In part 1 of this series we went over each of the altcoin categories that we are watching leading into a potential bull run, as well as a few honourable mentions. The first category that we discussed was Ethereum alternative layer 1 networks. The guide will offer a deep dive into this category, why we’re watching it and some altcoins in particular that we are watching.

What are Ethereum layer 1 alternatives?

In a nutshell, a layer 1 blockchain (L1) generally act as a platform where you can build applications and networks. Similar to how the internet provides a base for various online applications and platforms. They provide the fundamental architecture to support a token and in some instances, a diverse network of various tokens.

Ethereum was the first L1 smart contract platform and paved the way for other platforms. Now, there are 50+ L1 smart contract platforms on the market. Although the purpose remains the same, the tech behind these platforms differs in several ways.

Why we’re watching this category

While Ethereum still presents the lowest risk from an investing perspective out of any of the L1 networks, there are still several concerns regarding its scalability (I.e. the speed and cost of transactions on its network). This presents an opportunity for projects to provide a solution to this existing problem. There are two clear solutions here:

- Alternative L1 networks that are faster and more scalable than Ethereum.

- Layer 2 networks that sit on top of Ethereum and are designed to scale it.

During the 2021 bull market, L1 alternatives such as Solana, Avalanche, and Fantom emerged as outstanding performers. We anticipate that a similar pattern may unfold in a potential upcoming bull run, particularly as next-generation L1 platforms enter the market. These new entrants will need to distinguish themselves and find their niche in an already crowded market, whether it be DeFi, gaming or other sectors.

