Despite a lot of doom and gloom in the market, many positives remain. I dive into the things I’m watching for 2023.

Key Takeaways

- Layer 2s (solutions to help Ethereum scale) took significant steps in 2022 and should continue to upgrade, tokenise and gain adoption.

- By the end of 2022, Maker saw encouraging signs of real-world assets (RWA) making their way onto public blockchains. Will this trend continue?

- There is some serious Bitcoin development going on in private and public. I see big Bitcoin news on the horizon as early internet and payment pioneers are building Bitcoin-focused companies.

- The first major crypto game may launch this year.

- We may see a pivot or refocus back on DeFi.

- Stablecoins should continue expanding as they become increasingly important in the crypto economy.

L2s Continue Scaling & Tokenising

Layer 2s (L2s) took a big step in 2022. The two largest Ethereum L2s—Optimism and Arbitrum—have experienced incredible growth in the last year. It sounds complicated, but it all boils down to making Ethereum cheaper to use.

- The total share of total Ethereum gas used by L2s tripled in 2022, and L2s txs overtook L1 for the first time.

This is only the beginning.

- Major token launches from zkSync, StarkNet and Arbitrum—plus the relaunch of its community event.

- Major network upgrades to these solutions

- StarkNet upgrade

- Optimism Bedrock

- zkSync 2.0 full launch

- Polygon to launch its zkEVM (and other solutions)

- ConsenSys zkEVM (currently onboarding external users to the testnet)

- Upgrades from other scaling solutions

- Core Ethereum upgrades to promote these solutions

- A core upgrade will be EIP-4844, providing up to 20x additional scaling to lower the cost of using these networks—which could come towards the end of 2023.

If these upgrades happen in 2023, Ethereum should reach a significant milestone on its road to adoption. I don’t expect 2023 to be the year they scale Ethereum, but 2023 will be a pivotal year for development.

Will L2s continue to take back market share from alternative L1s?

In 2021-22, we saw alternative L1 blockchains take market share away from Ethereum. Now Ethereum and these networks are becoming cheaper and hopefully easier to use, will we see a pivot back to Ethereum?

How this impacts you?

- If Ethereum can make significant steps to scale the network, this could be bullish for Ethereum and ETH price. It can settle more transactions, gain more users and ultimately, accrue more value.

- These other networks could also capture some of this value.

Tokenisation Growing

The movement towards ‘tokenisation’ of everything as regulations come. Will this be the year real-world assets begin tangibly making their way to blockchains? Real-world assets (RWAs) tokenisation represents physical and traditional financial assets in digital tokens on a blockchain.

We saw positive signs to end the year from big names such as BlackRock and One River Financial speaking about a movement towards tokenisation.

Early signs

- A group of 12 banks (including Bank of America and Citi) conducted a pilot tokenisation program.

- JP Morgan, Deutsche Bank, and SBI Digital Asset Holdings traded tokenised currencies and bonds via Polygon.

- WisdomTree (a financial services company) launched a digital fund to tokenisation short-term treasury bonds.

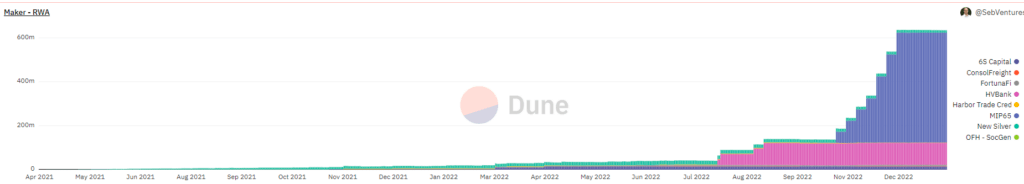

- MakerDAO collaborated with TradFi banks Huntingdon Valley Bank and Société Générale to set up vaults and collateral to borrow DAI.

These are small steps, but with greater regulatory clarity, we could see this trend continue.

Figure 1: MakerDAO Real–World Assets Tokenised (Loaned assets per month). Source Dune

How this impacts you?

