2024 promises to be a rollercoaster of innovation, regulatory shifts, and market dynamics that could reshape the landscape of digital currencies. Join me as I dive into what I’m watching this year, from a rotation back into ETH, new stablecoin designs, breakthrough games and much more.

Key Takeaways

- Ethereum could recapture attention thanks to several upcoming catalysts

- Stablecoins could reach a new all-time high.

- Crypto gaming may capture mainstream users with games that are genuinely fun to play.

- Australia could receive regulatory clarity, but the U.S. may struggle to find bi-partisan support. Will a big DeFi platform be the next to face an enforcement action?

- L2s make significant steps towards decentralisation, NFTs and digital identity come into the limelight and Solana partially ships Firedancer.

Last year, I dived into my 2024 preview, explicitly focusing on Bitcoin. It appears to be a landmark year for the largest cryptocurrency, and with so many headwinds, it deserves a post all for itself!

This post will focus squarely on the rest of the crypto ecosystem!

So, let’s dive in!

#1 Ethereum’s Next Big Upgrade—Will It Recapture Attention?

Prediction: We see a rotation back into ETH following a string of catalyst events, such as a new network upgrade to reduce L2 costs, re-staking narratives and the market front-running the ETH ETF.

ETH vastly underperformed the market last year, and I cannot help but notice ETH sentiment is, anecdotally, very bearish.

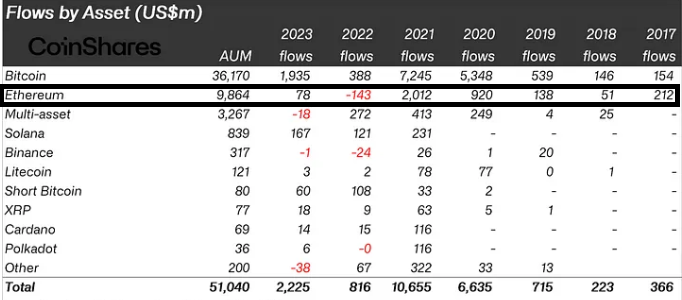

Looking at CoinShares Fund Flows Report, institutional interest in ETH in the last two years was lacklustre, with money flowing into other cryptocurrencies.

2023: Digital Asset Fund Flows Annual Report (Source: CoinShares)

With multiple catalysts for ETH, is a rotation back into ETH on the cards?

The most significant catalyst is Ethereum’s next upgrade, ‘Dencun’, scheduled for March 13. It aims to drastically reduce Ethereum’s scaling solution costs, making fees on L2s (e.g. Optimism) much cheaper (~5x).

Other ETH catalysts

Outside of the upgrade, many other catalysts could spark this rotation back to ETH:

ETH ETF front-running

ETH could be next in line for a spot ETF. Although I remain quietly cautious, BlackRock CEO Larry Fink’s positive words on an ETH ETF could fuel a movement to front-run the next big ETF launch. This is gaining traction, with Bloomberg ETF analysts estimating a “60% chance” of approval.

Will stablecoins help fuel a narrative towards crypto’s first ‘organic’ bond?

Exciting new projects like Ethena will launch, leveraging ETH yield to back a crypto-native stablecoin.

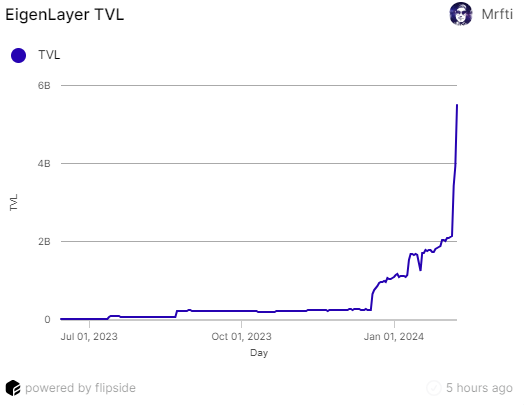

Re-staking driven by Eigenlayer token launch

Borrowing ETH security could spark new demand for ETH and increase the amount of ETH “locked”, reducing sell-side pressure. As of February 9, $1.4B worth of ETH has been deposited into Eigenlayer, with over $5.5B including all staked ETH variants.

