began to face heavily influenced its price. If traders, investors or businesses believe a newer cryptocurrency will become more valuable – in terms of money or function – the demand for BTC may drop.

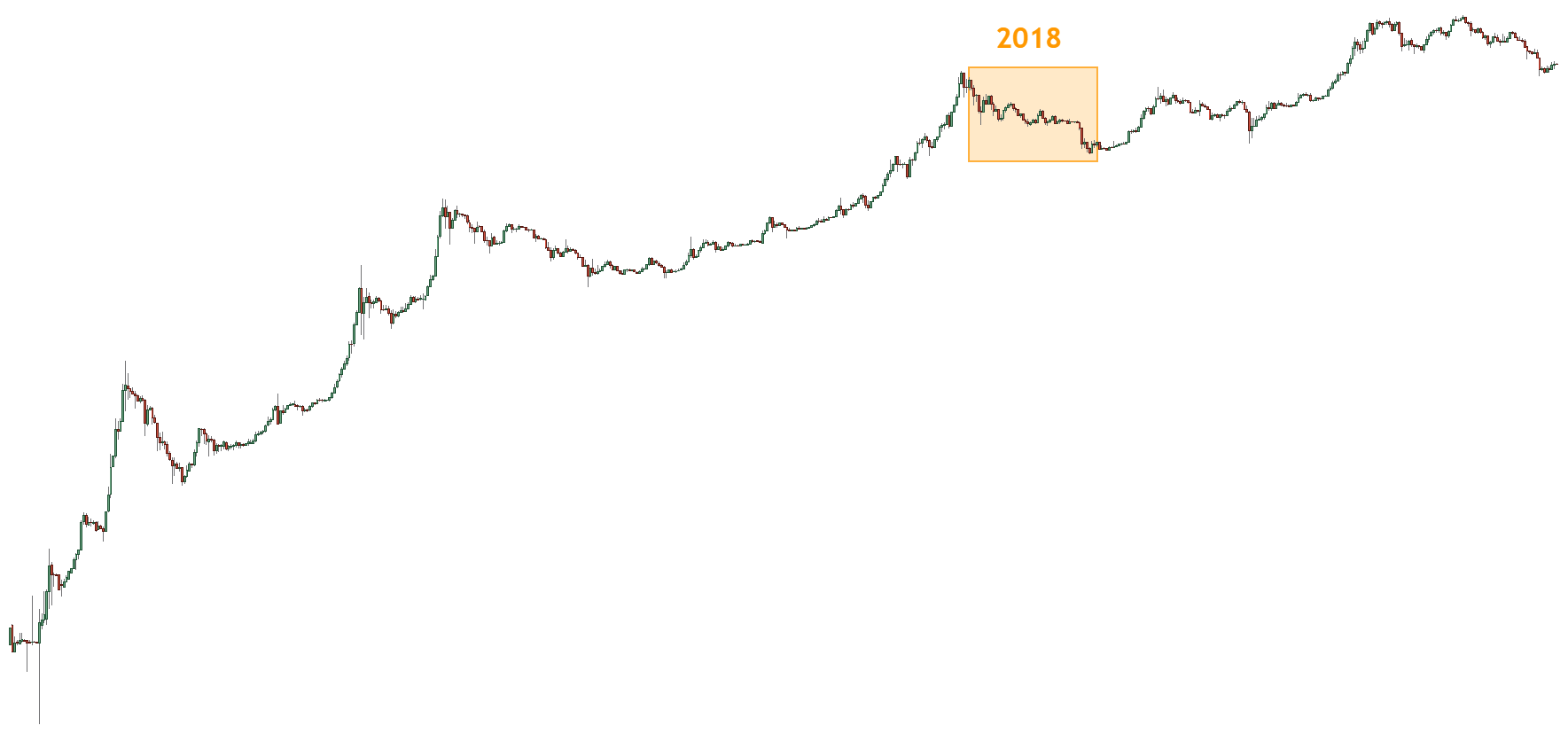

2018: Bitcoin plunges below $4,000 into another major bear market

Figure 6 – Bitcoin enters another major bear market during 2018

Hot off one of the most bullish markets the world had ever seen, Bitcoin’s price was quick to correct. The sheen of cryptocurrency had worn off and Bitcoin entered into a long winter, with its price dropping to approximately $3,700 USD by the end of 2018.

