Ripple has come a long way since its fiat beginnings in 2004 under the moniker RipplePay. After being purchased by a trio of developers and turned into a cryptocurrency project in 2012, Ripple released the XRP Ledger (XRPL) – the blockchain that secures the XRP cryptocurrency. This guide will dive into what exactly the XRP Ledger is, how it works and some of the leading apps within its budding ecosystem.

What is the XRP Ledger (XRPL)?

The XRP Ledger is a Layer 1 blockchain that manages transactions made with digital assets, including XRP. Like many others, it is a decentralised, distributed ledger intended to facilitate fast and cheap transactions around the world.

As one of Ripple’s primary objectives is to improve the efficiency of international asset transfers, creating a low-cost and scalable network was a top priority.

According to XRPScan, the XRP Ledger can process approximately 20 transactions per second, while settling transfers within 3-5 seconds.

By comparison, Bitcoin can only process about 7 transactions per second, and each confirmation can take 10 minutes or longer – making XRP much faster to use.

Important to Remember

Given one of Ripple’s key goals is to facilitate international asset transfers, it’s worth comparing XRPL’s performance to global payment solutions such as SWIFT. Even with major technological advances, international SWIFT transactions can often take several days to settle – compared to just a handful of seconds for transactions via the XRP Ledger.

How does the XRP Ledger work?

The XRP Ledger consists of three main operators – the community, node validators and platform developers. These parties form the core of the blockchain’s decentralised ecosystem.

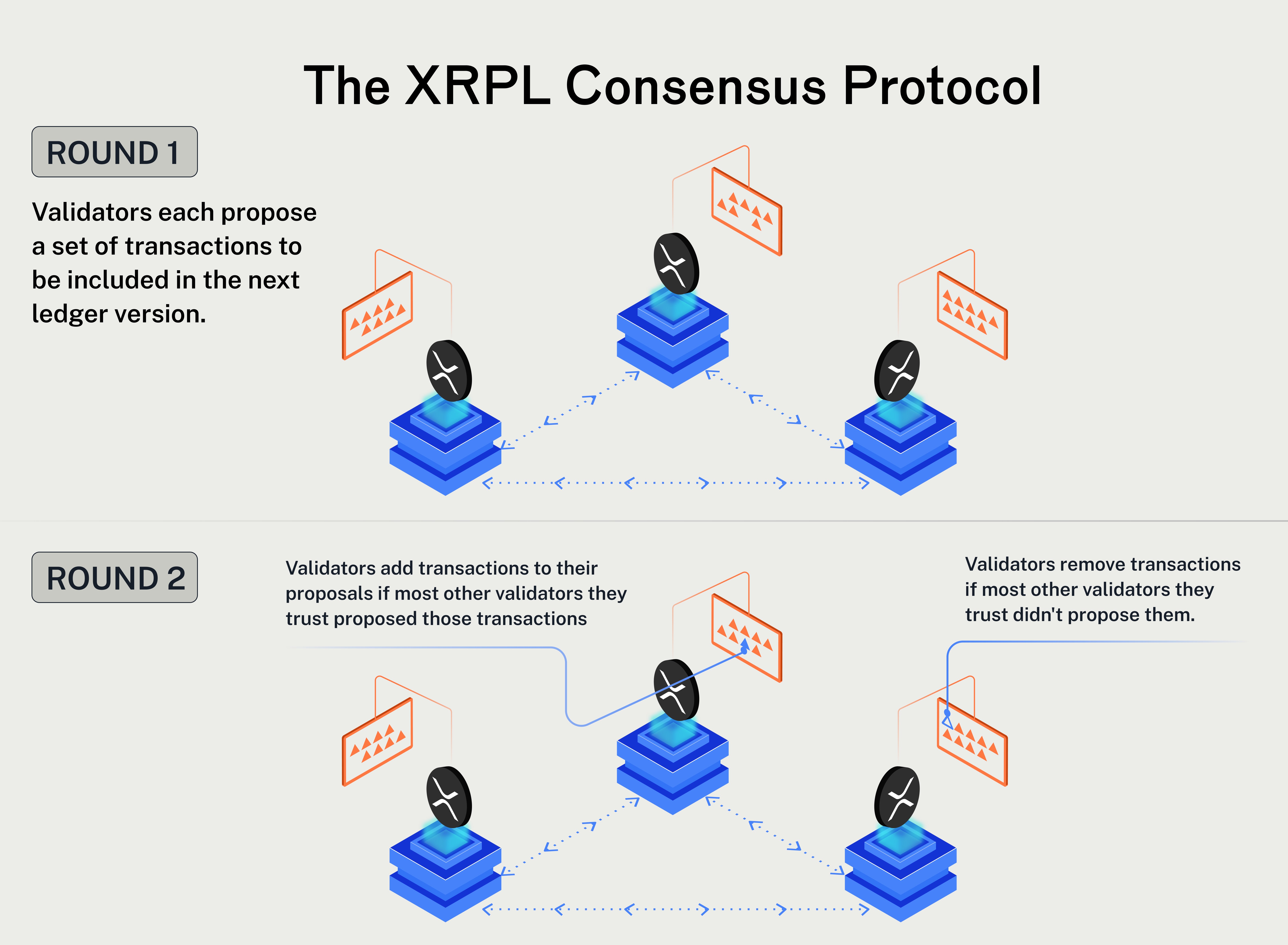

Compared to most modern distributed ledgers, XRPL boasts a rather unique consensus mechanism. For a blockchain to be effective, there must be a way for users on the network to agree that a transaction is legitimate – i.e., reach consensus.

Typically, Layer 1 blockchains will employ a Proof of Work or Proof of Stake protocol to achieve block confirmation.

