Don’t Forget!

To receive the reward on this course, you must also have two-factor authentication (2FA) enabled on your Swyftx account. If you already have 2FA enabled you will receive your reward as soon as you complete the course.

If you do not have 2FA enabled, you will receive your reward once you have enabled it and completed the course. Click here for a breakdown on how to set up up 2FA.

Investment scams are a form of fraud in which someone is tricked – directly or indirectly – into investing money into a product, business or “asset”. These scams exist across all financial markets, including the stock market, private businesses and the cryptocurrency sector. Investment scams usually target the vulnerable – inexperienced investors, for example – but can impact anyone.

This is a common theme of investment scams – being pressured into an investment based on returns that are simply “too good to be true”. While this age-old saying is cliched, it’s also extremely relevant for those new to investing, especially when navigating a chaotic market like cryptocurrency. However, far more elaborate scams are frequent too, and can be much harder to identify.

Did You Know?

The Wolf of Wall Street film and book are actually based on an investment scam. In this scheme, Jordan Belfort’s company convinced unsuspecting investors to put their money into highly speculative assets. The team would then artificially inflate the price of these stocks, making the investors think they were onto a winner and part with more money. However, before the victim saw a return on their “investment”, Belfort’s fraudsters would pull money out of the stock, making its value drop back to near-zero.

Investment scams aren’t just a feature of Hollywood films and the high life. They can happen to anyone, anytime. For example, “imposter bond scams” involve a fraudster impersonating a bank or financial institution and offering victims “safe” treasury bonds with higher than usual interest rates. Unfortunately, the investment opportunity never existed, and the scammer typically runs off with the victim’s funds.

Swyftx has a dedicated fraud team to prevent customers from falling victim to fraud and scams.

Investment scams in Australia

Investment scams are, unfortunately, quite prevalent in Australia. There are a few reasons for this – Australia is a relatively wealthy country, making it a prime target for off-shore scammers. On top of this, the Australian Securities and Investment Commission (ASIC) does not have international jurisdiction to target overseas fraudsters. This makes it far “easier” for non-Australian residents to get away with investment fraud.

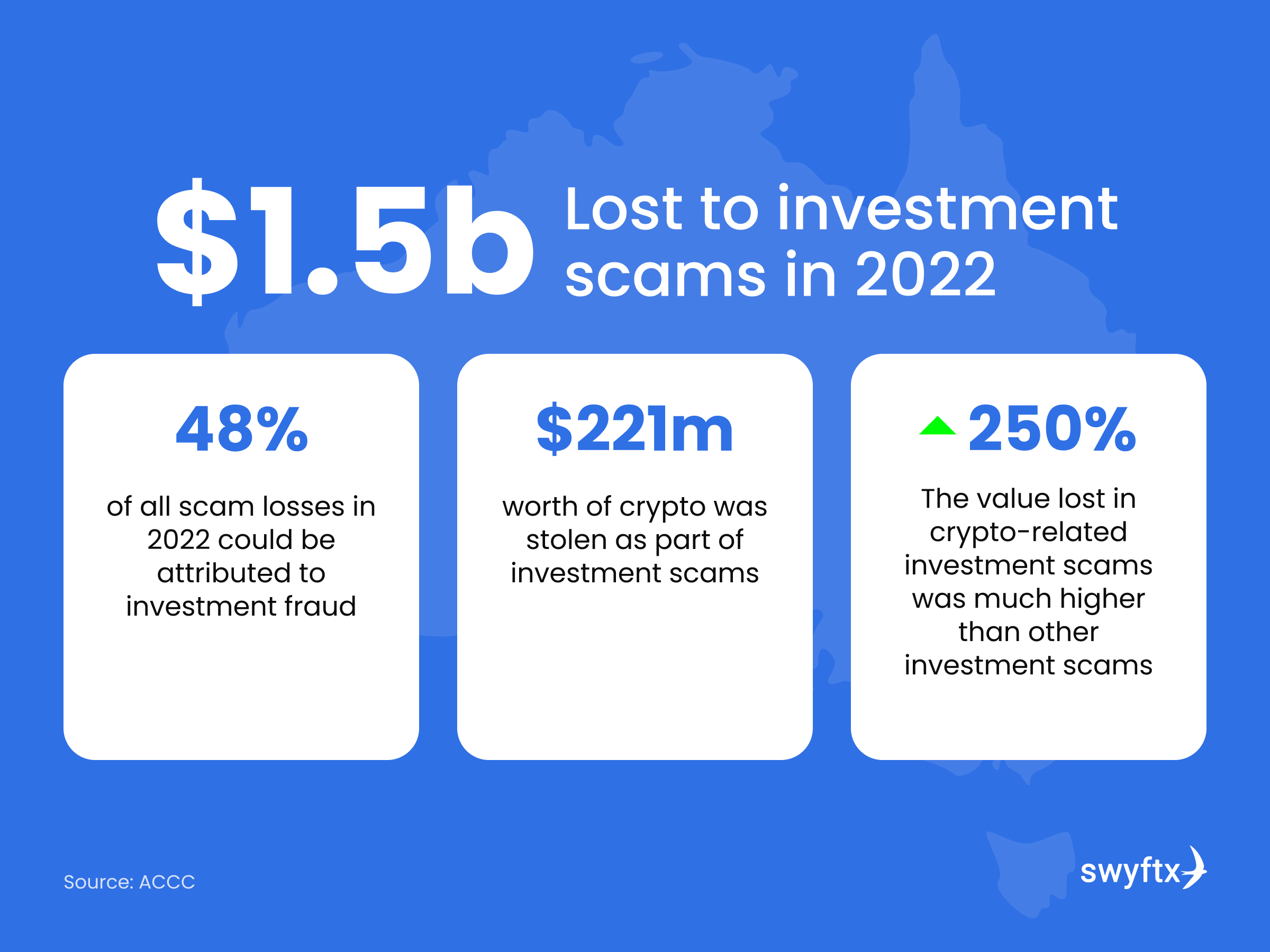

In 2022, Australian citizens lost a reported AUD $1.5 billion to investment scams – representing a 113% increase year on year, after a significant 270% increase in 2021. To make matters worse, the report only accounts for about 13% of all investment scams, meaning the actual figures are likely much higher. About 48% of all scam losses in 2022 could be attributed to investment fraud.

Australian investment scam statistics in 2022. Source ACCC.

According to the ACCC report, cryptocurrency ranks as the second most frequent payment method in scams, just behind bank transfers. The preference for crypto by scammers is likely due to the irreversible nature of its transactions, unlike bank transfers that can be frozen or blocked. Additionally, crypto transactions are more challenging to trace. However, on-chain analysis tools from companies like TRM Labs are increasingly evolving and becoming more precise in detecting blockchain-related fraud and scams.

$221.3 million AUD worth of crypto was reportedly stolen as part of investment scams through the entirety of 2022. While fiat currency was targeted more (with 13,100 reports of bank transfer scams compared to 3,910 crypto scams), the value of investment scams paid in crypto was on average, 250% higher.

The high rate of investment crime in Australia means anyone navigating the financial markets – particularly the crypto market – must remain vigilant. Gaining awareness and knowledge of scams is the first step to protecting your assets.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read