Impact factor 6: Regulation

Bitcoin and other cryptocurrencies tend to exist within a legal grey area. When governments and businesses tighten Bitcoin regulations, the effects nearly always ripple out to its price.

2018 was a year marred with scepticism and intervention after the 2017 price hike. The South Korean government was one of the first to take a negative stance on cryptocurrency. In January, the South Korean financial authorities announced an investigation into local banks providing Bitcoin. After their inquiry, the government decided to ban anonymous transactions using cryptocurrency, a massive blow to Bitcoin’s use case.

This was met with further bad news, but this time at the hands of major businesses. Facebook implemented a ban on its users advertising cryptocurrency, and payment provider Stripe removed their support for BTC transactions.

In only two weeks, tightening regulations had contributed to the price of Bitcoin dropping 50%.

Tip

Bitcoin regulation is not always a bad thing for BTC’s price. Sometimes, official legislation is required to make BTC a legitimate financial option. For example, the El Salvadorian government was the first to accept Bitcoin as a legal tender in 2021, meaning it had to be accepted by merchants. Additionally, Germany introduced favourable tax laws that exempted investors from paying a capital gains tax on BTC held for longer than 12 months.

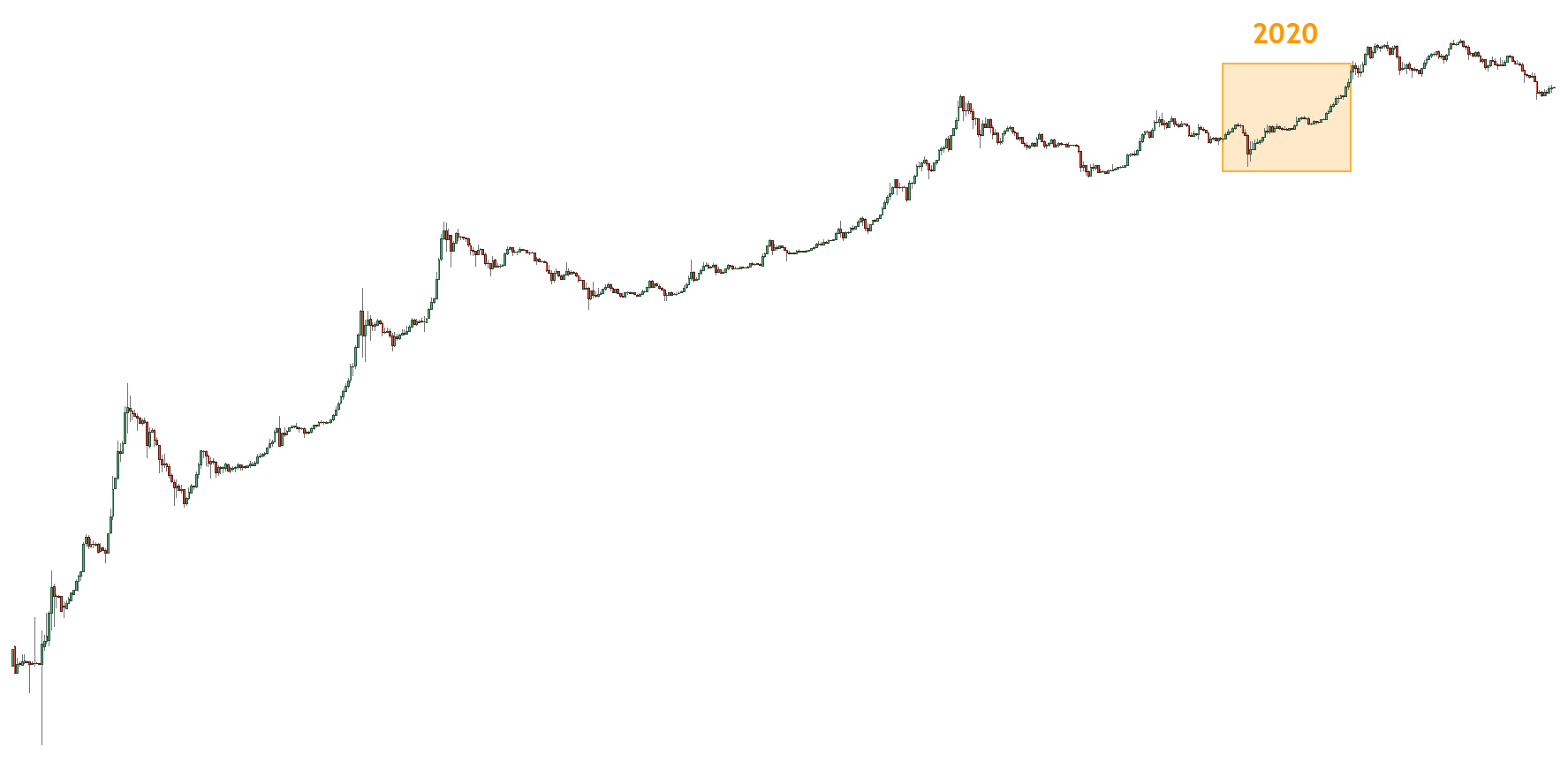

2020: Bitcoin fights back amid pandemic

Figure 7 – Bitcoin price action during 2020

Despite extreme economic and political uncertainty, Bitcoin and other cryptocurrencies enjoyed a rebound from the 2018-19 bear market. BTC ended the year at $29,000, an increase of 416% year-on-year.

Impact factor 7: Production costs

The COVID-19 pandemic had a lasting effect on the world around us. One of the biggest impacts was the working-from-home phenomena, which resulted in manufacturing halting and supply lines being thrashed. A global shortage of silicon quickly ensued, leading to the price of Bitcoin mining hardware increasing by thousands of dollars.

The production costs of mining Bitcoin are an often-overlooked factor for determining the coin’s price. Bitcoin mining was already becoming more expensive due to halving and increased competition, and the increased overheads played a role in BTC’s 2020-21 comeback.

