Welcome to the first part of our four-part series on crypto categories to watch for the next bull run. In this series, we will explore some emerging trends in the cryptocurrency market and discuss the factors that may make them worth watching.

While we won’t delve into individual altcoins in this guide, we will provide a high-level overview of some trends to watch and share reasons why we believe they could gain traction in a future bull market.

The subsequent 3 parts of this series will offer a deep dive into each of the altcoin category trends we’ve identified, touching on several coins that have shown strong growth and have the potential to gain further momentum. This will largely be based on adoption, activity, tech and a range of other factors, whilst also highlighting factors that could potentially pose a threat to each of these categories.

Important to Remember

Bitcoin is not an altcoin, so it will not be considered in this article as part of our trends, but rather used as a baseline. The same goes for Ethereum, even though some consider it to be an altcoin, its sheer size and dominance over the market as the premier layer 1 smart contract platform means we will not be considering it as part of this series.

When is the next bull run?

Bearish perspective

First of all, it’s important to note that a crypto bull run is not guaranteed, despite what has occurred during previous price cycles. The regulatory landscape surrounding cryptocurrencies is still evolving. Governments and regulatory bodies worldwide are continuously working to establish frameworks to govern the use and trading of digital assets.

Regulatory scrutiny is heating up particularly in the US, as the US Securities & Exchange Commission (SEC) has taken legal action against two of the largest crypto exchanges in the world i.e. Binance and Coinbase. The result of these lawsuits and uncertainty regarding regulation can have a profound impact on the market and investor sentiment. It is also important to remember that the global economy is in a vastly different shape then when previous crypto bull runs occurred.

Bullish perspective

Despite the regulatory scrutiny, there are several factors that historically have contributed to crypto bull markets that we can highlight. From a fundamental perspective, the biggest factor that is could bring about a bull market in 2024 is the Bitcoin halving.

Historically the price of Bitcoin has surged around a halving event, which has then been followed by a crypto bull market (but of course, it is not guaranteed to happen again).

Figure 1: History of Bitcoin halving and its impact on price.

Additionally, several huge investment managers like BlackRock, Fidelity and Greyscale have applied for spot Bitcoin ETFs, meaning they have likely identified that there is a large amount of institutional demand for Bitcoin.

If approved, these ETFs could open the floodgates to a wave of a new investors who have been interested in crypto but haven’t taken a traditional route to invest in the asset class. BlackRock’s CEO has even stated that he believes cryptocurrencies will transcend traditional currencies, including the US dollar.

Looking back at the 2021 bull market

Though not technically an altcoin, The rise of non-fungible tokens (NFTs) emerged as one of the most prominent trends during the 2021 bull market, with projects like Bored Ape and CryptoPunks captivating investors and collectors alike. These collections gained widespread attention as they represented the first mainstream use cases of NFT technology. Their unique digital assets and the concept of ownership through blockchain was the talk of the town.

Top categories to watch in the next bull run

Now, let’s shift our focus to the key trends that we believe could influence the next bull run. It’s worth noting once again, that previous trends and past altcoin performance are not indicative of future trends and altcoin performance. That being said, in the subsequent parts of this series, we will delve deeper into each identified trend and explore specific coins within those categories. Here’s a glimpse of what lies ahead.

1️⃣ Ethereum alternatives (layer 1 smart contract platforms)

Although it emerged as a leading category during the bullish surge of 2021, this category shows no signs of fading away anytime soon. Although Ethereum continues to maintain its dominance, the layer 1 battle of the next bull market will likely be focused on solving the scaling problem on Ethereum. However, the battle appears to be a lot more diverse than it was in the last bull market, with new layer 1 tech emerging and increased focus on layer 2 technology.

Sui and Aptos, two recently booming layer 1 ecosystems, have gained significant traction in 2023, particularly in light of their successful venture capital funding rounds.

Keep note: It is important not to overlook the more established layer 1 platforms. The Solana ecosystem continues to be captivating, thanks to its extensive ecosystem of Dapps and active developer engagement.

We’ll dive a little deeper into these networks in the next post of this series.

