As Bitcoin hovers ~10-month highs, it’s a great time to do a state of the market into the Lightning Network. I discuss why the market could be underappreciating Bitcoin’s Lightning Network development, with important news going under the radar as Bitcoin looks to establish itself as a medium of exchange.

Key Takeaways

- The Lightning Network is a relatively small but fast-growing payment layer built on top of Bitcoin.

- Adoption and development are making serious headway.

- Lightning Network development is a significant catalyst for Bitcoin to increase its credibility as a “money” by becoming a widely used medium of exchange.

- In particular, significant development from Strike, Lightspark, MicroStrategy and Sprial.

- For me, this development could be going under the radar as the crowd focus’ on short-term price wins.

The Lightning Network & Why it Matters

The Lightning Network (LN) is a core pillar for extending Bitcoin utility and has long been hyped to bring Bitcoin’s initial purpose (A Peer-to-Peer Electronic Cash System) to reality.

Despite early promise, the LN has taken much longer to scale than anticipated, with relatively little real-world adoption or uptake.

Until now…with a host of recent development and world-class teams building on the technology, there is growing excitement that’s perhaps being overlooked by the market.

Why it matters?

“Money” has traditionally been defined as a monetary asset that can be used as a (i) store of value and (ii) a medium of exchange.

Bitcoin is showing potential as a store of value but has struggled to be an effective medium of exchange due to high fees, long wait times and limited commercial adoption.

This appears to be changing, and if the below developments continue to unfold, it could strengthen Bitcoin’s legitimacy as money.

Issues with Lightning

So far, the LN has struggled in adoption for a few reasons:

- Its limited capabilities (Not widely supported)

- Difficult and barrier to use (challenging to set up and integrate)

- Low liquidity (LN total liquidity is <5% of ETH locked in smart contracts)

- Centralisation (higher trust at the moment)

There are also other issues, such as privacy (for a conclusive dive into the LN, I suggest Lyn Alden’s ‘A Look at the Lightning Network‘).

The below positive developments could fix these issues, fuel Lightning to become the “protocol for payments”, and increase Bitcoin’s narrative as a medium of exchange.

How Lightning is Growing

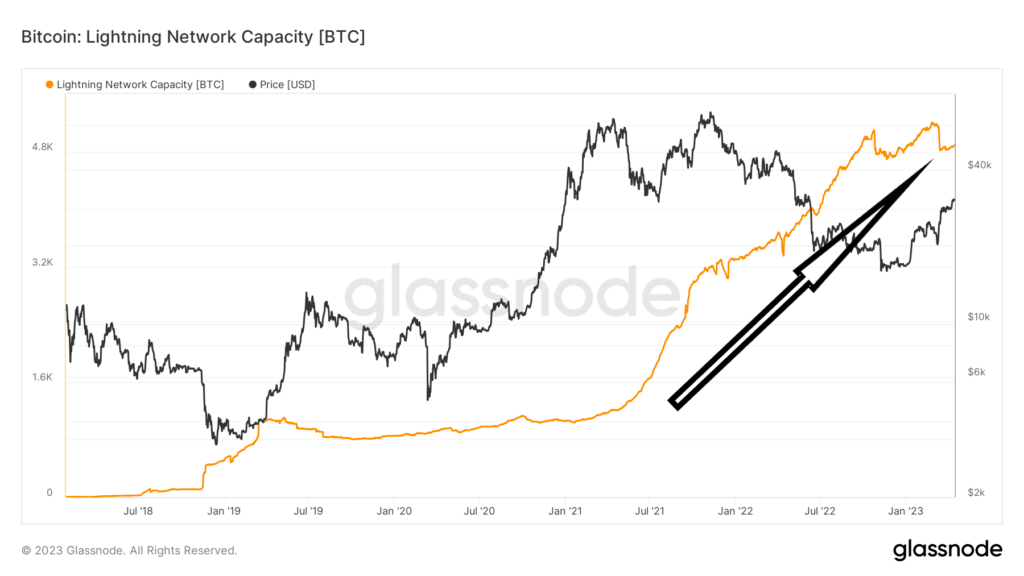

Despite very slow progress and limited uptake, the LN has accelerated in development across 2 core metrics:

Lightning’s Network Capacity grew throughout the bear market of 2022 and last month reached an ATH hitting 5,600 BTC.

