Managing crypto taxes can be a nightmare, given the complex nature of digital assets and the evolving regulatory landscape. However, there are various strategies and options available to crypto users in Australia to help manage their tax obligations. In this chapter, we’ll explore some of the key factors to consider when managing your crypto taxes and discuss several strategies that could be considered in relation to your taxes.

This course is for educational purposes only and should not be considered tax or financial advice. You should seek out the help of an accountant to obtain advice.

Holding cryptocurrencies for more than 12 months

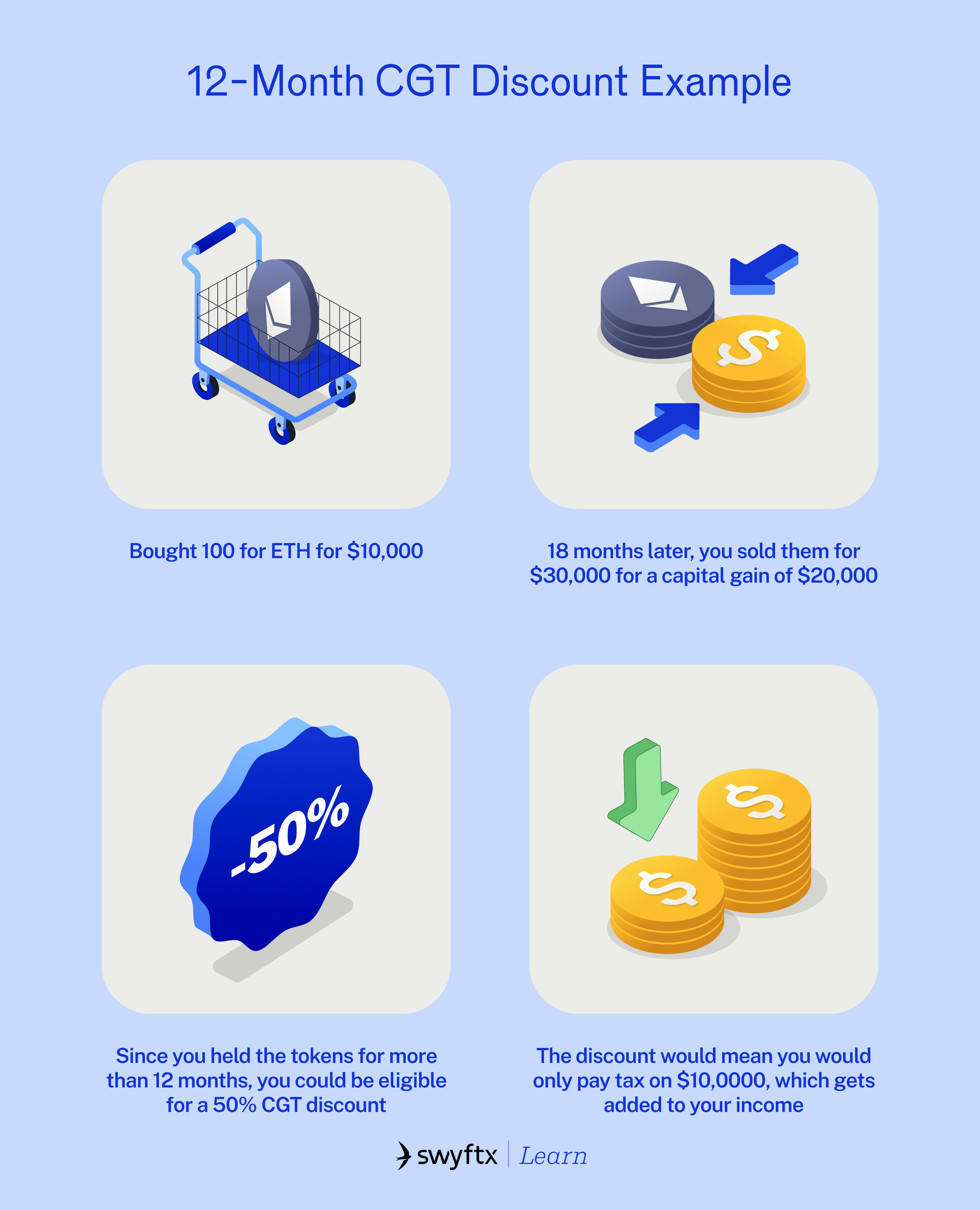

One of the most important factors to consider when managing your crypto taxes is the duration of holding your digital assets. In Australia, if a taxpayer holds a cryptocurrency for more than 12 months before disposing of it, any capital gains made upon disposal may be eligible for a 50% discount under the capital gains tax (CGT) rules. This means that only 50% of the capital gain will be included in the taxpayer’s assessable income, which can result in a lower tax liability.

