As the popularity of cryptocurrencies continues to grow, so does the need for individuals and businesses in Australia to understand and fulfil their crypto tax obligations. In the earlier chapters of this course, we outlined the guidelines and regulations provided by the Australian Taxation Office (ATO) regarding the taxation of cryptocurrencies. Building upon this, it’s crucial for crypto users to not only understand and follow these rules, but also be familiar with the process of filing their crypto taxes. In this lesson, we’ll cover the key tax dates which you need to be aware of in Australia and show you three different ways you can go about preparing your crypto taxes.

Key crypto tax dates

To ensure compliance with tax regulations, it is important to know key tax dates in Australia. The following dates are relevant for crypto tax filing for individuals:

- 1st July 2025: You can file your tax returns any time from this date onwards.

- 31st October 2025: Tax deadline for individuals filing without an accountant.

- 30th June 2026: End of the financial year period.

Working with an accountant or registered tax agent may allow for an extended deadline, generally until mid‑May or early June 2026, provided you’re registered by the 31 October cut-off.

Three different options

Before we dive into the three different methods for preparing your crypto taxes, it’s important to note that the method you go with may depend on the complexity and volume of your transactions, as well as your budget for tax-related expenses.

If you’ve invested in crypto and are thinking about potentially not reporting your crypto taxes, you will want to think again. Tax authorities worldwide are dedicating more resources to identify individuals who evade taxes on crypto gains, and the ATO is no exception.

Option 1: Do it yourself manually

One option for filing your crypto taxes is to do it yourself manually. This approach gives you complete control over the process. However, it can be time-consuming and prone to human error, especially if you have many transactions or complex crypto holdings. Still, if you only have a handful of transactions, this option may be one to consider.

Here is a 4-step process you can follow for filing your crypto taxes manually:

1. Compile your transaction history

To begin, you’ll need to collect all transaction data related to your cryptocurrency holdings from various sources, including exchanges, wallets and protocols you’ve used.

You’ll need to gather the following relevant information for each transaction:

- Date and time of the transaction

- Name of the cryptocurrency involved

- Amount of cryptocurrency involved

- Type of transaction (e.g. buy, sell, transfer)

- Price at the time of the transaction (in AUD)

- Any associated fees or commissions incurred

2. Categorise your transactions

After gathering your complete transaction history, the next step is to review and categorise each transaction accordingly. Based on what we’ve learned in earlier chapters, we know that different types of transactions have different tax implications. Therefore, we can now determine whether a transaction falls under capital gains, income or if it’s a non-taxable event.

3. Calculate your tax obligations

Once you have categorised your transactions, you’ll need to compute your capital gains and income. Your capital gains and losses will be determined based on the inventory method you have chosen to employ (i.e., FIFO, or other ATO-accepted methods.

Calculating your tax liabilities involves determining your capital gains or losses. For each transaction, you’ll need to calculate the cost basis (including any fees) and subtract it from the proceeds (i.e. the sale price). If the sale price exceeds the cost basis, you have a capital gain; if it is lower, you incur a capital loss. Sum up the overall gains and losses to determine your total net capital gain/loss.

Conversely, your total income can be calculated by just summing up the total proceeds received from income-generating crypto activities (e.g. staking rewards, airdrops, etc.).

4. Generate and file your tax reports

Once you have computed your capital gains, losses, and income in step 3, you must create tax reports that accurately reflect these values. Your tax reports should comply with ATO standards and include the following:

- Total gains and losses

- Split into short-term and long-term

- Net capital gain or loss

- Income from crypto-related activities

- Deductions, fees, or tax credits

After creating and finalising your tax reports, you can file your tax returns with the ATO and settle any taxes owed. In Australia, your capital gains get added to your total income (i.e. it’s not a separate tax rate); therefore, how much you owe will depend on your total income throughout the year (including salary and capital gains from other activities).

If you don’t want to file the tax reports yourself, you can entrust your tax reports to an accountant who can handle the filing process on your behalf.

NOTE: Remember to maintain accurate records of your cryptocurrency transactions for future reference to avoid complications in subsequent years!

Option 2: Hiring a tax professional

Hiring a tax professional such as an accountant specialising in crypto taxes can be an effective choice for individuals who don’t mind the increased expense and prefer a hands-off approach. Some advantages of working with a professional include:

- Expertise and guidance: A crypto tax accountant generally has in-depth knowledge of tax regulations and can provide personalised guidance based on your specific circumstances. They can help navigate complex tax laws and ensure compliance.

