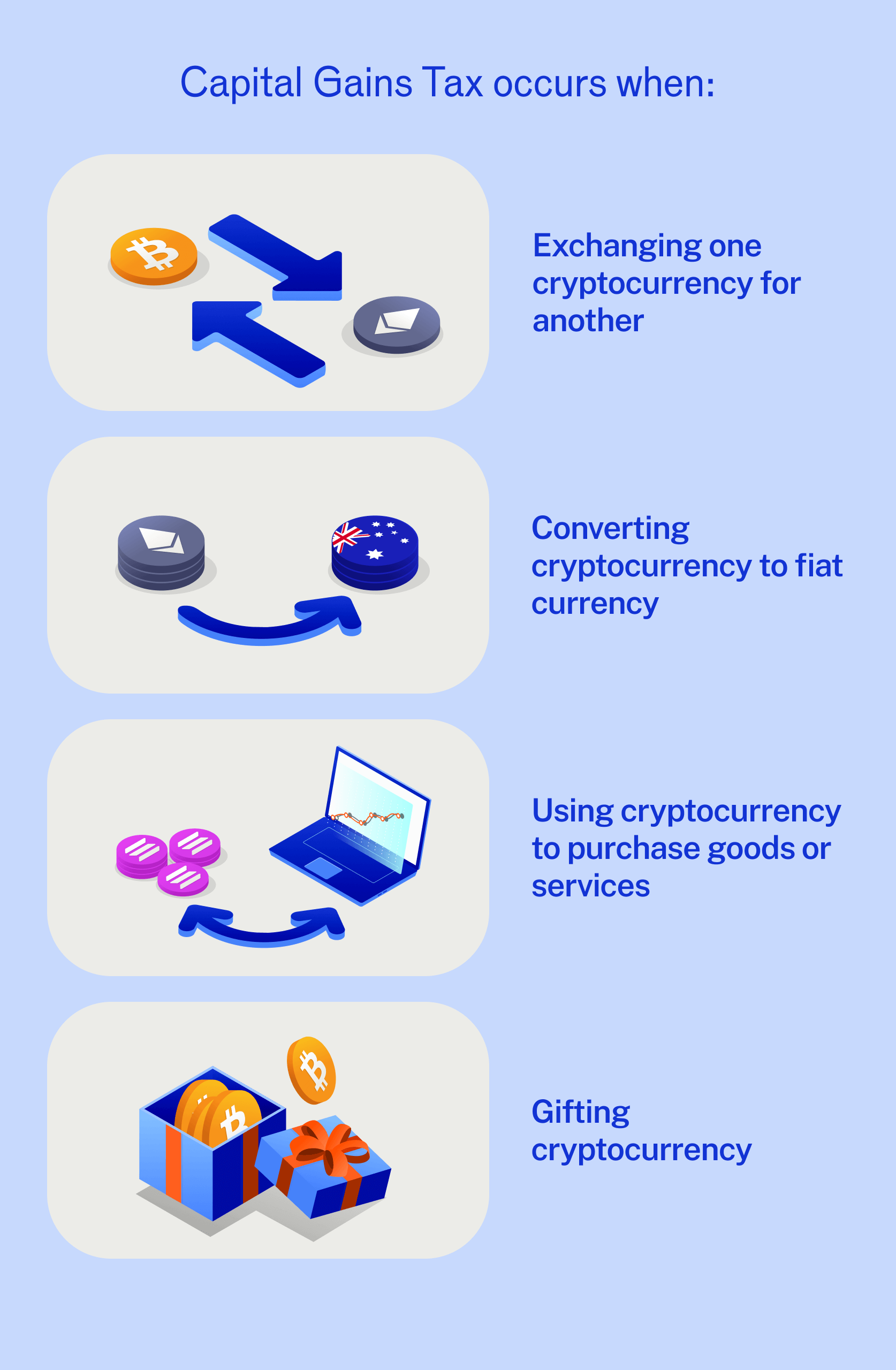

When does Capital Gains Tax (CGT) apply?