Layer 1 cryptocurrencies we are watching

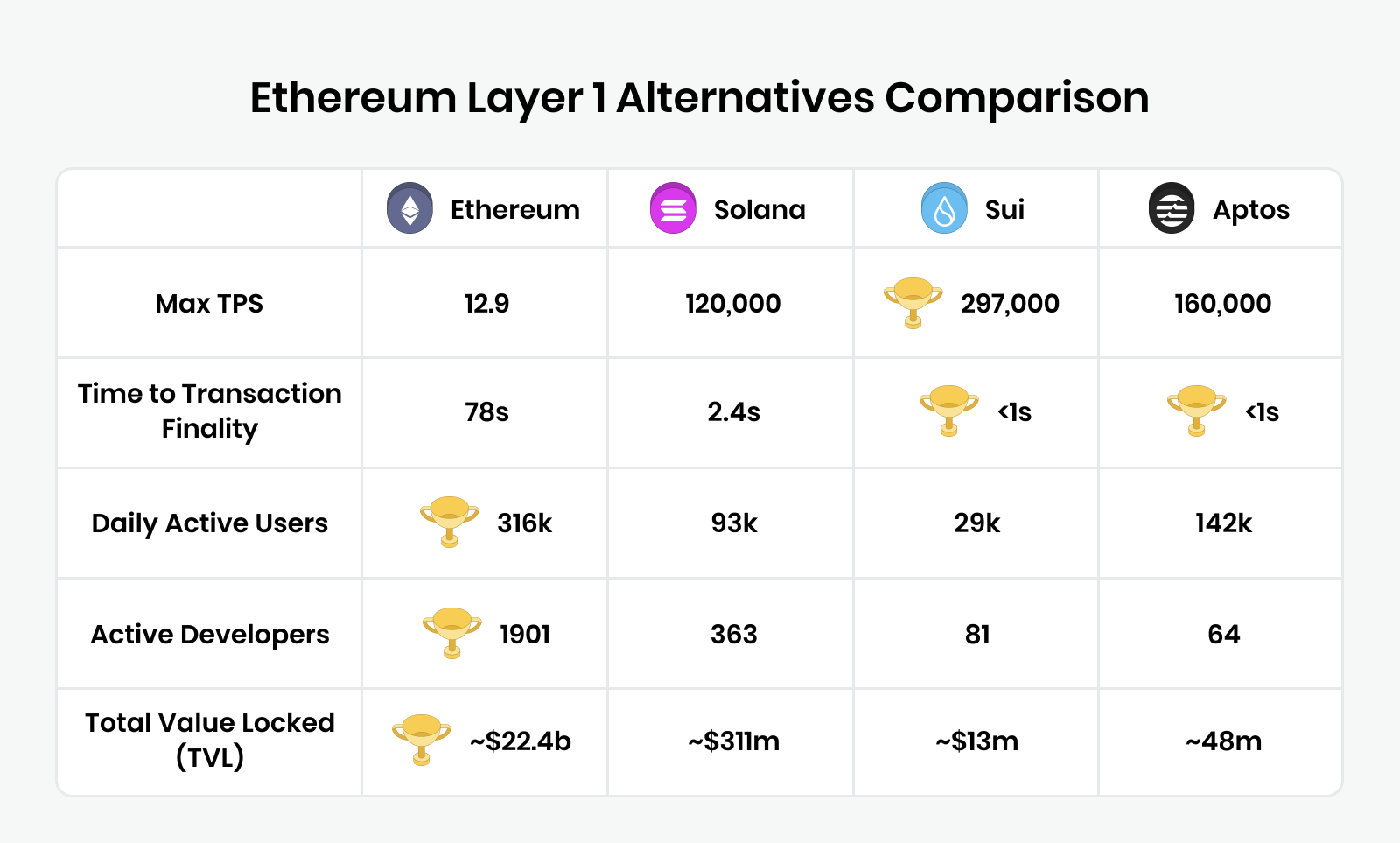

Below we’ve listed three L1 alternatives to Ethereum that we think are contenders to compete with Ethereum. The comparison table summarises some, but not all, of the headline metrics.

Sources: Token Terminal, DefiLama, Suiscan, Aptoscan, Aptos Explorer.

Note: The data in the table above are taken from different sources, are subject to change, and have not been independently verified.

Solana (SOL)

Despite being intertwined with FTX and being embroiled with its subsequent collapse, Solana has remained resilient and had a strong 2023 thus far, up 136% since the start of the year. It remains a worthy alternative to Ethereum thanks to quick transaction speeds, active developers & community engagement.

Solana looked to solve the problems that existed with Ethereum. It quickly gained popularity for its focus on low transaction fees, speed and scalability.

What we’ve seen during the last cycle is confirmed adoption of the chain, that’s sustained through the current bear market. There is still strong support for the values and direction of the Solana Foundation from their community even post-FTX. Fundamentally that’s what gets us excited about the future for Solana into the next cycle.

Also, we’re all quick to forget that Ethereum was also compromised in 2016, resulting in huge doubts and speculation in that chain’s future. It’s easy to sit here now and see Ethereum as a ‘blue-chip’ asset, but it wasn’t always the case.

Other reasons we’re watching Solana (SOL)

- Fourth highest developer count – trailing only to Ethereum, Polkadot and Cosmos

- Strong infrastructure development

- Projects like Helium and Render have migrated to Solana from Ethereum for faster and cheaper operations

- A report by PWC found that Solana is the highest-bought altcoin by both traditional and crypto hedge funds

- Solana continues to develop and innovate with products like the SAGA web3 phone

Sui and Aptos are two new L1 blockchains that launched within the last 12 months. They share a similar monolithic approach with Solana and represent a battle for the new generation L1 blockchain platforms.

Concerns around Solana

Solana has received criticism in the past for its network downtime as a result of tech issues on the blockchain. Many people in the community argue that these outages put DeFi protocols on the Solana network at risk of insolvency. However, Solana’s new upgrade, labelled “Firedancer” aims to fix this issue by increasing the efficiency and resiliency of the network.

Sui (Sui)

Sui is a noteworthy contender in the Ethereum L1 alternatives space that we’re watching.

Despite only launching this year, Sui stands out from other L1 chains with three key features. It offers instant transaction finality, which means transactions are completed more efficiently. It also makes smart contract deployment faster. These features make Sui a top choice for dApps that need rapid transaction speeds.

Sui’s backbone is its team. The project was launched by a team of ex-Facebook employees who had previously worked on the Diem/Libra stablecoin project before it was shut down due to regulatory concerns. Sui’s team has some of the most impressive resumes out of any of the existing L1’s.

