Bitcoin (BTC) is often regarded as the ‘king’ of cryptocurrency being the original cryptocurrency, with the highest market capitalization but altcoins have started to make their mark in the market with different use cases and strong performance metrics. The Bitcoin Dominance index shows Bitcoin’s reign in the crypto space, which can provide insight into how assets have performed.

This guide will explain ‘Bitcoin Dominance’, the factors that affect it, and how this information could impact cryptocurrency trading decisions.

What is Bitcoin Dominance

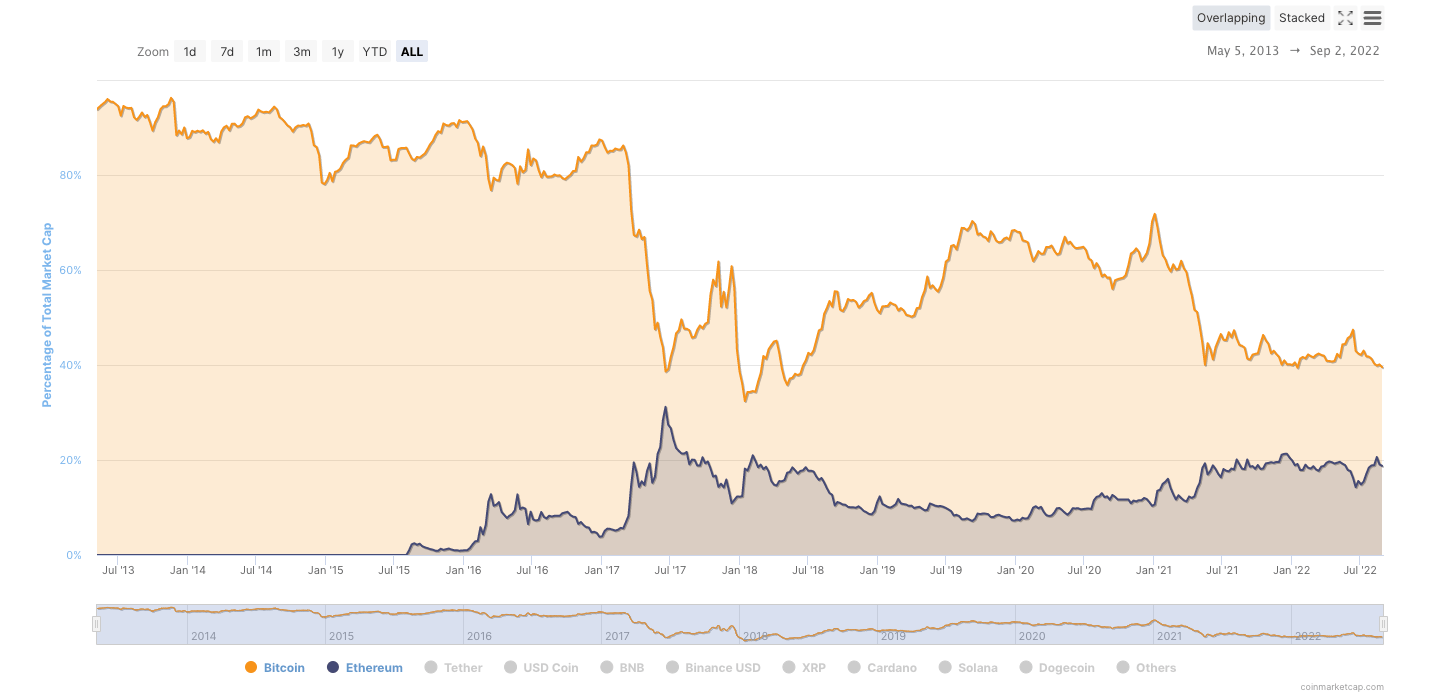

Bitcoin Dominance, also known as the Bitcoin Dominance Index/ratio, is the percentage that Bitcoin makes up of the total cryptocurrency market capitalization. This ratio can be calculated by dividing Bitcoin’s market cap by the total market cap. Generally, if the BTC dominance index increases, it means that Bitcoin is performing better than altcoins. The opposite is also true; if the index decreases, altcoins are outperforming Bitcoin. Monitor bitcoin dominance on Trading View.

