Solana was one of the biggest winners last year, but is SOL running out of steam? Below, I argue why SOL could continue its climb higher in what could be another landmark year for the revitalised Solana ecosystem.

Key takeaways

- Despite SOL’s 920% rally last year, it may keep climbing in 2024 due to several upcoming catalysts.

- The main catalyst is the ‘Firedancer’ upgrade, the partial release of which is expected by the end of Q2.

- Others include an increased wealth effect caused by airdrops and the expected growth of decentralised physical infrastructure networks (DePIN), one of Solana’s flagship use cases.

- Notable risks to Solana include a heightened threat of attacks and increasing competition.

Why SOL Remains One To Watch

Solana was a major winner of 2023, with SOL rising by 920%. But has it run out of steam?

While this performance will be tough to repeat, I ultimately expect SOL to reach new heights and potentially break into the top 3 cryptocurrencies by market cap. Below are the five main reasons why.

- Release of Firedancer, the first iteration of which (‘Frankdancer’) is expected by the end of Q2.

- Increased wealth effect as more Solana-based projects tokenise.

- Continued adoption through a landmark stablecoin approval and increasing onchain usage.

- Market participants underexposed to SOL could fuel sustained buy pressure.

- The DePIN narrative gaining steam

I covered Solana extensively in 2023, explaining why Solana remains one to watch, and for the reasons above, it could continue this trend.

Firedancer: Solana’s Next Major Upgrade

It’s hard to overstate the significance of Firedancer, an upcoming upgrade that will introduce a new client that promises to vastly improve Solana’s infrastructure. (A client is basically a piece of software that runs Solana.)

Below are the three main benefits promised by Firedancer.

- It will help further decentralise Solana, making the network more resilient and durable.

- It will help scale the network through faster and more concurrent transactions.

- It will lower the cost of running a validator node.

Firedancer is largely being under-discussed outside of the Solana ecosystem. It might garner more attention if it were renamed and marketed more heavily, such as Solana 2.0—which is arguably what Firedancer is.

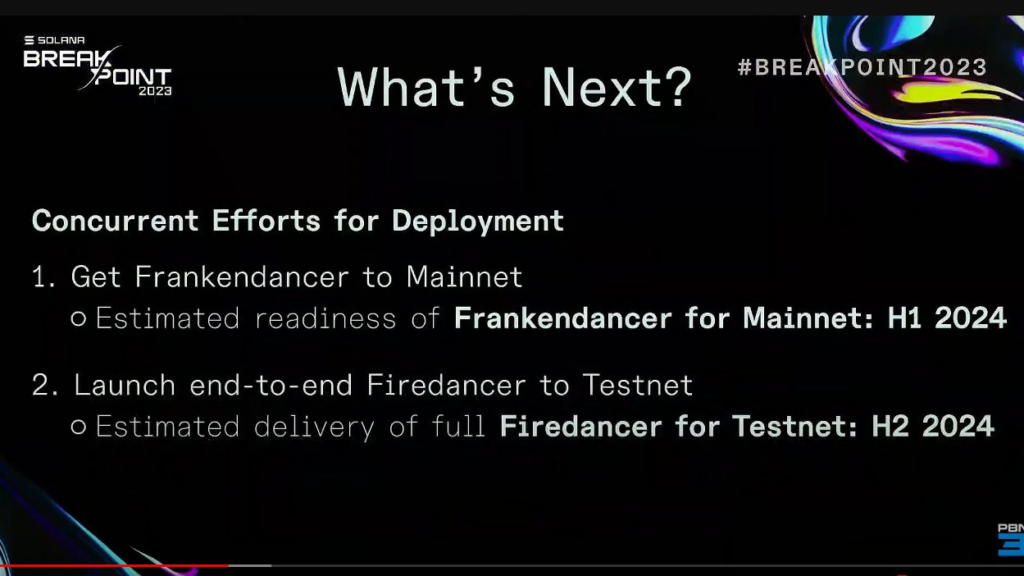

Release timeline: As per my Breakpoint breakdown, the mainnet release of Firedancer is set for the end of 2024 or early 2025, with an early implementation (i.e. ‘Frankendancer’) scheduled by the end of Q2.

