The Ethereum Shanghai Upgrade is a hard fork for the Ethereum protocol expected to be implemented in March 2023. It is a highly anticipated improvement, as it will allow validators to access their staking rewards for the first time since the launch of the Ethereum Beacon Chain in 2020. The upgrade is significant, given that nearly $26 billion worth of ETH will suddenly be unlocked and made accessible.

Key takeaways:

- Investors have been staking on the Ether network since December 2020 following the launch of the “Beacon Chain”.

- EIP-4895 will allow validators to withdraw staked ETH, and accumulated rewards, for the first time since the Beacon Chain’s release.

- The Shanghai Upgrade also boasts some other improvements like reducing gas fees.

- About 14% of all ETH in circulation (worth approximately US $26 billion) is currently locked up in Ethereum nodes.

What is the Shanghai Upgrade?

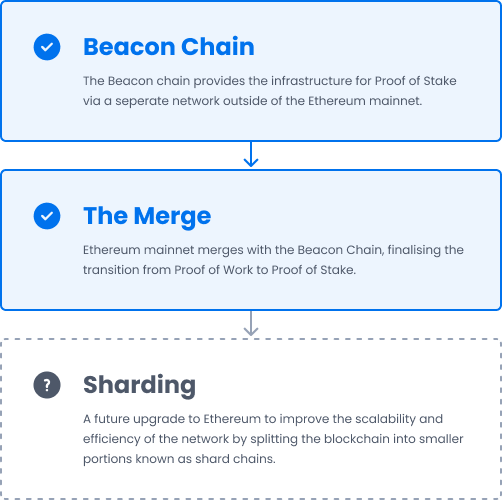

The September 2022 Ethereum Merge to a Proof of Stake consensus mechanism was a landmark moment for the protocol and the wider cryptocurrency industry. The complex transition took multiple years and was first introduced via the Beacon Chain in December 2020.

Over these years, validators could stake 32 ETH to contribute to the blockchain’s economic security and long-term viability. However, validators were required to lock up their original ETH tokens, and any rewards, until a later upgrade was implemented. Finally, that upgrade is almost live. In addition to staking changes, the Shanghai Upgrade is also improving efficiency for Ethereum developers paying gas fees.

EIP-4895

Ethereum Improvement Proposal-4895 is the flagship change of the Shanghai Upgrade. Investors have been waiting for this proposal to be implemented since staking was made available on the Beacon Chain in 2020. EIP-4895 lets node operators finally access their locked-up tokens, including any rewards they have accumulated.

How much ETH has been staked?