Capital gains tax can apply when you dispose of your cryptocurrencies. The ATO has released comprehensive web guidance on what is considered a disposal event, but some common actions can include selling crypto for fiat, swapping crypto to crypto and trading NFTs for crypto. In addition, more complex actions like paying gas fees or interacting with smart contracts can also be considered CGT events.

Let’s look at some fictitious examples to better understand how CGT may apply in different scenarios:

1: Crypto to crypto swaps:

- Suppose you bought 1 Bitcoin for $10,000 on Swyftx

- You later exchanged it for 10 Ethereum when the value of Bitcoin was $20,000.

- This exchange is a CGT event. You would be liable for CGT on the capital gain made from Bitcoin’s appreciation in value. The ATO requires you to calculate the Australian dollar value of both the acquisition and disposal events and report the capital gain accordingly.

- Capital Gains = Proceeds – Cost Base = $20,000 – $10,000 = $10,000

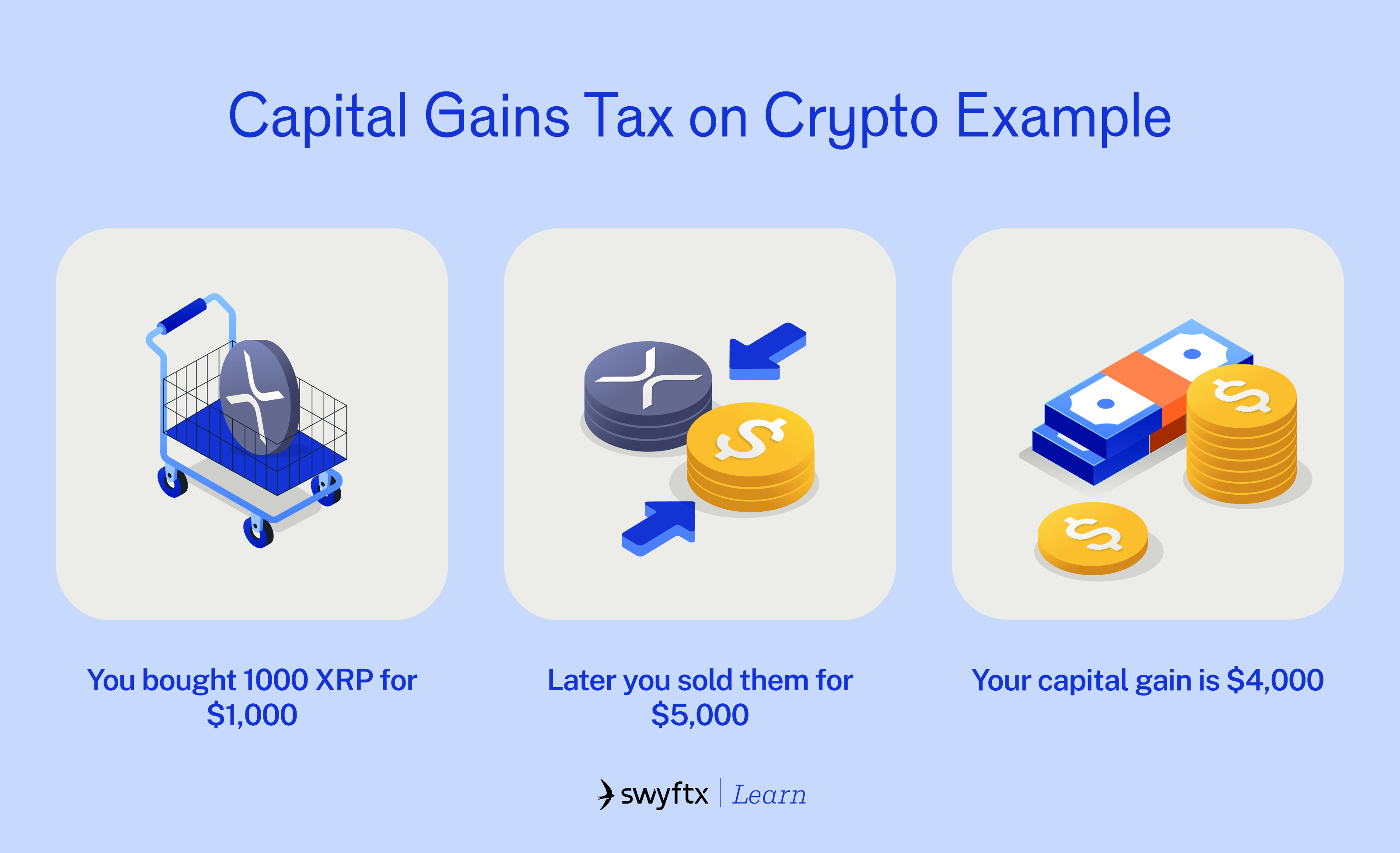

2: Selling crypto to fiat:

- Suppose you bought 1,000 XRP for $1,000 on Swyftx

- When the value of XRP later increased, you sold your 1,000 XRP for $5,000

- In this scenario, the capital gain is determined by subtracting the acquisition cost ($1,000) from the sale proceeds ($5,000). The resulting capital gain is then subject to CGT.

- Capital Gains = Proceeds – Cost Base = $5,000 – $1,000 = $4,000

Fees

Typically, when purchasing or selling crypto, a user will incur a fee. The ATO provides guidance on how crypto transaction fees are treated under CGT rules. For individual investors, the fees are generally included in the cost base when acquiring an asset and deducted from the capital proceeds when disposing of a crypto asset. This is illustrated in the simplified example below:

- You buy 1 ETH for $1,000 and pay a .01 ETH fee.

- Price of 1 ETH = $1,000

- Fee of .01 ETH = .01 x $1000 = $10

- Total Cost Base = $1,000 + $10 = $1,010

- You sell 1 ETH for $2000 and pay a .01 ETH fee

- Proceeds from sale = $2,000

- Fee = .01 x $2,000 = $20

- Total proceeds reported on your taxes = $2,000 – $20 = $1,980

Fees paid in fiat (such as AUD) are treated in a similar way, and are also added to the cost basis and deducted from the proceeds, the same way as crypto fees.