Fictitious example:

- Suppose you are an Australian taxpayer who purchased 100 Ethereum tokens for $10,000. After holding the tokens for 18 months, you sell them for $30,000.

- Acquisition Cost: $10,000

- Selling Price: $30,000

- Total Capital Gain: $30,000 – $10,000 = $20,000

- Since you held the Ethereum tokens for more than 12 months, you are eligible for the CGT discount. The discount allows for a 50% reduction in the capital gain for individuals.

- Discounted Capital Gain: $20,000 x 50% = $10,000

- Therefore, the capital gain subject to CGT would be $10,000.

- This discounted amount would then be included in your taxable income for the financial year in which the sale occurred.

Donating cryptocurrencies to registered charities

Another strategy to consider is donating cryptocurrencies to registered charities. In Australia, if an individual donates a cryptocurrency to a registered charity, they may be eligible for a tax deduction equal to the market value of the donated cryptocurrency at the time of the donation. To be eligible for the tax deduction, your donation must be made to organisations that are registered with the Australian Charities and Not-for-profits Commission (ACNC) and have a status as a deductible gift recipient (DGR). This means any donations made to social media or crowdfunding platforms won’t be tax deductible unless the recipient organisation holds DGR status. To check whether the organisation you are donating to has DGR status, you can enter the ABN or name in the search box of the ABN Lookup website this page or use the advanced search.

Choice of inventory method

The inventory method you choose can also impact the calculation of capital gains or losses when disposing of cryptocurrencies. In Australia, the ATO allows taxpayers to choose a reasonable accounting method, with the most common inventory methods used beingFirst-In-First-Out (FIFO), Last-In-First-Out (LIFO), and Highest-In-First-Out (HIFO).

