A wave of new projects have recently raised capital to build on Bitcoin. Many of these should eventually launch tokens. This report explores why ‘building on Bitcoin’ is suddenly such a hot narrative and how you can gain exposure to this fast-growing space.

Key Takeaways

- Never before have so many new projects been building on Bitcoin. This is all thanks to a recent invention called BitVM, which should launch within the next few months.

- Expect dozens of these new Bitcoin-based projects to announce token airdrops this year.

- Stacks (STX) stands out as a leading layer 2 network on Bitcoin.

- As this trend gains momentum in this bull market, it will almost certainly attract grifters who will view it as an opportunity to make easy money.

- Three ways to get exposure range from the easy (i.e. buying BTC), medium (i.e. established Bitcoin-based projects such as STX) and hard (i.e. new Bitcoin projects).

BitVM: The Reason For This Exciting Trend

Renewed interest in building on Bitcoin has come about because of something called BitVM, a new primitive that was announced last year and is close to being production-ready. BitVM is an open-source technology that verifies any compute on Bitcoin. It’s touted as the missing piece connecting Bitcoin and its emerging ecosystem of L2s and sidechains.

It fixes the biggest issue with Bitcoin DeFi or networks (i.e. lower trust assumptions), allowing a substantially more trusted way to bridge your BTC to these projects, with BTC being used to pay fees.

BitVM uses a similar technology that underpins many Ethereum L2s (i.e. optimistic rollups powering Arbitrum and Optimism). Simply put, with these rollups, only one honest actor is needed to ensure the network is running as intended.

The creators of BitVM are not some project that will launch a token. Instead, their goal is for BitVM to be a core ingredient of many future projects. In many ways, BitVM is like a seed that eventually lets many flowers bloom.

Why The Hype Is Justified

Narratives come and go all the time in crypto. While there’s always a ‘hot new thing’, very few of them have true substance behind them. As for the trend of building on Bitcoin, there is absolutely some substance given that it has been ignited by technical innovation (i.e. BitVM).

That said, it’s unclear which of these new projects will survive beyond this bull market. There is a land grab with many similar projects being funded and developed. It’s likely that the vast majority of these new projects will eventually wind down after years of trying to find product-market fit. Some of them may even turn out to be scams, unfortunately. However, there is a very real possibility that some will become household names in the market before too long.

Ways To Get Exposure

There are lots of ways to get exposure to the ‘build on Bitcoin’ narrative, ranging from relatively conservative to highly speculative.

Easy (lower risk): Simply buying BTC is the most straightforward way to benefit from the growth of its ecosystem. Bitcoin’s value will likely increase as these L2 solutions drive demand and utility. If you’re long Bitcoin innovation, long BTC.

Medium: More mature platforms like Stacks (STX), which bring smart contracts and apps to Bitcoin, offer a middle ground for those seeking more direct exposure to Bitcoin’s expanding capabilities without diving into the complexities of new individual projects.

Hard (highest risk): Getting involved in these newer projects requires greater understanding and offers a higher upside, but the risk is significant. Most of these projects will likely fail. However, there could be a few winners and holding for this cycle could provide outperformance if this narrative continues growing.

Noteworthy Projects

Two projects looking to capture this ‘build on Bitcoin’ narrative are Stacks (STX) and Citrea (No Token).

Stacks (STX)

Stacks stands out as a leading layer 2 network on Bitcoin. It’s token, STX, has risen by over 250% in the last 12 months.

Similar to Ethereum, Stacks enables smart contracts and decentralised applications (Dapps), yet it leverages the robust security and decentralisation of the Bitcoin blockchain. According to DappRadar, Stacks hosts 33 Dapps, which is higher notable layer 1 blockchains like Aptos and Theta. Additionally, Messari reported in its State of Stacks Q4 2023 report, that the network saw a 3,386% growth in revenue and 386% growth in Total Value Locked Quarter on Quarter.

The expansion of the Bitcoin ecosystem is expected to further propel STX’s growth, as it is at the forefront of the sector.

Citrea (No Token)

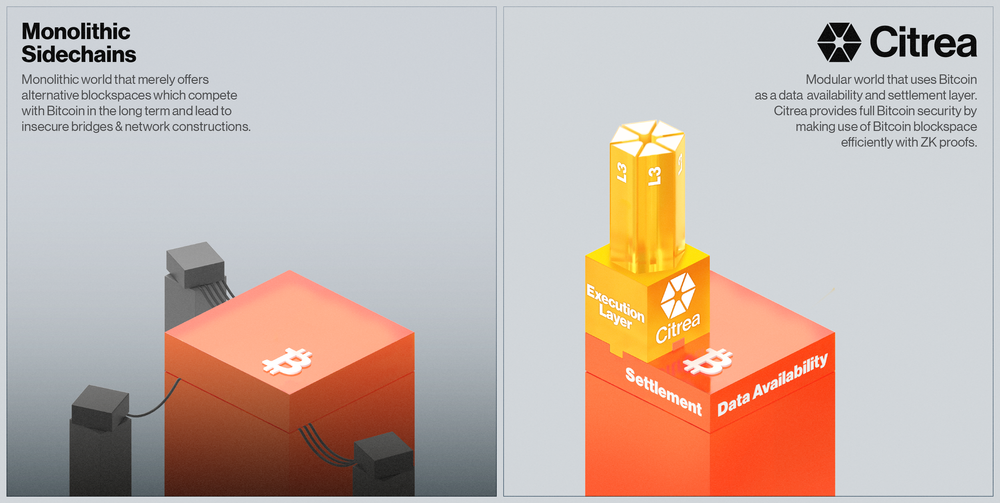

Citrea aims to be the first zk-rollup on Bitcoin. It is pursuing a similar modular approach to Ethereum and using BitVM to verify its proofs on Bitcoin.

Chainway Labs, the team building Citrea, announced a $2.7M seed round in February. An incentivised public testnet is set to launch in Q2.

Will there be a token? Citrea’s FAQ page states that BTC will be the native token. However, there could eventually be a governance token.

There are dozens of projects building on Bitcoin. Hit the drop-down menu for my thoughts on some other Bitcoin DeFi and scaling projects.

Risks

It’s worth approaching these projects with a healthy dose of scepticism and acknowledging the risks.

There is a high chance of rug pulls, grifters and fraud. More projects and value extractors will look to launch Bitcoin tokens and align themselves with this narrative. It is likely similar to what happened amid the DeFi and metaverse manias last cycle.

They do not inherit all of Bitcoin’s security and consensus. Using these networks is not like using Bitcoin directly. Some will have different trust assumptions, so before locking up any BTC in these networks, understand their limitations.

Will this contribute to a future Bitcoin fork? To get 100% trustless Bitcoin, the codebase must be upgraded. Could this wave of new projects destabilise Bitcoin and cause future rifts in the community?

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.