Source (Flipside via @Mrfti)

#2 New Stablecoins Designs & Increasing Usage In Commerce

Prediction: Stablecoins set a new record high for market cap, experience an influx in new designs and increased usage in commerce.

Stablecoins increase usability

Stablecoins are the backbone of the crypto economy. We’ve seen a bottom of stablecoin market cap, ending its 18 monthly consecutive declines late last year with a substantial uptick.

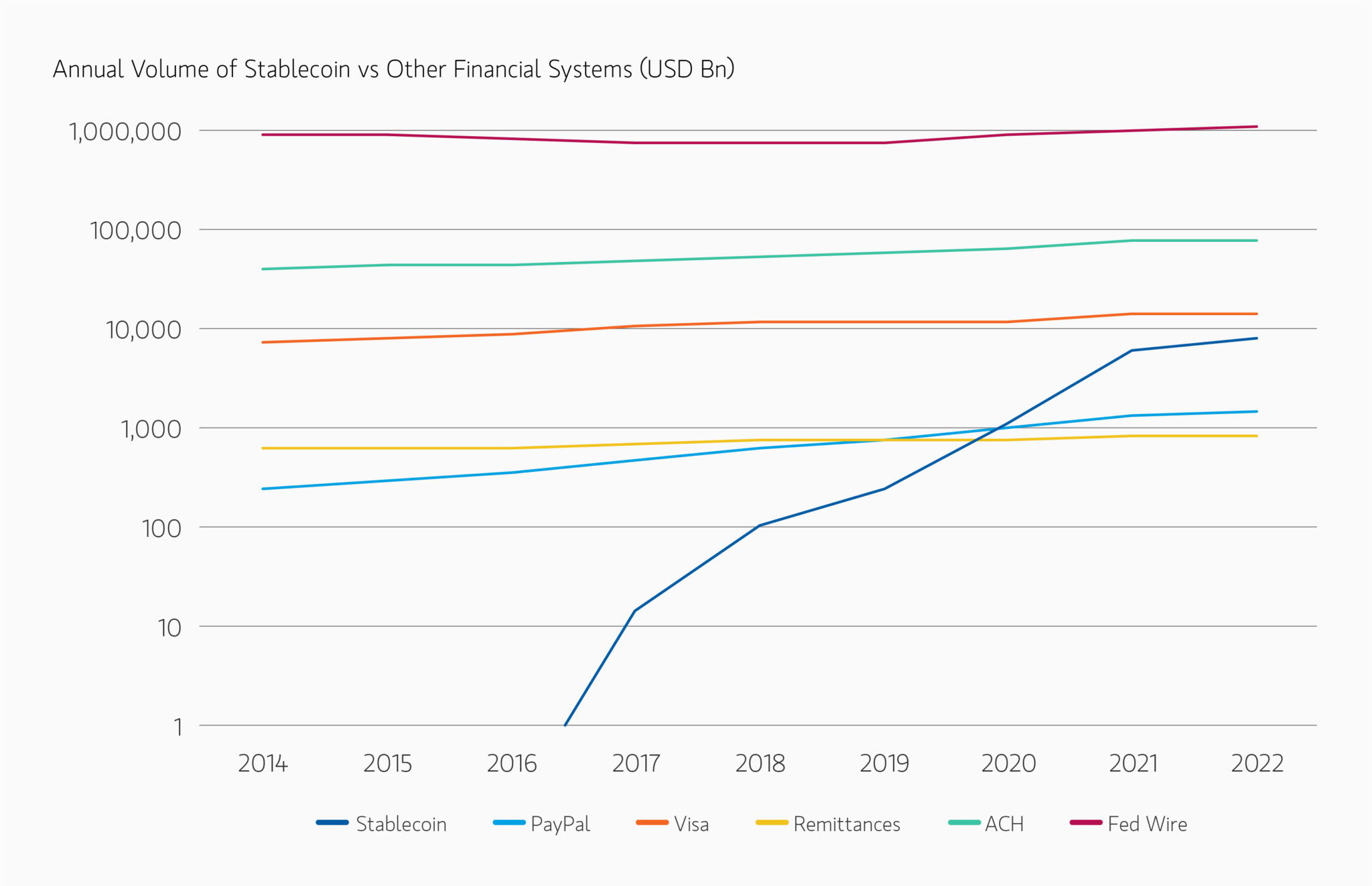

The graph below shows the disruption stablecoins have had on global financial rails, a trend I expect to continue.