Bitcoin’s long-term dominance can be attributed to the fact that it was the first ever cryptocurrency. The growth of Bitcoin paved a way for the entire crypto market.

Factors that affect Bitcoin Dominance

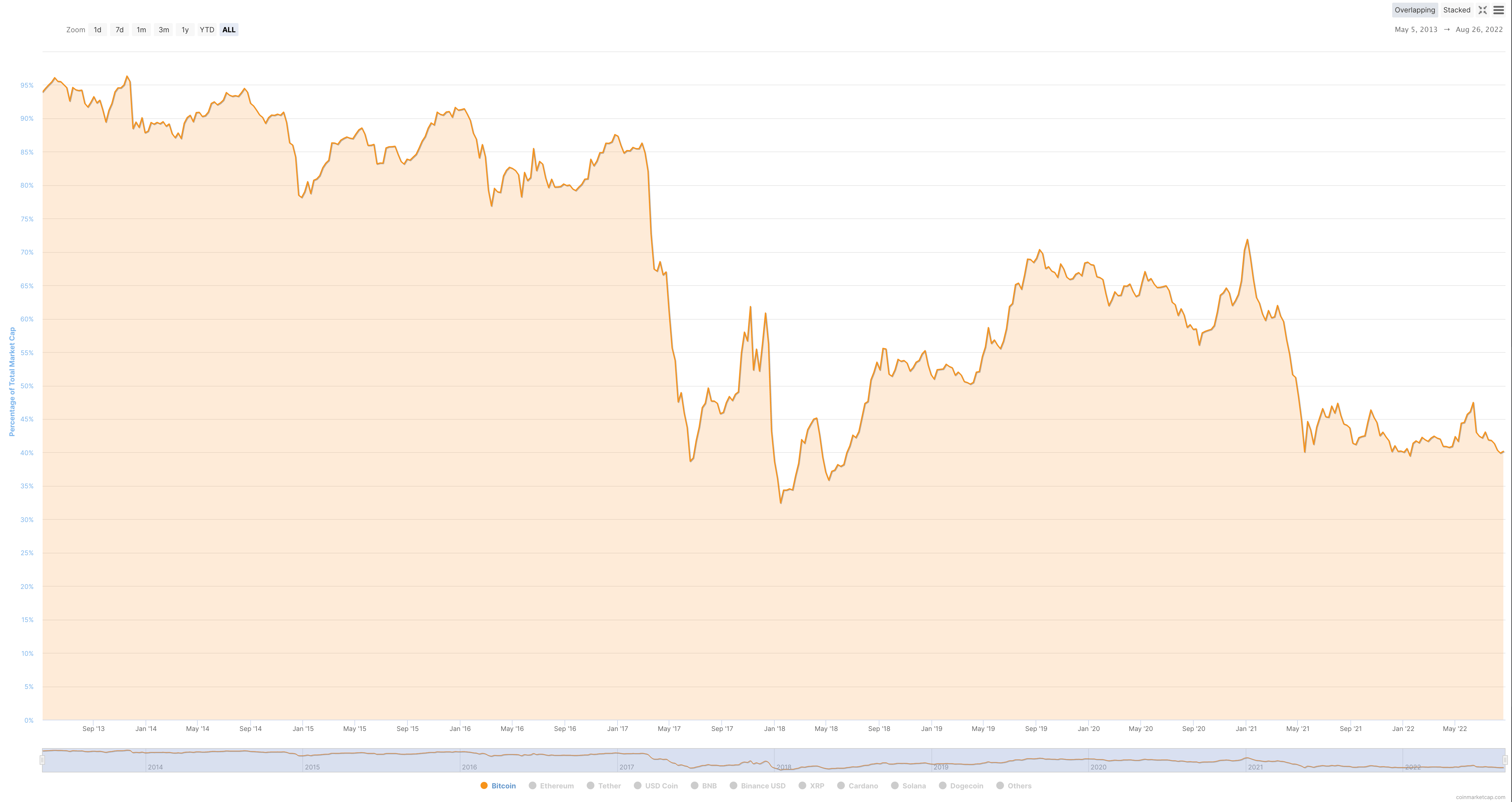

BTCs dominance index used to hover above 90% in the early stages of cryptocurrency. In recent years, Bitcoin’s dominance index has been slowly declining as seen in the chart above. This can be attributed to factors such as the emergence of new altcoins, current trends, and market movements.

New Altcoins and ICOs

The total crypto market cap is being diluted with new cryptocurrencies injected into the market. Emerging altcoins are also providing new use cases such as smart contracts, NFTs, metaverse gaming and DeFi, which attracts a wider range of investors from different backgrounds.

Bitcoins’ price is already comparatively high to other cryptocurrencies, and the rate of growth has seen to be steadily decreasing. Altcoins are relatively new, and some have seen rapid growth with extreme price increases. This has attracted investors that are attempting to capitalize on newer offerings with higher rates of growth by purchasing altcoins in the hopes of them going parabolic. This strategy does however present further risks.

