Don’t Forget!

To receive the reward on this course, you must also have two-factor authentication (2FA) enabled on your Swyftx account. If you already have 2FA enabled you will receive your reward as soon as you complete the course.

If you do not have 2FA enabled, you will receive your reward once you have enabled it and completed the course. Click here for a breakdown on how to set up up 2FA.

People can fall victim to many different types of investment scams. Some are easy to see through and avoid, while others can trick even the most internet-savvy investor. However, knowing the various tactics fraudsters use to entrap their victims can go a long way to creating a safer environment for investors – especially in the cryptocurrency scene.

Types of investment scams

There are several different ways to categorise investment scams. Cyber safety platform Chainabuse provides a thorough framework that investors can navigate to learn more about each category.

Fake project scam

Fake project scams are straightforward, but unfortunately quite common. Essentially a team of developers acts as though they are building a crypto project – often a grandiose one with aspirations to disrupt the industry. They request early investment from the community to help build their product. However, once the scammers are satisfied with the amount of money they’ve received, the developers disappear from the face of the planet and abandon the project.

A recent example is the “Amazon Wallet Presale”, where a project pretending to be launching an Amazon cryptocurrency accepted investments before deleting the website.

Tip

Anonymous developers aren’t out of the ordinary for crypto projects. But projects without a clear whitepaper or roadmap are. Avoiding cryptocurrencies without a clear identity and plan is a great way to stay away from fake projects.

Rug pulls

Rug pulls are a type of fake project scam that can often be quite convoluted. To begin with, the fraudsters will entice new investors via social media hype and other malicious tactics. However, once the scammer is satisfied with the money invested, they remove liquidity from the project. This means potentially thousands of helpless investors are left with an asset they can’t trade – making it worthless.

The most well-known rug pull in the crypto industry occurred in 2021 following the furor around the Korean drama Squid Game. A Squid Game coin – completely unrelated to the TV show outside of sharing a name – rose 14 million percent in just a week. But before any investors could cash in on their gains, the “rug was pulled” from underneath their feet and the coin became untradeable.

Did You Know?

The Squid Game token was set up as a scam from the start. For investors to “liquidate” their assets and sell the coin, they had to participate in a game based on the popular TV show. The catch? The game – promised to be coming soon – was never released.

Fake returns scams

Fake returns scams can vary from a one-person scheme to an entire business operation with hundreds of participants. The most common attacks are personal, where an individual will contact someone via social media and offer them unrealistic returns for sending them money.

In a recent example, a scammer going by the moniker Robert Smith repeatedly attempted to solicit USD $26 worth of BTC to their wallet address. In exchange, the scammer promised USD $7,000 and sent images of “receipts” to “prove” that the scheme worked. Luckily, the would-be victim identified the scheme as fraudulent and reported it to Chainabuse.

Ponzi scheme

The structure of a Ponzi scheme is relatively simple. The scammer offers an investment (or service) that provides excellent returns with minimal risk. The first few investors receive these unbelievable returns, prompting them to tell friends and family and allowing the con to spread.

In reality, the yield isn’t being generated legitimately. Rather, the scammer pays this “return” to old investors with money from new investors. So, just like a house of cards, when older investors start pulling out their money or new investors dry up, the scheme collapses.

The crypto industry has unfortunately been home to a few Ponzi schemes. The most well-known of these was 2016-18’s BitConnect, a high-yield investment program that spouted daily returns of 1% on investor’s BTC. Everything ran smoothly for a few years until the US government intervened and the platform stopped operating. As a result, the scheme collapsed and the founders of BitConnect made off with over AUD $3.5 billion.

Did You Know?

TRM Labs estimate that $7.8 billion ($12b AUD) was lost to Ponzi schemes in 2022 across the globe.

Pump and dump scheme

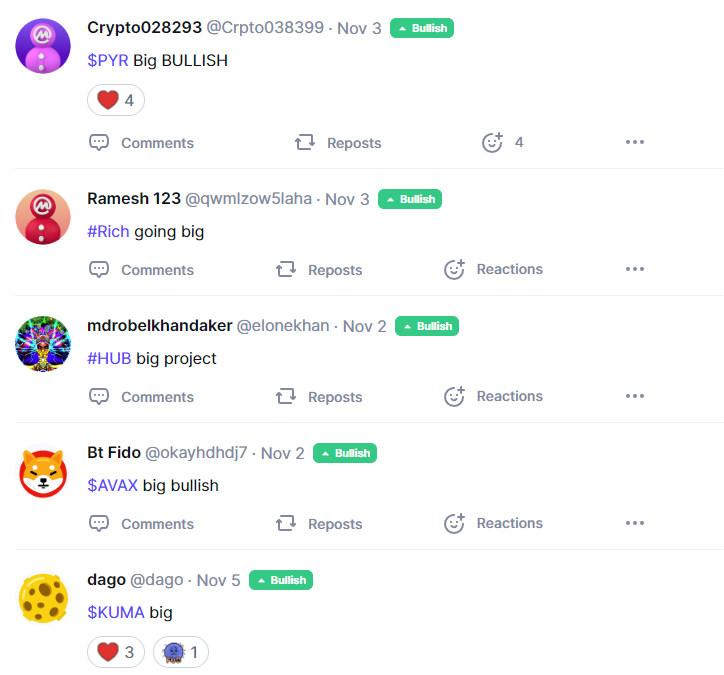

Pump and Dump (P&D) is a type of investment fraud that involves artificially manipulating the price of a stock or cryptocurrency. Sometimes, the scammers are behind the asset being exploited, but on other occasions, they target a random low market cap stock/crypto. The fraudsters, often through social media, generate fake hype by posting constant, misleading messages regarding the asset (pump). Once the price has reached a certain point, the scammers sell their portfolios, causing the price to plummet (dump) and leaving the victims with a massive loss on their investment.