2️⃣ Layer 2 scaling solutions

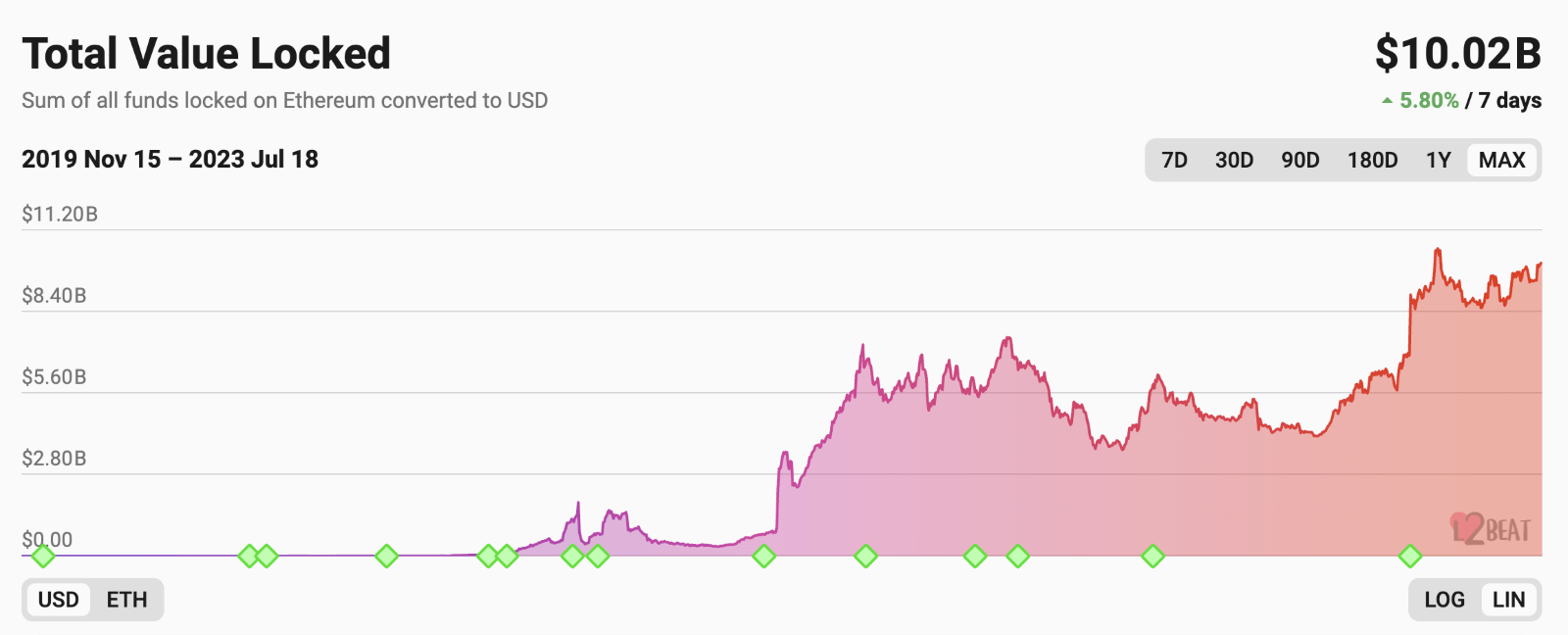

Layer 2 scaling solutions are poised to play a vital role in addressing scalability issues within blockchain networks, particularly Ethereum. Layer 2 (L2) transaction activity has grown significantly in the last 18 months, despite the bear market, with some networks processing more transactions than the Ethereum mainnet itself.

If you didn’t already need a reason to keep an eye on this sector, Coinbase has identified a large opportunity in the L2 space and has started developing their own L2 solution called ‘Base,’ using Optimism’s tech stack.

We’ll explore the coins driving this space, and their potential to make a significant impact, in our L2 deep dive.

Figure 2: Total value Locked (TVL) on Ethereum L2 scaling solution 2019-2023. Source L2Beat.

💧DeFi and Liquid Staking

The explosion of DeFi was one of the biggest trends in the 2021 bull market, particularly as decentralised exchanges and lending protocols started gaining traction. However, the sector has taken a big hit in the bear market over the last 18 months.

Now we have seen a new trend play out in the DeFi sector, one that is trending upwards and showing very few signs of slowing down. The trend we’re referring to is Liquid Staking and liquid staking derivatives (LSDs).

Liquid Staking is emerging as a popular and innovative option to solve the issues associated with traditional staking. Liquid staking provides users with liquidity while they stake they’re assets for passive income. Simply put, Liquid Staking allows users to stake their crypto to earn a yield while also keeping their funds liquid to maximise capital efficiency.

Year to date, liquid staking protocols have had a huge year, exemplified by the growth of Lido Dao (LDO) and Rocket Pool (RPL) as well as the increased use of LSDs in DeFi. Holders are using LSDs as collateral to take out loans and earn additional yield. This trend is referred to as LSDFI and it is gaining significant momentum, which we will explore in the Liquid staking deep dive.

Honourable mentions

🎮 GameFi/blockchain gaming

Crypto gaming is a substantial use case for blockchain, NFTs and cryptocurrency, which could explode in the coming years.

Gaming has the advantage over other crypto sectors of being fun and engaging which can attract huge news audiences. However, there are concerns regarding the longevity of individual games and their ability to sustain large communities, as players often tire of games no matter how good they are. That’s why we are more closely watching the networks that provide the necessary infrastructure to host and develop these games. Syndey-based Immutable X is on our watch list for this reason.

🇨🇳 Chinese based coins

The recent announcement to legalise retail crypto trading in Hong Kong for certain assets has sparked bullish sentiment for several Chinese-based crypto projects like Filecoin and Conflux. Many believe China is using Hong Kong as a testing ground for crypto with plans to capitalise on the growing industry. While purely speculative at this stage, if true, the potential would be significant, unlocking access to a market of over a billion people.

If China were to legalise cryptocurrencies, it is likely that they would prioritise local-based projects and blockchains, aligning with their strong emphasis on fostering domestic economic growth. This approach mirrors their strategy with social media, where they have restricted access to overseas platforms like Facebook and instead encourage the use of local-based social media sites.

🔑 Decentralised storage

Decentralised storage is an intriguing crypto category that could be worth keeping an eye on. As the amount of on-chain data on layer 1 networks continues to grow, the need for reliable and efficient storage solutions becomes crucial. However, it is important to consider that some of the larger layer 1 platforms may start developing their own decentralised storage systems, potentially diminishing the demand for independent storage protocols.

Despite these factors, there are notable projects like Arweave (AR) making waves in this field. Arweave recently achieved its highest monthly transaction volume in June, although the amount of data uploaded to it was at a nearly two-year low, likely due to the NFT winter.

🤖 Artificial intelligence

The intersection of crypto and AI is an interesting category that has had recent success, primarily driven by hype rather than underlying fundamentals or widespread adoption. However, as AI is expected to emerge as a major tech trend in the near future, the potential for AI-related crypto projects remains worthy of attention.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.