Initial coin offerings (ICOs) are campaigns to generate funds for a new project entering the market. Some coins have seen major pumps during an ICO, which can make them an attractive short-term investment for some investors. The opposite can also occur, given the risky nature of ICOs.

Did You Know?

ICOs can place significant pressure on the BTC dominance index as they can absorb a large amount of capital. The biggest ICO based on funds raised is EOSIO (EOS), raising over $4 billion USD within a year.

Recent trends

2021 gave rise to many crypto trends which captured a significant amount of market capitalization. Non-Fungible Tokens (NFT) exploded in 2021 with heavy ties to metaverse gaming. According to a report by blockchain data company Chainalysis, the total market capitalization of NFTs exceeded $40 billion USD in 2021.

Meme coins also were also popular in 2021, with Dogecoin and Shiba Inu surpassing $88 billion USD and $40 billion USD respectively. Both coins are sitting within the top twenty cryptocurrencies at the time of writing.

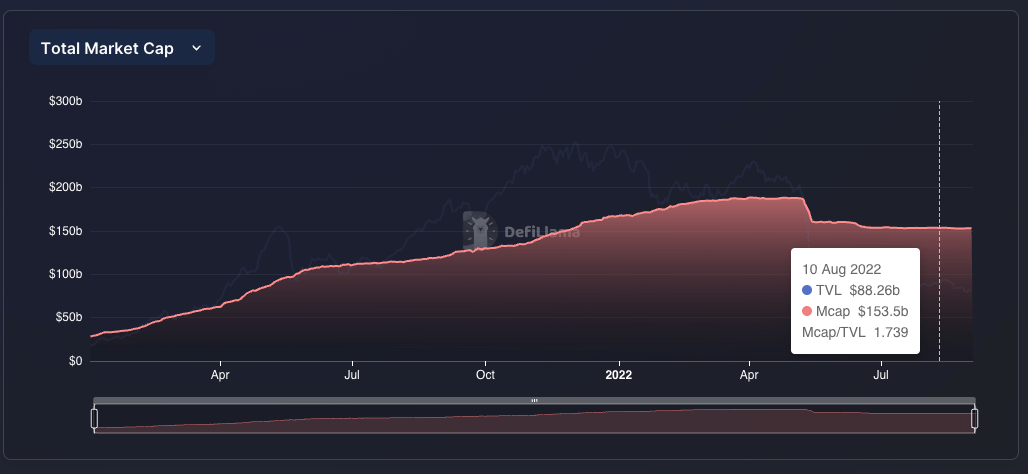

The world of decentralized finance (DeFi) introduced an avenue for crypto investors to earn passive income by holding or locking up crypto assets. These passive income techniques include yield farming and staking which are done through decentralized applications such as PancakeSwap and Uniswap. According to DefiLlama; the total value locked (TVL) in DeFi assets almost reached $200 billion USD in late 2021.