- Capacity = the total amount of BTC locked and circulating. As capacity increases, there’s more liquidity, increasing its utility as the network can send a higher volume and value of total payments.

Other core metrics, such as Lightning Network Channel Size, increased 100+% in the past year, while Lightning Network Payments Volume continues to grow.

Not all roses

Despite the capacity and volume increases, the number of these channels which make LN payments possible is – 35% over the same period.

Key Developments To Follow

Lightning Network adoption is increasing, which could be further fueled by a host of recent announcements to help Bitcoin on its way to becoming a medium of exchange.

#1 Lightspark emerges from stealth

Early PayPal President and the man behind Facebook’s failed stablecoin, David Marcus, revealed his new start-up company’s (Lightspark) plan to make the Lightning Network easier to use by eliminating the hoops to jump through and the manual work to set up Lightning support.

This announcement is something I’ve been eagerly waiting for, featuring in my 2023 look ahead, and I’m quite excited to see the demo, plus the impact it has in the coming years.

It’s a significant step forward for 3 reasons:

- Legitimises Bitcoin and the Lightning Network

- Makes the Lightning Network easier to use, which could increase adoption and capacity.

- Builds the infrastructure to unlock more use cases

#2 Increased adoption of Strike Network

Strike’s another payment company building on the LN and a big reason for the capacity growth as it targets emerging markets.

- Rolling out LN to more countries such as Senegal, Benin, Rwanda, Ivory Coast and Togo.

- Expand its LN-powered remittances to the Philippines.

#3 Increased integrations

The LN has seen increased integrations with Jack Dorsey-backed social media protocol Nostr, allowing users to pay with BTC via Nostr Zap.

#4 Sprial’s lightning development kit

Spiral is technology giant Block Inc’s (led by Jack Dorsey) Bitcoin-only company.

They’re a core part of scaling the LN via creating developer tools and frameworks to make it easy for anyone to build Lightning-compatible apps.

Last month they revealed their Lightning Development Kit (LDK) roadmap. The critical takeaway is Sprial is expanding vast resources and bringing together an open-source community to fuel LN infrastructure.

#5 MicroStrategy Bitcoin Lightning applications

MicroStrategy is creating tooling and apps for the Lightning Network. We could see more on this in the coming months. Just today, Saylor teased MicroStrategy are converting emails into Lightning addresses. I expect a lot to come in the next year on this front…

“We want to make it possible for any enterprise to spin up Lightning infrastructure in an afternoon…We have teams working on it and are looking to bring something out by next year. We expect to show something in the first quarter.”

Other Developments To Track

We’re also only scratching the surface, with possible more innovation coming for LN via Taro. I covered Taro last year in my DeFi on Bitcoin post, but it allows assets to be issued on Bitcoin and/or LN.

- Currently, developers can mint, send and receive Taro assets on the test network of the Bitcoin blockchain and could see significant announcements heading into 2024.

We are yet to see any significant announcements from big exchanges enabling the LN, although this week, Coinbase CEO Brian Armstrong hinted at plans to integrate at “some point”. Yet another catalyst to watch out for that could fuel growth for LN. There’s also continued adoption and usage via Bitcoin adoption in El Salvador.

Research-Backed, Crypto Insights That Save You Time

Collective Shift are pleased to to offer you a complimentary one-on-one strategy call with our founder and CEO, Ben Simpson. Collective Shift aims to provide research and analysis to help educate its members.

Disclaimer: This article is licensed by Swyftx from Collective Shift. The information on this page is for general educational and information purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Any opinions presented in this article belong to Collective Shift and may not align to the views of Swyftx. Customers are encouraged to do their own independent research and seek professional advice. Swyftx and Collective Shift make no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider Swyftx's Terms of Use and Risk Disclosure Statement for more details.