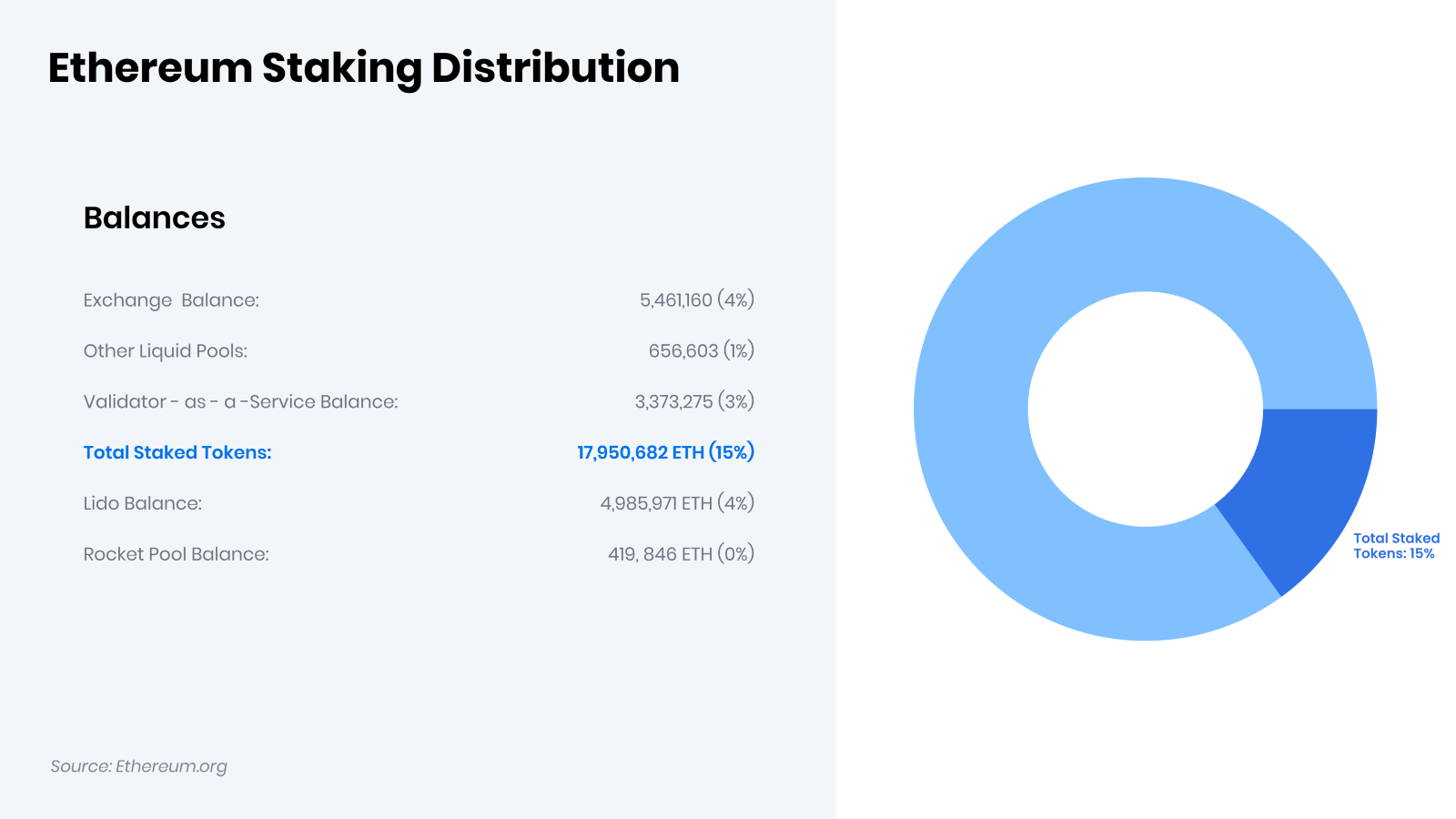

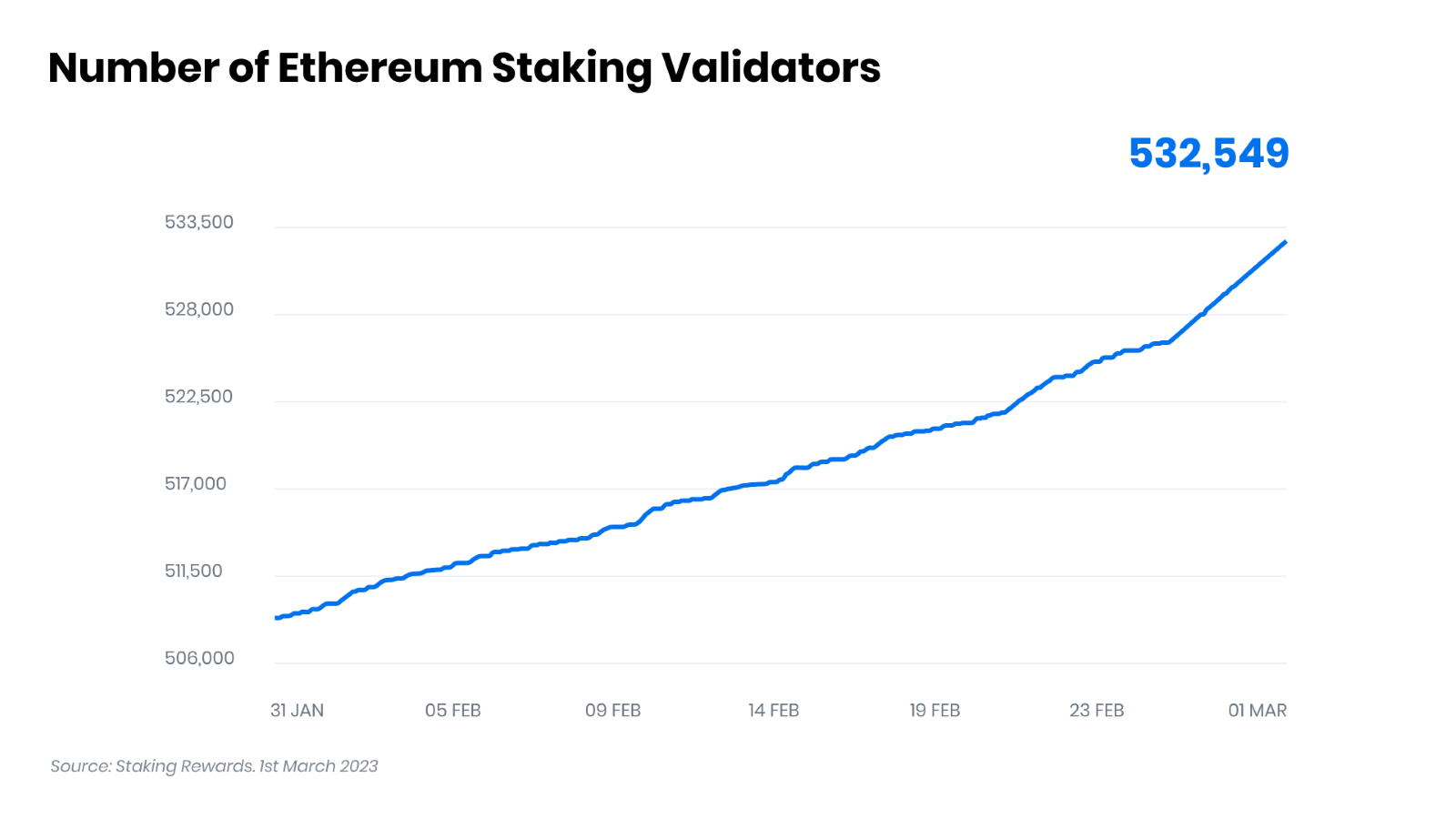

Approximately 14% of all Ether – equivalent to 16.5+ million ETH, or US$26 billion – has been staked in some form. Over 530,000 validators have contributed at least 32 ETH to set up a node validator and start receiving block rewards.

However, we must consider that a significant number of stakers won’t be directly affected by the new improvement proposal. The requirements for solo-running an Ethereum node are a little high, so many investors have instead turned to proxy-staking services. Lido (29.2%), and major crypto exchanges Binance/Kraken/Coinbase (26%) control nearly half of the entire ETH staking market. Many of these platforms already provide liquidity for those staking ETH by distributing derivative tokens that follow the price of Ether.

How many stakers are in profit?

Considering the tough bear market of 2022-23, the majority of Ethereum stakers are actually running at a loss. This is largely because most staking solutions became available during crypto’s substantial 2021 bull run, when prices were much higher. As of 16 February 2023, only about 31% of ETH stakers are in profit.

Most of this 31% began staking at the launch of the Beacon Chain in December 2020, when the price of ETH was ranging between US $400 and 700. It is likely these validators are long-term and dedicated Ethereum investors, as staking on the Beacon Chain at that time wasn’t popular among the mainstream (largely due to its illiquidity).

How will the withdrawal process work?

There will be two types of withdrawals available to stakers.

Partial withdrawal

A partial withdrawal will occur when validators only access their staking rewards while keeping their staking balances over 32 ETH. In this instance, the staker will continue to verify Ethereum network transactions and earn block rewards.

Partial withdrawals can be set up through something called a “withdrawal credential”. This will automatically “sweep” a balance once per week to extract ETH rewards to a connected wallet.

Full withdrawal

Full withdrawals will occur when a validator wants to extract their entire balance of locked-up ETH. This type of exit will be rate limited to avoid major price manipulation depending on the number of active validators. Given the current validator count (530K+), the Shanghai Upgrade would allow seven exits per epoch. With each epoch lasting approximately 6.4 minutes, this equates to around a theoretical maximum of 1,575 validators selling their ETH per day (up to 50,400 ETH).