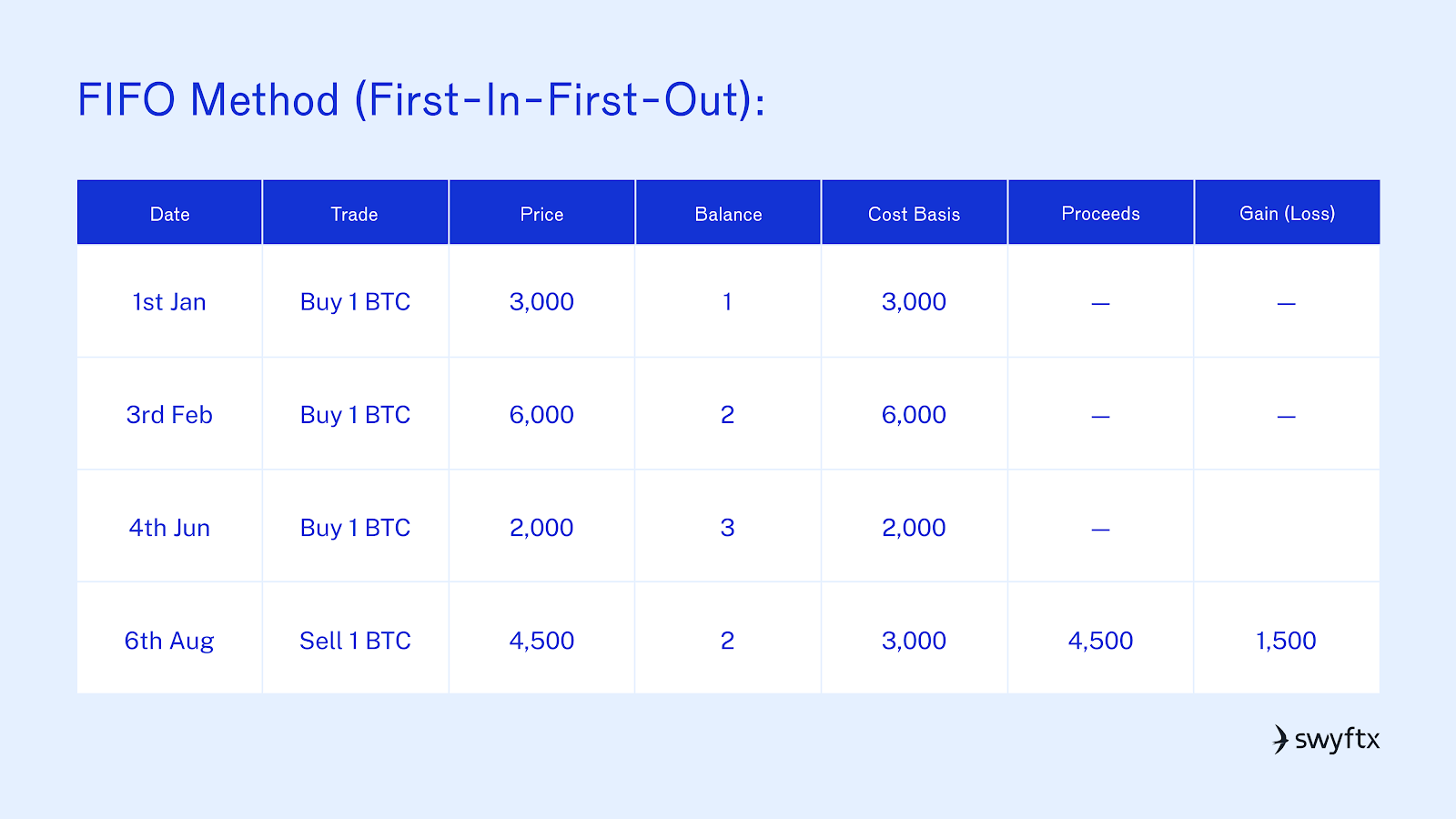

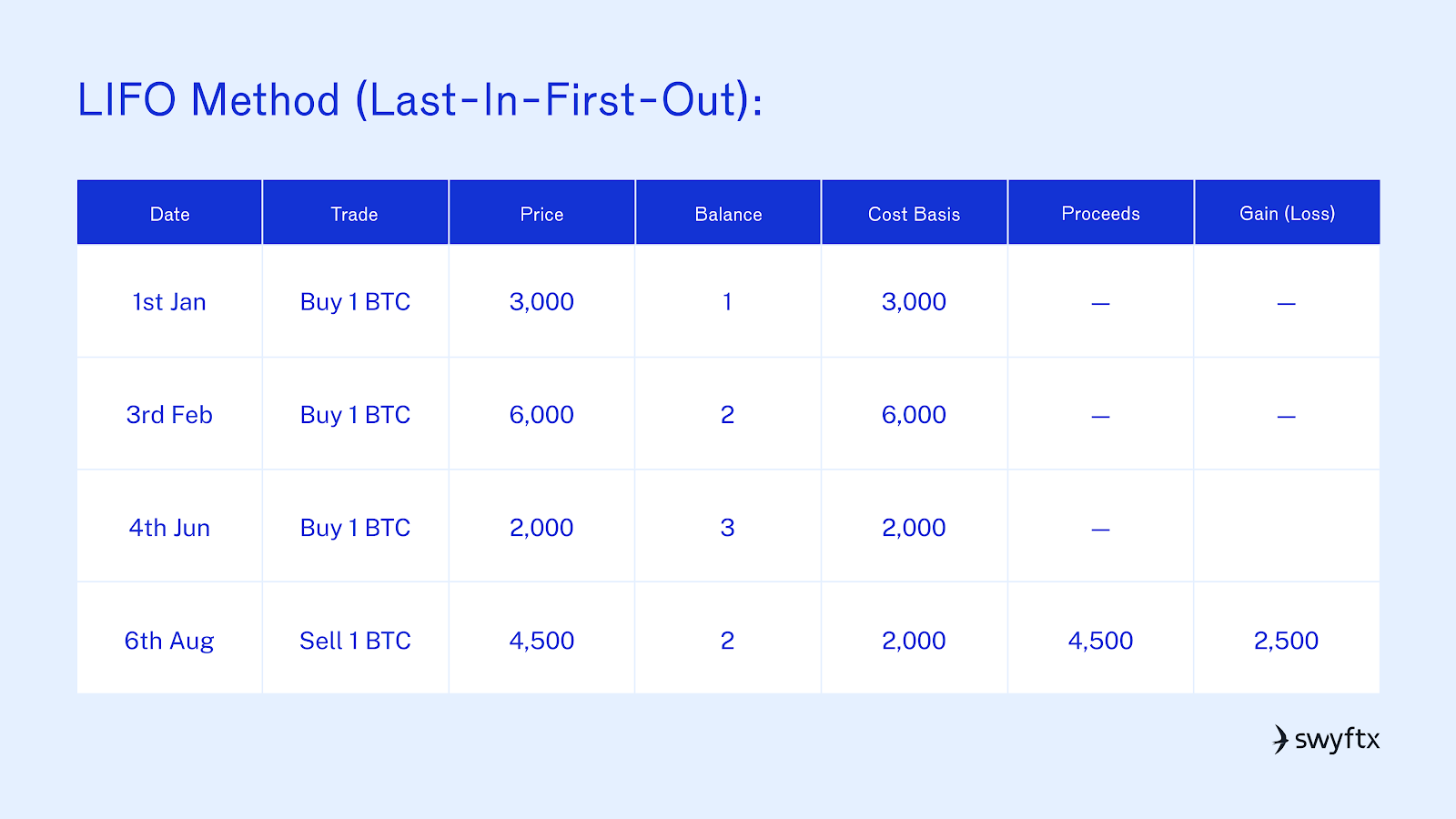

FIFO assumes that the cryptocurrencies acquired first are the ones sold or disposed of first. LIFO assumes the opposite (i.e., the last coins acquired are the first ones sold), while HIFO selects the coins with the highest cost basis and disposes of them first.

It’s important to note that once a method is chosen, it should be consistently applied for all transactions across all years (i.e., if you pick FIFO, you must stick to FIFO for all the years thereafter). Employing specialised crypto tax software (like Crypto Tax Calculator) can help you efficiently analyse and compare the outcomes of different inventory methods in order to understand the potential tax outcomes.

Fictitious example :

Let’s see an example where choosing one inventory method over another may result in a different tax outcome.

Say you are an investor who has bought and sold Bitcoin (BTC) multiple times over a specific period. We will consider four transactions in each inventory method example.

FIFO Method (First-In-First-Out):

LIFO Method (Last-In-First-Out):

In the above example, you sold the last purchase of BTC on the 4th June with a cost basis of $2,000, leading to a gain of $2,500.