Stablecoin Volumes Compared to Existing Financial Systems (Source: Morgan Stanley via Nic Cater)

With more jurisdictions passing or working on stablecoin regulation (Such as Singapore, UK, Hong Kong and Europe), I expect stablecoins to become increasingly used in e-commerce.

New stablecoins designs

I’m also expecting to see an influx of new stablecoins hit the market:

- Yield-bearing stablecoins: Mountain Protocol launched last year to provide a regulated yield-bearing stablecoin.

- Crypto native-tied stablecoins: Ethena is set to use Ethereum’s staking rate to power its upcoming USD.E stablecoin.

#3 Banks To Continue Re-entering Crypto

Prediction: We see an Australian bank turn on pilot crypto services and enter crypto custody.

Last year, European banks took steps to enter crypto custody and provide crypto services. I dived more into these developments in our newsletter last year—it’s a big deal because many people want to get exposure to cryptocurrency but via their traditional banking services.

Will we see Australian banks enter crypto again?

Although major Australian banks such as Commonwealth Bank cancelled their crypto pilot amid the bear market, this was not due to a lack of interest but driven by a lack of clear regulation.

While Commonwealth Bank paused crypto trading, other big Australian banks are following the trend of European banks and continuing to dip their toes in the water.

- ANZ made history in March 2022 when it minted its first A$DC stablecoin, becoming the first Australian bank to create a stablecoin.

- National Australia Bank (NAB) introduced its AUDN stablecoin on Ethereum in 2023.

I’m watching NAB very closely. NAB formed a partnership in late 2023 with custody provider Zodia and mentioned at AusCryptoCon that they would be rolling out a pilot program in early 2024.

Read: Insights & Takeaways From Our Action-Packed Weekend at Aus Crypto Con

#4 Crypto Gaming Finally Arrives

Prediction: The first crypto-native game breaks through into traditional gaming.

Crypto gaming remains at an exciting juncture. With billions of investments in crypto gaming, we’re finally starting to see these games eventually come to market.

I expect over the next 24 months, hundreds of new Web3 games launch, and, most importantly, they will be so fun to play they break into the mainstream gaming world.

One game that is vying for this spot is Illuvium. It opened its second game beta in 2023 on the Epic Store and remains on track for a launch sometime this year.

Other games are also ramping up development, such as Shrapnel (recently went live on the Epic Games store in early access), Off The Grid becoming the first crypto game on Xbox and 2021 crypto darling Axie Infinity, who quietly launched a new evolution feature to their NFTs.

For more, see our deep dive into five smaller games to watch in 2024.

Read: Web3 Game Launches To Follow In 2024

A crossroads

There is still a significant barrier, with the go-to game hubs Steam and Epic Games taking two very different approaches to blockchain-based games.

- Epic Games is pro-crypto, adding 20+ crypto games.

- Steam, the market leader, took the opposite approach, banning all NFT and blockchain-based games.

Meanwhile, mobile games, representing 50% of total video game revenue, are seeing a similar crossroads.

- Apple, like Steam, has a hardline approach to crypto games and NFTs.

- Like Epic Games, Google has turned pro-crypto, introducing a new policy last year to allow NFTs in games and apps, setting the groundwork for more NFT and crypto-native games launched for Android users.

#5 Will Australia and the U.S. finally receive market clarity?

Prediction: Clarity doesn’t come until 2025 for the U.S., but Australia gets a major crypto policy announcement. A top 3 DeFi platform becomes public enemy #1.

It’s been the topic on everyone’s lips… when regulatory clarity?

2023 proved to be a slow year for the U.S., lagging the rest of the world for updated cryptocurrency regulations.

However, there is a significant push to regulate the industry; last week, the U.S Treasury Secretary pushed for more legislation in 2024.

There is a glaring need for more clarity in the market, but I’m sceptical regulation passes, considering it is an election year in the U.S and will the U.S more divided than ever.

Will we see a blockbuster new enforcement action?