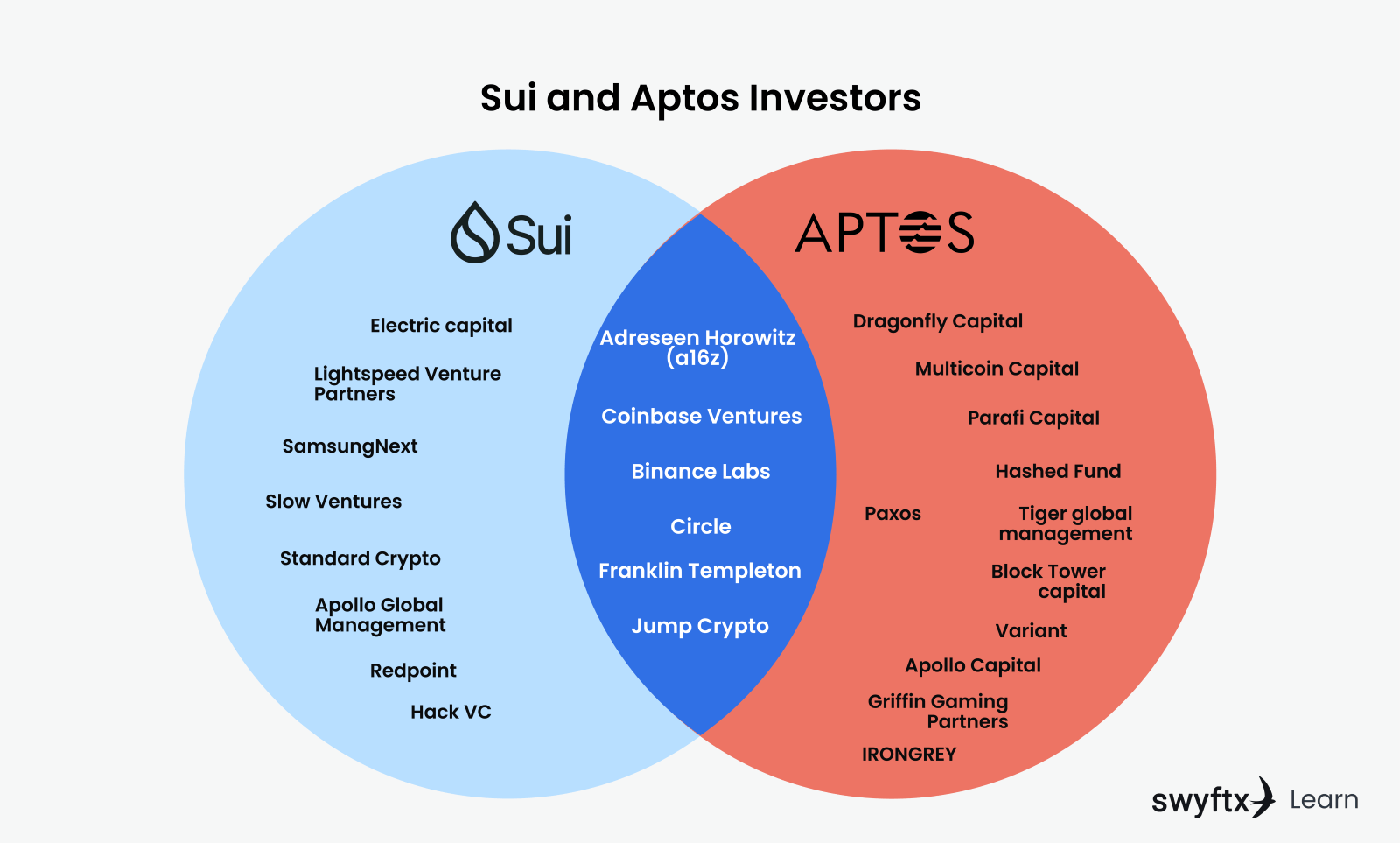

Additionally, Sui garnered a lot of attention when it raised $300 million through venture capital funding from investors including Coinbase Ventures, Binance Labs and Andreessen Horowitz (a16z). This level of financial commitment indicates a potentially strong investor confidence in Sui’s future.

The other reasons why we’re watching Sui

- Sui boasts strong transaction per second (TPS) rate at 297,000

- The network has a strong developer activity, outnumbering more mature L1 chains like Avalanche and EOS

Concerns of Sui

While Sui has potential, there remains some concerns. Firstly, Sui is a new ecosystem that hasn’t been fully tested in a full market cycle.