- Comprehensive tax planning: An accountant can help you strategise and optimise your crypto tax liabilities, potentially identifying deductions, credits or tax-loss harvesting opportunities.

- Accurate tax reporting: By entrusting your tax filing to a professional, you can have peace of mind knowing that your tax reports will be prepared accurately and in compliance with tax regulations.

- Audit support: In case of an audit or tax-related inquiry, having an accountant on your side can provide valuable support and representation.

While a tax professional’s expertise and guidance is often highly valuable, it tends to be costly, and may sit outside your budget. In this case, doing it yourself manually (option 1) or using a reputable tax software (which we’ll explore next) may be more suitable.

Option 3: Using crypto tax software like Crypto Tax Calculator

The last option we’ll explore to file your crypto taxes is to use a specialised crypto tax software like Crypto Tax Calculator (CTC). Using crypto tax software is a popular choice as it tends to be more efficient than manually calculating your taxes while generally being cheaper than hiring a tax professional.

Crypto Tax Calculator is an Australian-made crypto tax software designed for crypto investors and traders. CTC was built from the ground up to handle all types of crypto trading, from exchange trading to complex on-chain activity (including NFTs and DeFi) and supports over 3,500 exchanges, wallets and other accounts, including Swyftx!

The software seamlessly deciphers complex data from all of your exchanges and wallets, including any DeFi and NFT activity, automatically categorising transactions for tax purposes. Once all of your transaction data is imported, you can access tax reports that can be passed to your accountant or used to file directly with the ATO via myTax.

The platform goes beyond simple calculations, offering many product features, including smart reconciliation that learns as you go, direct smart contract integrations, tax-loss harvesting tool, customisable reports and much more.

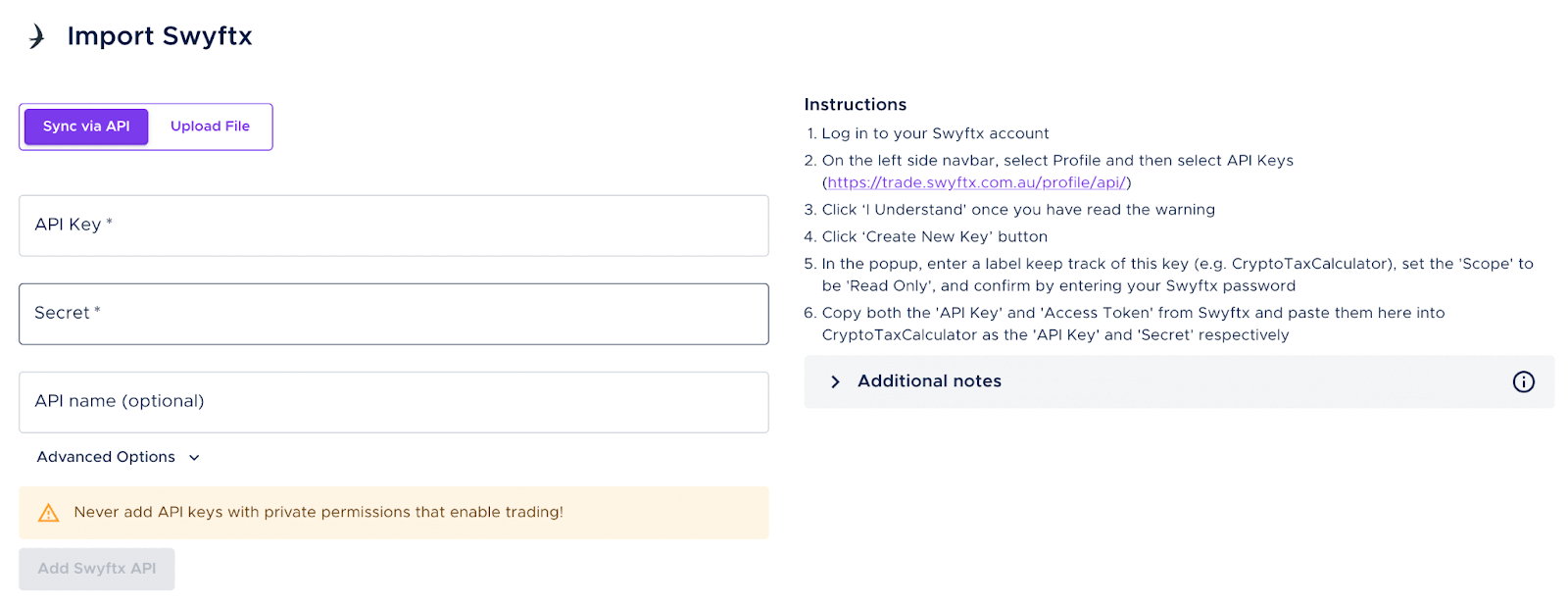

How to import your Swyftx transactions into Crypto Tax Calculator?

