Over the past decade, the blockchain sector has grown from a budding concept into a full-scale industry. Businesses and individual investors are exploring new and innovative ways to leverage the blockchain’s potential. Tokenised assets have quickly become one of the prominent uses of distributed ledger technologies. By now, many people are familiar with NFTs – hardly a day goes by without the mainstream media bringing them up. But NFTs are just one of the many use cases of tokenised assets. So, what exactly are they, and how useful can they be?

What are tokenised assets?

Tokenised assets are digital tokens created on distributed ledger technology, where each issued token represents underlying traditional assets. This underlying asset can be nearly anything – from physical assets like gold or trading cards to digital assets like popular songs or virtual artwork. This is viable due to the blockchain’s immutability, which results in an unchangeable record of who owns what asset (or proportion of an asset).

Tokenised asset example

To contextualise the concept, let’s look at a real-world example. Jacinta owns one month’s timeshare on a vacation property. She needs to liquidate a bit of money but doesn’t want to relinquish her grip on the real estate completely.

Instead of trying to sell individual days (or weeks) of the timeshare to friends and family, she could instead split her ownership into 28 tokens and sell them on an exchange. In this instance, each token would represent one day’s worth of vacation at the timeshare. Jacinta could retain as many tokens as she desired, while still making some cash.

Then, if the timeshare property were to appreciate in value and be sold, the profits would be distributed proportionally among token holders.

Tip

You can view some tokenised assets like a company offering stock market shares. They provide fractional ownership to investors – one token might be worth 100% of an asset. In contrast, another could be a tiny 0.00001%.

Fungible assets

Fungible assets are items that can be exchanged for one another while retaining the same market value and function. There are two things that fungible cryptocurrencies must be: divisible and interchangeable.

Divisible

Divisibility is an important element of fungible tokens. It allows investors to buy and sell fractions of various cryptocurrencies. This is how you can buy a 10th of a Bitcoin and still use it for basic payments like bills or online shopping. Imagine having to use a whole Bitcoin on a $30 grocery trip!

Interchangeable

Every unit of a given fungible asset is identical to one another. Each token will maintain the same value and use case, regardless of who owns it. For example, swapping one Ether (ETH) for someone else’s will make no difference to your portfolio worth (excluding network fees) or what you can use it for.

By contrast, if you swapped $1 AUD for $1 USD, the value of each unit would be entirely different, even though they’re both technically one dollar. This is why interchangeability is a huge factor in how Bitcoin and other digital currencies intend to work as a global currency.

Non-fungible assets

Non-fungible tokens (NFTs) have quickly surged to become one of the biggest talking points over the past few years. NFTs are tokenised, digital assets that cannot be exchanged like-for-like with another token. They can be a digital representation of almost anything, but at present are most commonly used to tokenise things like digital artworks, in-game items, and music. There are three things that non-fungible assets should be: non-interchangeable, non-divisbile, and unique.

Non-interchangeable

Each NFT has its own individual attributes and market value, meaning you cannot directly trade one NFT for another. For example, Shane owns an NFT of a cartoon koala. She could swap this with another cartoon koala from the same NFT collection, yet their worth might be thousands of dollars apart. This is because each NFT koala would be different – no matter how similar they may appear.

Non-divisible

NFTs cannot be divided like you can when buying a fraction of a Bitcoin. This is because an NFT represents 100% ownership of a unique token.

Interesting Fact

As the NFT market expands, exceptions to this rule have appeared in the form of F-NFTs. Some NFTs are worth hundreds of thousands – if not millions – which is a hefty price for most investors. F-NFTs allow collectors to purchase a fractional stake in a given token, particularly those with an underlying physical asset like property or a signed vinyl by The Beatles.

Unique

Generally speaking, no two NFTs are the same. Even if they look nearly identical, NFTs will have unique attributes that set them apart. For example, our two koala NFTs might share the same colour of fur but one might be adorned with a red bucket hat, while the other is smoking a pipe. Even when the differences aren’t as obvious, each NFT may have a separate serial number. Assets with a lower serial number (1–10) tend to be very valuable.

Fungible tokens are typically used for assets where providing liquidity on a secondary market is important. This might include tokenised representations of real-world currencies or fractional shares in a fund. Non-fungible tokens come into the picture when scarcity and individual ownership are paramount, like collectables.

What can be tokenised?

When it comes to asset tokenisation, the world is your oyster. Almost any asset can be transformed into a tradeable token.

Assets

An asset is any item you own – physical or digital – that can be exchanged for money. This might include personal assets such as collectable cars or fine art. You can tokenise business assets such as equipment and intellectual property too.

Did You Know?