In the U.S government’s settlement against Binance, they specifically called out DeFi and other cryptocurrencies that were not abiding by U.S. law.

Why? The SEC just cleared a new rule to change the definition of a ‘dealer’, meaning DeFi protocols and liquidity providers operating in the U.S. could face new compliance measures.

Most cryptocurrency protocols and projects have either left the U.S or do not serve U.S citizens, with the exception of industry leader Uniswap.

Will we see a showdown between the SEC and Uniswap Labs sometime this year?

As for Australia, we should expect the Australian Treasury to release its draft legislation on crypto by the end of the year.

Bonus

Dive into the bonus content below for those interested in other predictions and narratives I’m watching!

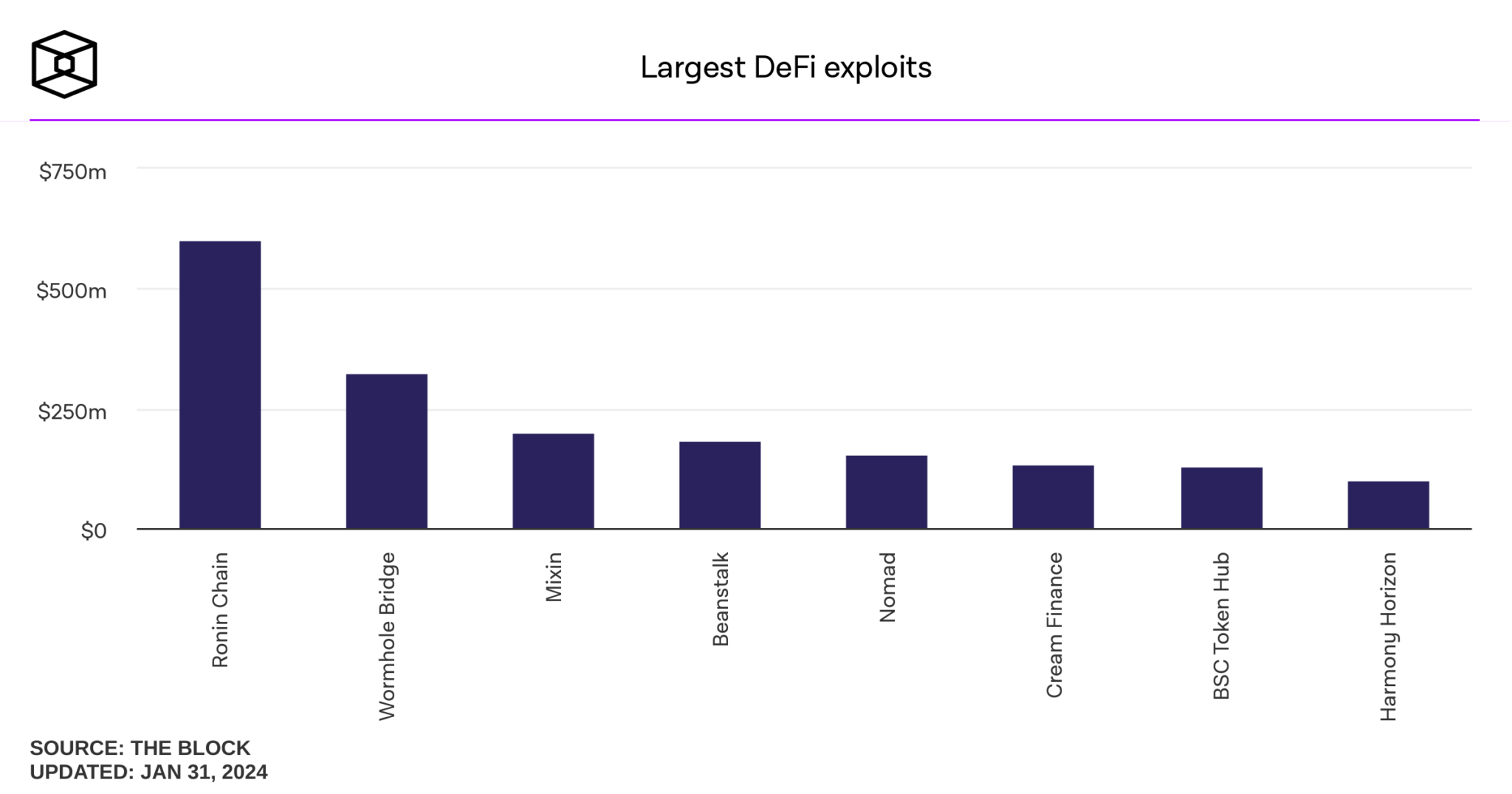

Security challenges

Prediction: We see a top 3 crypto exploit sometime this year.

