7-day market recap

Bitcoin has cooled off after 4 consecutive green weeks, where it set a 6-month high and recorded its second-best January since its inception in 2009. It appears to have hit a ceiling around the weekly resistance level of $23-24k USD.

Last week, Bitcoin and the rest of the crypto market remained relatively steady as the US Federal Reserve raised interest rates by 25 basis points – a sign of a more ‘dovish’ stance by the Fed.

AI-based cryptocurrencies have consistently been outperforming the rest of the market thus far in 2023. The recent interest in AI looks like it may continue following Google’s recent announcement regarding the launch of their AI chatbot, positioned as a competitor to OpenAI’s ChatGPT. However, we have seen a drop in the price of AI-related cryptocurrencies in the last 24 hours, ranging from around –8% to –22% across those in the category within the top 500 cryptocurrencies by market capitalisation.

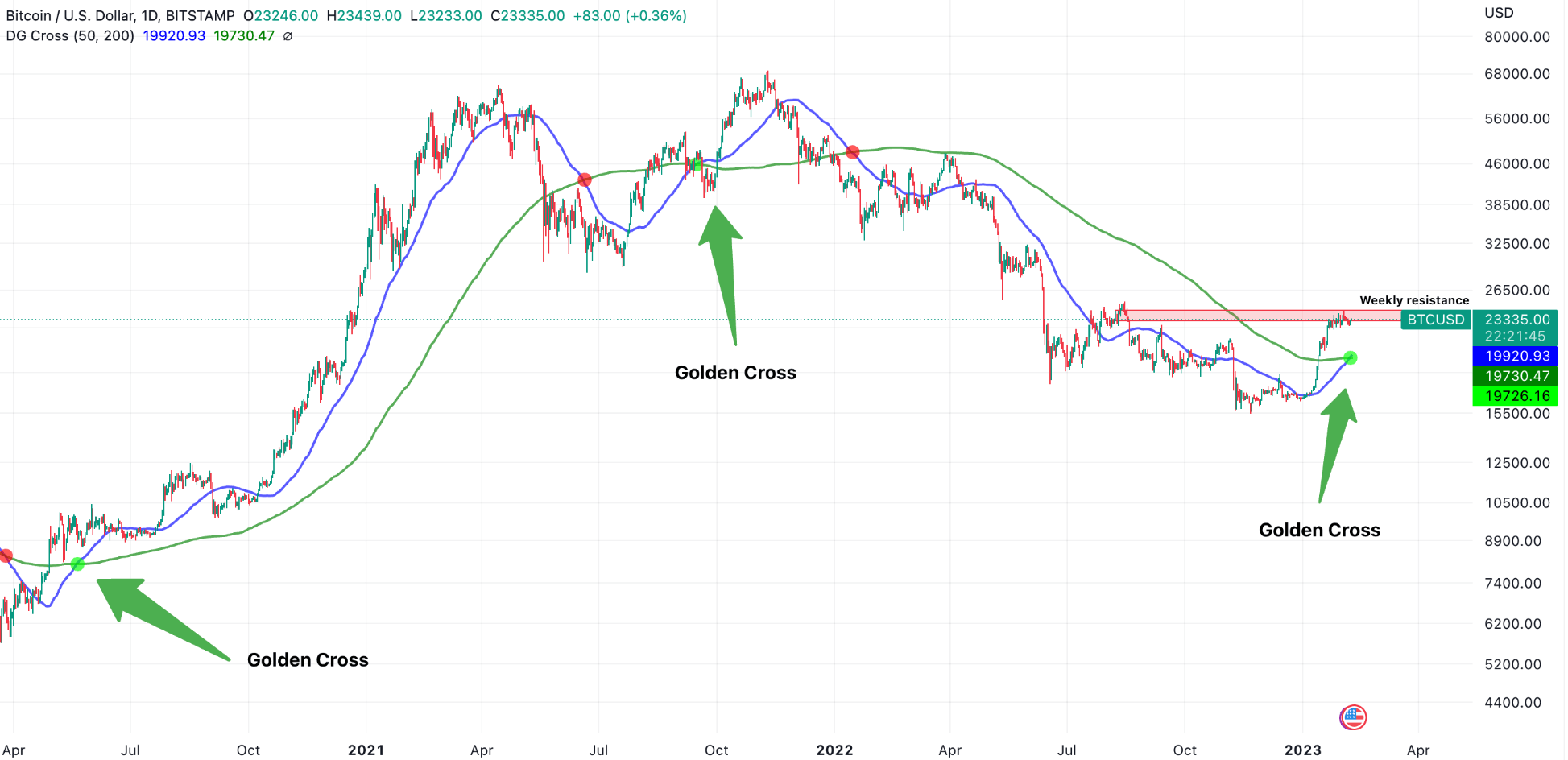

From a technical analysis perspective, both BTC and the S&P 500 triggered a ‘golden cross’ over the past week, this occurs when the 50-day moving average crosses above the 200-day moving average. For Bitcoin, this is its first golden cross since September 2021 and its 9th on record.

It’s important to note that not all previous golden crosses have been followed by an upswing in price. Click the link below for more details.

Market outlook

Looking ahead, the main macroeconomic announcement over the next few days will be the US Consumer Price Index (CPI) print on Tuesday night at 11:30 pm AEST. This is a major inflation data point and is used heavily by the US Federal Reserve for interest rate decisions.

US inflation has been in a downtrend since July 2022, and January’s release of positive CPI data was seemingly the catalyst for an initial upswing in market prices. The markets will be eagerly awaiting the data to see if the trend will continue.

The Federal Reserve has suggested that they won’t be looking to ‘pivot’ and cut rates in 2023, but Fed Chair Jerome Powell said in his speech after the recent FOMC meeting:

“We will continue to make our decisions meeting by meeting, taking into account the totality of incoming data and their implications for the outlook for economic activity and inflation.”

Coin watch – The Sandbox (SAND)

The Sandbox (SAND) has just agreed to collaborate on metaverse projects with the Saudi Arabia Digital Government Authority, stating they’ve signed a ‘memorandum of understanding.’

Saudi Arabia has shown significant interest in crypto and web3 in the past. The Saudia Central Bank (SAMA) hired a Chief of Crypto to lead its virtual assets and CBDC program. They’ve also been working on tokenising real estate and integrating blockchain technology into its healthcare system.

The collaboration is certainly an exciting development in the metaverse and gaming space and adds to the Sandbox’s growing list of partnerships including the likes of Playboy, Atari, Skybound Entertainment and CoinMarketCap.

SAND is currently down 89.44% from its highs in November 2021. Data from DappRadar shows that the platform is seeing approx. 400-500 unique active wallets interacting with the platform every day. This is significantly lower from its highs of around 4,500 daily users in February 2022, but that also follows the downtrend across the entire crypto ecosystem.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.