When CGT might not apply immediately

It’s important to note that certain crypto transactions may not trigger an immediate CGT event.

These can include:

- Transferring crypto between wallets you own: Transferring crypto from one wallet you own to another is generally not a CGT event. However, if any fees are paid in crypto as part of the transaction, those will likely be CGT transactions, subject to taxation.

- Receiving crypto as a gift: If you receive cryptocurrency as a gift, CGT does not apply at the time of receipt. However, if you later dispose of the gifted cryptocurrencies, you may be liable for capital gains tax on the difference between the market value when you received the gift and the disposal value.

- Donating to charity: Donating cryptocurrencies to eligible charitable organisations may qualify for tax deductions; therefore, these disposals may be tax exempted.

- Personal use: If you acquire cryptocurrency for personal use or consumption (e.g., buying a cup of coffee with Bitcoin), you may not be subject to CGT as long as the value is less than $10,000. However, the Bitcoin can’t have been bought for investment purposes and then used for transactions. This may be difficult to differentiate, and you should talk to your accountant before relying on this as the ATO has very strict criteria to avoid people gaming the system.

- Purchasing crypto with fiat: Simply buying cryptocurrency with fiat currency is not a taxable event. The asset does not become subject to taxation until it is later disposed of. The ATO has strict criteria for this rule, including that the crypto was not acquired primarily for investment purposes. Determining if an asset meets the personal use criteria can be complex, and seeking professional advice is recommended.

In the next section, we will explore the taxable implications of mining and staking cryptocurrency.

Get 30% off all Crypto Tax Calculator plans* using code SWXAU30

Crypto Tax Calculator is the official tax partner of Swyftx and is an Australian-made crypto tax solution built to handle everything from exchange trading to complex on-chain activity.

Claim offer now

Next lesson

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Course rewarded

Course rewarded

Article read

Article read