Key Takeaway

The growth of crypto opens new avenues and creates never seen before use cases that garner mainstream attention and build hype, which turns into market trends. Emerging trends can attract new and existing investors, which historically causes Bitcoin dominance to decline.

Market conditions

The market condition can affect the Bitcoin dominance ratio in a few ways. Stablecoins are cryptocurrencies that make up a significant portion of the total market capitalization. They are designed to maintain value equal to a fiat currency through the backing of real-world assets.

During bear markets, a convenient way for investors to hedge against dropping prices without having to convert to fiat money is to move funds from volatile assets like Bitcoin and non-stablecoin altcoins into stablecoins. Subsequently, investors often like to move funds into Bitcoin and other riskier assets during bull markets in order to capitalise on positive trading opportunities.

Warning: Stablecoins are designed to maintain value whilst maintaining the benefits of cryptocurrency. However, stablecoins are not the same as the government-backed fiat currencies they aim to mimic and are not guaranteed to be safe as they may lose their peg to the associated currency. UST, an algorithmic stablecoin depegged from the US dollar and has not recovered since.

Bitcoin Dominance signals

Altcoin Season

‘Altcoin season’ is a period where altcoins are outperforming Bitcoin. The Bitcoin dominance index may hint at an altcoin season when it’s trending down, whilst the total crypto market cap is on an uptrend. However, as with all metrics, there are a number of different reasons that changes in the index could occur. Some investors may look to diversify their portfolios during this period, in order to gain exposure to other cryptos with potentially higher growth rates.

