YTD recap

After a period of sideways movement and low volatility to finish off 2022, the new year has finally provided some fireworks.

Since the start of the year, Bitcoin has been on the charge, increasing by over 25% and hitting a 4-month high.

It is currently trading back within a channel similar to that of the market 6 months before the FTX fallout.

With almost three weeks of trending upwards, BTC has finally cooled off for a breather. The Relative Strength Index (RSI) went deep into overbought territory not seen since early January 2021. While the RSI has cooled, it’s still hovering above 70, which is traditionally considered as ‘overbought’.

Ethereum (ETH) has also had a strong start to the year, following a similar pattern to Bitcoin, currently sitting up 27% for the year.

Market outlook

Macro

As the US inflation data for December came in below expected at 6.5%, all eyes will be on the next FOMC meeting on the 2nd of February. The market will be eagerly waiting to see what the US Federal Reserve (Fed) has install for their next interest rate hike – with consensus currently being a 0.25% hike.

These significant data releases historically lead to volatility across the markets, including cryptocurrencies. Investors will be getting positioned based on what they predict the Fed will do, so the next couple of weeks should be interesting to see how markets prepare for the announcement.

From a technical perspective, with BTC now trading within the previous range – we have a clear range high around $22,500 USD and range low around $19,000 USD. These will both be key levels to keep an eye on over the coming weeks, with both levels historically acting as strong support and resistance.

Crypto market

The situation unfolding with Digital Currency Group (DCG) is one that could have a significant impact on the market.

DCG, a US-based venture capital firm with subsidiaries such as CoinDesk, Genesis, and Grayscale Investments, is currently facing financial difficulties that could have a significant impact on the crypto market.

The issues stem from its subsidiary, Genesis, which reportedly owes $900m USD to crypto exchange Gemini. Gemini had allocated user funds to Genesis to generate interest for its Gemini Earn feature.

A report by crypto-research firm Arcane Research has urged investors to pay attention to the ongoing financial distress related to DCG, as the outcome could result in the company being forced to liquidate its assets, including its large positions in GBTC and other Grayscale trusts, potentially leading to sell pressure on the open market.

Coin watch: AI Tokens

2023 is shaping up to be a big year for artificial intelligence (AI). We’ve seen several exciting developments in the space over the past few months.

One of the biggest is the release of OpenAI’s ChatGPT, a language processing model that is capable of understanding and responding to natural language inputs in a human-like manner. Adding to this, Microsoft are said to be in talks to invest up to $10b into OpenAI, firming up the strong belief in the future of this space.

The excitement in the AI space has found its way over to the crypto ecosystem. Recently we have seen an increase in price across several AI-related coins.

One of the top-performing AI coins, Fetch.ai (FET), has been on an incredible run. Since the November lows, FET has increased by over 350%.

Fetch.AI is a network built on the Ethereum blockchain, with a strong AI focus. The system allows for machine learning, deep learning, and other AI algorithms to be run on the network, making it possible for the network to learn and adapt to user behaviour and improve overall performance.

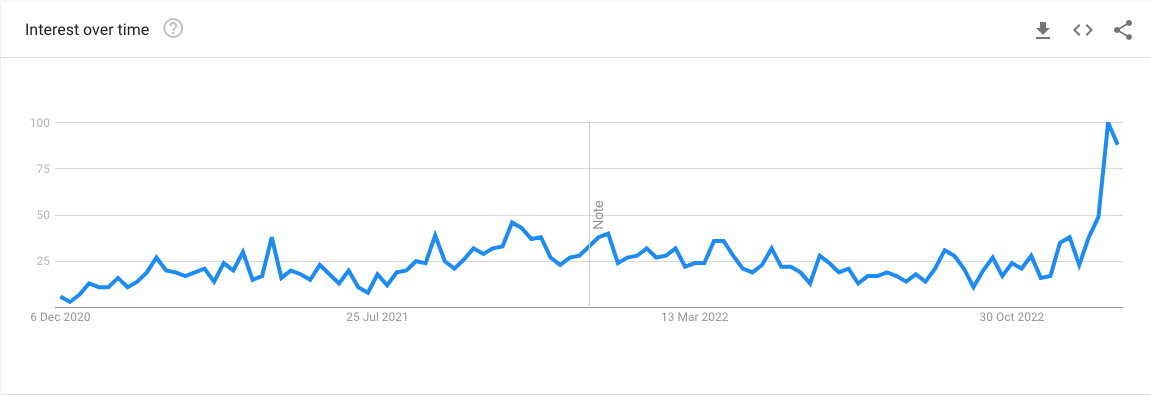

Another data point to confirm the currently strong AI narrative is the recent spike in interest in the Google search term “Crypto AI”. According to Google Trends, Crypto AI-related search terms have had a huge spike in volume, no doubt coinciding with the ChatGPT frenzy.

The AI space is an exciting and interesting area to watch in the upcoming year.

On top of FET, Swyftx currently offer other coins in the AI space, such as SingularityNET (AGIX) and Numeraire (NMR).

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.