2023 offered a much-needed source of hope after what was a disastrous 2022. After another eventful year, it’s essential to reflect on it. I dive deeper into the key themes, surprises, lessons and not only the things I got right but, most importantly, wrong.

Key takeaways

- The theme of 2023: Healing and maturing as crypto’s bad boys were served justice.

- What surprised me the most: The pace of banks and institutions leaning into crypto and the Lightning Network continuing to be overlooked.

- What I got right: Ethereum L2s took a big step forward, real-world assets (RWAs) boomed, and Solana weathered its existential crisis.

- What I got wrong: DeFi remained underwhelming, and stablecoins took longer than expected to rebound.

- My biggest lesson: Ethereum will always be cautious and ship slower than expected.

Theme For The Year: Bad Boys Served Justice

Outside of the obvious big year for Bitcoin driven by excitement over a possible spot ETF, this year’s big theme was the ‘bad boys’ of crypto being served justice.

- A speedy court trial for FTX’s Sam Bankman Fried found him guilty of all charges.

- Terra founder Do Kwon was arrested and set to be extradited to either the U.S. or South Korea.

- Celsius’ Alex Mashinsky was arrested and faces a Sep. 2024 trial.

- 3AC founder Zhu Su was arrested and facing court.

- Binance and CZ settled with the CFTC and the Department of Justice in the largest-ever settlement for any crypto company.

Over the past 18 months, the wave of bankruptcies severely damaged crypto’s credibility. Many of the 2022 villains were held accountable, drawing a line in the sand for the industry—a necessary step for the industry to mature.

Source: X via @yourfriendSOMMI

What Surprised Me The Most

The pace of banks and financial institutions launching, using and offering crypto or tokenisation services. Below are a few of my highlights. (Click the drop-down arrow below to see more noteworthy names getting into crypto.)

- Visa continued stablecoin settlement pilots on Ethereum and Solana.

- PayPal launched its stablecoin, PYUSD.

- Australian bank NAB partnered with Zodia to pilot institutional custody services and tested cross-border stablecoins.

- Another Aussie bank, ANZ, tested Chainlink’s Cross-Chain Interoperability Protocol (CCIP).

- Three leading German banks, Deutsche Bank, DZ Bank and Commerzbank, were granted crypto licences and custody services.

- French banks, Credit Agricole’s CACEIS, BNP Paribas and Societe Generale stepped further into crypto.

- Two large Brazilian banks, Itau Unibanco and Nubank, leaned into crypto.

- Even JPMorgan continued testing public and private blockchain products.

The signal was clear: despite the horror of 2022, financial institutions continue to look to offer, test and launch crypto or blockchain products and services.

Honourable Mention

I was surprised by the ongoing lack of interest in the progress being made on Bitcoin’s Lightning Network.

This year, I posted twice about the state of Lightning and was shocked by how under-reported its progress is. The ETF narrative likely drowned out this and other important Bitcoin catalysts.

Read: Is Bitcoin’s Lightning Network Development Being Underappreciated?

✅ What I Got Right

I was happy to reflect on my 2023 and half-yearly outlook posts and see many core predictions play out nicely. Below are the top few.

L2s Continue Scaling & Tokenising

My most successful prediction was the continued rise, development, adoption and tokenisation of Ethereum L2s.

We saw major network launches from Base, Polygon zkEVM, zkSync Era, Mantle, Scroll and Linea. Other exchanges, such as OKX and Kraken, have outlined plans or are rumoured to be launching Ethereum L2s.

Development on existing L2s continued, with significant network upgrades for Optimism (Bedrock) and radical plans for Polygon 2.0 initiated.

Widespread tokenisation continued, with Arbitrum launching ARB and Starknet teasing the upcoming launch and airdrop for its STRK token.

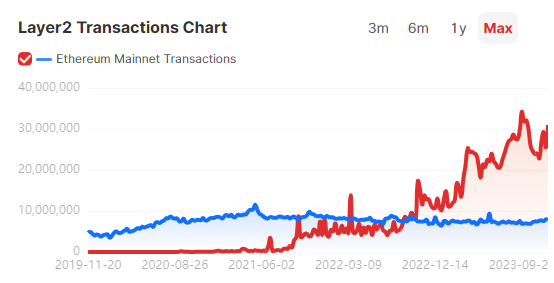

Most importantly, this translated into adoption, with TVL in Ethereum L2s increasing by more than 300% from $4B to $16B and total transactions surging.