As cryptocurrency adoption grows, so does the total value on public blockchains. This is fantastic for adoption but comes with a major downfall: the incentive to hack or attack increases. This is a good thing (as it battle-tests and hardens security), but there will be some collateral damage.

Solana ships Frankendancer in 2024

Prediction: The full implementation of Solana’s new validator client doesn’t come until 2025.

Solana’s Firedancer remains a significant catalyst and core upgrade to strengthen Solana’s network further. I expect an initial limited implementation called ‘Frankendancer’ to arrive in the year’s first half, but it remains doubtful we’ll see a full implementation this year.

Read: Is SOL Running Out Of Steam?

SocialFi stumbles

Prediction: We see crypto social media struggle to become the “breakthrough” consumer use case.

Farcaster has taken the crypto market by storm with innovative new ideas like “Frames”. Frames are just applications inside applications, meaning you never have to leave the app to mint, play or interact with external content.

This has soared Farcaster into one of the most widely used crypto applications. Although daily active addresses have increased to 30,000, Farcaster must show consistent activity over a longer period.

Will Farcaster follow the same steps as Friend.tech (the former SocialFi ‘it’ app of 2023)?

Digital ID & content verification is the killer use case for blockchain & NFTs

Prediction: Digital ID & NFT content verification make significant headwinds.

I expect public blockchains and NFTs to become solutions to the ongoing negative impacts of AI—for example, the loss of trust in what is “real”.

I’m expecting NFTs to come back in force this year, but not in the way you might think. Not as a speculative asset but as a means to restore trust and guarantee authenticity.

I’m watching whether these two themes merge and if NFTs as content verification become popular. Will we see more talk about using Digital IDs? Polygon ID could see significant adoption once a full rollout is realised.

L2’s journey towards decentralisation and adoption continues

Prediction: L2s make legitimate steps towards being more decentralised with the launch of multiple provers.

It’s no secret that L2s are not as decentralised as they would like.

A core part of this transition is launching independent ‘provers’—a prover verifies the network and activity to ensure everyone plays by the ‘rules of the game’.

Provers remain centralised, with either the L2’s foundation, core team or whitelisted actors having an outsized role. Optimism will launch its prover in 2024, and Polygon just released its prover, when launched, will mark a key milestone in decentralisation.

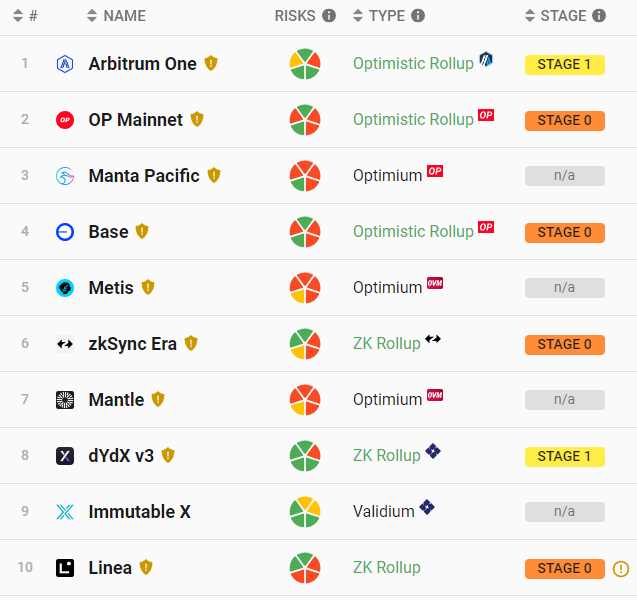

I expect a handful of L2s to transition to stage 1 rollups and exit stage 0.

L2 Rollups (Source: L2 Beat)

Thanks for making it to the end, and I look forward to hearing from members what you’re paying attention to this year.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.