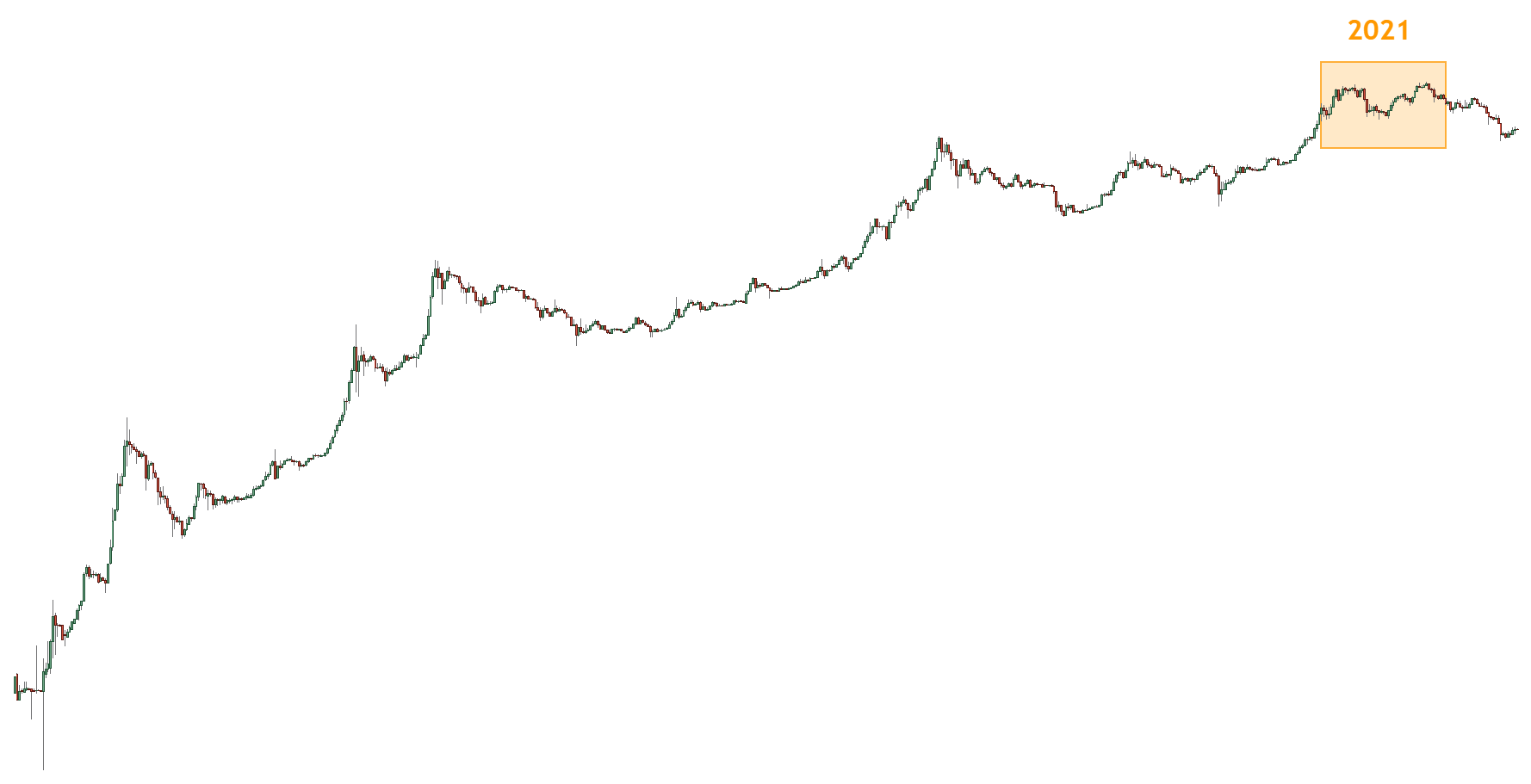

2021: Bitcoin smashes through $50,000 and sets all-time high

Figure 8 – Bitcoin sets all-time high during 2021

In November 2021, Bitcoin’s price continued to grow, reaching $50,000 and hitting its all-time high price of $68,789 USD. This price came from increased institutional spending, Coinbase going public, and societal enthusiasm after global lockdowns began to ease.

Impact factor 8: Influencers

Bitcoin is a highly speculative asset, and its value drivers can be quite mercurial. A big factor in the price of BTC is the opinions of society’s most famous figures. Through social media, well-known people have single-handedly influenced the price of Bitcoin. The biggest proponent of this is Elon Musk, the world’s richest human. Whenever Musk shares a tweet on crypto, the market often reacts.

In May 2021, Elon announced that his electric vehicle company, Tesla, would no longer accept Bitcoin payments. The news may have warded off investors because by the end of that week the price of Bitcoin had dropped 15%.

Barely a month later, Musk shared a tweet suggesting that Tesla would begin accepting Bitcoin transactions again once miners had figured out a way to lessen their Bitcoin’s energy consumption. This tweet helped shift market sentiment, and BTC’s price rose 8% within a few days.

Musk is not the only celebrity that uses their status to discuss Bitcoin. Hollywood stars like Snoop Dogg, Katy Perry and Matt Damon have all endorsed cryptocurrency. Status figures promoting Bitcoin help contribute to a positive media cycle, boosting demand for the coin.

