In part 2 of this series, we dove headfirst into layer 1 alternatives to Ethereum and why they present a compelling case in a potential bull run.

As we’ve mentioned, Ethereum’s reign as the dominant layer 1 network isn’t going away anytime soon. But it’s issues with scalability and long-term feasibility (slow and expensive transactions) is a key dilemma, even despite its move to Proof of Stake.

This has led to an explosion of layer 2 networks that sit on top of Ethereum, designed to foster quicker and cheaper transactions.

What are layer 2 scaling solutions?

Layer 2 networks utilise Ethereum’s strong and secure infrastructure to deliver quick and affordable transactions.

So imagine a network with strong foundations, resilient against bugs and attacks (Ethereum) and have another product settling batches of transactions and removing congestion on that network (layer 2). This is the value that layer 2 scaling solutions provide.

To explain this, imagine a Layer 1 (L1) being a bank vault. It has thick walls and complex locks that are closely monitored. Then, visualise a Layer 2 (L2) as being an ATM. While the bank vault is indeed super secure, as the bank’s number of users grows, it’s not feasible for everyone to visit the bank to withdraw money. ATMs are convenient, designed for efficiency and use the backbone of the banking infrastructure to transact. That’s no different to what we’re talking about here, except the blockchain isn’t limited to the storage and access to money like a bank. You can read more about smart contracts below.

Layer 2 scaling solutions function to batch transactions onto the primary layer 1 blockchain.

Why we’re watching this category

Over the past 18 months, L2 transaction activity has surged, even amidst the bear market. Even Coinbase, the only publicly listed crypto exchange has identified an opportunity in this space and has launched their own layer 2 network called BASE. It’s clear that layer 2 networks generate significant interest and are important to Ethereum’s scalability. Whether it is going to play a role in a potential bull market is anyone’s guess, but we will certainly be watching.

Additionally, an Ethereum upgrade called EIP-4844 slated for Q4 2023, is expected to make posting data to L2’s 99% cheaper. As it stands, this expense is currently the biggest expense L2’s incur today so this is upgrade is expected to be very beneficial for L2’s in general.

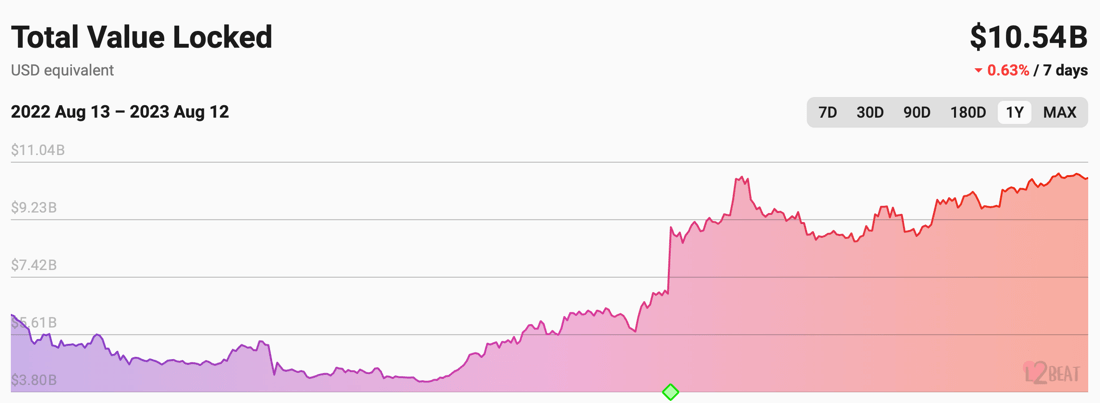

As the time of writing, the Total Value Locked on layer 2 networks is at an all-time high of $10.54b USD, up ~154% since the start of 2023.

Layer 2 cryptocurrencies we’re watching

Polygon (MATIC)

Polygon has not let the bear market slow it down one bit. In 2022, it earned the title of Decrypts Crypto project of the year.

