Despite the recent enforcement actions casting doubt over the industry, it’s been a largely strong first half of the year for cryptocurrency markets. I revisit my 2023 preview and the three things I’m looking forward to.

Key Takeaways

- My 2023 preview anticipated regulation and focused on Ethereum L2 launches and tokenisations.

- The 3 things I’m highly anticipating for the rest of the year are:

- Coinbase’s L2 launch.

- Ethereum scaling networks to receive scalability boost via major upgrade ‘Cancun’.

- Altcoins continue to feel the full brunt of regulation.

- Honourable mentions to:

- Potential cryptocurrency launches from Worldcoin, Illuvium, Solana and Celestia.

- Amazon and PayPal officially entering NFTs and stablecoins, respectively.

- Concerns over Binance acting as a headwind for the market.

Reviewing My 2023 Look Ahead

2023 has been action-packed, but before I dive into my H2 lookahead, it’s worth revisiting my initial 2023 lookahead.

Read: Things To Watch In 2023

✅ Hits

L2s continued to scale and tokenise

Arbitrum launched its token in the biggest airdrop of 2023. This trend will likely continue, with many other potential tokenisations on the horizon from StarkNet and zkSync.

We also saw a host of development for these solutions—Optimism’s bedrock upgrade went live, plus we saw the launch of zkSync EVM and Polygon zkEVM. In the last few days, Polygon teased details about Polygon 2.0—something to watch out for in the coming months.

Regulation taking centre stage

I was expecting massive regulation, and we got it, with two significant enforcement actions against the most prominent players in the crypto space, Binance and Coinbase.

Jack Dorsey & David Marcus product reveals

I was expecting some big announcements from the early payment pioneers, and we got it. An announcement that David Marcus’ Lightspark is building a Lightning Network platform for businesses.

Another key figure, Jack Dorsey, who has yet to reveal more details about his company’s upcoming Bitcoin miner, teased a public beta for a new hardware wallet to hit the market later this year.

❌ Misses

RWA tokenisation has yet to take off

Notably, MakerDAO is moving away from RWA as part of its “End Game”.

Although there has been a lot of positive interest in the area, investment bank Citi released a report this year estimating tokenisation to grow by 80x, labelling it as the “killer use case” for blockchain.

Gaming

Most games remain in the “building” stage, with games yet to hit the market this year. This remains on track, though, with Illuvium set to unveil its much-anticipated games sometime in 2023 after raising another $10M to extend its runway.

🏁 On track

DeFi CEX to DEX hits ATH

Although DEX derivative markets remain at only 1% compared to centralised exchanges (CEX), this one remains on track as DEX to CEX spot volumes hit a record high of 20%.

The biggest thing stopping greater adoption is the flipping of on-chain DeFi lending rates (in the range of 2% for stablecoins) versus high lending rates on Treasury bonds.

Stablecoins remain hot despite treasury yields increasing

Stablecoins have been a mixed bag—despite treasury yields encouraging outflows from the ecosystem (DeFi yields are lower than treasury yields), stablecoin supply has reduced by ~ $10B.

- USDC supply declined by 40% (~$28B), while USDT has soared +20% ( $17B).

Stablecoin dominance has also recovered from a yearly low of 5.5% to above 15%, on track to hit ATHs.

However, a stablecoin focus remains on track, with Circle’s native USDC expanding across the crypto landscape.

My H2 2023 Look Ahead

Now we’ve reassessed my 2023 lookahead, we can look at the three things to watch out for heading into the rest of the year.

#1 Coinbase ‘Base’ L2 launch

Perhaps the biggest thing I’m looking forward to in H2 2023 is Base’s launch.

They revealed a path to mainnet in May and have completed ⅗ of the criteria for a mainnet launch. The focus is now on testing, security and audits—high chance we see mainnet towards the end of the year.

We could see an inflow of projects launching on Base, and perhaps we see new cryptocurrencies emerge. There could be a chance we see ‘Base’ affiliated cryptocurrencies outperformance the broader altcoin market because:

- They have the users (90M verified users)

- Easy bridging from Coinbase

- Own wallet and potentially better UI

#2 Altcoins To Feel The Full Brunt Of Regulation

I expect regulation to be a constant theme for not only H2, but into 2024.

We continue to see U.S. exchanges delisting cryptocurrency altcoins included in the SEC lawsuit against Coinbase and Binance.

If so, this could hamper liquidity. The U.S. is a significant market with a lot of crypto users. If U.S. exchanges delist altcoins en mass, this could significantly impact the altcoin market.

DeFi also remains a hot topic for regulators—with worrying signs Europe and the U.S. are trying to regulate DeFi exchanges in the same grouping as centralised exchanges. DeFi could very well be the next head on the chopping block.

#3 Ethereum scaling networks to receive scalability boost

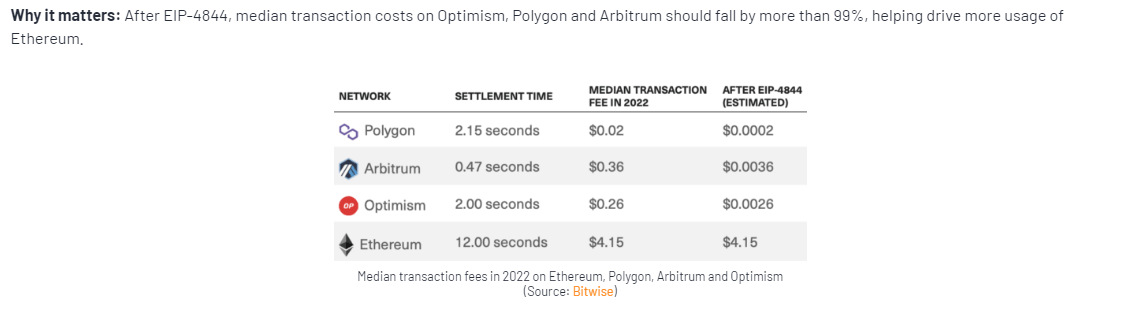

As reported in my 2023 look head and again in my Ethereum roadmap series, I’m eagerly awaiting an Ethereum mainnet upgrade towards the end of 2023 called ‘Cancun’. This will include EIP-4844 to hopefully slash the cost of using Ethereum-like networks by 10-20x. Once this goes live, transacting on these networks should routinely cost less than a cent.

What’s Next For Ethereum? Part 1: Scalability

Honourable mentions

I’m looking forward to 3 cryptocurrency launches over the next 12 months:

- Full Worldcoin token and platform launch

- Illuvium game launch

- Celestia token and mainnet launch

- Solana launching a critical piece of infrastructure called ‘Firedancer’ to make Solana safer, faster and reduce downtime.

Beyond crypto-native launches, I’m increasingly looking forward to the institutional adoption and interest in crypto markets. We got a glimpse of this in recent days; however, there are two big cryptocurrency announcements I’m eagerly awaiting:

- Amazon’s long-rumoured NFT marketplace launch

- PayPal’s stablecoin launch, which it halted due to regulatory uncertainty. Stablecoin legislation in July could pave the way for one of the year’s most significant crypto announcements.

Finally, let’s not underestimate the ongoing Binance concerns. If this takes a nasty turn and Binance and CZ appear more like FTX and SBF, there may be one final washout before the next bull market.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.