One of the fundamentals of cryptocurrency is the ability to always have full control and access to your assets. This mechanism is known as self-custody. The popular phrase “not your keys, not your crypto” is a reference to the importance of self-custody.

This article will explain what self-custody means in crypto, along with ways you can store crypto that grants self-custody.

What is self-custody in crypto?

Whenever you buy and store crypto on an exchange, you are trusting them with your digital currencies. The platform will stash these assets in a mixture of hot (online) and cold (hardware) wallets so they can be easily accessed whenever investors wish to trade them. The private keys to these wallets are owned, operated and controlled by the exchange – not the investor.

Self-custody, on the other hand, refers to investors having complete sovereignty over their finances. Instead of crypto being stored in a wallet controlled by a third-party business, the investor becomes the sole owner of their assets. This is accomplished by holding crypto in one (or multiple) self-custodial wallets where the investor is the only one with access to its private keys.

Key Takeaway

“Not your keys, not your crypto” has been a catchphrase of experienced investors. An easy way to contextualise this is by thinking of an exchange wallet as a bank. You are entrusting that financial institution to keep your assets safe. Alternatively, self-custody in crypto is a bit like storing cash in a safe, where only you know the code.

Hot wallets vs cold wallets

Crypto wallets can be classified as ‘hot’ or ‘cold’ wallets. Hot wallets are connected to the internet, with the most common being held on exchanges like Swyftx (although Swyftx then utilises both hot and cold wallets) and internet browser extensions like Metamask. Hot wallets are generally more convenient and easily accessible.

Cold wallets are objectively considered a safer method of storing cryptocurrency as it’s not connected to the internet, these methods of storage involve storing private keys on a physical medium. Hardware and paper wallets are examples of cold wallets which involve storing your keys on a USB-like device and jotting your private key down on a piece of paper.

Custodial vs non-custodial wallets

On top of hot vs cold storage, crypto wallets can be categorised as either custodial or non-custodial. Custodial wallets refer to when your crypto is managed by a third party, meaning less responsibility is typically required by the user to safeguard their assets. The most common type of custodial wallets are web-based exchange wallets.

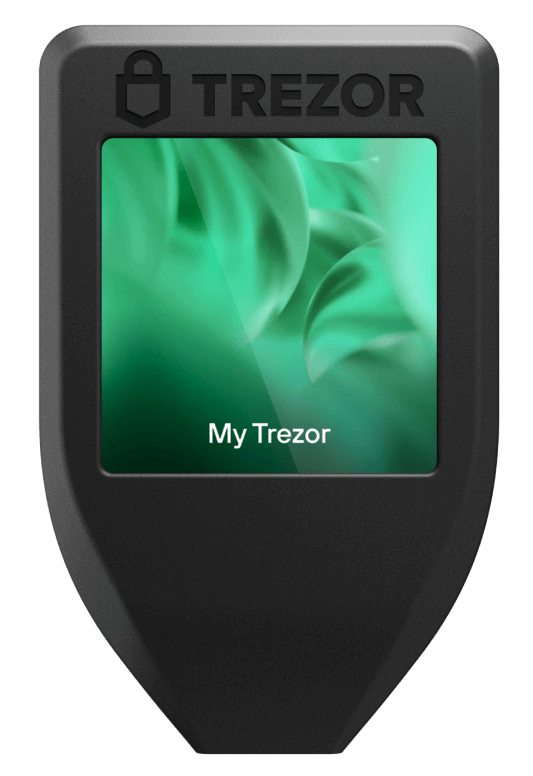

Non-custodial wallets, on the other hand, give you (the user) complete control over your private key and therefore your crypto. Non-custodial wallets come in all shapes and sizes. They can include web wallets like MetaMask and Trust Wallet, and also hardware wallets like Ledger and Trezor.

For those using a Self-Managed Super Fund to invest in cryptocurrency, it is highly recommended to use a non-custodial cold wallet as one of the most secure methods of storing digital assets.

How to take self-custody of crypto assets

Taking self-custody of crypto assets is as simple as opening a non-custodial wallet – where you have responsibility for your own private keys. You can then send your crypto holdings from an exchange wallet to your new wallet address.

An online (hot) wallet is a popular choice for crypto traders with smaller balances. Wallets like Metamask and Trust Wallet make it convenient to access crypto portfolios while maintaining control over your keys. However, these wallets are connected to the internet and can be hacked, giving the attacker access to your private key. Though this is rare, hardware wallets are considered to be a safer crypto self-custody solution as they are not connected to the internet.

If your hardware wallet is lost, stolen or destroyed, your PIN will protect you from theft and the recovery phrase allows you to access your crypto no matter what happens. It is important to maintain a hardware wallet in a secure location, as well as your recovery phrase (preferably in separate locations).

Ledger and Trezor are considered to be two of the most reputable cold storage wallets on the market.

Ledger

Ledger is one of the world’s most popular hardware wallets and supports the storage of 1,800+ cryptocurrencies. Ledger Nano X is Ledger’s flagship product. Features include an integrated mobile app, native exchange and even Bluetooth for wireless connections.

Trezor

Trezor is a slightly pricier hardware wallet. Still, it offers most of the bells and whistles a high-volume crypto investor would look for. The wallet provides 1,800+ digital currencies for storage, an in-built cryptocurrency exchange and a convenient colour touchscreen.

Tip

Holding cryptocurrency on an exchange wallet is not necessarily unsafe. Many reputable platforms exist with regular audits and proof of reserves to improve investor confidence. That said, it is still a good idea to strongly consider self-custody storage methods for maximum security.

Summary

Self-custody is a key feature of the industry – without it, true ownership of digital currency falls by the wayside. Using a self-custodial hardware wallet ensures that you are in sole control of your private keys and that your assets are less susceptible to losses.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.