Crypto is a particularly easy target for these scams due to the simplicity of launching a new token, and the speculative nature of most coins. One only needs to spend some time on Twitter, Coinmarketcap or similar social media to see accounts attempting to pump various cryptocurrencies.

Scammer tactics

There are three main tactics that scammers will use to trap victims in one of the investment scams listed above.

Social media scams

Social media is by far the biggest hazard for the novice crypto investor. Platforms like Twitter, Facebook and so on are filled with scammers attempting to artificially alter the price of their favourite coins or steal your login details.

For example, a Facebook account claiming to be Swyftx posts a link to a “giveaway” on Swyftx. However, the URL leads to a fake login portal that will steal customers’ usernames and passwords if they enter their details.

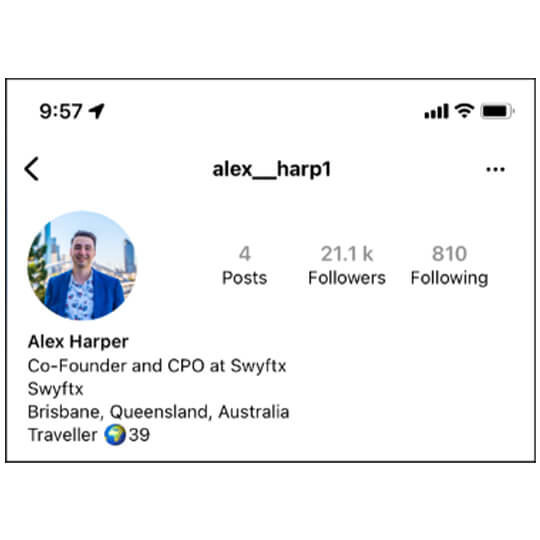

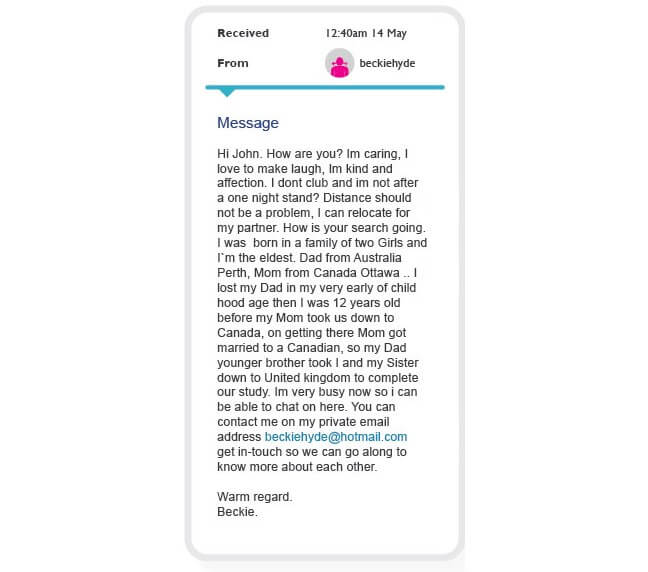

Impersonation scams

Also known as phishing, impersonation scams are rife throughout Australia. Impersonation scams can take the form of anyone.

Take the Instagram account alex__harp1 – a profile mimicking that of Swyftx’s co-founder, Alex Harper. This account reportedly sent Swyftx customers messages asking them to send crypto directly to a wallet to participate in a trading scheme. Of course, this account was not actually Alex Harper and was attempting to steal funds from Swyftx users. Remember that a legitimate business is extremely unlikely to contact its clients via social media without prior warning.

Important to Remember

Always double-checking URLs and verifying social media accounts can help investors steer clear of impersonation scams. Multi-factor authentication (MFA) can go a long way to avoid being on the other side of an impersonation scam, too.

Romance scams

Romance scams often start on dating apps like Tinder. The scammer will enter a seemingly real relationship with the victim over a few weeks, if not longer. However, as trust builds, the scammer will steer the conversation towards high-paying investment opportunities. If the victim ends up “investing” in one of these opportunities, the fraudster often “cuts off” the relationship and disappears without a trace.

Unfortunately, this is one of the biggest scams circling at the moment. This is exacerbated by some people believing they are impervious to relationship-based scams if they avoid dating apps or other romantic platforms. However, long-running romance scams (also called pig butchering) can start anywhere. Examples include:

- Unsolicited Facebook Messenger messages

- Word With Friends games

- Chess games

- Chance encounters – where scammers send a message to the “wrong number” asking for something simple like: “Hey Steve, can you pick me up?” If the victim replies, the scammer may spend time cultivating a relationship before eventually steering the conversations toward investment opportunities.

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read