However, the XRP Ledger stands apart thanks to its distinct consensus mechanism, aptly named the ‘XRP Ledger Consensus Protocol’.

Fundamentally, the protocol works similarly to staking. To participate, users must run a copy of the blockchain on their own devices (called a node). However, unlike with Proof of Stake networks, the XRPL doesn’t require users to lock up XRP tokens.

Instead, validators are added to a Unique Node List (UNL) based on trustworthiness and reliability. Criteria include uptime, a history of good behaviour and geographic location.

Operators added to the UNL and charged with maintaining the XRP Ledger are hand-picked by Ripple and the XRP Foundation, or by other node operators. This is key to what makes the XRPL network so efficient – the likelihood of bad actors slipping through the cracks is miniscule when participants are heavily vetted and have a history of reliability.

On top of this, consensus can be reached with only 80% of validators approving the transaction. This means that even if 20% of the network is malicious, or face downtime, the blockchain will continue operating transparently.

That said, XRP has also faced criticism for their consensus mechanism. Ultimately, Ripple and the XRP Foundation have a large say in who ultimately secures the network, which some believe is a threat to the blockchain’s decentralisation.

What can the XRP Ledger be used for?

The XRP Ledger has evolved substantially over time and now supports a wide range of use cases. The blockchain is an all-purpose DeFi platform and is in many ways comparable to the top dogs like Ethereum, Cardano and Solana.

At its core, the XRPL works like most other blockchains – a distributed ledger that supports decentralised payments with digital currencies. The protocol also allows developers to create and issue tokens for their applications, or other purposes. This is mostly manifested via stablecoins and tokenised assets, but users can find XRP-native memecoins too like SIGMA and PONGO.

Interestingly, the XRP Ledger does not support smart contracts, which are a prominent feature of most competitors. Rather, most prominent financial functions are built into the blockchain’s code which can make building on XRP simpler – but a little less flexible.

Key Takeaway

The XRP Ledger includes a native decentralised exchange (DEX), an escrow system, payment channels and multi-signing, which facilitates common DeFi activities (such as lending and token swapping) without needing smart contracts.

Some of the common use cases of the XRP Ledger are:

- Cross-border payments

- Tokenising real-world assets, such as US Treasury Bills

- Minting and trading NFTs

- Build and play blockchain-based games with an XRPL-native economy

- Supply chain management

- Lending and borrowing services

What are the top dApps on the XRP Ledger?

The XRP Ledger has a growing list of applications and gateways available for users to interface with the blockchain. However, as the protocol is mostly used as an enterprise-level solution, the number of prominent dApps (approximately 50) is far below other networks like Ethereum (4,000+), Solana (450+) and BNB Smart Chain (5,000+).

The network also has significantly fewer unique active wallets (UAW) compared to other DeFi ecosystems.

Even so, monthly on-chain volume for XRPL dApps has broken past $10 billion USD in 2025, thanks to several high-profile projects and the release of the RLUSD stablecoin, which we’ll cover below.

First Ledger

FirstLedger is a Telegram-integrated decentralised exchange (DEX) operating on the XRP Ledger. It allows users to sign up via the popular smartphone application and connect a supported wallet. Then, using the FirstLedger bot via Telegram, investors can trade XRPL-native memecoins, participate in airdrops or even mint their own XRPL tokens.

XPMarket

Often the biggest XRPL application based on unique users and trading volume, XPMarket has positioned itself as the hub for all on-chain activities. The platform supports all the DeFi basics, including a decentralised exchange, automated market maker and liquidity pools for lending and borrowing.

Like other popular dApps on competitors, XPMarket offers unique reward features for completing weekly tasks and participating in the ecosystem. Investors can also trade NFTs or simply use the platform for data insights through XRPL on-chain analytics and volume rankings.

xrp.cafe

xrp.cafe is the leading NFT marketplace on the XRP Ledger. The platform hosts thousands of XRPL-native digital collectables and allows budding artists to mint their own NFTs on the network.

What is RLUSD?

Ripple USD (RLUSD) is a USD-pegged stablecoin that operates natively on the XRP Ledger. Released in the backend of 2024, RLUSD quickly built momentum as an alternative to preeminent stablecoins such as USDC and Tether USD.

RLUSD has a home in the Ripple Payments ecosystem, allowing businesses to settle cross-border transactions via a tokenised USD, as well as XRP and other fiat currencies.

Ripple, the team in charge of issuing and managing RLUSD, has guaranteed the stablecoin will remain fully backed by cash and cash equivalents, with these reserves independently audited by a third-party firm.

The relatively new project has Ethereum Virtual Machine (EVM) compatibility, giving RLUSD a life outside of the XRP ecosystem. This means that popular Ethereum dApps such as Uniswap or Compound may support RLUSD for various DeFi activities.

But perhaps the biggest point of difference offered by RLUSD is its regulatory background. With stablecoins becoming a more appealing option for institutions, Ripple leveraged its industry stature to create a trustworthy alternative to other players in the market. To cap this off, RLUSD secured regulatory approval from the New York State Department of Financial Services (NYDFS), joining an exclusive list of stablecoins overseen by the fiscal agency.

Wrap up

The XRP Ledger is the engine that drives the Ripple ecosystem. The blockchain employs a unique consensus mechanism that gives it several advantages, including fast and efficient transactions intended to revolutionise the clunky world of cross-border payments. Foregoing a smart contract-based network, the XRPL has built a native DeFi world that is slowly starting to rival some of its peers.

Though the XRP Ledger was initially built to facilitate international transactions, it is far from a one-trick-pony. As more developers come to the platform, the network’s kit of DeFi applications will add further depth to one of the Web3 world’s most popular projects.

Quiz

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.

Article read

Article read