From a technical perspective, Polygon has always been a scaling solution for the Ethereum chain. Technically it is a sidechain, but in recent pivots, Polygon will be a true L2 using ZK (Zero Knowledge) technology. This will allow for greater speed and capacity, ‘rolling up’ many transactions into batches for settlement. The beta for this mainnet went live in March 2023 and has been running with a 99.88% uptime.

Part of the reason why Polygon garnered so much attention in 2022 was thanks to its list of partnerships with huge global companies, such as:

- Nike

- Mercedes

- Meta

- Adobe

- Stripe

- JP Morgan

Unfortunately, the price of MATIC has not performed as well as some expected it to in 2023. However, Polygon announced it will go through a relaunch later this year which is sure to capture interest. This relaunch will be aptly named Polygon 2.0 and the MATIC token will be renamed to POL.

The upgrade can be quite technical but to summarise, the changes will centre around:

- Connecting its many chains so the value can easily flow around the ecosystem.

- Polygon’s proof-of-stake ‘sidechain’ will become increasingly backed by Ethereum.

- Upgrading the MATIC token to POL

- Governance changes to improve decentralisation.

The above was taken from a deep dive from Collective Shift. You can read the full report here.

Concerns of Polygon

We have outlined below some concerns we have identified on the finer details of this anticipated roadmap.

The Migration – While migration isn’t anything new in the crypto space, the plans for Polygon 2.0 are ambitious and likely heading into uncharted territory. This will likely be a transitional change, but interoperability with existing systems may be a pain point.

New emission plans – Currently, when staking MATIC, staking rewards are distributed for keeping your tokens as a part of the validation network. We will be keen to see what changes occur here, especially with the proposed new multi-chain functionality. If there are more generous rewards than currently offered, its price could be diluted compared to the current price on MATIC.

Security – While they may not function the same, previous and current multichain projects are often targets for sophisticated attacks that target security deficiencies. It will be interesting to hear how the team addresses this concern and ensures Polygon 2.0 is free from vulnerabilities.