Firedancer timeline (Source: Breakpoint 2023)

Increased Adoption & Legitimacy

Landmark Stablecoin Approval

Perhaps one of the most underreported positive news stories of 2023 was stablecoin issuer Paxos receiving approval from the New York Department of Financial Services (DFS) to expand to the Solana blockchain. In the announcement, Paxos touted Solana’s speed and low fees, detailing plans to debut a USD-backed stablecoin on the network on January 17.

Previously, the DFS had only allowed stablecoins to be issued on Ethereum, making this a symbolic step forward for Solana as it continues to build reputation and legitimacy.

Onchain Fundamentals Catching Up

Solana also is experiencing a substantial rise in onchain activity. Solana is setting new records for new active addresses and non-vote transactions.

As per Messari’s State of Solana for Q4 2023, Solana saw sustained quarter-on-quarter (QoQ) growth across many metrics in Q4, including average daily fee payers (102%), DeFi TVL (303%), average daily DEX volume (961%), and average daily NFT volume (359%).

Advances have also been seen in Solana’s developer ecosystem. There are now over 2,500 monthly active developers in the ecosystem and over 50% retention—meaning once they’re building in the ecosystem, they’re staying.

Wealth Effect

A wave of Solana-based projects are tokenising, reminiscent of the Ethereum ecosystem several years ago when Uniswap, ENS, 1inch, dYdX and many others launched tokens.

In the last few months, Pyth (PYTH) and Jito (JTO) tokenised and airdropped to early users. Jupiter (JUP) is another to have recently announced a token. Its airdrop at the end of January will be distributed to a large number of early Solana users.

And this is only just getting started. I’m expecting to see dozens of airdrops be announced by Solana-based projects in 2024.

These airdrops will likely generate significant wealth, a decent portion of which could stay within the Solana ecosystem and lead to additional buying pressure on SOL and other Solana-based altcoins or NFTs.

DePIN Narrative

Decentralised physical infrastructure networks (DePIN) is a sector that’s starting to gain momentum. It’s widely expected that this momentum will accelerate in 2024.

It may seem like jargon, but it is relatively simple. A handful of products use Solana and crypto token incentives to run infrastructure services. They believe a crypto-first approach allows them to offer competitive products.

Popular Solana DePIN projects include:

- Helium (HNT): Launched a U.S. nationwide $5 mobile plan. (Migrated hundreds of thousands of devices to Solana last year.)

- Render (RNDR): Migrated to Solana last year and saw significant speculation driven by AI hype.

- Hivemapper (HONEY): Mapping service, recently listed on Coinbase.

- Pocket Network (POKT): Middleware infrastructure provider officially integrated with Solana.

Is The Market Underexposed To SOL?

Solana is gaining greater adoption and legitimacy as a top cryptocurrency with staying power and one of the best general-purpose blockchains.

Looking at exchange-traded SOL products listed globally, Solana heavily lags Ethereum. As per CoinShares’ latest Digital Asset Fund Flows Weekly Report, SOL products have $750M in assets under management (AUM) compared to $11.1B for ETH.

If Solana continues to build legitimacy and advance in its mission to be a global state machine, allocations of SOL may start increasing. (In other words, will the typical set-and-forget portfolios of ‘only BTC’ or ‘BTC and ETH’ eventually become ‘BTC, ETH and SOL’?)

Is the market prepared for this possible shift? The above AUMs may suggest no.

Why It Could NOT Continue

Of course, there are risks and reasons why SOL may not continue rising. It has already bounced relatively high from its bottom of $8, and another market-wide correction is always possible.

There are two main risks with Solana: network risk and competitor risk.

Network Risk

Solana has surged into the top 5 and is now one of the biggest cryptocurrencies. As TVL increases, so will incentives to attack the network. Solana must ensure it can prevent significant attacks on the network from competitors looking to disrupt its network security or attackers looking to steal funds.

Any disruption of “uptime” would likely negatively affect SOL and undermine user confidence in the network.

Competitor Risk

There is a noticeable rise in competition from other high-performance monolithic blockchains. Examples here include Aptos (APT), Sui (SUI) and Sei (SEI).

Blockspace is becoming highly commoditised; no longer is performance or blockspace becoming an issue. There is a genuine risk that these new blockchains steal meaningful market share from Solana, which is why it’s so important to track onchain activity and other metrics.

A key competitive advantage for Solana remains large-scale integrations, greater decentralisation, dapps, adoption and significant UI improvements, which should help distinguish it from these newer blockchains.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.