Quite a few companies are focussing on real estate as a tokenised asset. Accredited investors can use platforms like RealT, SolidBlock, and HeroX to own a small slice of land. Some of these tokens even pay out dividends based on revenue generated from renters.

Equity

Equity is an asset’s value minus any outstanding expenses, like debt or liabilities. Equity is commonly tokenised as shares in a business or organisation. Tokenised shares are held in a digital wallet like other cryptocurrencies, instead of a stock market trading account.

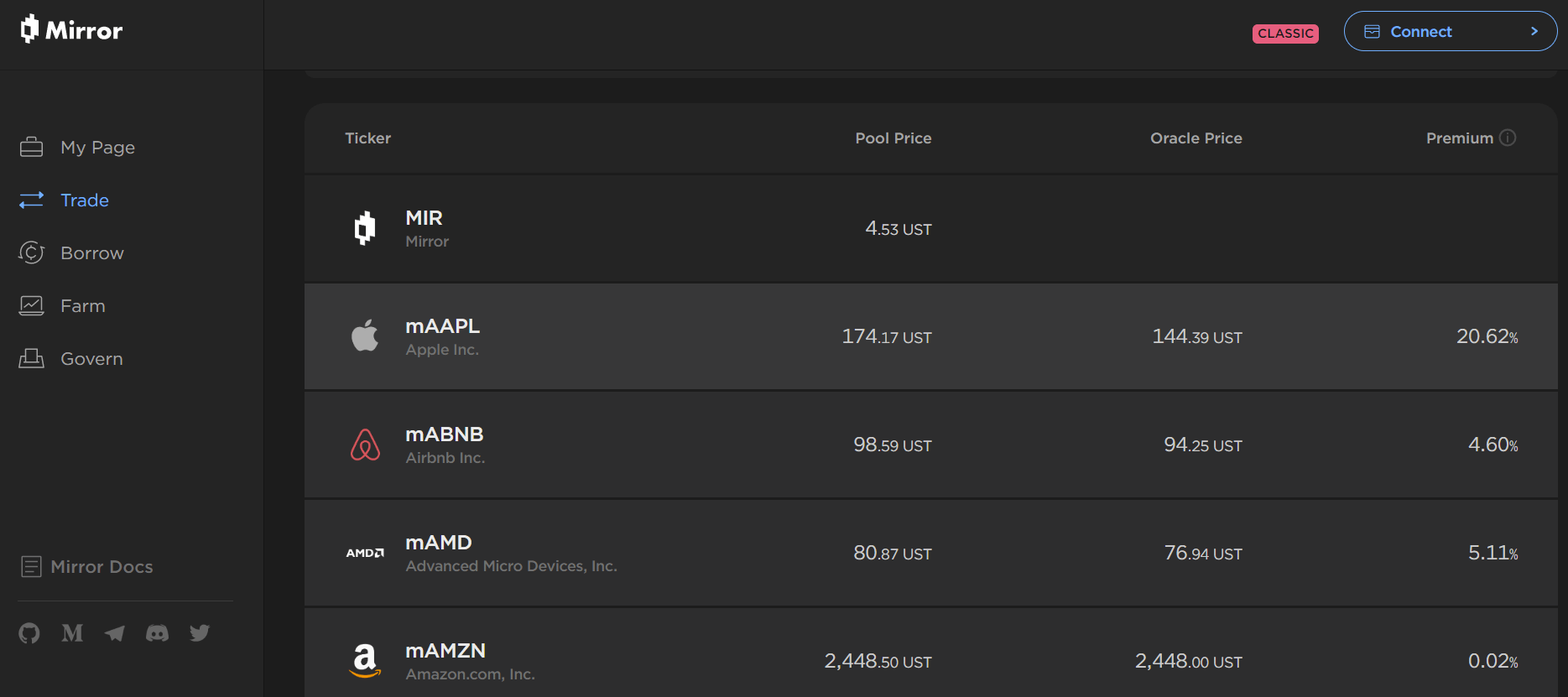

Already investors are seeing multi-national stocks being tokenised. These ‘mirrored’ versions of equity are usually backed by real shares at a ratio of 1. Examples include Apple (mAAPL), Tesla (mTSLA), and Twitter (mTWTR).

Figure 1 – Examples of a number of mirrored assets

Funds

Fractional investment funds are a fast-growing market in financial markets. Funds are a type of ‘basket’ stock that holds a diverse range of valuable assets, rather than just one. Businesses can tokenise investment funds, where each token represents a proportional share of the fund’s ownership.

A huge step forward in the tokenisation of funds came in 2021 when trillion-dollar investment capitalist Franklin Templeton released their U.S. Government Money Fund. Investors can purchase and exchange tokenised shares in the fund on the blockchain.