- Tokenisation could be a source of utility & demand for public blockchains like Ethereum.

- If more RWA make their way onto blockchains, it could increase fees and value for protocols such as Maker.

What’s Block Inc, Jack Dorsey & David Marcus Building?

I’ve been vocal about how bullish I am about Block Inc, Jack Dorsey & others building out core Bitcoin infrastructure and utility. A look at their GitHub and public statements show they’re busy building.

We know a hardware wallet will launch sometime this year, and we got a teaser of what to expect.

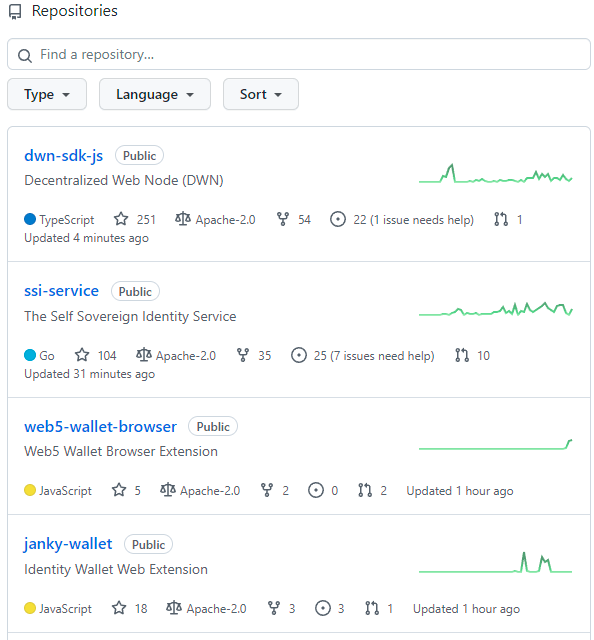

Block Inc is also building core open internet infrastructure (such as a Bitcoin Dex) via its Bitcoin-only company Spiral and collaborating via another open community project called TBD. TBD is building in the open and working on identity, wallets and decentralised networks in what’s touted as “Web5”.

Figure 2. Source TBD GitHub

I’m also highly optimistic and looking forward to what other big names are doing. Such as ex-PayPal president and payments pioneer David Marcus who’s building a Bitcoin-focused company.

I’ve seen a lot of 2023 lists, but this is one I have yet to see mentioned and feel is going incredibly under the radar.

How this impacts you?

- It shows influential people are paying attention and doubling down on Bitcoin in the bear market. A signal pointing to strong fundamental development.

- We could see more infrastructure, use cases, and adoption from this, which could spark a narrative for price growth amid challenging conditions.

Will We Finally See A Viral Cypto-Native Game?

The only game to gain significant traction has been Axie Infinity, and that’s been plagued with many criticisms and questions over sustainability.

The recent game3 awards were held with a shortlist of the winner providing an exciting look at what’s ahead. To save you a click, see the winners below.

- Game of the Year + Best Adventure Game = Big Time

- People’s Choice = League of Kingdoms

- Games’ Choice = The Harvest

- Best Action game = Superior

- Best Mobile Game = Thetan Arena

- Best Content Creator – Bycent

- Best Esports Game + Best Multiplayer Game = EV.IO

- Best Card Game + Best Strategy Game = God’s Unchained

- Best Shooter game = MetalCore

- Best RPG = Illuvium

- Best Casual Game = Blankos Block Party

- Best Graphics = Star Atlas

- Most Anticipated = Shrapnel

Illuvium remains the game to watch in 2023 for me, with 2 of its 3 games ramping up private and public beta testing.

If any game has a chance to break through into gaming and transcend the crypto niche, it is Illuvium due to its potential to draw in regular gamers.

I remain doubtful of other web3 games, such as Star Atlas, due to their recent losses due to the FTX collapse (covered latest crypto report).

How this impacts you?

- Gaming is seen as a moat for NFTs, blockchain and cryptocurrency to enable new ways to monetise and create games.