How could this affect the price of Ethereum?

According to Etherscan, ETH validators have accumulated about 1M Ether tokens (approx. $1.6 billion USD) in staking rewards. If we assume that all validators partially withdraw their yield, this amount is more than five times lower than ETH’s daily trading volume (generally about $9 billion). Add on that these withdrawals will occur over days (possibly weeks), rather than 24 hours. Based on this, it seems unlikely that partial withdrawals will significantly impact the price of Ethereum.

However, full withdrawals could have a greater impact on Ethereum’s price, which is why EIP-4895 introduced a waiting list to prevent this. Only 1,575 stakers can make a full exit on any given day – equivalent to approximately 50,400 ETH. At current Ether prices, this would represent an additional US$82 million in daily sell volume, which is comparatively minor when looking at institutional trading figures.

The Ethereum Shanghai Upgrade may place some sell pressure on the price of ETH, but given the limitations placed on it by the upgrade, may not substantially impact the price.

How does Ethereum staking compare to other assets?

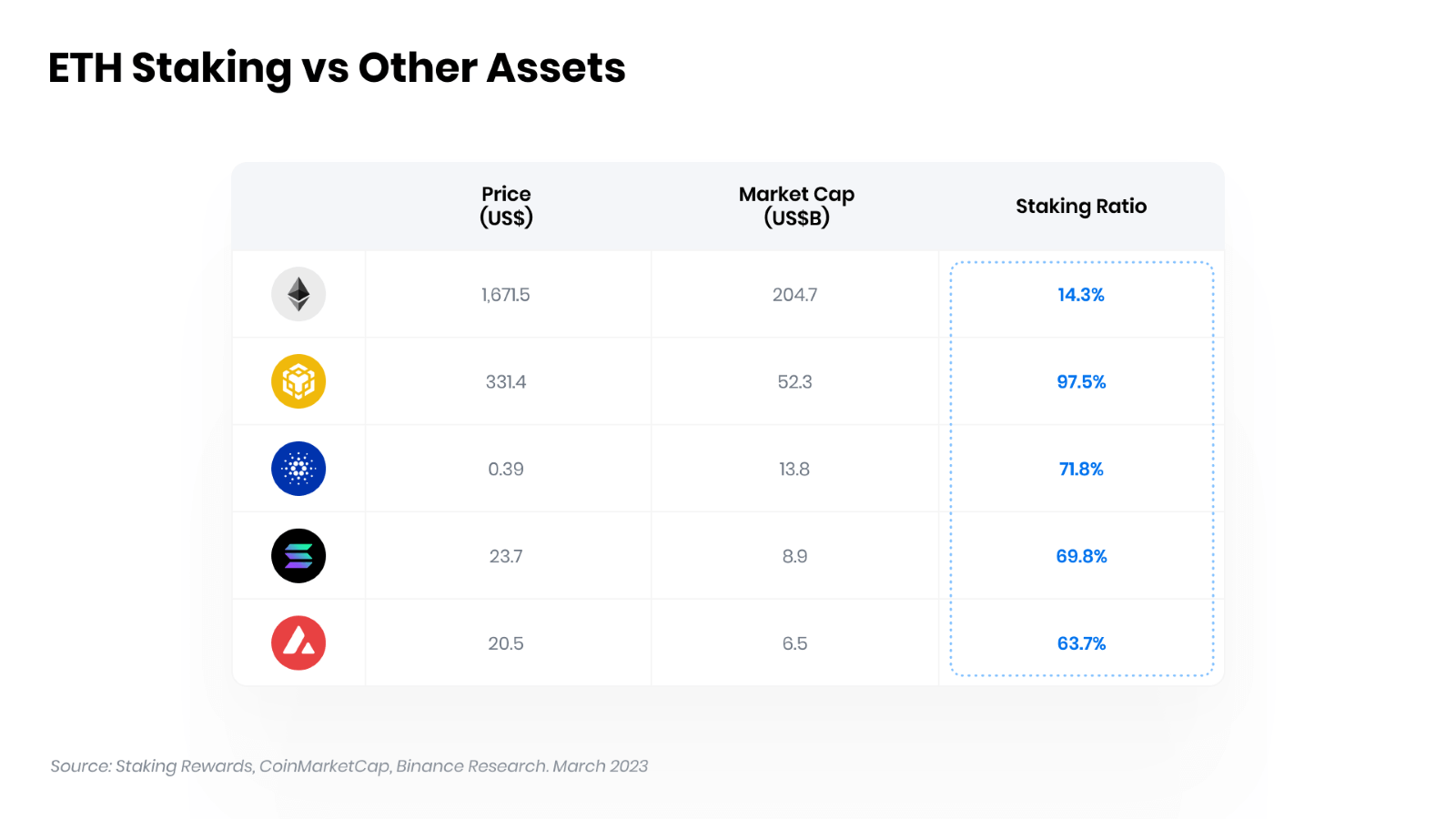

Ethereum is one of the least proportionally staked cryptocurrencies of any operating on a Proof-of-Stake network. Ether’s staking ratio is only around 14%. By comparison, ~70% of ADA and Solana and 63% of AVAX are locked up on their respective blockchains. However, it should be noted that Ethereum’s market cap is also substantially larger than these assets.