Services

Businesses can offer tokens that are exchangeable for their unique products or services. An example that’s growing in prominence is loyalty rewards programs. Some businesses have replaced their ‘points’ systems by distributing blockchain tokens instead. A token might be redeemed as you would with loyalty points, but it can also be used as a membership pass or traded on a third-party market.

Interesting Fact

Singapore airlines were one of the first companies to explore the potential for tokenisation in loyalty rewards programs. They developed a mobile application known as Kris+, where customers could convert miles flown into tokens. These tokens could then be exchanged for exclusive member rewards, such as cheaper flights or free drinks while flying.

The benefits of tokenisation

Greater liquidity

Say that you own an expensive oil painting you’re looking to sell. The market for these real-world assets is usually quite sparse – it can take months, or even years to sell them. Instead, you could now consider creating a secondary market through tokenisation. So rather than trying to sell a single asset to a single buyer, you can now sell 500 tokens to 500 different buyers. Each token would represent a 1/500th ownership of the expensive painting. If the painting were to be sold, the revenue would be distributed to the token holders.

Cheaper and more efficient transactions

Exchanging assets can be an annoying process. Take the stock market for example – you can only buy shares during trading hours. Having a busy day can easily result in significant opportunity costs. On the other hand, crypto markets are open 24/7 and finalise transactions within minutes (or even seconds). There’s also no need to rely on an intermediary snooping around for a 5% commission – tokenisation removes the necessity and cost of third parties.

Transparency in asset ownership

Blockchains are immutable by design. There is no way for someone to change transaction records – once someone has bought a token, it’s set in stone. This brings a whole new level of transparency to the transferral of goods. Businesses and investors don’t need to worry as much about keeping piles of receipts or thousands of screenshots when exchanging crypto tokens.

Secure identity

The improvement of blockchain technology has led to the sector playing a massive role in digital identity verification. When somebody purchases a token, their unique wallet keys are stored on the digital ledger. This makes it easy for platforms and services to quickly verify that token owners are who they say they are.

The challenges with tokenisation

The tokenisation of assets is an exciting financial tool already making waves beyond the blockchain world. However, as with many new concepts, there are a few roadblocks tokenisation must overcome before it becomes the norm.

The primary issue tokenisation faces is government regulation. Some governments have tried to stimulate cryptocurrency growth and introduced leniency with digital assets. However, many others, such as China, Vietnam and Russia, have swung the hammer and made it difficult for businesses and individuals to reap the full benefits of tokenisation.

Another prominent dilemma is the management of a token’s underlying assets. There is no clear answer yet, but it will likely require some degree of government involvement.

Interesting Fact

In 2021, Seth Green developed and uploaded Bored Ape NFTs based on characters from his TV show Robot Chicken. He intended to use them as stars of the show’s upcoming season. However, before he could begin production, the NFTs were stolen, and filming had to be immediately paused. This is because it’s illegal to use NFTs you don’t own for commercial purposes. Green ended up spending over $300,000 USD to reclaim his NFTs and the rights to intellectual property that was originally his.

The future of tokenisation

Tokenisation has already come a long way in its first few years in the spotlight. One of cryptocurrency’s primary philosophies is to enable fair and democratic financial opportunities for those across the globe. This may extend to tokenised assets, and even in their infancy, this technology is changing how investors and businesses interact with assets.

Just how far tokenisation can revolutionise the financial industry will depend heavily on government intervention. Regulators will need to find an administrative middle-ground that protects consumers while maintaining the core principles of cryptocurrency. If they do, this will go a long way to creating the necessary infrastructure to support large-scale tokenisation of different asset classes. Countries like Japan and Germany are already taking progressive approaches to blockchain integration – and with many others beginning to take note, the future of tokenisation looks bright.

Summary

Tokenisation is a powerful financial tool that has the scope to unlock a whole new world of finance and asset management. The ability to create a cost-effective, secure, and liquid transfer of ownership can benefit anyone, from budding content creators to age-old businesses. Just how far tokenisation goes will rely on how seriously governments decide to regulate it. But no matter what, it’s hard to deny the technology’s impressive potential.

Disclaimer: The information on Swyftx Learn is for general educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any assets. It has been prepared without regard to any particular investment objectives or financial situation and does not purport to cover any legal or regulatory requirements. Customers are encouraged to do their own independent research and seek professional advice. Swyftx makes no representation and assumes no liability as to the accuracy or completeness of the content. Any references to past performance are not, and should not be taken as a reliable indicator of future results. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose. Consider our Terms of Use and Risk Disclosure Statement for more details.