Litecoin is one of the very few coins to survive multiple crypto winters. Its status as the top altcoin has been long-eroded by Ethereum, but LTC is still one of the most important blockchains in the industry. It was long considered the “silver” to Bitcoin’s “gold”, and is regarded as the original altcoin. Although some believe Litecoin to be “dead”, the network still receives – admittedly infrequently – developer attention to keep it relevant.

Litecoin was originally built as a “fork” of Bitcoin’s source code and therefore retained several of the blockchain’s features. One such element was the concept of “halving”, a supply and demand strategy that ensures LTC tokens remain deflationary. Litecoin halving occurs every four years and can have a major impact on the coin’s short and long-term price action.

What is the Litecoin halving?

Litecoin halving is an event coded into the blockchain, which is triggered every time 840,000 blocks are mined on the network. On average, this takes about four years, similar to the Bitcoin halving. Once the conditions are met, the amount of LTC earned by Litecoin miners is halved.

To fully understand how and why Litecoin halving is significant for the protocol’s ecosystem, we must first dive into how the blockchain works.

The Litecoin blockchain

Litecoin’s network is very similar to Bitcoin’s, as they are both built around the same underlying code. Importantly, the Litecoin protocol employs a Proof of Work consensus mechanism. This means independent miners running Litecoin software compete to solve a complex cryptographic algorithm. The first miner to successfully find the solution gets the privilege of verifying the next block of Litecoin network transactions and adding it to the chain. In exchange, the successful miner receives a “block reward” – a pre-determined amount of LTC. The very first block reward for miners was 50 LTC per block.

This is where the Litecoin halving comes into play. If the network’s block reward remained stagnant from 2011, LTC’s entire supply would quickly be mined and brought into circulation. Such a system would likely result in Litecoin becoming an inflationary currency and potentially plummeting in value. Halving the network’s block reward helps LTC remain valuable and scarce and

How have the Litecoin halvings impacted price?

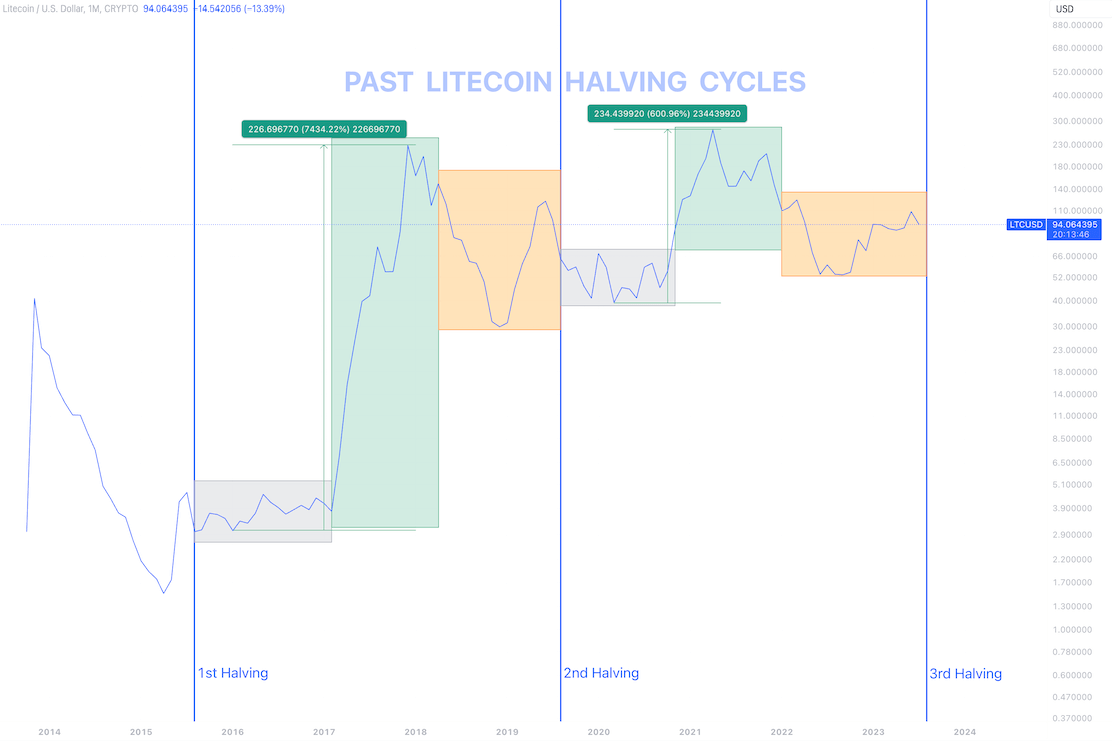

Litecoin halvings haven’t typically had a profound impact on price action as Bitcoin halvings, but there are still patterns to look out for investors to consider. Historically, in the lead-up to a halving event, trading volume has increased along with volatility and price. Once the event has occurred, these metrics have tended to drop off, with the price correcting and eventually stabilising. As always, though, we can never truly predict what will happen this halving.

Figure 1: Past Litecoin halving cycles. Source TradingView

Taking a look back, the first Litecoin halving took place in August 2015. In the run up toward this date, LTC jumped from USD $1.84 in late June to $4.68 by the start of August. Eventually, the digital currency’s value settled at around $3 in September.

The second time around was in August 2019, amid a market-wide downturn. Again, the lead-up to the halving was extremely bullish as the price of LTC catapulted to $164 in May that year. But by August, interest had fallen dramatically and the Litecoin halving did little to arrest the coin’s downward momentum. LTC’s descent slowed in the lead-up to the August halving, but quickly continued its earthbound trajectory in the months following.

In summary, historical Litecoin halvings have shown similar patterns, and it will be interesting to see whether we witness similar limited price movement followed by a price surge after the upcoming halving on 2nd August. Nevertheless, it is essential to remember that past performance does not guarantee future outcomes.

Other Litecoin updates

Litecoin’s recent updates include:

- Litecoin’s network was made compatible with “Ordinals”. This allows LTC tokens to be inscribed with data, making NFTs on the Litecoin blockchain a reality.

- Litecoin received significant institutional attention after being listed on the TradFi exchange EDX Markets.

- The lead-up to the next LTC block reward halving on August 2nd 2023 has seen its trading activity increase across centralised exchanges.

- May 2023 saw Litecoin integrate the Layer 2 protocol Lightning Network, which helps the blockchain reduce congestion, improve scalability and slash transaction fees.

You can buy and sell Litecoin on Swyftx.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.