On Monday evening, the Worldcoin protocol was officially launched, along with its WLD token, which triggered a wave of hype and an equal amount of scepticism. The price of WLD quickly jumped from $0.3 to $3 USD only hours after being listed on major exchanges. Let’s dive in and explore this ambitious yet divisive project.

What is it?

Worldcoin was founded on the notion of creating a scalable, globally inclusive identity and financial network.

“Proof of personhood” is the core idea behind Worldcoin. In today’s day and age, proof of personhood is an unsolved problem globally. The Worldcoin project team anticipate that due to the advent and rise of AI (Artificial Intelligence) models this problem will become more pressing. How do we verify if someone online is human, and how do we know one human from another? World ID could be this global system for standardisation.

How does it work?

World ID, is the technology behind Worldcoin. It utilises zero-knowledge proofs to preserve user privacy while verifying proof of personhood. It also uses a biometric device referred to as ‘the Orb’. The Orb is a physical device developed to scan a user’s iris to onboard and establish humanness. This process binds a user to their World ID.This means the World ID can only be used by that individual.

A Worldcoin Orb

Worldcoin (WLD) is the digital currency of the project. However, WLD is not available in certain countries, including the United States. Currently, each human is eligible for a share of WLD tokens for onboarding into the ecosystem and verifying their humanness. However, there is presently limited number of the Orbs, and none are in Australia or New Zealand, yet. World ID and Worldcoin are currently all part of the World App ecosystem for now, but future growth is planned by the team.

People and funding

The project team, Tools for Humanity, is co-founded by Alex Blania & OpenAI’s CEO Sam Altman, the creator of ChatGPT.

