“Layer 2 (L2)” solutions are essential to Ethereum’s growth and scalability. We’re beginning to see a glimpse into the potential future of Ethereum, where new users may not use Ethereum directly, and its role as a core settlement and security layer increases.

Key Takeaways

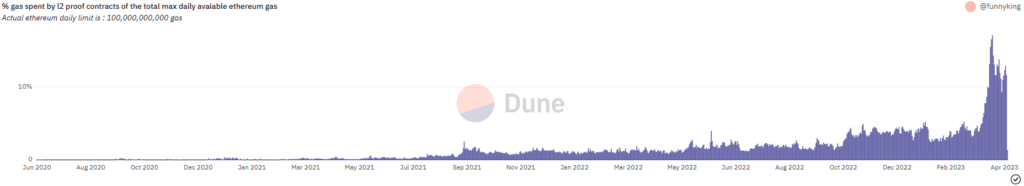

- Ethereum L2s are becoming big spenders + demanders of Ethereum gas and block space.

- It’s an insight into what the future of Ethereum may look like.

- Most new users entering the space into 2024 likely won’t use the main Ethereum chain directly.

- This trend should only continue as more Ethereum-like networks go live.

Ethereum L2s Continue To Demand Ethereum Blockspace

Blockspace, gas and L2s are all relatively confusing to understand for most. But they’re critical to understanding Ethereum’s value and future.

Let’s break it down as simply as possible because if you’re a holder of ETH, this directly impacts you.

Blockspace is the space on a blockchain that can run code or store data. It is the product the Ethereum blockchain sells, and ETH is the economic incentive to run the chain, the token to pay fees or perform actions on the network.

- For example, an NFT project may choose to secure its artwork and tokens on Ethereum; an individual may secure a large trade, and an application deploys its contracts or value on the network.

It’s important because who wants Ethereum blockspace is critical to valuing ETH and its success in the long run.

In the past, applications, projects and users were major demanders of blockspace. My initial hunch was we’re going to see L2s start to become big gas spenders on Ethereum, and recent data is proving this to be true.

L2 gas usage is spiking and becoming big gas spenders, hitting a high of ~18% of total Ethereum gas in its most considerable uptick ever. It’s worth noting the high level remains even after the spike due to the Arbitrum airdrop.

Why does it matter?

Because it’s an insight into what the future of Ethereum may look like. It’s showing L2 networks and scaling solutions are becoming big customers of Ethereum security, demanders of blockspace and total gas consumption.

New users entering the space in 2023 and especially 2024 likely won’t use Ethereum L1, and smaller users may not even know they’re using Ethereum at all. It’s a potential insight into the bull case for Ethereum as it becomes a core settlement and security layer.

The future

Although this trend may decrease in the short term with upcoming fixes such as EIP 4844 (making the cost to settle back to Ethereum L1 much cheaper, thus lowering gas spent), over the long term, we could still continue to see Ethereum L2 networks become some of the highest demanders of total Ethereum blockspace.

Let’s also remember there are still significant Ethereum-like networks yet to go live, such as:

- StarkNet is yet to gain any meaningful adoption as it awaits major upgrades.

- zkSync Era and Polygon’s zkEVM are only now launching.

- Coinbase’s ‘Base’ L2 is only in testnet.

- A range of other scaling solutions, such as “Linea” from ConsenSys (the Company behind MetaMask), remain in testnet.

Of course, whether these L2s can accrue value is still debated.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.