7-day recap

During the recent week, both Bitcoin (BTC), Ethereum (ETH) and the global crypto market have continued to show signs of strength.

Bitcoin specifically has had its best-performing month since October 2021.

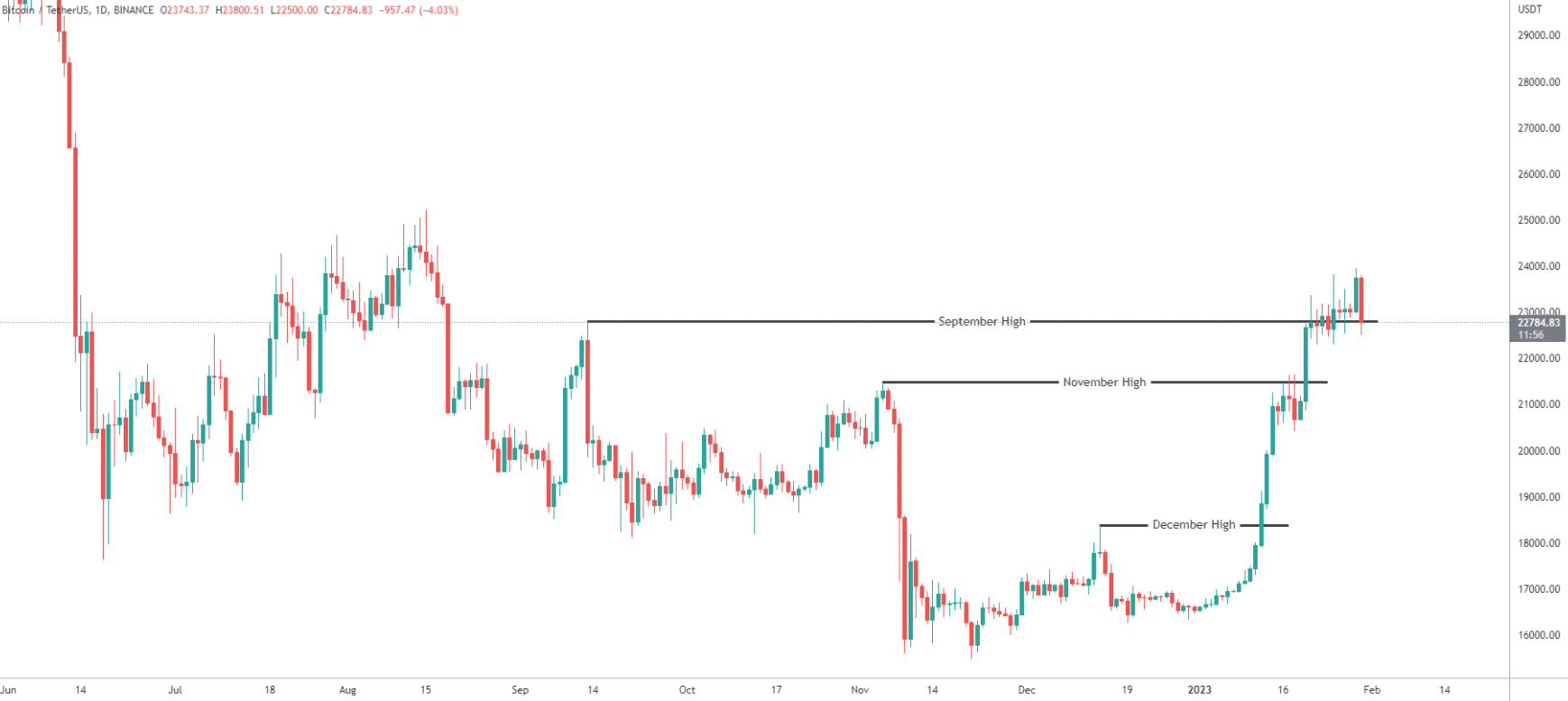

Looking at the charts, recent prices have surpassed monthly highs from September, November and December 2022. Also, BTC is now trading above pre-FTX fallout levels.

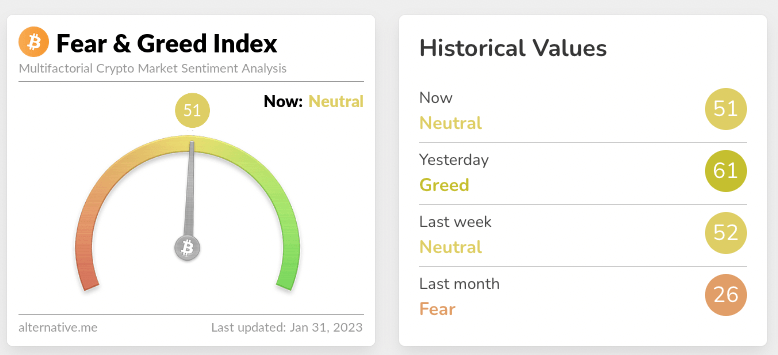

The Fear and Greed index reached a score of 61 this week, commonly categorised as “Greed.” This is the highest reading since November 2021, when Bitcoin hit it’s all time high.

According to the publishers, when the fear and greed index indicates “extreme greed” (75-100), this means the crypto market could be due for a correction. Conversely, a score of 1-24 indicates “extreme fear”, which again according to the Index’s publishers could be a buying opportunity. While we do not endorse this as an investment approach, it is an interesting metric to seek to understand the mood across the crypto space. Click the link below for more information on this index and how it is calculated.

Market outlook

It’s an interesting time to be writing about price, as it’s the first big macro news week of 2023.

The big-ticket news item is the FOMC where the US Federal Reserve will address its monetary policy stance and release the latest interest rates.

The Fed is expected to slow rate hiking to 25 basis points, which would increase interest rates from 4.50% to 4.75%. While it’s speculation to guess where this one is going to land, the key takeaway is that volatility in the crypto market is likely to follow this event, based on historical price action following similar FOMC meetings.

Coin Watch: Polygon (MATIC)

Despite the bear market, Polygon had a huge year in 2022, earning the title of Decrypts Crypto project of the year. The layer-2 network has been hitting win after win with continued technical development and its expanding list of mainstream partnerships.

Key partnerships

Polygon has continually made headlines over the last 12 months for their partnerships with huge global brands including the likes of:

- Starbucks

- Mercedes

- Meta

- Adobe

- Stripe

- The NFLLiverpool FC

The initiatives range from providing infrastructure to loyalty programs, NFT integrations and payment solutions.

Technical developments: Zk-rollup

Zero-knowledge (Zk) tech is a hotly anticipated solution to the scalability problems on Ethereum. It provides the functionality for large batches of transactions to be verified faster. Think about many transactions are ‘rolled up’ into one large batch. This in turn reduces costs and increases the speed and capacity of a network.

Polygon co-founder Sandeep Nailwal recently tweeted that an Ethereum-compatible ZK update will be launching soon.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.