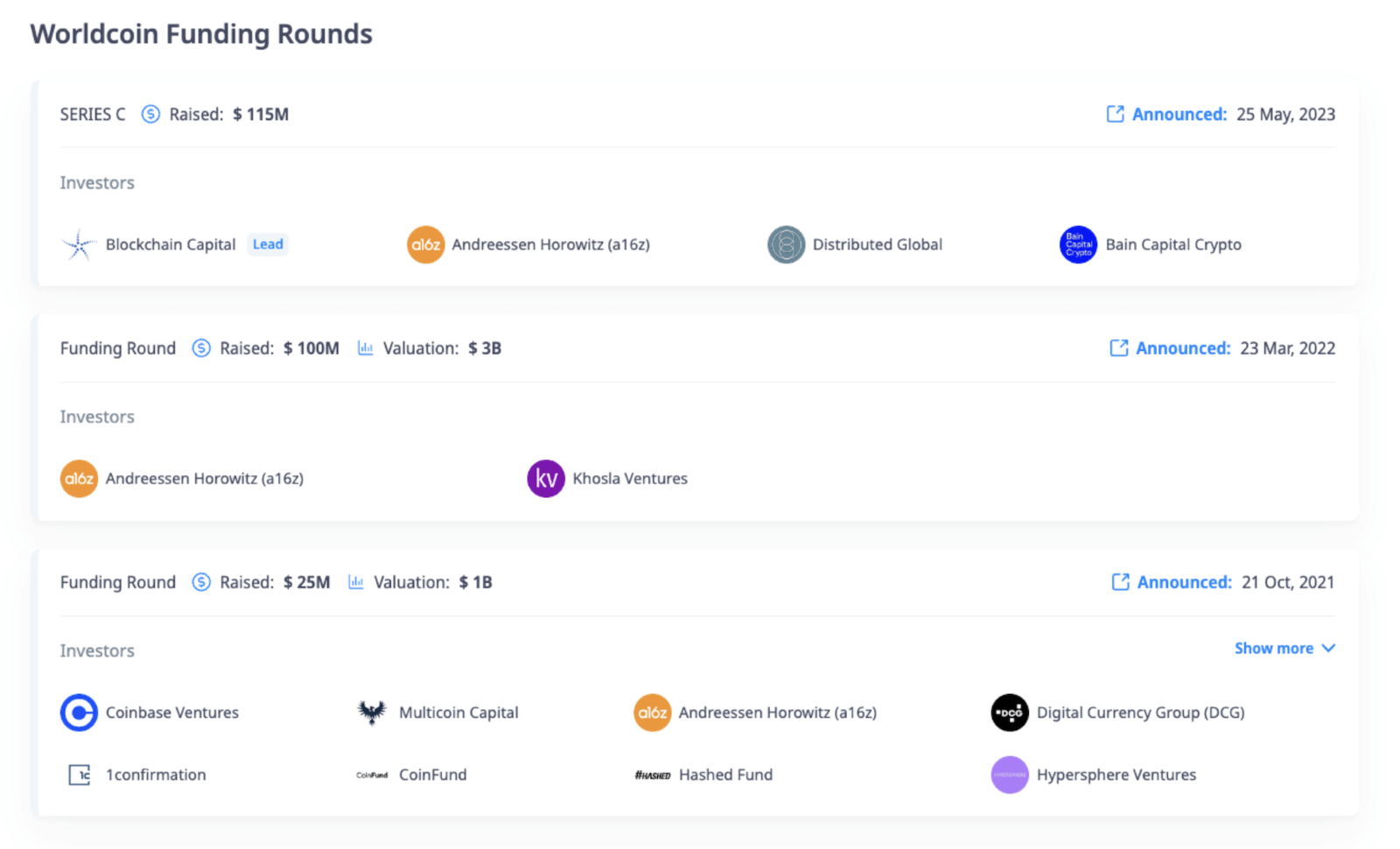

Early funding in 2021 brought some big names to the project, attracting the likes of Coinbase Venture, a16z, and Digital Currency Group (DCG). Since then, the project has raised $240m USD.

Figure 1: Worldcoin funding rounds. Source Cryptorank.

Tokenonmics

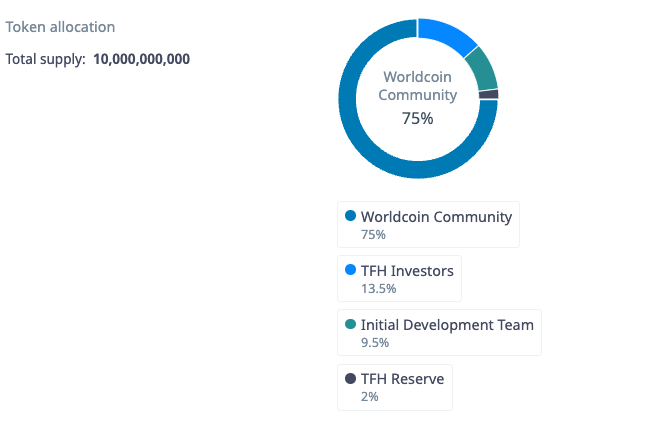

Most of the allocated supply is set aside for the Worldcoin community. The remainder set aside for investors and development team members.

Figure 2: Token allocation. Source Worldcoin whitepaper.

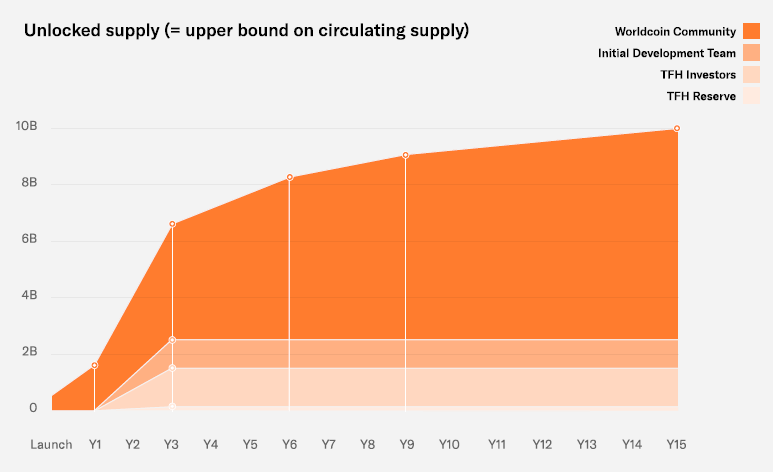

The supply and distribution of these tokens for investors and the development team are locked for a year, and there is a linear unlock up to year 3.

For year 1 of the launch, circulating supply is community driven.

Figure 3: WLD unlocked supply entering the market. Source Worldcoin whitepaper.

Concerns around token supply

Currently, only about ~1.5% of Worldcoin’s maximum token supply is in circulation, which is extremely low. The concern here is that as more tokens enter the market, it will lead to a dilution of the market cap, resulting in a decrease in the price of each individual token.

Worldcoin (WLD) is listed for trading on Swyftx.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.