To import your Swyftx transactions into the Crypto Tax Calculator platform, follow these simple steps:

- Start by visiting their website here and create a free account by clicking ‘Start for free’ in the top right corner.

- Once you’ve created your free account, you can navigate to the ‘Integrations’ page and search for ‘Swyftx’. Click on the Swyftx logo that appears.

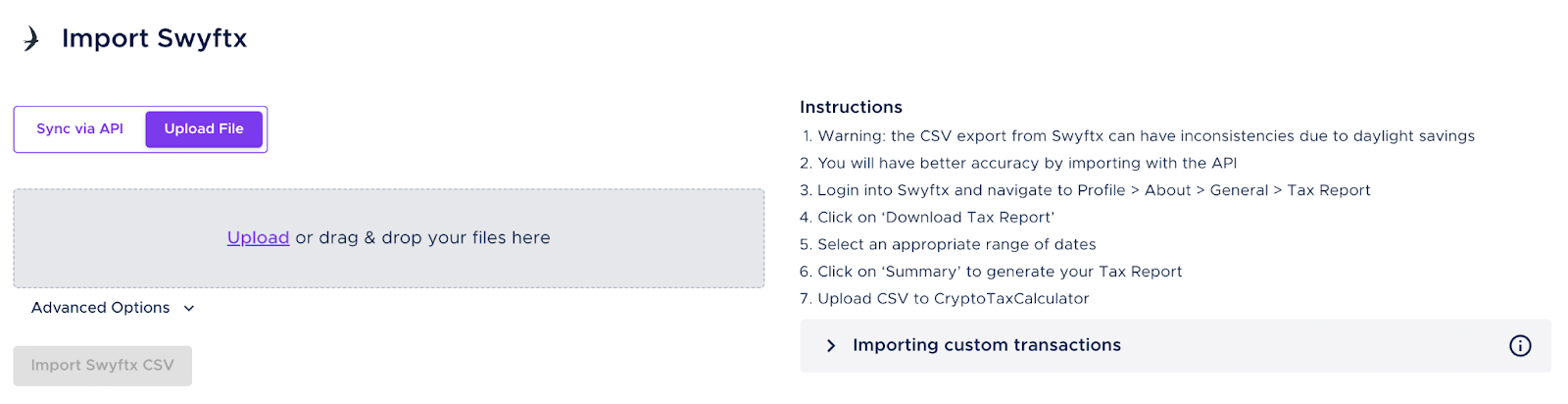

- You’ll find two options for importing your Swyftx data. You can choose either option and simply follow the instructions which appear on the right-hand side.

Option 1: Import your data via API keys

Option 2: Import your data via CSV files

Remember to import data from any other wallets or exchanges you have, including ones that are no longer used as they may hold important taxable information for your transactions. Once all your data is imported, head to the ‘Transactions’ page, where you’ll find a comprehensive overview of your crypto activity. The ‘Review’ page will highlight any necessary actions you need to take to reconcile your transactions.

After reviewing your transactions, you can generate a range of tax reports on the ‘Reports’ page. These reports can be shared with your accountant or directly filed with the ATO via myTax.

As part of Swyftx’s partnership with Crypto Tax Calculator, the team at CTC is offering a 30% discount off the first year of your subscription.

You can start by visiting their website here and using the promo code SXAU30 at checkout to claim your discounted subscription.* Offer ends 31 October 2025.

*Eligible for first-time users only

Summary

When it comes to filing your crypto taxes, being aware of critical dates and choosing the right filing method is crucial for compliance and accurate reporting. Whether you decide to file manually, hire a professional accountant or use crypto tax software like Crypto Tax Calculator, each approach has its upsides and downsides.

Consider your transaction complexity, volume and budget to determine the most suitable method for your crypto tax filing needs. Remember, proper tax compliance is essential in the evolving landscape of crypto taxation, as tax authorities are increasingly focusing on enforcing tax regulations in this space.

In the next and final section, we will explore some key factors to consider when filing your crypto taxes, as well as review a checklist of what to do to prepare for tax season.

Get 30% off all Crypto Tax Calculator plans* using code SWXAU30

Crypto Tax Calculator is the official tax partner of Swyftx and is an Australian-made crypto tax solution built to handle everything from exchange trading to complex on-chain activity.

Claim offer now

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Course rewarded

Course rewarded

Article read

Article read