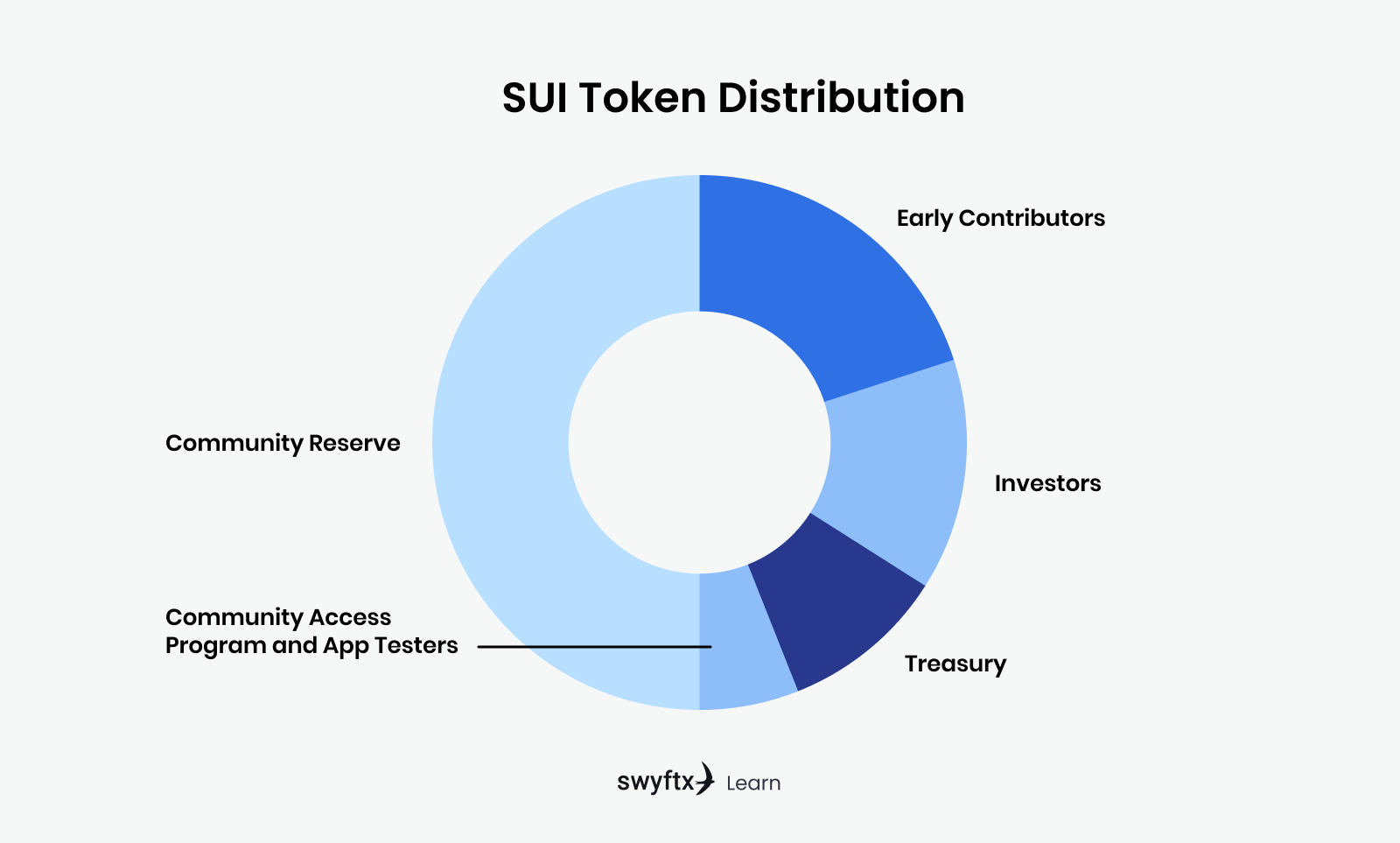

Sui’s tokenomics have also come into question recently. Only 14% of tokens are available for retail investors, which means the remainder are reserved for the Sui team, early investors and the Sui Foundation treasury.

Additionally, Sui only attracts an average of 14,000 new accounts daily and lacks active addresses which is less than ideal for building a robust userbase.

Aptos

Aptos is another Ethereum L1 alternative that’s gaining attention and has had a strong 2023 to date. Aptos’s mission is to unite web2 and web3 and is working closely with Google to do this. Its standout features include quick transaction finality, less lag in deploying smart contracts, and speedy transaction times, which are great for high-speed apps. Just like Sui, the team behind Aptos are ex-Facebook/meta employees who had previously worked on the Diem/libra project. Reportedly, there are around 170 staff members dedicated to the development of the Aptos project, as indicated on LinkedIn (however, this may not be the best indicator as anyone can say they work for the project).

In March 2022, Aptos raised $350 million in a seed round led by the venture capital firm a16z and also included investors like Coinbase Ventures and Binance Labs.

Everything on Aptos is coded in a language called Move which is based on the Rust language invented by the Diem developers. Solana, Near Protocol and Polkadot all use the Rust coding language, so it makes it easy for developers on these networks to migrate to Aptos.

According to the Aptos explorer, there are over 6 million unique wallet addresses on the Aptos network. To put this in perspective, Cardano only has 4.2 million accounts on its network, and it is a top 10 cryptocurrency.

Other reasons why we’re watching

- According to the Aptos team, the network can process over 150,000 TPS.

- The network consists of over 100 active validators

- Currently averaging 82,000 new accounts per day

- Aptos has partnered with Google Cloud to support web3 builders

Concerns of Aptos

Much like Sui, the Aptos mainnet was launched recently (in late 2022) and therefore has not been tested through a full cycle. Aptos claims its blockchain is scalable, decentralised and secure. However, achieving all three aspects simultaneously is practically impossible due to the blockchain trilemma. It seems their primary focus lies on scalability above all else.

While Aptos, is decentralised in nature by being a blockchain network, it has become under heavy criticism for being too centralised. This is primarily due to it being heavily venture capital-backed and most of the validators being controlled by Aptos Labs. In order to run a validator on the Aptos network, you need to stake 1 million APT tokens, which translates into millions of dollars, making it inaccessible to most of the population.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.