- A breakout game could fuel adoption and be a sign of more practical use cases besides speculation.

Will DeFi Return As Users Pivot Back?

Much of 2022’s failure was centralisation and opaque yield products.

There’s been a loss of confidence in CEXes, with many worried about keeping large amounts (especially traders) on these platforms. We could see a continued movement towards DeFi options, futures and exchanges.

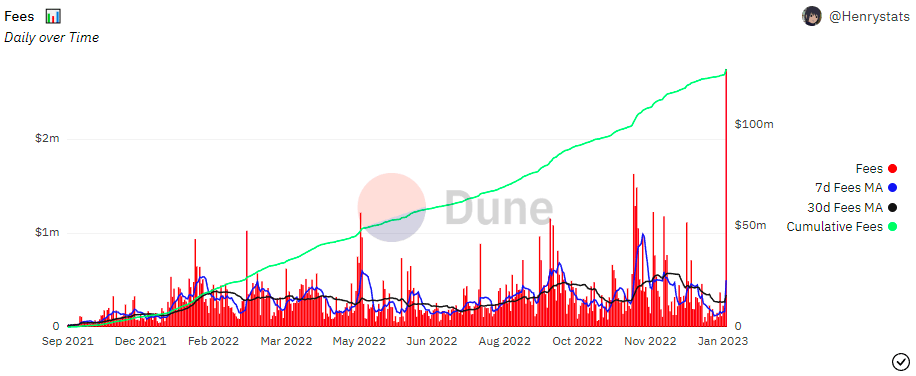

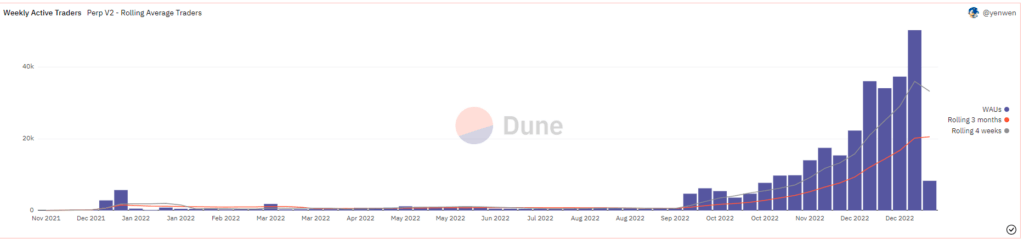

We’re already seeing a higher uptake of DeFi platforms. Active weekly traders on Perpetual Protocol soared following Oct. 2022 and spiked again after the FTX collapse, while GMX saw a massive spike in fees to start the year.

Figure 3: GMZ daily fees. Source Dune

Figure 4: Weekly Active Traders Perp V2 – Rolling Average Traders. Source Dune

Will we see a return to a deeply beaten-down DeFi?

DeFi has been down only since May 2021, with the DeFi Pulse Index (DPI) – 90% down from all-time highs.

Figure 5: DeFi pulse Index. Source Coingecko

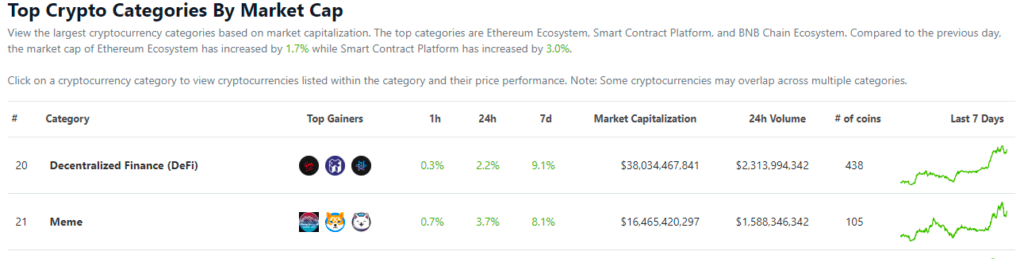

DeFi has been so beaten down, DeFi tokens now only represent only ~3% ($~25-30B) of cryptocurrency’s total market cap.