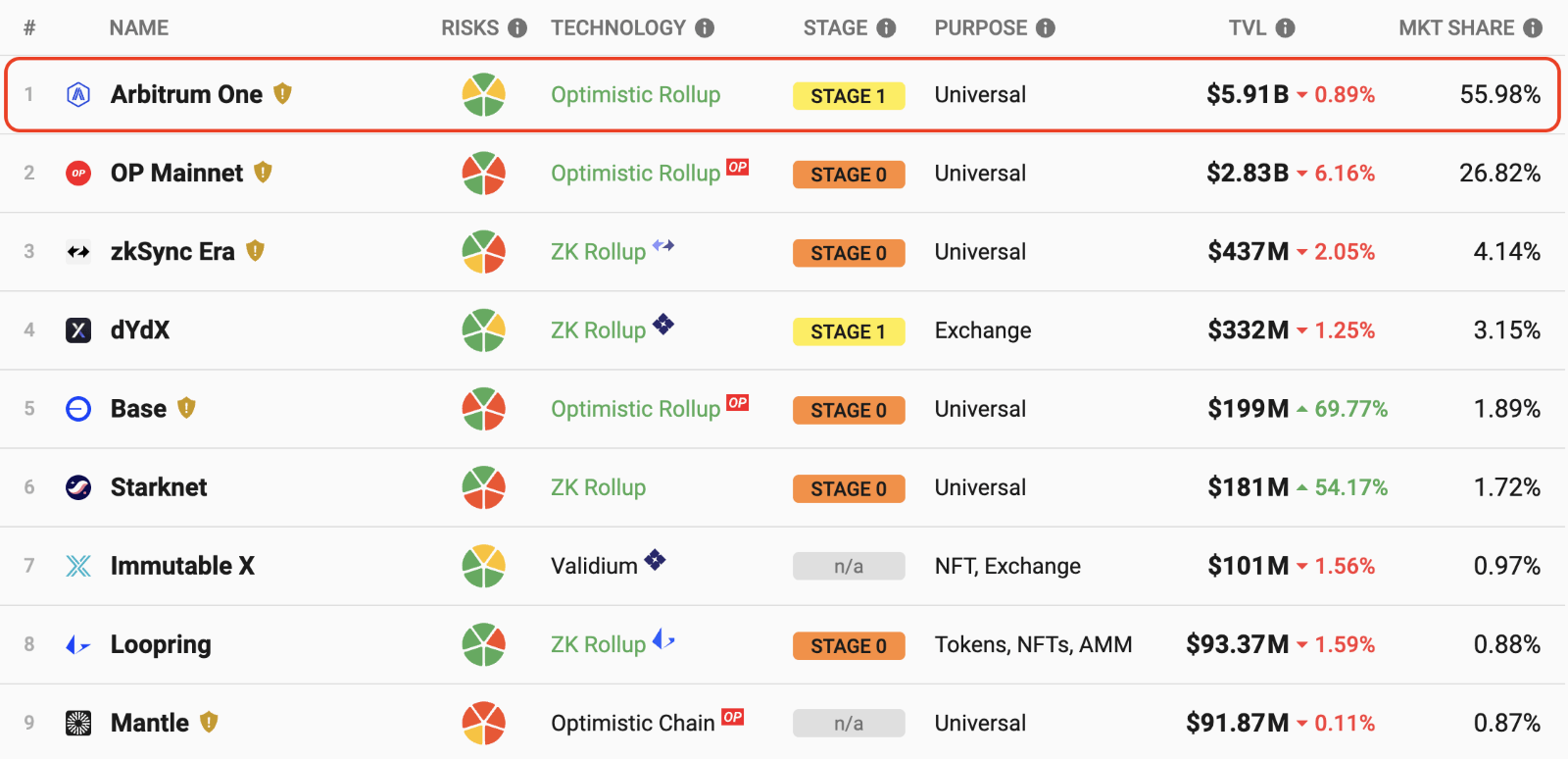

Arbitrum (ARB)

As it stands, Arbitrum is currently leading the pack as the most widely used Ethereum layer 2 network. Its token, ARB, launched earlier this year via airdrop and has held its value relatively well. This is quite rare as typically after an airdrop, holders who received tokens will sell off immediately to cash in on free money (which, who can blame them). This usually results in a major price drop. The fact that Arbitrum has maintained its value shows there is belief in the project upon early adopters as airdrop participants.

Arbitrum has more stablecoins on it than all the other stablecoins combined. Stablecoins play a hugely important role in the crypto landscape, and the market cap of all stablecoins has increased by over 2 million percent in the last 5 years, and it’s not going away anytime soon. The preference of Arbitrum for stablecoin transactions shows strong belief and adoption of the network.