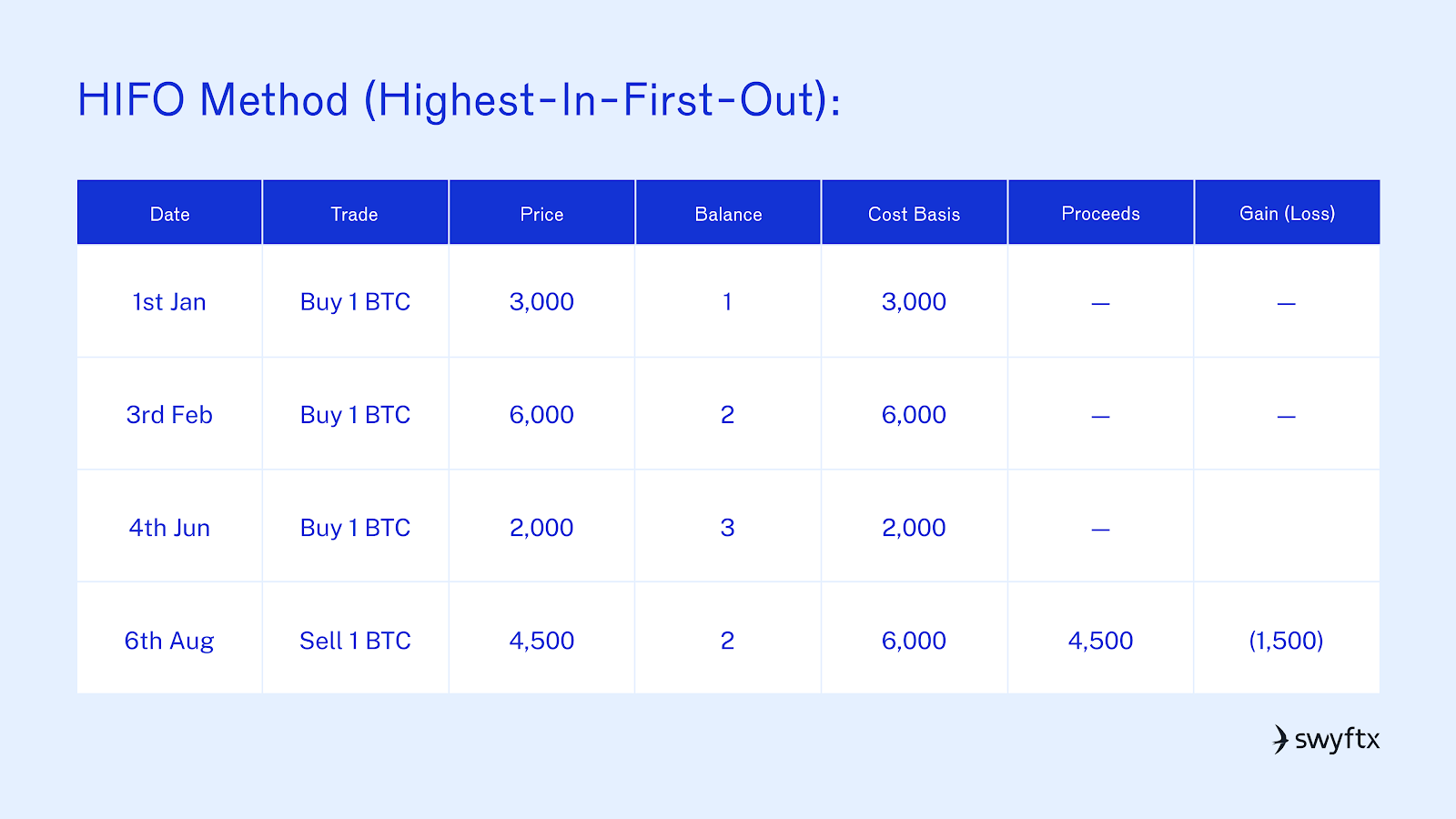

HIFO Method (Highest-In-First-Out):

In the above example, you sell the highest-priced purchase of BTC on the 3rd Feb with a cost basis of $6,000, leading to a loss of $1,500.

Wash sales

A wash sale refers to a situation where an investor strategically sells an asset at a loss (taking advantage of market downturns) only to buy it back almost immediately. This allows the investor to maintain their original asset position while creating an opportunity to claim a capital loss for tax purposes.

As expected, tax authorities are well aware of wash sales, and on the 27th of June 2022, the ATO issued a warning to investors not to engage in asset wash sales. The ATO does not define specific timeframes for a wash sale, but it ultimately depends on the taxpayer’s intention of the sale. If it is perceived that the taxpayer is intentionally generating artificial losses with the sole purpose of obtaining a tax advantage, the ATO would consider this as a wash sale.

Summary

As you’ve witnessed in this chapter, effectively managing crypto taxes requires careful consideration of the many different factors and options which can help you understand your tax outcomes. We’ve seen strategies ranging from holding your cryptocurrencies for more than 12 months, all the way to the use of tax loss harvesting strategies.

In order to prepare for tax season, you can follow this checklist and tackle your crypto taxes effectively and efficiently:

- Gather all wallets and exchange accounts

- Make a list of all wallets and exchanges used, including international and self-storage wallets

- Record all wallet addresses you control, including MetaMask, Ledger, etc

- Export complete transaction history from all of your accounts

- Collect all transaction data, including:

- Buys and sells

- Swaps (crypto to crypto)

- NFT purchases and sales

- Airdrops, staking, yield farming etc.,

- Wallet transfers

- Ensure timestamps are correct and values are represented in AUD

- Tag each transaction type: capital gains vs. income (if using Crypto Tax Calculator, this will be done for you)

- Determine capital gains and income

- Review short term and long term sales

- Calculate deductions or losses

- Generate tax report

- Lodge your tax return

- Keep records and backups of all documents

Get 30% off all Crypto Tax Calculator plans* using code SWXAU30

Crypto Tax Calculator is the official tax partner of Swyftx and is an Australian-made crypto tax solution built to handle everything from exchange trading to complex on-chain activity.

Claim offer now

Quiz

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Course rewarded

Course rewarded

Article read

Article read