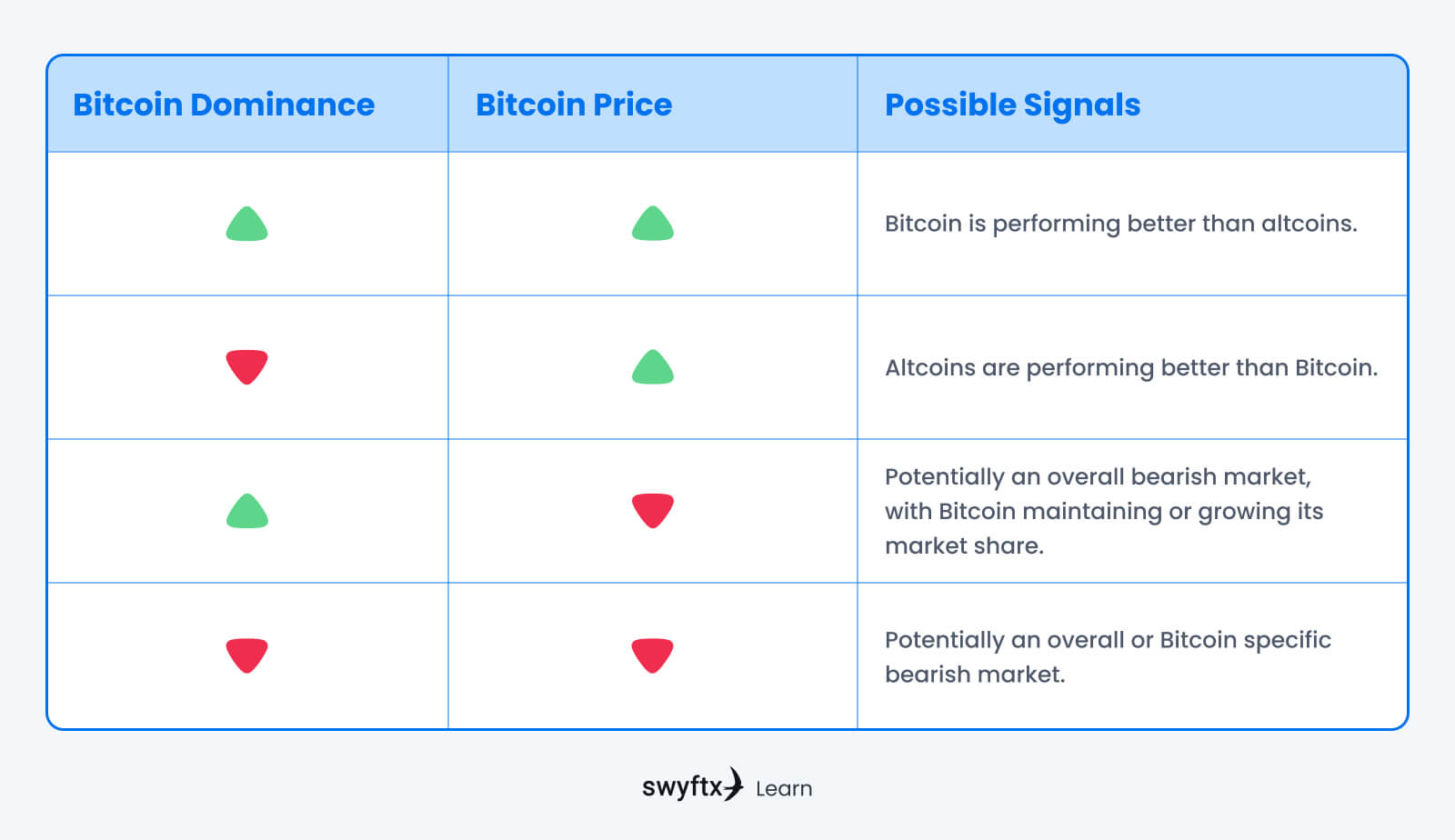

Using Bitcoin Price

The price of Bitcoin can also be used alongside the Bitcoin dominance to show trends in Bitcoin or altcoins. As with most technical indicators, the matrix below isn’t concrete but suggests some potential outcomes. This can be something to consider when choosing which asset to invest in. Given the volatile nature of cryptocurrency, these indicators may be present, but it may not mean that any signal is going to remain true. This table is provided for educational purposes only and should not be taken as investment advice.

Special considerations

The Bitcoin dominance index is used more for determining which assets are performing better, rather than indicating a suitable time to enter the market. Historically, the overall crypto market has shown tendencies to follow the price of Bitcoin, so if the indicator shows BTC’s dominance dropping, it does not necessarily mean it is the right time to buy altcoins.

As with all technical indicators and signals, Bitcoin dominance should never be solely used to make trades. Experienced traders would utilise multiple trade signals to give themselves optimal entry and exit strategies.

Will Bitcoin lose its dominance?

Up until 2017, Bitcoin consistently hovered around 90% dominance in the crypto market. However, in 2017, Ethereum reached its highest percentage of total market cap at 30%, the closest it has ever been to toppling Bitcoin, whilst Bitcoin fell below 40%.

Ethereum is the second biggest cryptocurrency in terms of market capitalization. Outside of a payment currency, the Ethereum blockchain has developed a lot more use cases since its launch, such as smart contracts, NFTs, and becoming a major platform supporting decentralized applications.

The Ethereum Merge; a highly anticipated upgrade to Proof of Stake, has now gone live. This calibre of upgrade has never been attempted with any blockchain and has the potential to revolutionise the cryptocurrency space.

Did You Know?

Environmental impact is important to consider, as Tesla halted using Bitcoin as payment due to its enormous carbon footprint. Ethereum’s transition to Proof of Stake has reduced energy consumption by around 99.95%.

Summary

The BTC Dominance index helps investors understand Bitcoin’s and altcoin’s overall performance, which traders can use to make more informed trading decisions. Bitcoin dominance can be affected by market condition, emerging altcoins, and current trends. It is uncertain if (or when) Bitcoin will lose its dominance in the cryptocurrency market, as Ethereum’s many use cases and plan for the future aim to provide value to the ecosystem.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.