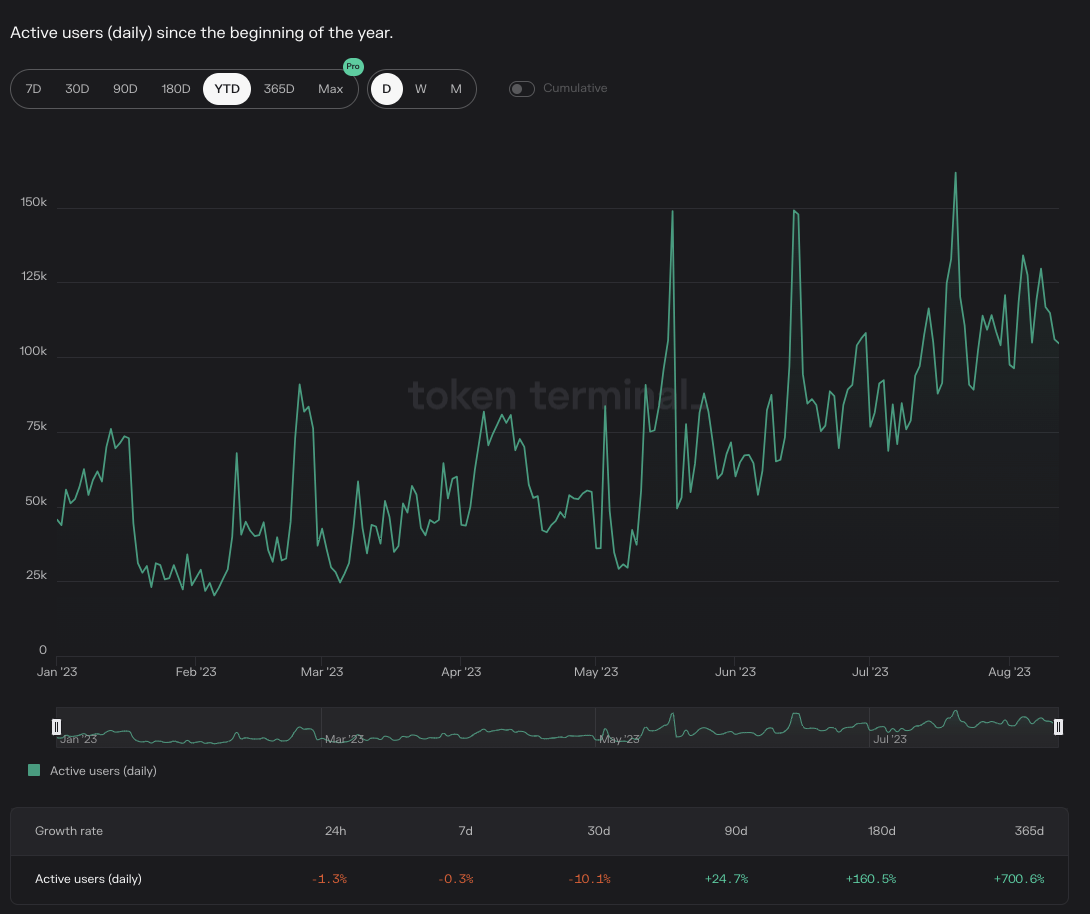

Over the course of 2023, we’ve seen the number of new and returning users continue to increase as a trend and is reasonably correlated with the total value locked in the network (TVL).

Optimism (OP)

Optimism has recently completed a major upgrade to its infrastructure, labelled the Bedrock upgrade. Transaction costs and confirmation times have been cut by around 90%. We have also seen the adoption of the chain’s infrastructure by Coinbase in the launch of their BASEnetwork chain using the Optimism tech stack. Optimism is poising themselves in the market to be a ’super-chain,’ with it tapping into the multiple networks using their technology and bringing them together to communicate more efficiently.

In the last two years alone, OP has cumulatively saved users $2.69b USD in fees, and 15.8 years in time saved from transaction confirmation times.

Optimism daily active users. Sourece Token Terminal.

So far in 2023, the daily active users of the project have largely trended up. The launch of Worldcoin (WLD), a project built on Optimism resulted in Optimism briefly overtaking Arbitrum in daily active transactions. It is impactful projects like this may be attributed to the active growth of users on the chain.

Immutable X (IMX)

We’ve spoken about the use case of NFTs evolving to be more than just JPEGs. Australian-based Immutable X are one of the industry leaders in developing the technology and infrastructure to enable the next generation of innovation in the blockchain gaming sector. They aim to solve problems with scalability and user experience.

The zero-knowledge roll-up technology will solve similar scalability problems, focusing on GameFi and NFT problem statements. To bring AAA game titles to the space, blockchain infrastructure needs far more bandwidth, which Layer 2 solutions like immutable X aim to provide.