There are several reasons for this disparity. A major one has been the previous illiquidity of staking Ethereum, something that the Shanghai Upgrade will address. It is usually a positive for Proof-of-Stake protocols to have more individual node operators, as it improves the network’s decentralisation and security. It is quite possible that the new Ethereum upgrade will bring in a host of new validators to the game, increasing the token’s staking ratio.

ETH has currently become a deflationary asset

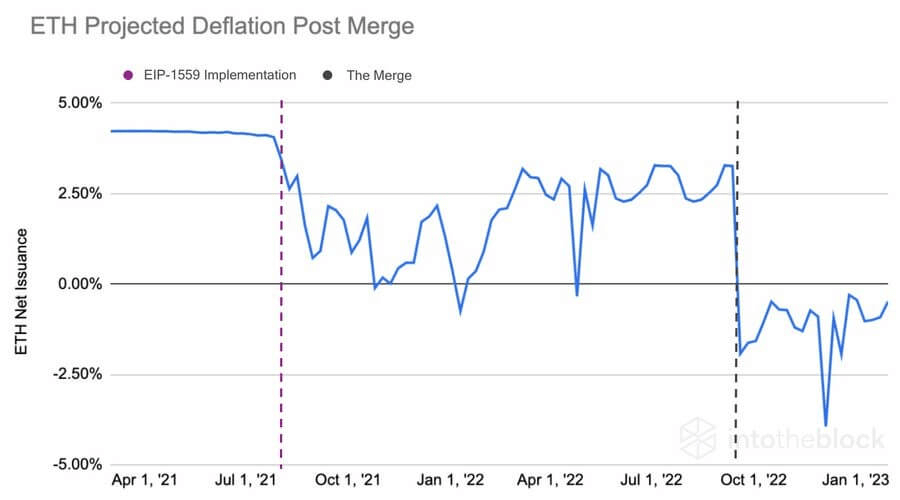

Ethereum has been an inflationary asset for most of its life, this means that there is more ETH being created than burned/destroyed. However, the Ethereum Merge had a substantial impact on the token’s issuance vs burning. Moving away from Proof-of-Work meant the reward paid to miners was slashed, and EIP-1559’s fee burn mechanism reduced annual supply by more than 3%. The current inflation rate of Ethereum is -0.03%.

The graph below shows the drop in ETH supply following both the EIP-1559 upgrade the Merge.

What’s next on the Ethereum roadmap?

The Shanghai Upgrade is expected to be added to Ethereum’s Mainnet by April 2023 at this stage. From there, Ethereum developers will turn their attention to the blockchain’s next major upgrade – sharding. Some pundits hoped that the Shanghai Upgrade would contain EIP-4844 (the sharding update), which will go a long way to improving the network’s scalability. This improvement will now likely come toward the end of 2023 and may present another massive moment in Ethereum’s history.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.