L1 vs L2 Ethereum Transaction Count (Source: Orbiter)

Tokenisation Growing

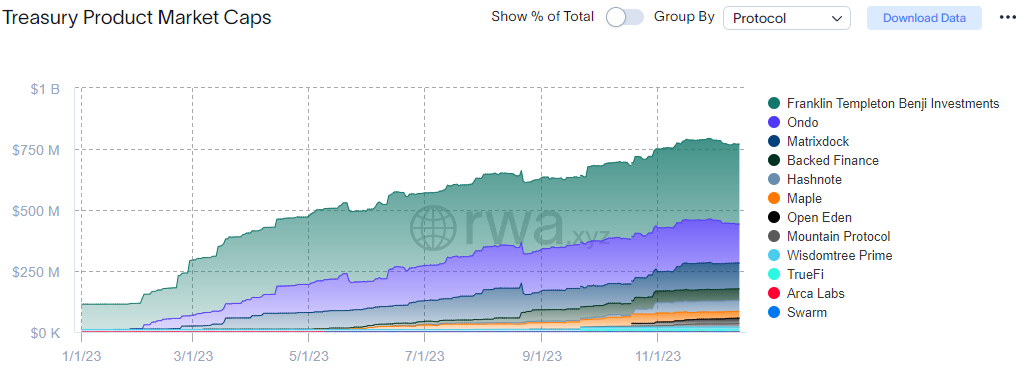

This year, real-world assets (RWAs) entered the limelight, helping cryptocurrencies such as Maple (MPL) and Centrifuge (CFG) outperform the market. The most notable source of growth in RWAs was through various projects offering onchain exposure to treasury yields.

To end the year, Coinbase launched ‘Project Diamond’ to onboard RWA targeted at institutions on Base.

U.S. Treasuries (Source: RWA.xyz)

Solana

In my May post, I looked into why Solana remained with serious staying power and in my H2 outlook, I was extremely interested in ongoing Solana developments.

Matt, Leon, and I have been strong on Solana and noted in previous market reports to the end of 2022, especially after the post-FTX collapse.

Solana was the big altcoin winner in 2023, outperforming the market with a year-to-date return of 650%.

Thanks to hype around the upcoming Firedancer upgrade (which went live on testnet), we saw substantial interest in the Solana ecosystem and a few significant airdrops (such as Jito, which we included in our airdrop analysis).

Read: 5 Reasons Solana Has Staying Power

❌ What I Got Wrong

Stablecoin Supply Did Not Grow

The supply of stablecoins fell for the first eight months of the year (recording 18 straight monthly declines) and bottomed at $123B.

Although we did see big players such as PayPal launch PYUSD, the supply of all other stablecoins besides USDT declined.

Highly Anticipated Games Did Not Launch

We did not see the first truly mainstream web3 game go live this year—it seems my enthusiasm got the better of me! More crypto-native games were pushed back or continued to develop.

However, we saw the first public launch from Illuvium on the Epic Store, with web2 gaming giants continuing to look into the space. Despite being off on timing, I believe next year could be the breakout year for crypto gaming. (Stay tuned for my 2024 predictions!)

DeFi remains underappreciated

I expected DeFi to see a potential reversal in fortunes and outperform the market. As the following metrics show, it was a mixed bag for DeFi this year:

- DEX to CEX futures trade volume decreased from 2% to 1.67%

- DeFi dominance was unchanged at 4.3%

- DEX to CEX spot trade volume increased from 8.8% to 11%

Despite isolated wins, such as Uniswap spot volumes topping Coinbase on multiple occasions and being early to cover the DYDX token revamp and price surge, it mostly failed to translate to strong price performance. For example, DeFi token index, DPI, underperformed the market, increasing by only 34%.

My Biggest Lesson

One lesson I’ll never fade is that the Ethereum developers will always ship later than the market predicts. And this isn’t always a bad thing.

I expected EIP-4844 to go live via the ‘Dencun’ upgrade by year-end. This didn’t happen, with Dencun now expected in Q1 2024.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.