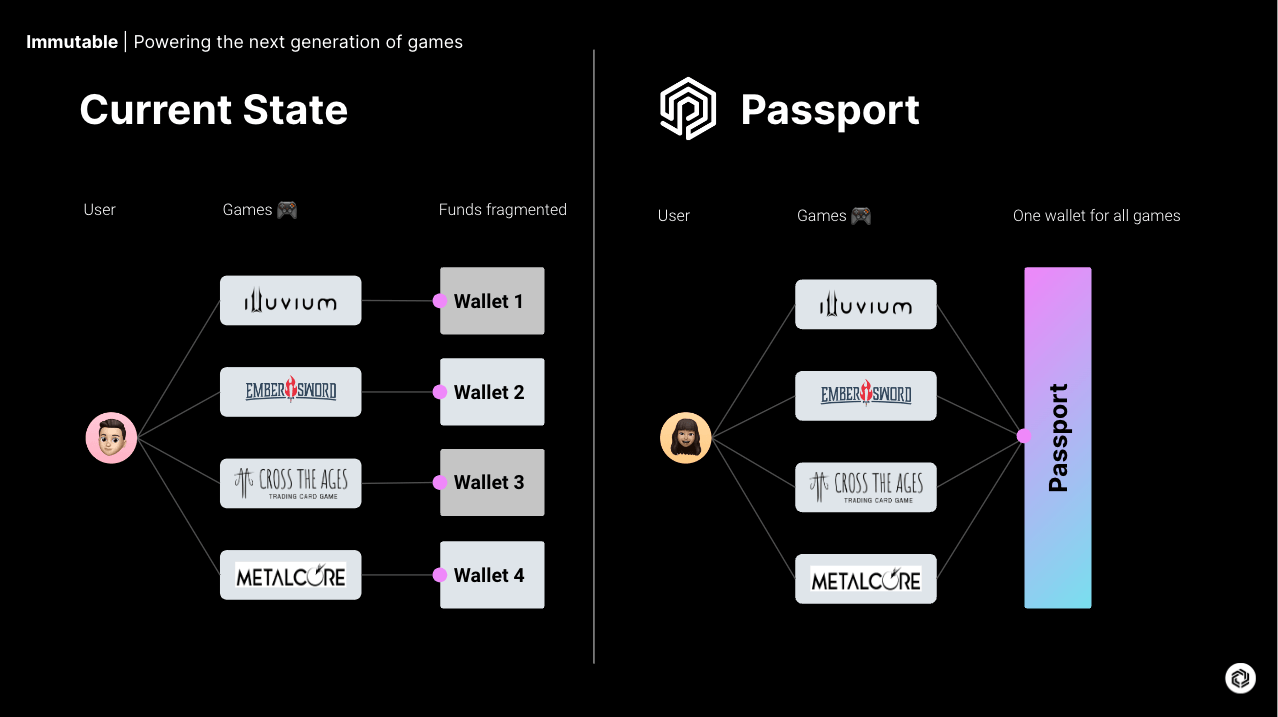

NFT infrastructure is also a big cornerstone of what makes IMX different to its scaling competitors and attractive to developers. Using API abstraction layer technology, IMX will simplify and fast the trading and transfer of NFTs. This is a powerful paradigm change from the current technology available. A user wouldn’t need to touch a smart contract. For example, you could hypothetically harvest and sell in-game resources on an in-game marketplace using blockchain technology without signing any transactions. A big part of this is possible through their innovative NFT-enabled wallet infrastructure.

Concerns of Immutable X

AAA games – There has yet to be a public release of a AAA title. Immutable is all about ground-breaking tech to allow gaming to interface with the blockchain like never before. However, outside of some demos and closed beta, we still await a working proof.

User adoption – If these games are built, will there be a community and ecosystem that adopts them. While there has been much said about improvements compared to the current landscape, is it difficult enough to win over current gamers.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.