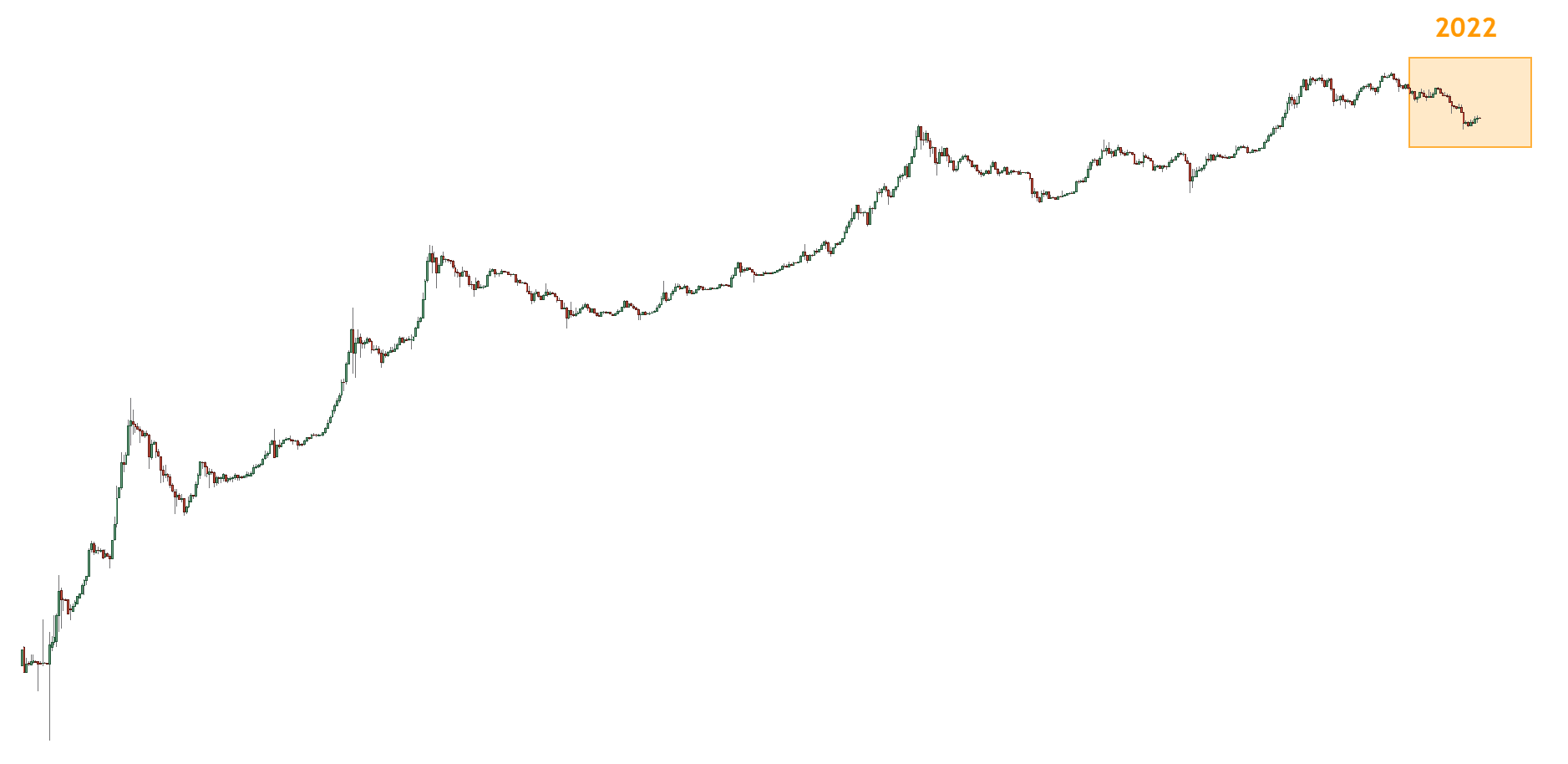

2022: BTC drops below $20,000 into another major bear market

Figure 9 – Bitcoin enters another major bear market during 2022

As the dust settled from Bitcoin’s all-time high, the cryptocurrency showed signs of falling away in November and December of 2021. By the start of 2022, Bitcoin’s price had consolidated between $40–45,000 USD, where it stayed until May.

Worsening economic conditions saw the value of BTC plummet. By July, Bitcoin fell below the $20,000 threshold for the first time since 2020.

Impact factor 9: Geopolitical events

Global geopolitical events like war, pandemics, and presidential changeovers can all impact the price of Bitcoin.

A recent example is the 2022 bear market’s short-term recovery on the back of a massive geopolitical event – Russia’s invasion of Ukraine. After Vladimir Putin declared war on Ukraine in February, the European Union quickly placed economic sanctions on the Russian Ruble. This resulted in the Ruble plummeting by 21.29% within a few hours and becoming worth less than a US cent.

As a result of their fiat currency becoming practically worthless, Russians began to move their money out of banks and into Bitcoin. Within 24 hours, Russian residents had traded over 1.5 billion Rubles into BTC. The price of Bitcoin reacted accordingly, rising from under $35,000 to close at $44,000 within a week.

Summary

Bitcoin has experienced a lot of landmark events for an asset that’s only been around for just over a decade. Whether it’s a declaration of war, an Elon Musk tweet, or a global pandemic, there is a huge range of factors to consider when trying to understand Bitcoin’s price history.

Cryptocurrencies like Bitcoin are constantly evolving, and an analysis of their previous price movements isn’t enough to predict their future value. However, knowing what, how and why BTC’s value has fluctuated can help investors make a more informed decision when adding Bitcoin to their portfolios.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.