- For perspective, this is only double that of meme coins. If DeFi is a new financial system built on-chain, this is a significant imbalance.

The question: Although there may be a flight to DeFi in the coming years, it’s uncertain whether the winners will be the old protocols or the new breed.

Figure 6: Top Crypto Categories by MarketCap. Source Coingecko

How this impacts you?

- There could be a growing opportunity in the market for DeFi protocols that emerge as the ‘winners’ if we see a pivot back to DeFi.

- The imbalance in market share between meme coins and DeFi tokens could show DeFi is relatively underappreciated.

- Growing DeFi market share not only provides value at the application layer (i.e. Uniswap or dYdX) but at the blockchain layer as more value is transacted and settled on these chains.

Regulation As A Big Theme Of 2023

*Before talking about policy and regulation, this is not to be perceived as legal advice but general information and speculation around the inevitable regulation coming for the market*

Crypto’s 2022 failures could come home to roost in 2023. The industry will face the consequences of last year’s failures and collapses (3AC, Celsius, BlockFi, FTX, Terra), and we should see fundamental steps towards greater crypto regulation.

Impacts

- Bad: It could be short-term bearish, depending on how harsh the regulation is. It’s unclear how DeFi will be treated.

- Good: It could be net positive long-term, heading into 2024 with greater regulatory clarity.

After all, some big banks like Australia’s Commonwealth Bank paused in-app trading, citing the need for greater regulatory clarity. Aside from the government, looking at the SEC’s public statements, they are prepared to come down HARD on the industry.

There is a massive need for clarity.

Not knowing what’s a security and what’s a commodity is terrible for the industry. It limits growth and adoption as builders and investors are worried about getting involved or creating crypto-centred products.

However, there is a chance we may not see real regulation for DeFi and crypto, given the U.S. government is very split and polarised on the issue.

How this impacts you?

- Regulatory clarity could be a net positive and allow the next capital inflow to enter the space.

- Harsher regulation and more enforcement could pose short-term trouble for non-compliant cryptocurrencies.

Stablecoins To Continue Expanding

Stablecoins have shown to be one of cryptocurrency’s first wide-scale use cases. They allow anyone to trade in or hold U.S. dollars like never before.

Research by the Brevan Howard Digital team put on-chain stablecoin transaction volume at a ~$9T annualised run-rate, exceeding the volumes processed by giant payment companies such as Mastercard, AmEx and Discover.

- They expect on-chain stablecoin volumes to increase >$15T, outpacing Visa’s ~$12T in annualised volume.

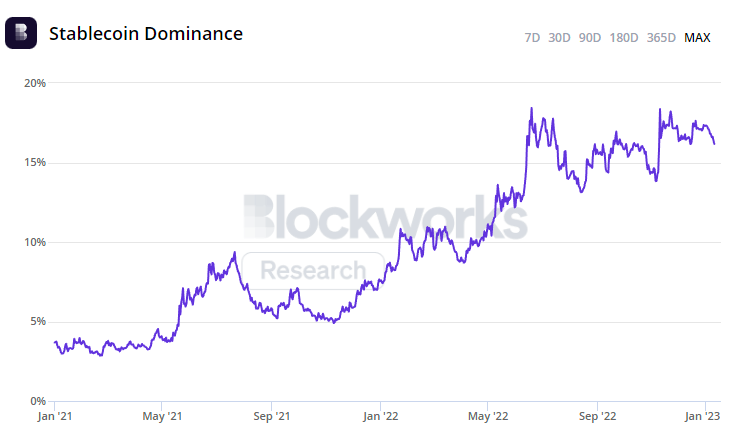

As a result, we could see stablecoin market cap grow above the current 15%

Figure 7: Stablecoin Dominance. Source Blockworks

How this impacts you?

- Stablecoin growth is a big demand driver for these public blockchains.

- Increasing stablecoin volume signals growing usage and adoption, reinforcing the value of these crypto networks.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.